- Home

- »

- Healthcare IT

- »

-

Pharmacovigilance And Drug Safety Software Market 2033GVR Report cover

![Pharmacovigilance And Drug Safety Software Market Size, Share & Trends Report]()

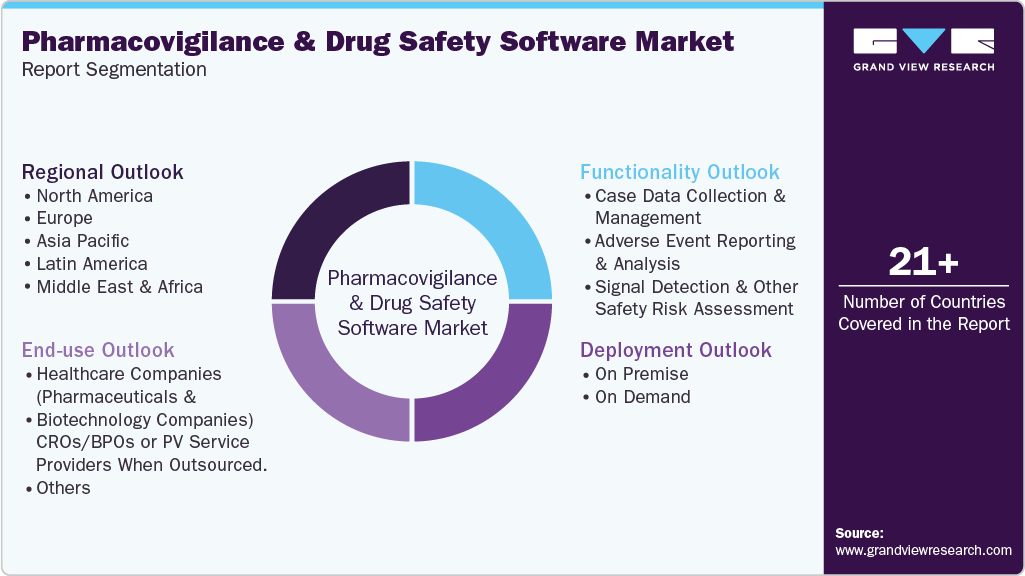

Pharmacovigilance And Drug Safety Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Functionality (Case Data Collection And Management, Adverse Event Reporting And Analysis), By Deployment (On Premise, On Demand), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-144-3

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmacovigilance And Drug Safety Software Market Summary

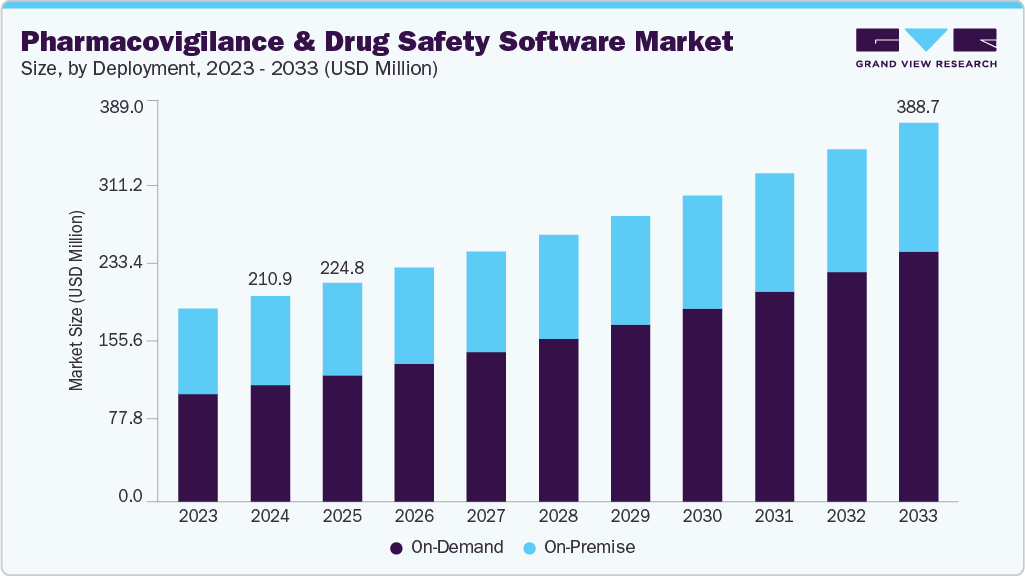

The global pharmacovigilance and drug safety software market size was valued at USD 210.96 million in 2024 and is projected to reach USD 388.74 million by 2033, growing at a CAGR of 7.1% from 2025 to 2033. The growing availability of data, the need to process & derive insights from the generated data, stringent reporting norms & standards, and increasing software upgrades by key companies are some of the key drivers of this market.

Key Market Trends & Insights

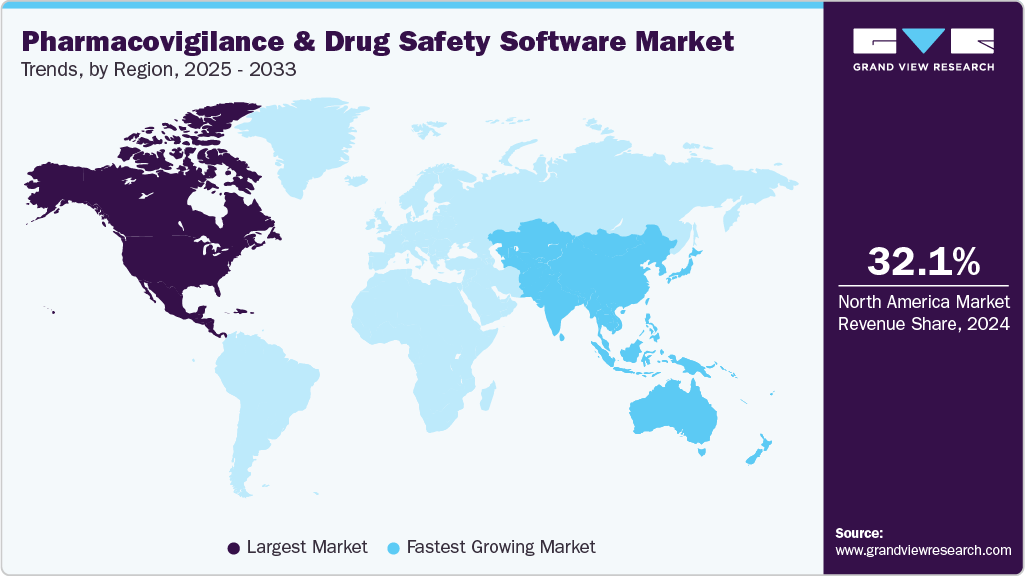

- North America dominated the market for pharmacovigilance and drug safety software with a share of 32.11% in 2024.

- Asia Pacific is estimated to be the fastest-growing region over the forecast period.

- Based on Deployment, the on-demand segment held the largest market share of 56.78% in 2024.

- Based on functionality, adverse event reporting and analysis held the dominant market share in 2024.

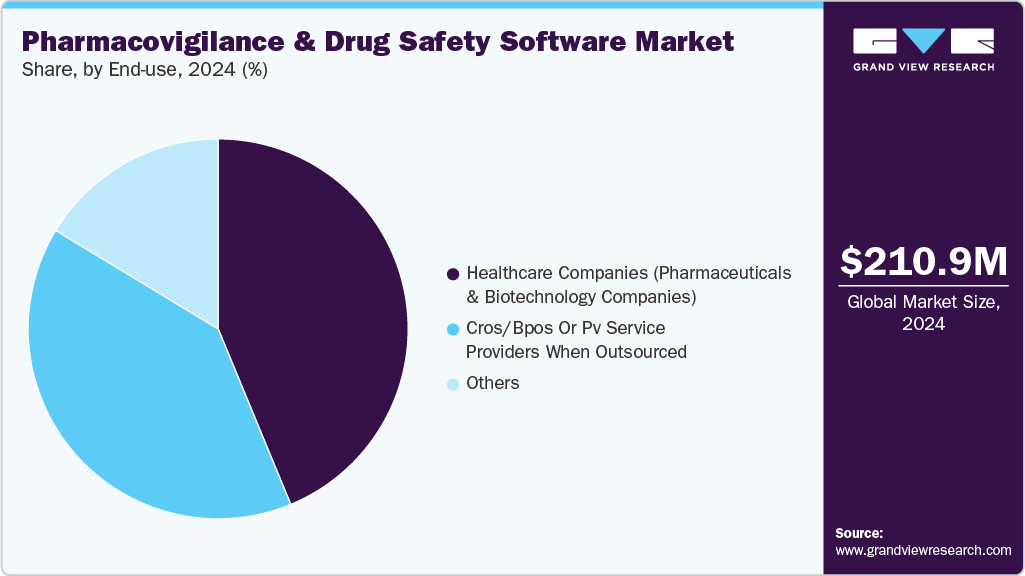

- Based on end use, healthcare companies held the dominant market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 210.96 Million

- 2033 Projected Market Size: USD 388.74 Million

- CAGR (2025-2033): 7.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

INTIENT Pharmacovigilance by Accenture is a comprehensive product suite that helps in the collection and management of a full spectrum of pharmacovigilance data. The platform also enables users to understand potential compliance issues and emerging trends and report on adverse events. The rising incidence of adverse drug reactions (ADRs) and medication errors is a key factor driving the growth of the industry. As drug therapies become more complex and polypharmacy increases, healthcare systems face greater risks of adverse events that compromise patient safety and increase hospitalizations. According to an article published by Springer Nature, the proportion of urgent hospitalizations caused by ADRs was reported as 5.0% (95% CI 4.5-5.6%) among 5,707 consecutive patients hospitalized for acute medical illnesses between June 2018 and May 2021. Such findings highlight the critical need for advanced pharmacovigilance solutions that can efficiently detect, analyze, and prevent drug-related risks through real-time monitoring and automated reporting systems.

Moreover, increasing pressure to follow safety guidelines set by government authorities such as the European Medicines Agency and the U.S. FDA is contributing to the growing adoption of pharmacovigilance systems. Many pharmaceutical companies are moving toward outsourcing pharmacovigilance activities to curb operational costs. Manufacturers are gradually shifting from being fully integrated pharmaceutical companies to sharing costs by collaborating with service providers. Services outsourced range from medical writing and clinical trial data collection to medical reporting and other PV services. Outsourcing helps increase internal resource flexibility, improves timelines, and results in better outcomes.

AI in Pharmacovigilance and Drug Safety Software Market

The integration of AI in the industry is transforming how adverse event detection, data analysis, and risk assessment are conducted. AI-driven algorithms enable the automated identification of safety signals from vast datasets, including clinical trials, electronic health records, and social media sources, thereby significantly reducing the manual workload and improving accuracy. Machine learning and natural language processing (NLP) tools enhance case processing, duplicate detection, and causality assessment, enabling faster decision-making and proactive risk mitigation. Moreover, predictive analytics powered by AI help forecast potential safety concerns, supporting regulatory compliance and strengthening overall drug safety surveillance.

One such development by providers is PubHive, which launched advanced pharmacovigilance services in December 2024. These services are designed to enhance drug safety by automating and streamlining aggregate safety reporting and literature review processes. Their AI-powered platform offers SMEs centralized management of Individual Case Safety Reports (ICSRs), automated signal detection, and compliance reporting, significantly reducing manual tasks and accelerating time-to-market for new drugs.

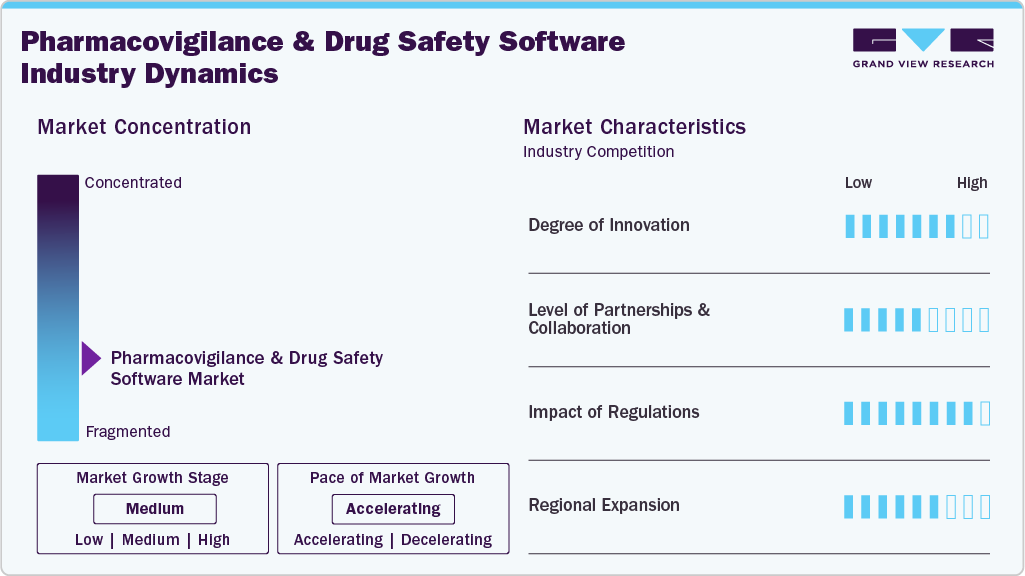

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the pharmacovigilance and drug safety software market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry is high. However, the regional expansion observes moderate growth.

The degree of innovation in the industry is high, driven by the growing need to automate adverse event detection, ensure regulatory compliance, and enhance data accuracy. Vendors are introducing AI-enabled platforms that streamline case processing, signal detection, and reporting workflows, allowing faster identification of potential drug risks and improved decision-making. These innovations are strengthening post-market surveillance and optimizing safety operations across the pharmaceutical value chain.

The industry is expected to witness significant growth fueled by strategic partnerships and technological advancements that enhance drug safety monitoring, automate reporting, and strengthen regulatory compliance. For instance, in January 2025, Clinigen partnered with Tepsivo, acquiring a minority stake in the AI-driven pharmacovigilance services provider Tepsivo. This collaboration integrates Tepsivo's advanced, automated PV platform with Clinigen's expertise to modernize pharmacovigilance processes, improving compliance, efficiency, and cost-effectiveness in global drug safety monitoring. The partnership aims to leverage AI and digital innovation to deliver faster, more reliable safety monitoring and regulatory compliance for pharmaceutical and biotech clients worldwide.

Regulations have a significant impact on the industry, as stringent requirements from agencies such as the FDA, EMA, and WHO mandate systematic monitoring, documentation, and reporting of adverse drug events. These compliance frameworks drive demand for advanced software solutions capable of ensuring data accuracy, auditability, and real-time reporting. At the same time, evolving global and regional regulatory standards encourage continuous innovation and integration of automation to maintain transparency and regulatory readiness across the drug safety lifecycle.

The industry is expanding across regions, driven by increasing regulatory mandates for adverse event reporting, growing pharmaceutical R&D activities, and rising adoption of AI-enabled platforms for efficient safety monitoring and compliance management.

Case Study: Automating Pharmacovigilance Case Handling with PVXtract

Background:

A leading Indian pharmaceutical company faced inefficiencies and time-consuming processes in handling Canada vigilance case submissions. Manual entry and validation tasks led to delays in regulatory reporting and increased risks to compliance obligations.

Objective:

To streamline and automate the pharmacovigilance case intake, validation, and submission steps for Canada vigilance, reducing turnaround time while maintaining regulatory accuracy.

Solution Implementation:

The company deployed PVXtract, an advanced pharmacovigilance software module, integrating their case workflow with digital automation. The software leveraged data extraction, validation algorithms, and direct submission capabilities to Health Canada’s regulatory portals.

Results:

-

Case processing time reduced from several hours to a few minutes per case.

-

Regulatory submissions achieved higher accuracy and consistency, minimizing manual errors.

-

Compliance tracking improved, with real-time dashboards and audit trails supporting oversight and reporting requirements.

Deployment Insights

On the basis of deployment, the on-demand segment dominated the market in 2024, with a market share of 56.59%. Healthcare IT providers are increasingly favoring on-demand solutions due to their numerous advantages, including cost-effectiveness, scalability, real-time data access, and enhanced collaboration among stakeholders.

The segment is also expected to grow at the fastest CAGR, attributed to the introduction of cloud computing and its rapid adoption by healthcare IT providers. On-demand solutions such as cloud-based SaaS solutions are expected to gain popularity in the coming years. Increasing adoption of these platforms by pharmaceutical companies and contract research organizations is driving the segment. Remote access to data, real-time data tracking, and scalability are notable benefits associated with cloud-based systems.

Functionality Insights

On the basis of functionality, the adverse event reporting segment dominated the market for PV drug safety software and accounted for the largest revenue share of 38.5% in 2024. This growth is attributed to the rising volume of adverse event data, stringent global regulatory reporting requirements, and the growing need for automated, real-time case management and submission systems that ensure compliance and accuracy in safety monitoring.

The case data collection and management segment is estimated to grow the fastest in the coming years. This is due to the increasing need to avert errors in database management. These solutions are used to track individual case safety reports and avoid data redundancy through the elimination of errors. Key companies offer integrated end-to-end solutions to enhance their offerings and increase market share.

End Use Insights

The healthcare companies segment dominated the market and accounted for the largest revenue share of 43.76% in 2024. PV and drug safety software solutions are widely accepted by pharma and biotech companies to facilitate clinical trial programs and reduce the burden on medical expenditure. Pharmacovigilance outsourcing is a growing trend in the pharmaceutical industry, and as a result, manufacturers are striving to identify various ways to contain costs and minimize operational expenses by gradually shifting from being fully-integrated pharmaceutical companies to sharing costs through collaborations with service providers. This is expected to strengthen the growth of contract research firms that perform these activities for pharmaceutical companies.

The CROs segment is expected to exhibit profitable growth during the forecast period. PV service providers, in an attempt to ensure sustainability, are providing customized end-to-end solutions to meet consumer needs. These firms are also incorporating integrated technologies, such as electronic data capture and hosting of PV warehousing to aggregate cross-industry data, which enables risk evaluation.

Regional Insights

North America pharmacovigilance and drug safety software market dominated and accounted for the largest revenue share of 32.11% in 2024. Owing to government-aided initiatives favoring the adoption of PV and drug safety software systems, for instance, the Open FDA initiative provides scientists and application developers access to its massive database through open search-based programs, which is anticipated to boost usage rates over the forecast period. Mini-Sentinel is a project started by the U.S. FDA to promote active surveillance systems, which provide statistically relevant data in lesser time. Initiatives such as these strengthen the growth of the regional market.

U.S. Pharmacovigilance And Drug Safety Software Market Trends

The pharmacovigilance and drug safety software market in the U.S. is experiencing significant growth, driven by a robust regulatory environment and the growing emphasis on real-time drug safety monitoring. Increasing adoption of AI, automation, and cloud-based solutions by pharmaceutical companies and contract research organizations (CROs) is enhancing the efficiency of adverse event reporting and compliance management. In addition, initiatives promoting data interoperability and advanced analytics are strengthening post-market surveillance efforts, positioning the U.S. as a leader in digital pharmacovigilance innovation.

Europe Pharmacovigilance And Drug Safety Software Market Trends

The pharmacovigilance and drug safety software market in Europe is witnessing significant progress, supported by continuous regulatory enhancements and digital modernization efforts. The European Medicines Agency’s (EMA) EudraVigilance system implemented significant updates in 2023 to improve data quality and operational efficiency, including stricter validation rules and clearer reporting guidelines. These measures helped reduce duplicate and erroneous submissions, resulting in approximately 1.9 million ADR reports, a 34% decline from 2022, reflecting improved data accuracy and compliance across the region’s pharmacovigilance ecosystem.

The UK pharmacovigilance and drug safety software market is driven by the Medicines and Healthcare Products Regulatory Agency’s (MHRA) focus on modernizing drug safety surveillance post-Brexit. Initiatives such as the Yellow Card Biobank, launched to link adverse drug reaction reports with genomic data, highlight the country’s commitment to integrating real-world evidence and advanced analytics. In addition, the increasing adoption of AI-driven platforms and cloud-based pharmacovigilance systems by pharmaceutical companies further supports efficient safety monitoring and regulatory compliance across the U.K. healthcare landscape.

The pharmacovigilance and drug safety software market in Germany is expanding rapidly, supported by strong regulatory oversight from the Federal Institute for Drugs and Medical Devices (BfArM) and the Paul-Ehrlich-Institut (PEI). The country is highlighting digital transformation in drug safety monitoring through initiatives promoting electronic adverse event reporting and integration with the EU’s EudraVigilance system.

Asia Pacific Pharmacovigilance And Drug Safety Software Market Trends

The pharmacovigilance and drug safety software market in Asia Pacific is witnessing robust growth, driven by expanding pharmaceutical manufacturing, increasing clinical trial activity, and rising regulatory focus on drug safety monitoring. Countries such as Japan, China, and India are strengthening pharmacovigilance frameworks and adopting advanced digital tools to improve adverse event reporting and compliance.

The Japanese healthcare system places significant importance on drug safety and pharmacovigilance. There is a growing emphasis on improving the monitoring and reporting of ADRs to ensure the safety of patients. This is expected to drive the market for software. Moreover, the country has been actively embracing technological advancements in healthcare. The integration of PV software with advanced features, such as real-time data analysis, signal detection algorithms, and artificial intelligence, has been a key initiative to improve the efficiency and accuracy of ADR monitoring and reporting.

The pharmacovigilance and drug safety software market in China is growing rapidly, driven by expanding pharmaceutical activity, stricter regulatory oversight, and increased emphasis on patient safety. According to a study by the NIH, among 5,644 ADR cases reported from 2020 to 2023 at a large Chinese hospital, 7.2% were classified as severe ADRs, highlighting the need for advanced safety monitoring systems. This rising incidence of serious adverse events is encouraging hospitals, pharmaceutical firms, and regulators to adopt AI-enabled and cloud-based pharmacovigilance software to enhance reporting accuracy, streamline workflows, and ensure timely risk detection across China’s healthcare ecosystem.

Latin America Pharmacovigilance And Drug Safety Software Market Trends

The pharmacovigilance and drug safety software market in Latin America is expanding steadily, supported by growing regulatory alignment with international safety standards and increasing pharmaceutical R&D activity across countries such as Mexico and Argentina. Regional health authorities are strengthening adverse event reporting systems and promoting electronic pharmacovigilance frameworks to enhance transparency and compliance.

Middle East & Africa Pharmacovigilance And Drug Safety Software Market Trends

The pharmacovigilance and drug safety software market in the Middle East & Africa is anticipated to witness steady growth over the forecast period, owing to the growing biopharmaceutical market, untapped opportunities pertinent to the entire clinical trial cycle, and a rise in supportive government initiatives. The lack of coordinated PV systems and the increasing need for efficient ADR reporting systems are positively impacting the overall market in this region. This is a result of illicit drug consumption, the lack of a stringent regulatory framework, and low awareness.

Key Pharmacovigilance And Drug Safety Software Companies Insights

Key players operating in the pharmacovigilance and drug safety software market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Pharmacovigilance And Drug Safety Software Companies:

The following are the leading companies in the pharmacovigilance and drug safety software market. These companies collectively hold the largest market share and dictate industry trends.

- Oracle (Cerner)

- Accenture

- IBM Corporation

- ITClinical

- UBC (United BioSource Corporation)

- Ab Cube

- Ennov

- EXTEDO

- Veeva Systems

- IQVIA

- Sarjen Systems Pvt. Ltd.

- Flex Databases

- Tepsivo Oy

- ArisGlobal

- EVERSANA

Recent Developments

-

In July 2025, EVERSANA unveiled EVERSANA ORCHESTRATE PV, an AI-driven pharmacovigilance solution designed to transform drug safety workflows by automating and accelerating literature monitoring, aggregate report authoring, and regulatory reporting.

“We remain as committed as ever to ‘pharmatize AI.’ Today, we bring pharmacovigilance leaders the long-overdue intelligent, scalable solution to complex and costly PV workflows, Through the power of our ORCHESTRATE operating system, our best-in-class experts in drug safety, and rapidly evolving AI-solutions, we’re streamlining safety processes, ensuring global compliance, and helping influence better patient outcomes.”

- Jim Lang, CEO, EVERSANA.

-

In March 2025, Tech Mahindra, in collaboration with NVIDIA, has launched an autonomous pharmacovigilance (PV) solution powered by agentic AI and NVIDIA AI Enterprise software. This solution enhances the accuracy, speed, and efficiency of PV workflows by automating case intake, data transformation, quality control, and compliance management, and uses large language model (LLM)-powered AI agents to independently handle case classification, prioritization, and verification.

“As the pharmaceutical industry navigates volumes of data during trials and post-launch, our collaboration with NVIDIA leverages generative AI and multi-agent systems to streamline the pharmacovigilance process. Together, we are revolutionizing drug safety management and using the innovative AI-driven framework to develop multiple use cases for our global customers.”

-Nikhil Malhotra, Chief Innovation Officer & Global Head of AI and Emerging Technologies Tech Mahindra.

Pharmacovigilance And Drug Safety Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 224.84 million

Revenue forecast in 2033

USD 388.74 million

Growth rate

CAGR of 7.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, functionality, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Oracle (Cerner); Accenture; IBM Corporation; ITClinical; UBC (United BioSource Corporation); Ab Cube; Ennov; EXTEDO; Veeva Systems; IQVIA; Sarjen Systems Pvt. Ltd.; Flex Databases; Tepsivo Oy; ArisGlobal

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Gobal Pharmacovigilance And Drug Safety Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pharmacovigilance and drug safety software market report based on deployment, functionality, end use, and regions.

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On Premise

-

On Demand

-

-

Functionality Outlook (Revenue, USD Million, 2021 - 2033)

-

Case data collection and management

-

Adverse event reporting and analysis

-

Signal detection and other safety risk assessment

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Healthcare Companies (Pharmaceuticals & Biotechnology Companies)

-

CROs/BPOs or PV service providers when outsourced.

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.