- Home

- »

- Pharmaceuticals

- »

-

Pharmerging Market Size, Share And Trends Report, 2030GVR Report cover

![Pharmerging Market Size, Share & Trends Report]()

Pharmerging Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Pharmaceutical, Healthcare), By Economy (Tier-1, Tier-2), By Indication (Lifestyle Disease, Infectious Disease), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-256-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmerging Market Size & Trends

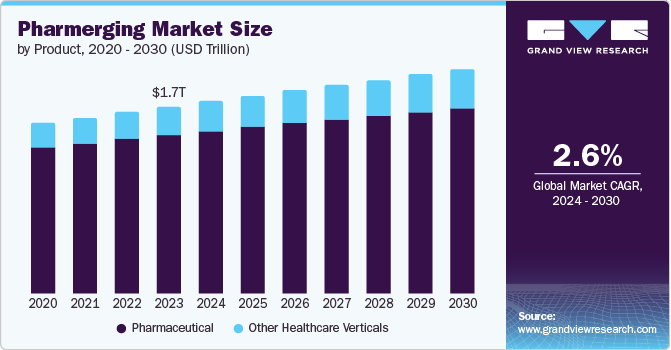

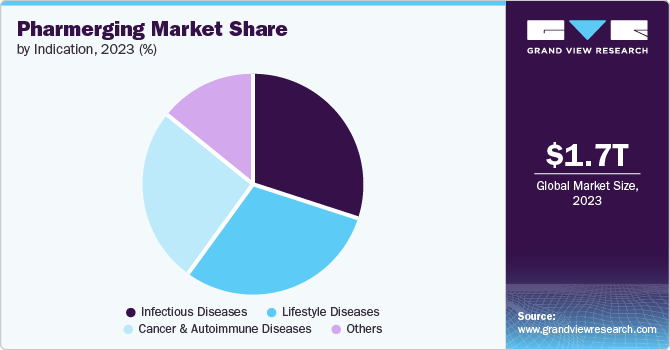

The global pharmerging market size was valued at USD 1.73 trillion in 2023 and is projected to grow at a CAGR of 2.6% from 2024 to 2030. This growth is attributed to the growing requirement for affordable generics. In addition, government policies that promote localization are expected to draw from generic drug manufacturers rather than original drug makers. At the same time, some other significant aspects of market rise include technological advancement and growing demand for generics. Furthermore, there is a rising interest in over-the-counter medications for colds, pain, critical disorders, and digestive problems.

The rising aging population is also impacting the sector in various nations across the globe. It is estimated that by 2030, one in six people will be over the age of 60. Pharmaceutical companies invest more in research and development, leading to a higher demand for generic therapies. Furthermore, the increasing healthcare spending and improved healthcare access are also driving the market growth. The pharmerging market is the growing public knowledge about the early detection of chronic illnesses to enable prompt treatment, which is closely linked to the investment in cost-efficient solutions for these illnesses. The rising demand for inexpensive medications to deal with chronic diseases in their early phases is propelling the demand of the pharmerging sector.

Product Insights

The pharmaceutical product segment dominated the market and accounted for the largest revenue share of 85.0% in 2023. The generic prescription pharmaceutical sector is forecasted to grow due to cost-consciousness in these regions and rising healthcare expenditures. In addition, the increasing need for over-the-counter medications, generic prescriptions, and patented drugs on a global scale is a crucial driver behind the growth of this sector in the projected period. The pharmaceutical industry has a strong position in the healthcare sector of emerging economies. Growth in the generic prescription drug market is anticipated to propel the pharmaceutical industry upward.

Furthermore, other healthcare verticals are expected to grow at a CAGR of 4.8% over the forecast years. This growth is attributed to the increasing demand for diagnostic equipment, the growing incidence of chronic disorders, and government initiatives to advance and develop the healthcare sector. Furthermore, the rising demand for medical imaging devices, the adoption of point-of-care treatment, and continuous innovative practices by companies further drive the market.

Economy Insights

The tier-1 economy led the market, accounting for the largest market share at 60.5% in 2023. This growth is attributed to the increasing demand for affordable, innovative therapies and the growing emphasis on medical devices for disease treatment and diagnosis. The healthcare market in Tier 1 economies, such as China, is augmenting the overall growth of the Pharmerging market globally. Furthermore, factors such as patent expiration, increased urbanization, and rising investments in medical research by governments contribute to the dominance of the Asia Pacific region, particularly China, in the Pharmerging market.

Furthermore, tier 2 is expected to grow at a CAGR of 4.3% over the projected years. Tier II comprises Brazil, India, Russia, and South Africa. Led by its aging population, increasing consumer awareness, and supportive government regulations, Brazil’s market is rising with a growing elderly population and increasing healthcare expenditure. Furthermore, India's market is driven by initiatives led by the government, a considerable middle-class population, and healthcare spending.

Indication Insights

Infectious diseases dominated the market and held a revenue share of 30.3% in 2023. This growth is attributed to the rapid developments in healthcare infrastructure and the rising prevalence of infectious diseases worldwide. Furthermore, the increasing incidence of malaria, tuberculosis, HIV, malaria, and others increases the demand for vaccines and antivirals worldwide, thereby driving the segment’s growth.

Lifestyle diseases are expected to grow at a CAGR of 3.5% over the forecast years owing to increasing urbanization, sedentary lifestyles, unhealthy diets, and rising obesity rates. In addition, the growing prevalence of non-communicable diseases, such as cancer, cardiovascular diseases, and diabetes, is a significant contributor to the expansion of this market. Furthermore, the aging population and increasing life expectancy in Pharmerging countries are leading to a higher incidence of age-related lifestyle diseases.

Regional Insights

The North America pharmerging market dominated the global market and accounted for the largest revenue share of 42.8%. This growth is attributed to the rise in healthcare spending and the expansion of private hospitals, which are driving the development of the worldwide healthcare market. In addition, the prevalence of chronic illnesses among individuals and the rising awareness of early disease detection and treatment methods fuel market growth. Furthermore, the elderly population in various nations is highly susceptible to severe medical issues such as heart failure, dementia, and high blood pressure. These age-related ailments are driving the demand for pharmaceuticals.

U. S. Pharmerging Market Trends

The pharmerging market in the U.S. dominatedthe North America market with a revenue share of 88.7%. This growth is driven by the increasing demand for pharmaceuticals, the aging population, and the rising prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer in pharmerging markets, enhanced healthcare access, and expanding government efforts.

Europe Pharmerging Market Trends

Europe pharmerging market is expected to experience substantial growth in the pharmerging market due to the prevalence of different diseases on the rise, leading to a growing interest in cutting-edge and superior outcomes. This trend is expected to drive substantial growth in the market in the near future.

The pharmerging market in the UK is expected to grow substantially owing to the rise in non-communicable diseases, increasing population, expanding healthcare industry, rising incomes, escalating government spending on healthcare, international collaborations, and ongoing innovation are key factors driving the growth of this market. Ongoing advancements in medical treatments for various conditions are projected to propel the pharmerging market forward in the coming years.

Asia Pacific Pharmerging Market Trends

The Asia Pacific pharmerging market is expected to grow with a CAGR of 4.1% over the forecast period. The region has grown in the pharmerging market and is now in the eye of the global pharmaceutical industry, driving betterment, progress, innovation, and development in the healthcare sector.

China pharmerging market led the Asia pacific market and accounted for the significant share in 2023. This growth is driven by patent expiration, urbanization, and government investments, offering numerous opportunities in the pharmerging market. With the entry of critical companies and increasing demand for generic therapy, the market is expected to experience significant growth. Additionally, China's healthcare systems are promoting generic medications to reduce costs, transitioning towards raising awareness about generic therapies through private-public partnerships, leading to recent developments in the pharmerging market.

The pharmerging market in India is driven by rising awareness of diseases and their timely treatment to minimize harm in the future, increasing demand for generic drugs, healthcare spending, and initiatives led by the government to develop the healthcare industry. Furthermore, increased awareness about insurance policies and the key companies offering a wide range of product portfolios is expected to fuel the region’s growth.

Key Pharmerging Company Insights

Some of the key companies in the pharmerging market include Sanofi, Pfizer Inc., AstraZeneca, GlaxoSmithKline, F. Hoffmann-La Roche Ltd., GE Healthcare, Eli Lilly and Company, Medtronic, Abbott, Johnson and Johnson market are focusing on development & to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Abbott discovers, develops, manufactures, and markets a diverse range of healthcare products, including generic pharmaceuticals, diagnostic systems and tests, and pediatric and adult nutritional products; they also offer various medical devices, including heart failure, electrophysiology, rhythm management, vascular and structural heart devices.

-

GE Healthcare manufactures diagnostics scanners, imaging agents, and software to help physicians see the internal brain more clearly and improve patient management in the healthcare system.

Key Pharmerging Companies:

The following are the leading companies in the pharmerging market. These companies collectively hold the largest market share and dictate industry trends.

- Sanofi

- Pfizer Inc.

- AstraZeneca

- GlaxoSmithKline

- F. Hoffmann-La Roche Ltd.

- GE Healthcare

- Eli Lilly and Company

- Medtronic

- Abbott

- Johnson and Johnson

Recent Developments

-

In May 2024, Sanofi collaborated with OpenAI and Formation Bio to create AI-powered software to speed up drug development and effectively bring new medicines to patients. The teams are expected to combine databases, software, and regulated models to grow purpose-built and custom solutions replacements across the drug development lifecycle.

-

In March 2024, AstraZeneca acquired Fusion Pharmaceuticals, a clinical-stage company developing next-generation radioconjugates for cancer treatment. The deal I expected to expand AstraZeneca's oncology portfolio and bring new expertise in actinium-based radioconjugates.

Pharmerging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.78 trillion

Revenue forecast in 2030

USD 2.08 trillion

Growth Rate

CAGR of 2.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, economy, indication, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Sanofi; Pfizer Inc.; AstraZeneca; GlaxoSmithKline; F. Hoffmann-La Roche Ltd.; GE Healthcare; Eli Lilly and Company; Medtronic; Abbott; Johnson and Johnson

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmerging Market Report Segmentation

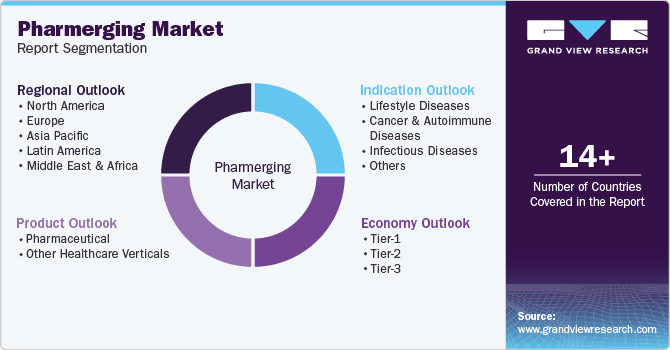

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmerging market report based on product, economy, Indication, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical

-

Patented Prescription Drugs

-

Generic Prescription Drugs

-

OTC Drugs

-

-

Other Healthcare Verticals

-

Medical Device

-

Clinical Diagnostics

-

Others

-

-

-

Economy Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tier-1

-

Tier-2

-

Tier-3

-

-

Indication Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lifestyle Diseases

-

Cancer & Autoimmune Diseases

-

Infectious Diseases

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U. S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.