- Home

- »

- Clinical Diagnostics

- »

-

Platelet Aggregation Devices Market Size Report, 2030GVR Report cover

![Platelet Aggregation Devices Market Size, Share & Trends Report]()

Platelet Aggregation Devices Market Size, Share & Trends Analysis Report By Product Type (Systems & Instruments, Consumables & Accessories), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-188-5

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Platelet Aggregation Devices Market Trends

The global platelet aggregation devices market size was valued at USD 806.9 million in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.6% from 2024 to 2030. The market's growth is attributed to the rising burden of chronic disease, technological advancements, and increased awareness of platelet-related disorders and their importance in various medical conditions. Increasing heart diseases, strokes, and related conditions are on the rise. For instance, the British Heart Foundation (BHF) data published in June 2023 reported that heart and circulatory diseases cause around 1 in 3 deaths globally: an estimated 20.5 million deaths in 2021. However, platelet aggregation devices are crucial for assessing and managing these conditions since platelet function plays a significant role in clot formation and blood vessel health thus contributing to market growth during the forecast period.

Moreover, ongoing advancements in medical technology have led to the development of more refined and accurate platelet aggregation devices. These innovations have made diagnosis and treatment more effective, encouraging healthcare facilities to invest in such equipment. Automation and digitalization have modernized platelet function testing, enhancing accuracy and efficiency. Real-time data analysis allows for immediate results, advancing diagnosis and treatment decisions, while user-friendly interfaces simplify device operation.

Moreover, these advancements enable a broader range of parameters to be measured within a single device, catering to diverse testing requirements and enhancing diagnostic capabilities. As a result, healthcare providers can offer faster and more comprehensive care to patients with thrombotic and hemostatic conditions. This continual technological progress is a key driver of market expansion and improved patient outcomes.

The increasing burden of chronic diseases such as heart diseases and strokes, which account for a substantial portion of global deaths, necessitates precise diagnosis and management. These devices play a key role in assessing these conditions, as platelet function is critical in clot formation and blood vessel health. Additionally, technological advancements in healthcare have led to the development of more advanced and accurate platelet aggregation devices, meeting the growing demand for cutting-edge technology in the sector.

Healthcare policies and regulations, when favorable, can further drive market growth while increasing awareness of platelet-related disorders among healthcare professionals and the general population enhances the demand for these devices. Furthermore, the prevalence of hereditary bleeding disorders such as hemophilia A, hemophilia B, and von Willebrand disease underlines the market's importance in managing such conditions effectively.

Product Insights

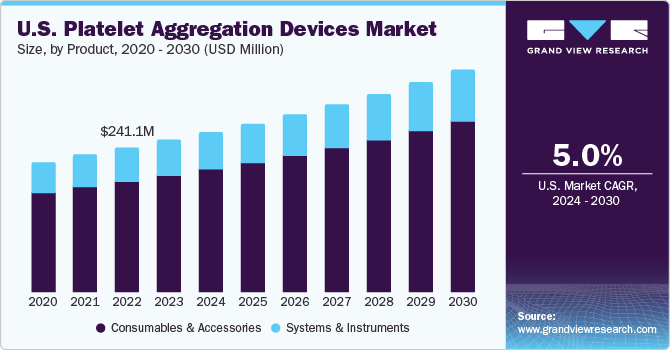

Based on the product segment, the market is divided into systems & instruments, and consumables & accessories. The consumables and accessories segment held the largest share of.76.2% of the platelet aggregation devices market in 2023 and is anticipated to grow at the fastest growth rate over the forecast period. Several factors contribute to the dominance of this segment. Ongoing demand for reagents, test kits, and disposable components, driven by diagnostic and research needs in healthcare, ensures a reliable revenue stream for manufacturers. Moreover, continuous technological advancements and the expanding applications of platelet aggregation testing fuel demand for specialized consumables. For instance, in February 2022, Futura Surgicare Pvt Ltd expanded its product portfolio with the launch of Hemostax under the new brand Dolphin Hemostats. Hemostax is an absorbable hemostatic product designed to aid surgeons in achieving more efficient bleeding control. Market players' initiatives such as these further contribute to the dominance of the segment in 2023 and during the forecast period.

The systems and instruments segment held a significant market share in 2023. The Systems and Instruments segment offers automation and a broad parameter range for accurate platelet function assessment, vital for research and clinical applications in thrombosis and hemostasis studies. Moreover, ongoing technological advancements, such as real-time data analysis and user-friendly interfaces, reinforce their market dominance. Key market players employ strategies such as new product launches, innovation, and expansion. For instance, in July 2021, Sysmex Europe GmbH introduced the CN-3500 and CN-6500 blood coagulation analyzers using CLEIA methodology, streamlining testing workflows for diverse needs. These innovations enhance productivity and enable quicker diagnosis and treatment, improving patient care and research outcomes, and driving segment growth during the forecast period.

Application Insights

Based on application, the market is segmented into clinical and research. The research segment held the largest share in 2023. Rising R&D initiatives for the diagnosis of various chronic conditions that make use of platelet aggregation devices are one of the major factors responsible for the dominance of this segment. These devices are used mostly in the screening of novel drug formulations and toxicity assessment.

The clinical applications segment is expected to grow at the fastest growth rate over the forecast period.The rising incidence of cardiovascular diseases and bleeding disorders demands precise platelet function testing for diagnosis and treatment monitoring. Additionally, advancements in platelet aggregation device technology have enhanced their accuracy and efficiency, making them essential in clinical settings. Furthermore, increased awareness among healthcare professionals and patients about the benefits of early diagnosis and personalized treatment strategies further drives the demand for platelet aggregation devices, contributing to the segment's rapid growth.

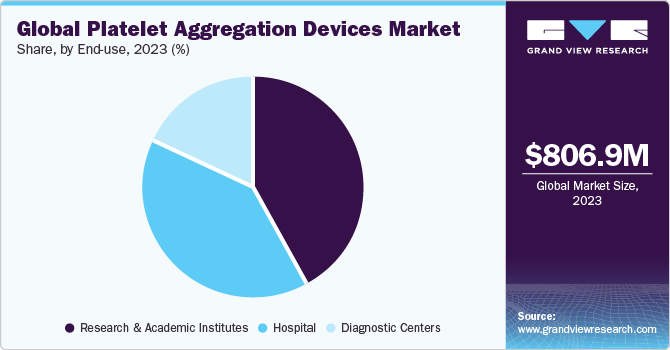

End-use Insights

Based on end use, the market is segmented into hospitals, diagnostic centers, and research and academic institutes. The research and academic institutes segment held the largest share in 2023.Research and academic institutes dominate the market due to their pivotal research For instance, In October 2023, University of Birmingham researchers made a breakthrough by creating nanobodies that control platelet clumping, providing invaluable insights. These nanobodies open the door to advanced platelet aggregation devices, enhancing diagnostic precision and therapeutic potential. As a result, the market is anticipated to experience significant growth, driven by the demand for more effective tools in managing platelet-related conditions.

The hospital segment is expected to grow at the fastest growth rate over the forecast period.Hospitals are the primary healthcare institutions for patient care, and the rising prevalence of cardiovascular diseases and bleeding disorders necessitates using platelet aggregation devices for diagnosis and treatment. Moreover, hospitals have advanced infrastructure and specialized medical staff, making them well-equipped to handle complex cases requiring platelet aggregation testing. This increased demand for accurate diagnosis and patient care within hospital settings drives the robust growth of platelet aggregation devices in this end-use segment.

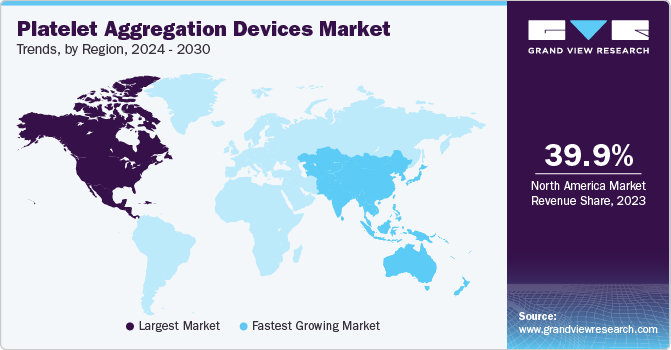

Regional Insights

North America accounted for the largest share of 39.98% in 2023. The prevalence of diseases such as leukemia, lymphoma, and other blood-related disorders in the region is a significant driver for the growth of the region's market. As the incidence of these diseases continues to rise, there is a growing need for diagnostic and treatment solutions. These devices play a crucial role in monitoring and managing these conditions, aiding in developing personalized treatment plans and patient care.

For instance, according to the Leukemia & Lymphoma Society, new cases of leukemia, lymphoma, and myeloma are expected to account for 9.4 percent of the estimated 1,958,310 new cancer cases in the US in 2023. Additionally, as per the American Cancer Society, non-Hodgkin lymphoma (NHL) is a common cancer in the U.S., comprising about 4% of all cancers, further driving the demand for platelet aggregation devices in the North America market.

Asia Pacific is anticipated to grow at the fastest rate during the forecast period. Regions with increasing populations with an increasing prevalence of cardiovascular diseases, require advanced diagnostic and monitoring tools like platelet aggregation devices. Additionally, healthcare infrastructure and awareness are on the rise, leading to greater demand for medical devices. Furthermore, emerging economies in the Asia Pacific region are witnessing investments in healthcare, fostering technological advancements. This combination of factors is driving substantial market growth, making the Asia Pacific a promising hub for platelet aggregation device manufacturers and providers during the forecast period.

Key Platelet Aggregation Devices Company Insights

Key established companies operating in the market include F.Hoffmann-La Roche Ltd., Sysmex Corporation, and Siemens Healthcare GmbH. Several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Emerging players focus on new product launches to establish their customer base and then focus on increasing their customer reach by expanding regionally. These players also collaborate and partner with leading established companies for brand recognition and value.

Key Platelet Aggregation Devices Companies:

The following are the leading companies in the platelet aggregation devices market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these platelet aggregation devices companies are analyzed to map the supply network.

- AggreDyne, Inc.

- Bio/Data Corporation

- Chrono-Log Corporation

- F. Hoffmann-La Roche Ltd

- Haemonetics Corporation

- Siemens Healthcare GmbH

- Werfen

- Sysmex Corporation

- Sienco, Inc.

- Drucker Diagnostics

Recent Developments

-

In May 2022, Precision BioLogic launched its CRYOcheck Chromogenic Factor IX assay for hemophilia B monitoring in the EU, UK, Australia, Canada and New Zealand following regulatory approvals. The assay offers a broad test range, ease of use, and compatibility with automated analyzers, enhancing hemophilia testing capabilities in these regions.

Platelet Aggregation Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 848.50 million

Revenue forecast in 2030

USD 1.18 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AggreDyne, Inc.; Bio/Data Corporation; Chrono-Log Corporation; F. Hoffmann-La Roche Ltd.; Haemonetics Corporation; Siemens Healthcare GmbH; Werfen; Sysmex Corporation; Sienco, Inc.; Drucker Diagnostics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Platelet Aggregation Devices Market Report Segmentation

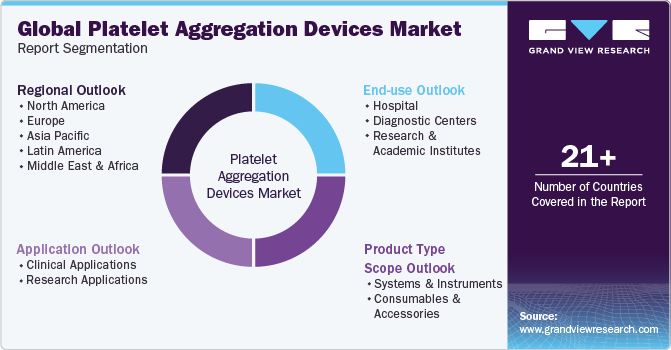

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global platelet aggregation devices market based on product type, application, end-use, and region:

-

Product Type Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Systems and Instruments

-

Consumables and Accessories

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Applications

-

Research Applications

-

-

End-use Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Diagnostic Centers

-

Research and Academic Institutes

-

-

Regional Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global platelet aggregation devices market size was estimated at USD 806.9 million in 2023 and is expected to reach USD 848.50 million in 2024

b. The global platelet aggregation devices market is expected to grow at a compound annual growth rate of 5.6% from 2024 to 2030 to reach USD 1.18 billion by 2030.

b. Consumables and accessories segment held the largest share of.76.23% of the platelet aggregation devices market in 2023 and is anticipated to grow at fastest growth rate over the forecast period. Several factors contribute to the dominance of this segment. Ongoing demand for reagents, test kits, and disposable components, driven by diagnostic and research needs in healthcare, ensures a reliable revenue stream for manufacturers.

b. Some key players operating in the platelet aggregation devices market include AggreDyne, Inc., Bio/Data Corporation, Chrono-Log Corporation, F. Hoffmann-La Roche Ltd, Haemonetics Corporation, Siemens Healthcare GmbH, Werfen, Sysmex Corporation, Sienco, Inc., Drucker Diagnostics

b. Key factors that are driving the market growth include rising burden of chronic disease, technological advancements, and increased awareness of platelet-related disorders and their importance in various medical conditions. Increasing heart diseases, strokes, and related conditions are on the rise.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."