- Home

- »

- Homecare & Decor

- »

-

Playing Cards & Board Games Market, Industry Report, 2030GVR Report cover

![Playing Cards And Board Games Market Size, Share & Trends Report]()

Playing Cards And Board Games Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Playing Cards, Board Games), By Distribution Channel (Offline, Online), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-3-68038-744-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Playing Cards And Board Games Market Summary

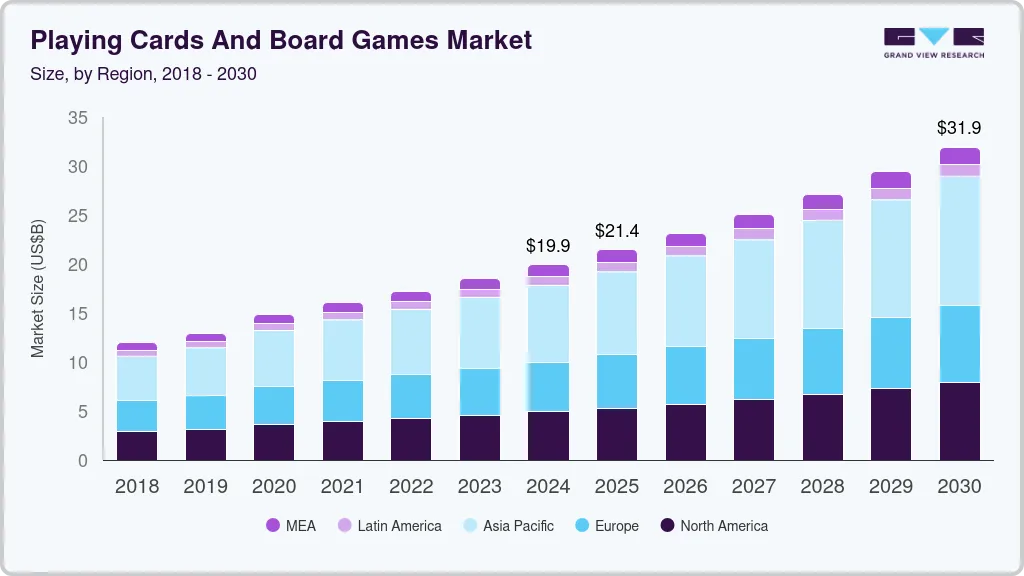

The global playing cards and board games market size was valued at USD 19.90 billion in 2024 and is projected to reach USD 31.93 billion by 2030, growing at a CAGR of 8.3% from 2025 to 2030. The increasing interest in indoor entertainment activities, particularly during the COVID-19 pandemic, boosted the demand for playing cards and board games as families and friends seek engaging ways to spend time together at home.

Key Market Trends & Insights

- Asia Pacific playing cards and board games market dominated the global market with the largest revenue share of 39.5% in 2024.

- The U.S. playing cards and board games industry is expected to grow significantly over the forecast period.

- Europe playing cards and board games industry is expected to grow significantly at a CAGR of 7.6% over the forecast period.

- Based on product, the board games segment dominated the market with the largest revenue share of 73.4% in 2024.

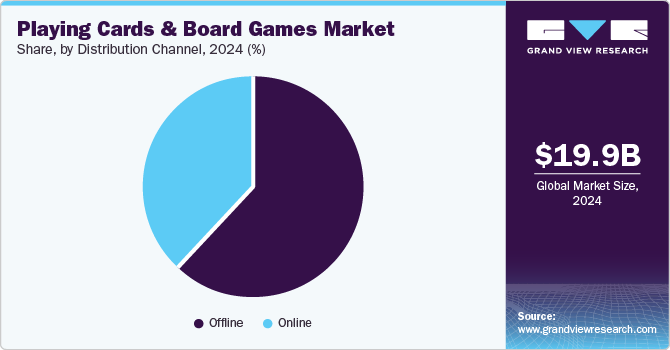

- Based on distribution channel, the offline segment dominated the playing cards and board games industry with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.90 Billion

- 2030 Projected Market Size: USD 31.93 Billion

- CAGR (2025-2030): 8.3%

- Asia Pacific: Largest market in 2024

The rising popularity of tabletop gaming events and conventions has further expanded the market, attracting diverse consumers. The re-emergence of tabletop and card games as entertainment and recreational activities is projected to bode well for market growth. Manufacturers focus on producing simple games with elegant mechanics and impressive artwork to attract more consumers. The rise in the number of board game cafes worldwide is expected to influence the demand positively.

For instance, the Waterloo and Hackney branches of Draughts Café in London have approximately 500 and 850 board games, respectively. Manufacturers focus on introducing various innovative playing cards and board games to reach a newer consumer base. For instance, the massive success of Settlers of Catan has attracted many players and boosted manufacturers' innovation and creativity.

Additionally, the growing trend of board game cafes and bars, which offer a social environment for playing games, contributes to market growth. Innovations in game design and introducing new and creative game concepts continue to capture consumer interest. Furthermore, expanding online retail channels has made these products more accessible to a wider audience, supporting market expansion.

The rising influence of social media and celebrity endorsements, especially on millennials is expected to drive the demand for tabletop games such as playing cards and board games, For instance, TableTop, a popular web series starring Wil Wheaton and Felicia Day generated great curiosity and improved sales of various tabletop games featured on the show. Traditional card games are gaining popularity on mobile gaming platforms owing to wider acceptance on social networks and thus, producers are developing digital versions of conventional card games. For instance, in 2019, Asmodee Digital launched a new The Lord of the Rings card game for Windows PC and Mac.

Product Insights

Board games dominated the market with the largest revenue share of 73.4% in 2024. This growth is attributed to the enduring popularity of board games across various age groups. The resurgence of interest in traditional tabletop games and innovative new game designs has driven the market forward. Board games offer a unique blend of strategic thinking, social interaction, and entertainment, making them a favored choice for family gatherings, social events, and casual get-togethers. Additionally, the growing trend of board game cafes and the cultural shift towards offline, screen-free entertainment options further support the market's dominance.

Playing cards are expected to grow at the fastest CAGR of 8.9% over the forecast period. The resurgence of interest in traditional card games and the introduction of innovative and themed card games appeal to a broad demographic, from casual players to serious enthusiasts. The accessibility and portability of playing cards make them a popular choice for various social gatherings and events. Additionally, the growing trend of digital card games has contributed to a renewed interest in physical playing cards, as players seek a tangible and nostalgic gaming experience. The rise of gaming communities and social media platforms that promote card game tournaments and events further supports this growth.

Distribution Channel Insights

Offline channels dominated the playing cards and board games industry with the largest revenue share in 2024. This dominance is primarily due to the continued popularity of traditional retail outlets such as toy stores, specialty game shops, and large retail chains. These physical stores allow consumers to browse, physically inspect, and test games before purchasing, enhancing the overall shopping experience. Additionally, many customers prefer the immediacy of buying games in-store rather than waiting for online deliveries. The personal interaction and customer service available in brick-and-mortar stores further enhance the appeal of offline shopping. The presence of organized events and in-store game nights also drives foot traffic and sales in these retail outlets.

The online channel is expected to grow at the fastest CAGR over the forecast period owing to the increasing convenience and accessibility of online shopping. Consumers are drawn to the vast selection of products available on e-commerce platforms, competitive pricing, and the ease of purchasing from the comfort of their homes. The rise of digital marketing and social media has also played a significant role in driving online sales, with influencers and gaming communities promoting new and popular games. Additionally, the global reach of online retail allows consumers to access products that may not be available in local stores.

Regional Insights

Asia Pacific playing cards and board games market dominated the global market with the largest revenue share of 39.5% in 2024. The region's large and diverse population and a deep-rooted culture of traditional games and family gatherings drive the high demand for playing cards and board games. Additionally, the increasing popularity of modern and innovative board games and the rising trend of gaming cafes and social gaming events contribute to the market's growth. The rapidly expanding middle-class population and rising disposable incomes also play a crucial role in driving consumer spending on leisure and entertainment products. Furthermore, the presence of leading game manufacturers and the adoption of digital platforms to promote and sell games enhance the market dynamics in the Asia Pacific region.

North America Playing Cards And Board Games Market Trends

North America playing cards and board games industry was identified as a lucrative region in 2024 owing to the resurgence in tabletop gaming and increased consumer interest in traditional forms of entertainment. The region's strong gaming culture, coupled with a robust retail infrastructure, supports market expansion. Events such as gaming conventions and tournaments have gained popularity, further boosting sales. Additionally, the rise of board game cafes and social gaming spaces offers new avenues for consumer engagement. The diversity of games available, from classic card games to complex board games, caters to a wide range of preferences, ensuring sustained demand in the market.

U.S. Playing Cards And Board Games Market Trends

The U.S. playing cards and board games industry is expected to grow significantly over the forecast period owing to its dynamic innovation and consumer enthusiasm for gaming. The growing trend of family game nights and social gatherings centered around games has significantly boosted market demand. The country's diverse population and cultural melting pot contribute to various game preferences, driving the development of unique and varied game offerings. Additionally, the strong presence of major game publishers and the increasing popularity of crowdfunding platforms for game development further propel market growth. This vibrant market landscape ensures a continuous influx of new and engaging games that captivate U.S. consumers.

Europe Playing Cards And Board Games Market Trends

Europe playing cards and board games industry is expected to grow significantly at a CAGR of 7.6% over the forecast period. The region's well-established gaming communities and conventions provide a robust platform for market growth. European consumers prefer high-quality, intricately designed games that offer immersive experiences. The increasing popularity of eco-friendly and sustainably produced games aligns with the region's environmental consciousness, further driving market trends. Additionally, the integration of technology with traditional board games, such as app-assisted gameplay, enhances the appeal and accessibility of games, supporting continued market expansion in Europe.

Key Playing Cards And Board Games Company Insights

Some key companies in the playing cards and board games market include Games Workshop Limited, NECA/WizKids LLC (WizKids), IELLO, Grey Fox Games, Disney, and others. The leading players focus on product innovation to gain a greater market share. They launch new products with innovative concepts, layouts, and designs to attract more consumers.

-

Grey Fox Games is a prominent publisher in the playing cards and board games industry, known for its high-quality and innovative game designs. Their product lineup includes a variety of engaging and strategic games, such as Champions of Midgard, Deception: Murder in Hong Kong, and After the Empire. These games often feature rich themes, intricate mechanics, and high production values, appealing to both casual and serious gamers.

Key Playing Cards And Board Games Companies:

The following are the leading companies in the playing cards and board games market. These companies collectively hold the largest market share and dictate industry trends.

- Games Workshop Limited

- NECA/WizKids LLC (WizKids)

- Grey Fox Games

- Disney

- IELLO

- Buffalo Games

- University Games Corporation

- Delano Games

- LongPack Games

- Boda Games

Recent Developments

-

In October 2024, Spin Master Games announced the release of “Wicked: The Game”, priced at USD 25. The game invites players to embody the four principal characters from the film and engage in a cooperative storybook adventure against the Wizard. Participants must collect card sets to earn Thrillifying Magic and unlock story chapters, striving to reach the Emerald City first. Aimed at ages ten and up, this family strategy game celebrates the beloved “Wicked” narrative.

-

In April 2024, Mattel prepared to launch Scrabble, a new version of the classic word game aimed at making it more collaborative and accessible. The innovative double-sided board will retain the original game on one side while introducing a faster, team-oriented format on the flip side.

Playing Cards And Board Games Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.45 billion

Revenue forecast in 2030

USD 31.93 billion

Growth Rate

CAGR of 8.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa,

Key companies profiled

Games Workshop Limited; NECA/WizKids LLC (WizKids); Grey Fox Games; Disney; IELLO; Buffalo Games; University Games Corporation; Delano Games; LongPack Games; Boda Games

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Playing Cards And Board Games Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global playing cards and board games market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Playing Cards

-

Board Games

-

Chess

-

Scrabble

-

Monopoly

-

Ludo

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.