- Home

- »

- Medical Devices

- »

-

Pneumatic Tourniquet Market Size And Share Report, 2030GVR Report cover

![Pneumatic Tourniquet Market Size, Share & Trends Report]()

Pneumatic Tourniquet Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Application (Orthopedic, Intravenous Regional Anesthesia, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-337-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pneumatic Tourniquet Market Summary

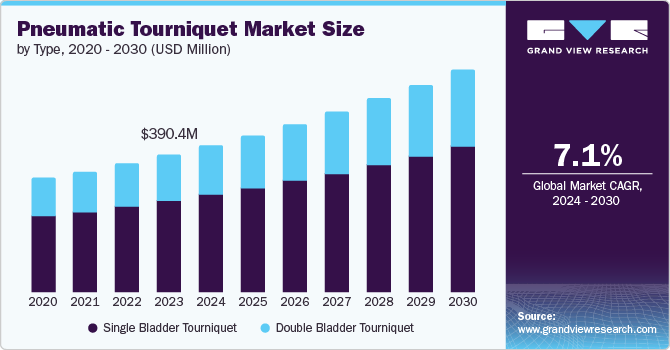

The global pneumatic tourniquet market size was valued at USD 390.4 million in 2023 and is projected to reach USD 631.0 million by 2030, growing at a CAGR of 7.1% from 2024 to 2030. The rising prevalence of sports injuries, increasing cases of road accidents leading to emergency surgeries, and the growing number of orthopedic and other surgeries are the factors contributing to the growth of this market.

Key Market Trends & Insights

- North America pneumatic tourniquet market dominated the global industry in 2023.

- By type, the single-bladder segment held the largest market share of 66.4% in 2023.

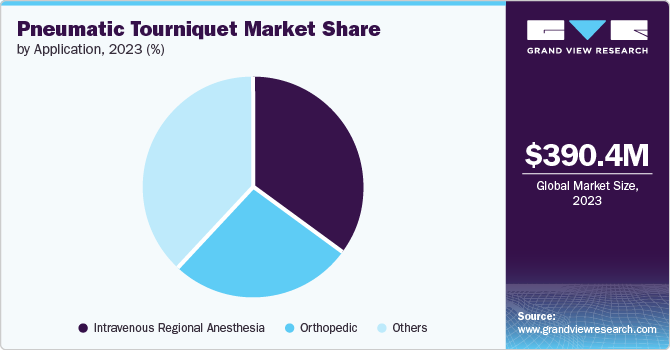

- By application, the Intravenous Regional Anesthesia (IVRA) segment held a significant revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 390.4 Million

- 2030 Projected Market Size: USD 631.0 Million

- CAGR (2024-2030): 7.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Furthermore, innovations in medical technology and the increasing inclination towards minimally invasive surgical procedures are expected to boost the market growth in the approaching years.

The pneumatic tourniquets are extensively used in complicated surgical processes to maintain the dry operative area and limit the intraoperative blood loss to a certain limit. The device is used across surgeries to restrict blood flow by applying pressure. In recent years, developed and developing economies have witnessed rising surgeries due to multiple factors. It includes an increasing rate of injuries, growing participation in sports and outdoor activities, and accidents causing complicated injuries.

Respiratory diseases have also been prevailing at a rapid rate in recent years. According to the National Center for Health Statistics, the U.S. recorded 147,382 deaths in 2022 caused by Chronic lower respiratory diseases, including asthma. The unceasing increase in new cases has also resulted in a growing number of respiratory emergencies where pneumatic tourniquets are adopted to deliver desired results. These aspects are expected to fuel growth for this industry in approaching years.

Type Insights & Trends

“Double bladder tourniquet segment is expected to witness fastest growth at 7.6% CAGR”

The single-bladder segment held the largest market share of 66.4% and is expected to grow considerably over the forecast period. The adoption of these devices is increasing owing to the ability to offer desired assistance through consistent controlled pressure and compression. Regardless of the force and location of a healthcare professional's hand, using a single tourniquet reduces complications and pain, leading to better clinical outcomes. It is expected to generate greater demand for the segment.

The market growth of the double bladder tourniquet segment is attributed to its special design for Intravenous Regional Anesthesia (IVRA) procedures. The double-bladder tourniquet device allows each bladder to be inflated and deflated separately, allowing anesthesia professionals to manage patients' pain experiences and improve comfort levels.

Application Insights & Trends

“The intravenous regional anesthesia segment to witness a rapid growth rate of 7.6%”

The Intravenous Regional Anesthesia (IVRA) segment held a significant revenue share in 2023. This segment is primarily driven by factors such as the rising number of limb surgeries and the cost-effective nature of intravenous regional anesthesia. According to the WHO, approximately 1.3 billion people die due to fatal road traffic accidents. Some of the advancements associated with tourniquet instruments used in IVRA include safety lockout, automated cuff testing, and leak detection capacities.

The orthopedic segment is expected to experience a noteworthy CAGR during the forecast period. It is mainly due to the rising number of orthopedic surgeries. According to the McLeod Health Report 2022, 18,577,953 orthopedic surgeries were performed in the U.S. A rise in inclination towards minimally invasive surgeries over long-term treatments, presence of expert surgeons, and availability of enhanced technology assistance are expected to propel growth for this segment

Regional Insights & Trends

“Canada to witness market growth of CAGR 8.1%”

North America pneumatic tourniquet market dominated the global industry in 2023 and is projected to grow significantly over the forecast period. The growth is attributed to an increase in the number of orthopedic surgeries performed on the geriatric population and traumatic injury cases. Furthermore, key players in the region are developing and delivering pneumatic tourniquet systems that utilize microcomputers to attain automated pressure control, alarms, and other safety features. These aspects and the growing demand for orthopedic surgeries are expected to boost the regional market growth.

U.S. Pneumatic Tourniquet Market Trends

The U.S. pneumatic tourniquet market is expected to experience a significant CAGR from 2024 to 2030. This market is mainly driven by the large number of surgical procedures performed in the country owing to its premium healthcare infrastructure and the presence of expert professionals in the field of surgery. The U.S. market is also driven by the presence of major players in the domestic industry.

Europe Pneumatic Tourniquet Market Trends

Europe pneumatic tourniquet market is anticipated to experience noteworthy growth during the forecast period. It is attributed to a substantial increase in the number of surgical procedures performed in the region every year. In addition, advancements in healthcare infrastructure, the availability of assistive technology, and the growing geriatric population are contributing to the rising demand. According to Eurostat, 21.3 % of the total EU population was 65 years and over in 2023.

Germany pneumatic tourniquet market held a significant market share in the regional industry. The country's improved healthcare services and facilities, a growing number of surgeries successfully performed by skilled surgeons, and the availability of innovative technology and devices are contributing to this market demand. Increased accidents and trauma injuries are also adding to this market demand in Germany.

Asia Pacific Pneumatic Tourniquet Market Trends

The Asia Pacific pneumatic tourniquet market is anticipated to register the fastest CAGR during the forecast period. This region is anticipated to experience considerable growth opportunities due to a rise in the number of orthopedic and other surgical procedures, especially limb surgeries. Additionally, the market is driven by an increasing inclination towards clinical trials and significant R&D investments from global market participants.

India pneumatic tourniquet market is one of the lucrative spaces in this region. This market is mainly driven by factors such as the unceasing number of traffic accidents, trauma-related injuries caused by falls, crashes, and other accidents, the rising rate of surgeries performed in the country, and growing medical tourism.

Key Pneumatic Tourniquet Company Insights

Some of the key companies operating in this market are AneticAid, Stryker, Ulrich Medical USA, VBM Medizintechnik GmbH, Zimmer Biomet and others. Owing to the growing competition, major brands in the industry have adopted strategies such as collaborations, healthcare industry tie-ups, heavy investment in R&D, innovation-based new product developments, and geographical expansions.

-

Stryker, a medical technology solutions company, offers the SmartPump Tourniquet System, which is equipped with advanced technology tools and safety features. The company also provides surgical implants, navigation systems, emergency medical equipment, and other medical devices.

-

Zimmer Biomet, a healthcare and medical technology organization, designs and manufactures orthopedic reconstructive products, sports medicine solutions, biologics, extremities and trauma devices, spine technologies, and related surgical products. The company's pneumatic tourniquet systems are equipped with personalized pressure technology, an integrated barcode scanner, dual ports, and a distal sensor for Limb Occlusion Pressure (LOP).

Key Pneumatic Tourniquet Companies:

The following are the leading companies in the pneumatic tourniquet market. These companies collectively hold the largest market share and dictate industry trends.

- AneticAid

- Stryker

- ulrich medical USA

- VBM Medizintechnik GmbH

- Zimmer Biomet

- DS MAREF Co. Ltd.

- DESSILLIONS & DUTRILLAUX

- Hangzhou Kimislab Co., Ltd.

- Shanghai Huifeng Medical Instrument Co., Ltd.

- Jiangsu Qianjing Medical Equipment Co., Ltd

Recent Developments

-

In June 2024, Zimmer Biomet Holdings, Inc. and RevelAi Health announced a multi-year co-marketing agreement. These medical technology industry participants have joined forces to commercialize AI-based patient engagement solutions.

Pneumatic Tourniquet Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 417.5 million

Revenue forecast in 2030

USD 631.0 million

Growth rate

CAGR of 7.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France,Italy, Spain, Denmark, Sweden, Norway China, Japan, India, South Korea, Australia, Thailand, Brazil,Argentina, UAE,Saudi Arabia, Kuwait and South Africa

Key companies profiled

Stryker; Zimmer Biomet; Ulrich Medical; AneticAid; VBM Medizintechnik GmbH; Dessillions & Dutrillaux; DSMAREF Co.Ltd.; Hangzhou Kimislab Co., Ltd.; Shanghai Huifeng Medical Instrument Co., Ltd.; Jiangsu Qianjing Medical Equipment Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

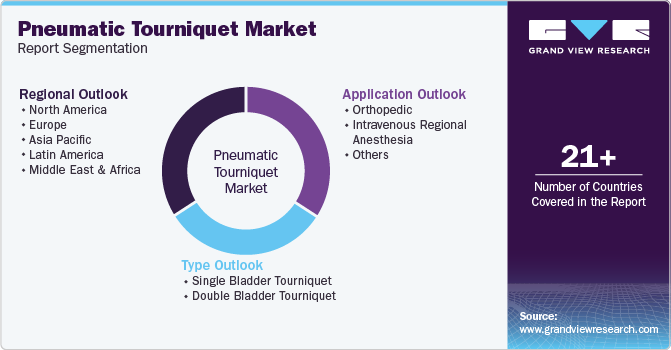

Global Pneumatic Tourniquet Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global pneumatic tourniquet market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Bladder Tourniquet

-

Double Bladder Tourniquet

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic

-

Intravenous Regional Anesthesia

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.