- Home

- »

- Clothing, Footwear & Accessories

- »

-

Plus-size Clothing Market Size, Share & Growth Report, 2030GVR Report cover

![Plus-size Clothing Market Size, Share & Trends Report]()

Plus-size Clothing Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Casual, Sportswear, Inner Wear, Ethnic Wear, Formal, Night Wear), By Gender, By Age Group, By Pricing, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-362-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plus-size Clothing Market Summary

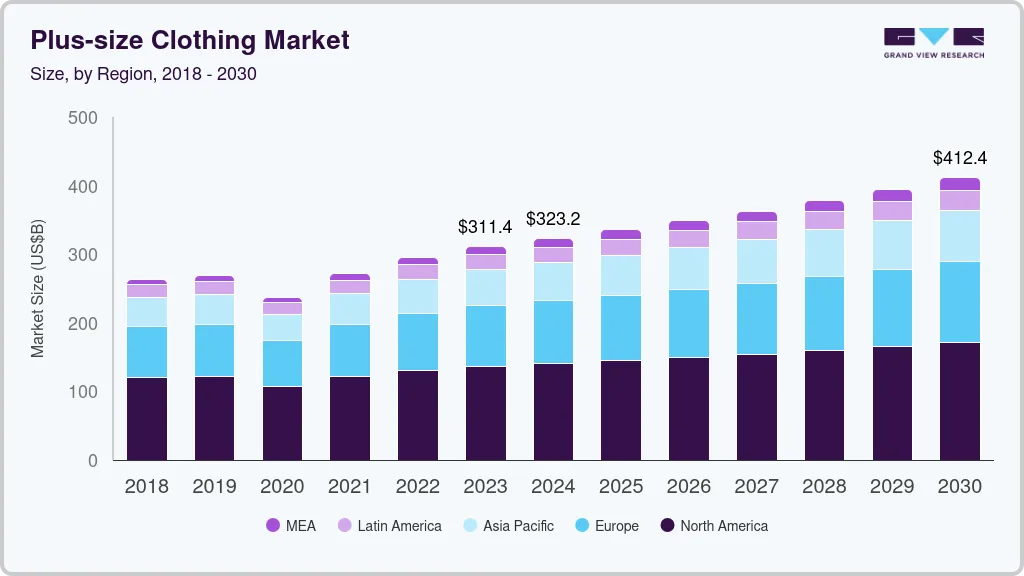

The global plus-size clothing market size was estimated at USD 311.44 billion in 2023 and is anticipated to reach USD 412.39 billion by 2030, growing at a CAGR of 4.1% from 2024 to 2030. The global market is experiencing a significant surge in consumer spending.

Key Market Trends & Insights

- North America dominated the plus-size clothing market with the revenue share of 43.97% in 2023.

- The plus-size clothing market in the U.S. accounted for a revenue share of 82% in North America in 2023.

- By gender, the women segment led the market with the largest revenue share of 52.20% in 2023.

- By age group, the below 15 segment led the market with the largest revenue share of 14.5% in 2023.

- By pricing, the mass segment led the market with the largest revenue share of 68.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 311.44 Billion

- 2030 Projected Market Size: USD 412.39 Billion

- CAGR (2024-2030): 4.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Within this sector, the demand for fashionable plus-size clothing for women is witnessing a remarkable increase in sales. The global market has seen a significant uptick in consumer spending, and the plus-size segment has been a major contributor to this growth. Plus-size clothing is defined as sizes above 18, which encompasses approximately 67% of women in the UK. Despite being the majority, this group has historically been underrepresented in the fashion industry. The growing awareness of body positivity and inclusivity has prompted a shift in both consumer expectations and industry standards.

There has been a marked increase in the demand for clothing that not only fits but also flatters and celebrates plus-size bodies. Brands are moving away from the notion of “othering” plus-size women and are instead embracing them as a vital part of their consumer base. According to Alexandra Waldman, co-founder of Universal Standard, the practice of segregating sizes into “plus” and “straight” perpetuates inequality. Universal Standard, which offers sizes ranging from 0 to 38, is a pioneer in this movement, striving to make fashion accessible to all women regardless of size.

Major retailers have significantly expanded their plus-size offerings. For instance, Walmart offers a dedicated brand, Terra and Sky, specifically to serve this audience. High-street retailers such as New Look, River Island, and Marks & Spencer have also expanded their offerings to include extensive plus-size women's clothing lines.

Target expanded its plus-size lines, Universal Thread and A New Day, to include more on-trend styles and better fits. These collections are available both online and in stores, providing plus-size consumers with fashionable options that were previously harder to find.

The online retail space has become a crucial platform for plus-size fashion. Unlike physical stores, which often have limited plus-size selections, online retailers can offer a broader range of sizes and styles. This convenience has driven many consumers to shop online, boosting sales in the plus-size category. ASOS, for example, has an extensive plus-size range that includes both in-house designs and items from other popular brands, catering to a wide array of fashion preferences.

Collaborations with celebrities and influencers who advocate for body positivity have also bolstered the visibility and appeal of plus-size fashion. In 2022, Lizzo, a prominent advocate for body positivity, launched her own shapewear line, Yitty, in partnership with Fabletics. This line focuses on inclusivity and offers a wide range of sizes, promoting the message that all bodies are beautiful.

Product Insights

The casual segment led the market with the largest revenue share of 38.37% in 2023. The demand for casual plus-size clothing has surged, driven by the shift towards comfortable and stylish everyday wear. With the rise of remote work and casual office environments, consumers are seeking versatile pieces that blend comfort with fashion. Brands like Torrid and Lane Bryant have expanded their casual wear collections to include trendy tops, comfortable jeans, and stylish dresses that cater to plus-size consumers.

The sportswear segment is projected to grow at the fastest CAGR of 4.4% over the forecast period. The increasing emphasis on health and fitness, coupled with the body positivity movement, has spurred demand for plus-size sportswear. Consumers are looking for performance-oriented activewear that provides support and comfort. Fabletics, co-founded by actress Kate Hudson, has also made inclusivity a core part of its brand by offering stylish activewear in a wide range of sizes.

Gender Insights

Based on gender, the women segment led the market with the largest revenue share of 52.20% in 2023. The women’s plus-size clothing segment is driven by the increasing representation of diverse body types in media and advertising. Women are seeking fashionable, well-fitting clothing that reflects current trends and celebrates their bodies.

The children segment is projected to grow at the fastest CAGR of 5.9% over the forecast period. There is a growing recognition of the need for inclusive sizing in children’s clothing. Parents are looking for stylish, comfortable, and age-appropriate options for their plus-size children. Brands like Lands’ End and Justice’ offer’s plus-size clothing options for children, including jeans, t-shirts, and dresses that cater to different body types.

Age Group Insights

Based on age group, the below 15 segment led the market with the largest revenue share of 14.5% in 2023. The push for inclusivity in fashion extends to younger age groups, with parents advocating for more options for their plus-size children. The trend towards body positivity is influencing the development of stylish and comfortable clothing for this age group. Retailers like Kohl’s and Old Navy offer extended sizes for kids, providing a variety of options that are both trendy and suitable for active lifestyles.

The 16 to 59 segment is projected to grow at the fastest CAGR of 3.4% over the forecast period. This segment is characterized by a diverse range of needs, from casual wear to professional attire and everything in between. The increasing acceptance of diverse body types in society drives the demand for fashionable and functional clothing for plus-size individuals in this age group.

Pricing Insights

Based on pricing, the mass segment led the market with the largest revenue share of 68.2% in 2023. Affordability and accessibility are key drivers of the market growth of the mass. Consumers in this segment are looking for budget-friendly options that do not compromise on style or quality. Retailers like Walmart and Target offer extensive plus-size collections that are affordable and accessible to a wide range of consumers. These brands focus on providing trendy and cost-effective options that cater to the plus-size market.

The premium segment is projected to grow at the fastest CAGR of 4.6% over the forecast period. The premium segment is driven by consumers seeking high-quality, fashionable clothing that offers superior fit and finish. This segment often includes designer labels and high-end brands that cater to plus-size individuals. These brands emphasize inclusivity without compromising on the quality and style expected in the premium market. Ralph Lauren, for instance, offers a range of sophisticated pieces that cater to plus-size consumers looking for both everyday luxury and special occasion wear.

Regional Insights

North America dominated the plus-size clothing market with the revenue share of 43.97% in 2023. With a significant portion of the population falling into the plus-size category, there is a high demand for fashionable and comfortable clothing options. Social media and influencer marketing play a crucial role in shaping trends and consumer preferences.

U.S. Plus-size Clothing Market Trends

The plus-size clothing market in the U.S. accounted for a revenue share of 82% in North America in 2023. The presence of major retail chains and e-commerce platforms has facilitated the market growth. Walmart’s Terra and Sky and Target’s Universal Thread lines are also popular for their affordability and variety.

Asia Pacific Plus-size Clothing Market Trends

The plus-size clothing market in Asia Pacific is projected to grow at the fastest CAGR of 5.2% from 2024 to 2030. The Asia Pacific market is growing, driven by increasing consumer awareness and demand for inclusive fashion. Japan’s plus-size market is evolving, with brands like Nissen and Marui offering inclusive sizing. The trend towards body positivity is gradually gaining traction, influencing consumer preferences.

Europe Plus-size Clothing Market Trends

The plus-size clothing market in Europe accounted for a revenue share of around 28% in 2023. The region’s diverse fashion landscape and strong emphasis on style have driven brands to expand their plus-size offerings. There is also a growing trend towards sustainability, with consumers seeking eco-friendly options.

Key Plus-size Clothing Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Plus-size Clothing Companies:

The following are the leading companies in the plus-size clothing market. These companies collectively hold the largest market share and dictate industry trends.

- MANGO

- Hennes & Mauritz AB

- F21 IPCo, LLC

- Nike, Inc.

- adidas America, Inc.

- Puma SE

- Lane Bryant

- RALPH LAUREN MEDIA LLC

- ASOS

- Ashley Stewart

Recent Developments

-

In April 2023, Full Beauty Brands acquired Eloquii Inc., a plus-size apparel label previously owned by Walmart. Eloquii offers clothing in sizes 12W to 44W, cup sizes A to O, bras in band sizes 30 to 58, and medium to wide-wide footwear. This acquisition enabled Full Beauty Brands to expand its market share in the rapidly growing U.S. plus-size women's market

-

In November 2022, Adidas partnered with 11 Honoré to launch its first performance activewear capsule exclusively for plus sizes, available in sizes 1X–4X. The collection featured 14 pieces, including a corset sports bra with supportive sheer mesh, a body-hugging onesie partially made from recycled materials, and athleisure classics like a French terry sweatsuit and matching sets in earth-tone patterns

Plus-size Clothing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 323.24 billion

Revenue forecast in 2030

USD 412.39 billion

Growth rate

CAGR of 4.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 – 2022

Forecast period

2024 – 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, gender, age group, pricing, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

MANGO; Hennes & Mauritz AB; F21 IPCo, LLC; Nike, Inc.; adidas America, Inc.; Puma SE; Lane Bryant; RALPH LAUREN MEDIA LLC; ASOS; Ashley Stewart

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plus-size Clothing Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plus-size clothing market report based on product, gender, age group, pricing, end use, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Casual

-

Sportswear

-

Inner Wear

-

Ethnic Wear

-

Formal

-

Night Wear

-

Others

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Women

-

Men

-

Children

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 15

-

16 to 59

-

60 & Above

-

-

Pricing Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

Luxury

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. North America dominated the plus-size clothing market with a share of around 43% in 2023. Social media and influencer marketing play a crucial role in shaping trends and consumer preferences in this region.

b. Some of the key players operating in the plus-size clothing market include MANGO; Hennes & Mauritz AB; F21 IPCo, LLC; Nike, Inc.; adidas America, Inc.; Puma SE; Lane Bryant; RALPH LAUREN MEDIA LLC; ASOS; Ashley Stewart

b. Key factors that are driving the plus-size clothing market growth include the growing awareness of body positivity and inclusivity, and the shift towards comfortable and stylish everyday wear.

b. The global plus-size clothing market was estimated at USD 311.44 billion in 2023 and is expected to reach USD 323.24 billion in 2024.

b. The global plus-size clothing market is expected to grow at a compound annual growth rate of 4.1% from 2024 to 2030 to reach USD 412.39 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.