- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Pallets Market Share, Growth & Trends Report, 2030GVR Report cover

![Plastic Pallets Market Size, Share & Trends Report]()

Plastic Pallets Market (2023 - 2030) Size, Share & Trends Analysis Report By Material (High Density Polyethylene, Low Density Polyethylene), By Type (Nestable, Rackable, Stackable), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-301-1

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Pallets Market Summary

The global plastic pallets market was estimated at USD 7.3 billion in 2022 and is projected to reach USD 11.2 billion by 2030, growing at a CAGR of 5.6% from 2022 to 2030. The market is anticipated to be driven by the growing demand for hygienic, contamination-free, and durable pallets in food & beverage, pharmaceutical, and chemical industries.

Key Market Trends & Insights

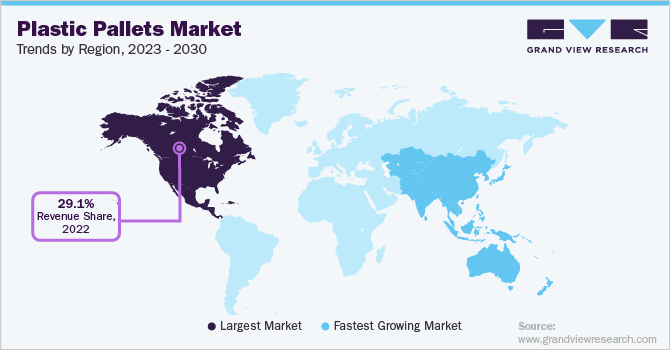

- North America dominated the global plastic pallets market with the largest revenue share of 29.1% in 2022.

- Asia Pacific market is expected to grow at the fastest CAGR of 6.5% from 2023 to 2030.

- By material, the high-density polypropylene (HDPE) dominated the market and accounted for the largest share of 68.2% in 2022.

- By type, the nestable pallet dominated the market and accounted for the largest revenue share of 43.7% in 2022.

- By application, the food & beverages dominated the market and accounted for the largest revenue share of 23.4% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 7.3 Billion

- 2030 Projected Market Size: USD 11.2 Billion

- CAGR (2023-2030): 5.6%

- North America: Largest market in 2022

The increasing focus on sustainable material handling solutions is driving the demand for reusable packaging, which, in turn, is propelling the demand for plastic pallets made of recycled plastic. The U.S. was the key country in the North America plastic pallet market in 2022, owing to the high trade value generated by the country. Its trade was valued at USD 3.7 trillion in 2020, wherein USD 1.4 trillion was through exports and USD 2.3 trillion was through imports. It stands as a top importing country globally with other key importing countries including China, Germany, Japan, Canada, and Mexico.

Transportation and logistics industry in the U.S. has been growing year-on-year with increasing demand from imports and exports coupled with augmenting FDI (foreign direct investment) in the country. The overall FDI reached approximately 9.4 billion in 2019, owing to the rising demand for logistics from the highly-integrated supply chain network in the country. Some of the key companies in the logistics business include XPO Logistics, Inc., UPS Supply Chain Solutions, DHL Supply Chain, C.H. Robinson Worldwide, and Expeditors International of Washington.

Increasing demand for logistics from industries such as food & beverage, chemical, and pharmaceutical has resulted in increased logistics spending by 8% in 2019 and 11.4% in 2018. This spending pattern in transportation and logistics industry is expected to directly bolster the demand for plastic pallet over the forecast period. Furthermore, the growing demand for processed food in food & beverage industry, which requires cold chain logistics in the U.S is one of the key driver that is expected to accelerate demand for plastic Pallet at a greater scale

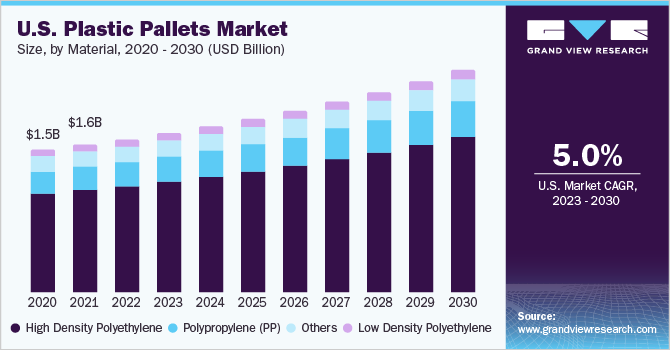

Material Insights

The high-density polypropylene (HDPE) dominated the market and accounted for the largest share of 68.2% in 2022. HDPE Pallet are easy to clean, solvent and corrosion-resistant, and offer strong impact resistance due to which these are widely preferred by end-use industries. However, polypropylene (PP) material segment is expected to witness the highest growth from 2023 to 2030 as the PP Pallet are extremely durable which makes them ideal for heavy-duty applications in close supply chains.

Pallet made from HDPE are easy to clean as the material is corrosion and solvent resistant. HDPE is extremely durable and offers strong impact resistance; thus, HDPE Pallet incur minimal or no damage due to rough handling by forklift and other material handling equipment. In addition, HDPE Pallet offer robust weather and chemical resistance, which make them suitable for pharmaceutical and food applications.

Besides, the growing preference for sustainable material handling solutions by end-use companies owing to the rising stringent regulations on the use of plastic packaging due to environmental concerns is likely to fuel the demand for recycled HDPE Pallet in the coming years.

Type Insights

The nestable pallet dominated the market and accounted for the largest revenue share of 43.7% in 2022. Nested Pallet can be nested into each other, due to which they occupy lesser space during transportation and proves to be cost-efficient as compared to other pallet types. In addition, nestable Pallet are less expensive than rackable and stackable Pallet, which makes them ideal for export or open-loop supply chains.

Affordability of nestable pallet makes them an ideal pallet option for export applications. The increasing adoption of plastic pallet over wooden pallet for export applications, due to their non-contamination properties, is expected to fuel the demand for nestable plastic pallet over the forecast period. However, the design of nestable pallet limits their application in heavy load handling; thus, nestable pallet are not considered to be the preferred pallet for the handling of heavy loads in closed-loop supply chains.

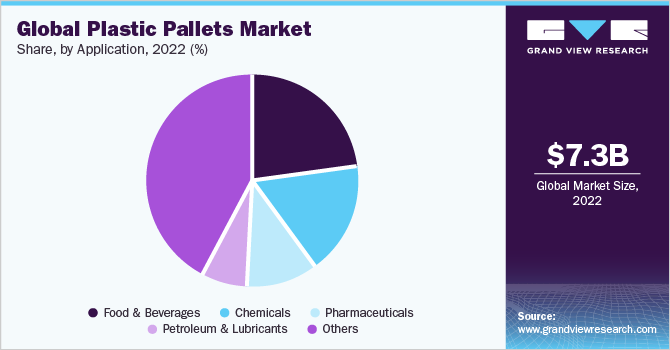

Application Insights

The food & beverages dominated the market and accounted for the largest revenue share of 23.4% in 2022. In food & beverage industry, plastic Pallet are utilized by agricultural companies and farmers to handle fresh produce and by bakery, dairy, beverage, meat, and other food processing companies to store, handle, and transport raw and processed end products. Plastic pallet are increasingly preferred over wooden Pallet for food application as the former do not have nails and splinters in their structure, which otherwise can damage the food products.

Furthermore, wooden pallet are prone to bacteria, pests, and fungi, which can contaminate food products. Thus, to avoid food contamination, food processing companies are gradually shifting from wooden Pallet to plastic pallet, which are more hygienic, easy to clean, and reduce the risk of contamination. Rising preference of plastic pallet by the manufacturers of food & beverages is expected to drive the growth of food & beverages end-use segment over the forecast period.

Regional Insights

North America dominated the plastic pallets market and accounted for the largest revenue share of 29.1% in 2022. Presence of robust manufacturing industry particularly in the U.S. amounts to the region’s considerable share. Trade agreement such as T-MEC is further expected to boost the demand for plastic Pallet across the region. However, outbreak of COVID 19 had severely affected the usual business operations, which, in turn, declined the demand for plastic Pallet throughout 2020 in the region.

The North American pallet market is expected to record a significant CAGR of 5.2% over the forecast period (2023-2030). This is due to the increased demand for plastic Pallet from end-user industries, especially in domestic supply chain. The trade between the U.S., Mexico, and Canada has been growing year-on-year with agreements such as the North American Free Trade Agreement (NAFTA) and United States-Mexico-Canada Agreement (USMCA). The overall U.S trade in goods with Canada reached USD 525.7 billion in 2020 from USD 612.0 billion in 2019.

Asia Pacific was a key region in the global plastic Pallet market with the highest share of in 2022. The market is expected to advance at the fastest CAGR of 6.5% over the forecast period owing to the increasing product demand from manufacturing sectors in India, China, and Japan.

Asia Pacific has been a hub for manufacturing sector owing to the presence of countries that are involved in the Trans-Pacific Partnership Agreement (TPP). TPP is a free trade agreement that has strengthened the trade and manufacturing sector among countries in the region, thus, driving the demand for plastic Pallet over the years

Key Companies & Market Share Insights

Key companies are increasingly adopting market strategies such as expansion to strengthen their market position and expand into new territories. For instance, October, 2022, ORBIS Corporation announced the expansion of its manufacturing facility located in Urbana, Ohio. The expansion will take place in an already existing ORBIS plant, located at 200 Elm St, adding 30% more space for the manufacture of totes, bulk containers, and Pallet. Further, in July, 2022, Allied Plastics has expanded its distribution center, moving from 85,000 square feet to a larger space spread across an area of 173,000 square feet at the Wilmot, U.S.; the expansion was aimed at enhancing productivity. Some of the prominent players in the plastic pallets market include:

-

Orbis Corporation

-

RehrigPacific Company

-

Monoflo International

-

CABKA Group

-

Allied Plastics, Inc.

-

Polymer Solutions International

-

Perfect Pallet, Inc.

-

TranPak, Inc.

-

TMF Corporation

Plastic Pallets Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.6 billion

Revenue forecast in 2030

USD 11.20 billion

Growth rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2020

Forecast period

2023 - 2030

Quantitative units

Volume in million units; revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

Orbis Corporation; Rehrig Pacific Company; Monoflo International; CABKA Group; Allied Plastics, Inc.; Polymer Solutions International; Perfect Pallet, Inc.; TranPak, Inc.; TMF Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Plastic Pallets Market Report Segmentation

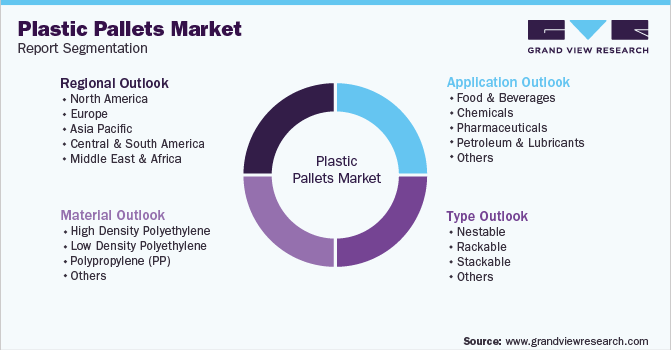

This report forecasts revenue growth at regional & country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the plastic pallets market report based on material, type, application, and region:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

High-Density Polyethylene

-

Low-Density Polyethylene

-

Polypropylene (PP)

-

Others

-

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Nestable

-

Rackable

-

Stackable

-

Others

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018- 2030)

-

Food & Beverages

-

Chemicals

-

Pharmaceuticals

-

Petroleum & Lubricants

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plastic pallets market was estimated at USD 7.3 billion in the year 2022 and is expected to reach USD 7.6 billion in 2030.

b. The global plastic pallets market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 11.20 billion by 2030.

b. Asia Pacific was a key region in the global plastic Pallet market with the highest share of in 2022. The market is expected to advance at the fastest CAGR of 6.5% over the forecast period owing to the increasing product demand from manufacturing sectors in India, China, and Japan.

b. Some of the key players operating in the plastic pallets market include ORBIS Corporation, Rehrig Pacific Company, Monoflo International, CABKA Group, Greystone Logistics, TMF Corporation LLC, Allied Plastics, Inc., and Perfect Pallets, Inc.

b. The key factors that are driving the plastic pallets market include the growing demand for sustainable, sturdy, and durable packaging products by end-user companies. Besides, expanding manufacturing and e-commerce activities across the world are also driving the global plastic pallets market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.