- Home

- »

- Advanced Interior Materials

- »

-

Physical Vapor Deposition (PVD) Faucet Finishes Market Size Report, 2030GVR Report cover

![Physical Vapor Deposition (PVD) Faucet Finishes Market Size, Share & Trends Report]()

Physical Vapor Deposition (PVD) Faucet Finishes Market Size, Share & Trends Analysis Report By Color (Chrome, Nickel, Rose), By Application (Home Use, Hotel Use), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-084-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Report Overview

The global physical vapor deposition (PVD) faucet finishes market size was valued at USD 12.04 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.3% from 2024 to 2030. The market growth is due to an increase in the hotel, hospitality industry, and construction industries. Global expansion in the residential and commercial sectors has also led to market growth. Rising disposable income and urbanization have led customers to prefer durable and visually appealing plumbing products and components.

Faucet manufacturers are adopting PVD technology due to the growing consumer desire for attractive, durable finishes in residential and commercial environments. Technological advancements in PVD technology, such as increased coating consistency and finishing enhance product reliability and performance. Additionally, PVD faucet finish producers have a great opportunity to expand into new markets and increase their presence due to the increasing construction and renovation projects worldwide, particularly in developing countries.

Physical vapor deposition is a method of coating done in a vacuum environment. Processes such as evaporation and deposition are involved. The methods are eco-friendly and improve the surface characteristics of inorganic or organic materials. Compared to electroplating or painting, PVD does not produce any harmful waste. Products coated with PVD coatings are durable and have a longer lifespan, reducing the accumulation of solid wastes. Several manufacturers and consumers are adopting eco-friendly materials and practices to promote sustainability. Hence, there is a rise in the implementation of PVD coating for manufacturing faucets and other plumbing fixtures.

Color Insights

The nickel segment dominated in 2023 with a revenue share of 37.1%. The growing demand for high-quality, visually appealing, and durable faucet finishes encourages market growth. Nickel finishes offer a sleek design that aligns with modern trends. The minimalist style makes it a perfect choice for contemporary designers and homeowners. Nickel coatings provide properties such as enhanced durability and corrosion resistance. The rising adoption of eco-friendly practices has led to major companies adopting PVD finishes as they require fewer chemicals and generate less waste than other alternatives.

The chrome segment is expected to grow at a fast CAGR of 8.2% during the forecast period. The increased adoption of chrome-coated faucets in real estate drives demand. Chrome coating applied through the PVD technique offers enhanced durability and corrosion resistance. The coating ensures better functionality for a longer period, hence minimizing the need for maintenance. Chrome-coated faucets are a cost-effective choice compared to other finishes.

Application Insights

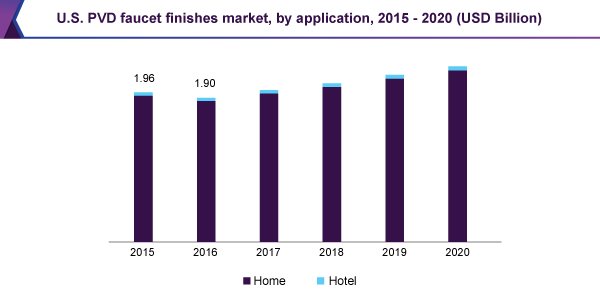

The home use segment dominated the market in 2023 with a share of 61.6%. Rapid urbanization and increased disposable income have led to customers adopting interior customization. Customers are focusing on improving the visual representation of their homes and bathrooms. Hence, there is a rise in demand for plumbing accessories with PVD finishes, as they offer a better appearance with enhanced durability. The rising population and economic growth have led to a rise in the construction industry, increasing demand for PVD faucets and other plumbing fixtures.

The hotel use segment is expected to grow at a CAGR of 7.6% during the forecast period. The market growth is due to the rise in the hotel and hospitality industry and an increased focus on the appearance of bathroom fittings in hotels and restaurants. PVD finishes offer a luxurious appearance that enhances the experience of guests. The appearance of all the fittings and components of a hotel room plays an important role as it helps create a positive first impression on the guests. Urbanization, rising tourism, and economic growth have led to a global rise in the hotel industry.

Regional Insights

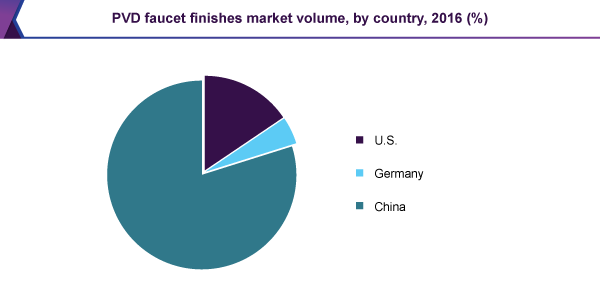

Asia Pacific dominated the physical vapor deposition (PVD) faucet finishes market with a market share of 46.5% in 2023. The market is growing due to rapid urbanization and rising living standards. Homeowners are now focusing more on the visual appearance of their house fixtures. Hence, there is an increased investment in home improvement and renovations. This has increased demand for PVD faucets and other bathroom components.

China Physical Vapor Deposition (PVD) Faucet Finishes Market Trends

China held a substantial market share in 2023 attributed to a strong manufacturing infrastructure and rapid growth in the construction sector. The presence of a skilled workforce and modern production facilities makes it easier to implement technologies such as PVD coating. Major manufacturers use advanced coating technologies such as PVD to meet the increasing demand for durable and aesthetically enhanced products.

Europe Physical Vapor Deposition (PVD) Faucet Finishes Market Trends

Europe had a significant market share in 2023, owing to an increased preference for bathroom fittings with better design, quality, and durability. The market growth is also due to rising renovation projects in the region, which has many aging housing stocks. Environmental regulations and the rising awareness regarding sustainable practices have led to increased production of PVD faucets and their sale in the region.

The UK physical vapor deposition (PVD) faucet finishes market is expected to grow rapidly due to rapid urbanization and increased disposable income, which has increased the adoption of visually enhanced bathroom fittings. New market trends and innovative designs have also aided the market growth. The rise in renovation projects in several parts of the country has also contributed further.

North America Physical Vapor Deposition (PVD) Faucet Finishes Market Trends

North America physical vapor deposition (PVD) faucet finishes market was identified as a lucrative region in this industry in 2023. Growth in the residential and commercial real estate sector and increased preference for bathroom fittings with aesthetic designs have led to market growth in this region. Rising disposable income has led to increased adoption of high-end and premium products. Hence, these factors are responsible for the market growth in the region.

The U.S. physical vapor deposition (PVD) faucet finishes market is expected to grow rapidly due to the rising population and preference for visually appealing bathroom fittings. The presence of major hotel and restaurant industries also aids in the country's market growth. Furthermore, the increased adoption of sustainable practices by major manufacturers has resulted in the increased adoption of PVD techniques to manufacture faucets. Therefore, these factors aid in the country's market growth.

Key Companies & Market Share Insights

Some major companies in the physical vapor deposition (PVD) faucet finishes market are Kohler Co., Delta Faucet Company, Moen Inc., Grohe AG, and others. Companies are focused on improving their product portfolios by integrating various technological advancements and trending designs. They also spend heavily on marketing the product to enhance their market penetration.

-

Kohler Co. is a company that specializes in the design and manufacturing of bath and kitchen products. The company produces showers, faucets, sinks, vanities, and more. It also provides power generation systems, tile, and home interior products.

-

Delta Faucet Company deals with the manufacturing of residential and commercial faucets and other kitchen and bathroom products. The company also provides products such as kitchen sinks, bath fixtures, and toilets.

Key Physical Vapor Deposition (PVD) Faucet Finishes Companies:

The following are the leading companies in the physical vapor deposition (PVD) faucet finishes market. These companies collectively hold the largest market share and dictate industry trends.

- Kohler Co.

- Delta Faucet Company

- Moen Inc.

- Grohe AG

- TOTO LTD

- Hansgrohe

- LIXIL Corporation

- Bold International

- American Standard

- Dornbracht GmbH

Physical Vapor Deposition (PVD) Faucet Finishes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.89 billion

Revenue forecast in 2030

USD 19.64billion

Growth Rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Color, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Brazil; Saudi Arabia

Key companies profiled

Kohler Co.; Delta Faucet Company; Moen Inc.; Grohe AG; TOTO LTD.; Hansgrohe; LIXIL Corporation; Bold International; American Standard; Dornbracht GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Physical Vapor Deposition (PVD) Faucet Finishes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global physical vapor deposition (PVD) faucet finishes market report based on color, application and region.

-

Color Outlook (Revenue, USD Billion, 2018 - 2030)

-

Chrome

-

Nickel

-

Rose

-

Black

-

Gold

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Home Use

-

Hotel Use

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."