- Home

- »

- Medical Devices

- »

-

Point-of-Care Medical Imaging Market Share Report, 2030GVR Report cover

![Point-of-Care Medical Imaging Market Size, Share & Trends Report]()

Point-of-Care Medical Imaging Market Size, Share & Trends Analysis Report By Product (X-ray, Ultrasound, CT), By Application (General, Cardiovascular), By End-use (Hospitals, ASCs), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-998-1

- Number of Report Pages: 102

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global point-of-care medical imaging market was valued at USD 1.21 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. The growing adoption of point-of-care (POC) medical imaging devices coupled with constant technological advancements is likely to boost the industry’s growth in the coming years. For instance, in September 2021, GE Healthcare introduced AMX Navigate, an AI-based portable X-ray system, this system eliminates 100% of user interface clicks. Moreover, the increasing incidence of target diseases, combined with the increased focus on preventative healthcare among the population is expected to contribute to the industry growth in the coming years.

The primary factor influencing the use of POC imaging systems in healthcare facilities is their contribution to enhanced patient care, infection control, and rapid diagnosis. Transferring seriously ill patients to the radiology department may result in complications for the patient. As per the International Journal of Critical Illness & Injury Science, a few instances of transport-related consequences include dangers to the respiratory system, traumatic damage, acid-base homeostasis, glucose regulation, the risk for infection, and even fatality. Thus, by bringing diagnostic imaging equipment right to the patient’s bedside, patient transportation risks can be eliminated.

Radiologists and other diagnostic professionals focus on image quality, speed, flexibility of application, and ease of use. As POC imaging systems continue to advance, these systems can offer all of these characteristics by utilizing cutting-edge technology and design. This is expected to drive the adoption of POC medical imaging systems. During the COVID-19 pandemic, point-of-care imaging systems, such as ultrasound and x-rays, had proven to be effective in monitoring critically ill patients, and thus since the pandemic, the demand for these systems has only been accelerating. Furthermore, constant technological advancements support industry growth.

Major industry players are adopting different strategic initiatives, such as product development and government approvals, to gain higher shares. For instance, in September 2022, Philips received FDA approval for its new compact ultrasound system, the innovative 5000 Compact Series. In August 2020, GE Healthcare showcased its handheld ultrasound Vscan, with extended support through the LVivo EF application, at the American Society of Echocardiography 2020. The device features an AI-based solution that automatically calculates and analysis cardiac ejection fractions expanding its utility at the point of care.

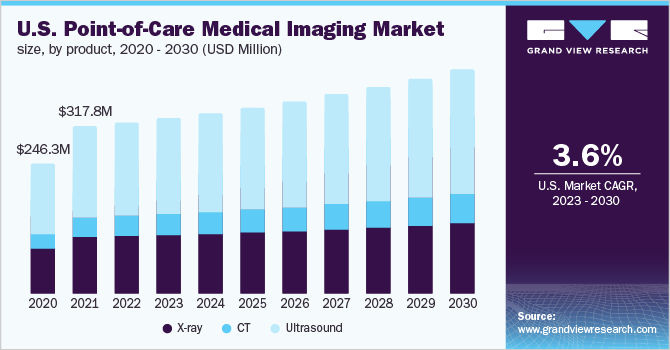

Product Insights

The ultrasound segment dominated the global industry in 2022 and accounted for the maximum share of more than 56.60% of the overall revenue. The segment is projected to expand further at a steady CAGR maintaining its dominant industry position throughout the forecast period. The growth can be attributed to the introduction of technologically advanced POC Ultrasound Systems (POCUS) and an increase in the number of patients visiting emergency departments with a variety of health issues, including acute stomach pain, urological difficulties, and chest discomfort. Moreover, the demand for POCUS is anticipated to increase due to its multiple therapeutic and diagnostic applications.

The CT product segment is expected to register the fastest growth rate during the forecast period. Point-of-care/mobile CT scanners have highly beneficial results when compared to stationary CT scanners, as they lower the time taken for patients to undergo diagnostic imaging, improve patient recovery, increase the accuracy of patient care, and shorten hospital stays. The ability of mobile CT to conduct imaging tests on a patient without requiring repositioning and restricting the patient’s movement makes CT scans possible even for the most unstable and severely ill patients. All these factors will drive the growth of this segment.

Application Insights

The general imaging application segment dominated the industry in 2022 and accounted for the largest share of more than 30.10% of the overall revenue. General imaging is less expensive than other applications and includes a wide range of scans that clinicians need for diagnosis and direct treatment, including scans of the abdomen, musculoskeletal system, small parts, urology, liver, thyroid, scrotum, bladder, pancreas, kidneys, spleen, and gallbladder. Furthermore, the growing awareness about general radiology with POC devices is expected to drive the segment over the coming years.

On the other hand, the cardiovascular segment is expected to witness the fastest growth rate during the forecast period. The growing demand for cardiac imaging is a major challenge faced by cardiologists owing to the increasing prevalence of cardiovascular disorders worldwide. Globally, each year, approximately 17 million deaths are due to cardiovascular diseases. The increasing prevalence of cardiovascular disorders has put significant pressure on the healthcare systems, where physicians have to address a large number of patients in a short time. This has contributed to the growing demand for POC imaging systems in cardiac care, thereby supporting segment growth.

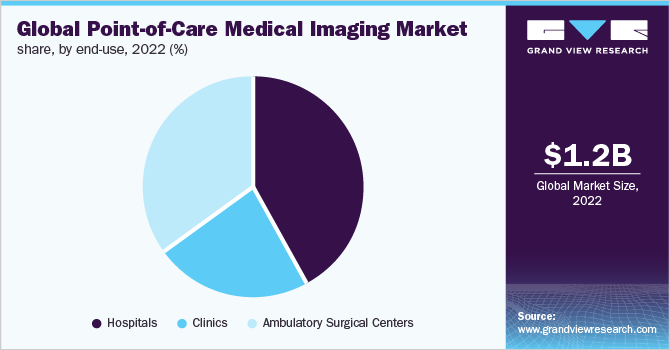

End-use Insights

The hospitals end-use segment dominated the global industry in 2022 and accounted for the largest share of more than 42.30% of the overall revenue. Hospitals are replacing stationary modalities with portable technology to raise the level of care provided to patients and lower the expense of in-hospital patient transportation as well as the processing time, cost, and storage required by traditional film systems. For instance, in July 2022, MIOT hospital, based in Chennai, India, acquired mobile full-body CT scan equipment to allow real-time imaging during surgeries. Thus, the increase in the adoption of point-of-care imaging technology by end-users is expected to boost segment growth during the forecast period.

On the other hand, the Ambulatory Surgical Centers (ASCs) end-use segment is anticipated to witness the fastest growth rate during the forecast period. The growing number of patients visiting ASCs for taking surgical care is expected to contribute to the segment growth. Therefore, there is a need for POC imaging systems for use in ambulatory surgery, which can access patients in any direction or height and produce high-quality three-dimensional images. Moreover, efficient cost coverage policies for point-of-care systems in these centers are expected to boost segment growth.

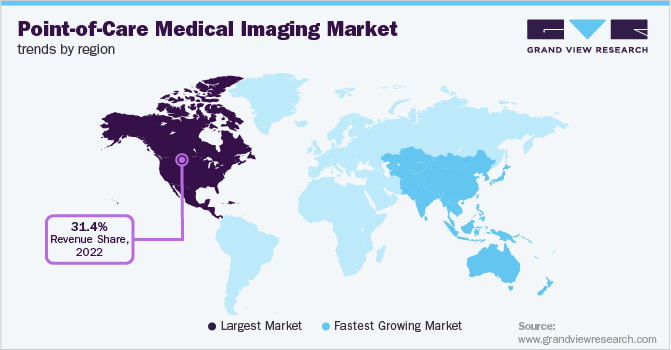

Regional Insights

North America dominated the global industry in 2022 and accounted for the largest revenue share of more than 31.40% of the overall revenue. The region is projected to expand further at a steady CAGR over the forecast period. Some of the major factors contributing to the region’s growth include a higher preference for technologically improved medical systems and accessibility of advanced healthcare facilities. Furthermore, the increased government spending on healthcare in the region is expected to drive growth. For instance, according to the Centers for Medicare & Medicaid Services, healthcare spending in the U.S. increased by 9.7% to USD 4.1 trillion in 2020.

The industry growth in the region is anticipated to be further boosted by the presence of prominent players like GE Healthcare and FUJIFILM SonoSite. On the other hand, the Asia Pacific region is anticipated to witness the fastest growth rate over the forecast period owing to supportive government initiatives for improving the healthcare infrastructure in the region. Moreover, economic development in countries, such as India and China, is expected to facilitate market growth. The growing target population along with low per capita income in the region has also led to a high demand for affordable treatment options.

Key Companies & Market Share Insights

Key players are focusing on various growth strategies, such as new product launches, expansion, collaborations, partnerships, and acquisitions. For instance, in October 2022, NeuroLogica Corp. received the European Union (EU) CE marking for its Elite Mobile Computed Tomography, with this, it is anticipated that the company’s portfolio of mobile CT scanners will continue to provide the European Union with point-of-care CT imaging. Some of the prominent players in the global point-of-care medical imaging market include:

-

GE Healthcare

-

Siemens Healthineers AG

-

Philips Healthcare

-

Canon Medical Systems Corp.

-

Mindray

-

FUJIFILM SonoSite, Inc.

-

Esaote

-

Neurologica

-

Samsung Medison

-

Xoran Technologies, LLC

Point-of-Care Medical Imaging Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.24 billion

Revenue forecast in 2030

USD 1.67 billion

Growth rate

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Columbia; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

GE Healthcare; Siemens Healthineers AG; Philips Healthcares; Canon Medical Systems Corp.; Mindray; FUJIFILM SonoSite, Inc.; Esaote; Neurologica; Samsung Medison; Xoran Technologies, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

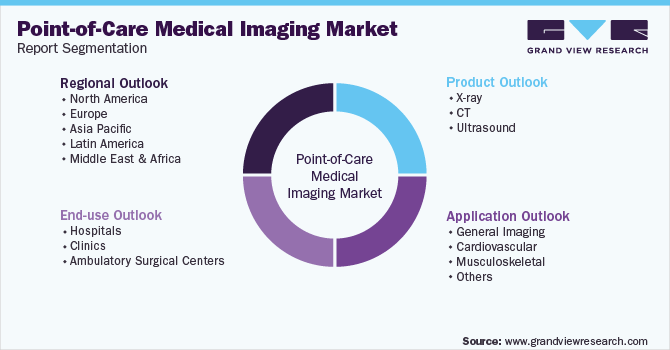

Global Point-of-Care Medical Imaging Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global point-of-care medical imaging market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

X-ray

-

CT

-

Ultrasound

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Imaging

-

Cardiovascular

-

Musculoskeletal

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The point-of-care medical imaging market size was estimated at USD 1.21 billion in 2022 and is expected to reach USD 1.24 billion in 2023.

b. The point-of-care medical imaging market is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 to reach USD 1.67 billion by 2030.

b. North America dominated the market with a share of 31.42% in 2022 owing to the higher preference for technologically improved medical systems and the accessibility of advanced healthcare facilities in the region.

b. Some key players operating in the market include GE Healthcare; Siemens Healthineers AG; Philips Healthcares; Canon Medical Systems Corporation; Mindray; FUJIFILM SonoSite, Inc.; Esaote; Neurologica; Samsung Medison; and Xoran Technologies, LLC

b. Key factors that are driving the point-of-care medical imaging market growth include growing adoption of point-of-care (POC) medical imaging devices and constant technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."