- Home

- »

- Medical Devices

- »

-

Point Of Care Ultrasound Systems Market Size Report, 2030GVR Report cover

![Point Of Care Ultrasound Systems Market Size, Share & Trends Report]()

Point Of Care Ultrasound Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Portability, By Technology (2D, 3D/4D, Doppler), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-793-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Point Of Care Ultrasound Systems Market Summary

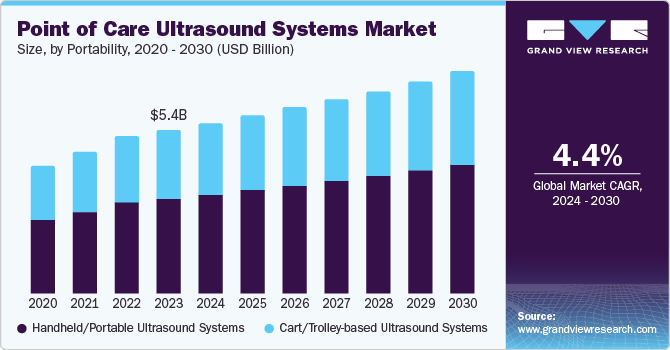

The global point of care ultrasound systems market size was valued at USD 5.44 billion in 2023 and is projected to reach USD 7.36 billion by 2030, growing at a CAGR of 4.4% from 2024 to 2030. Factors boosting market growth are the demand for fast diagnosis, technological development, prevalence of chronic diseases, elderly population, improved healthcare facilities, increased focus on patient-centered care, cost benefit for a procedure, clinician training, and positive government regulatory support.

Key Market Trends & Insights

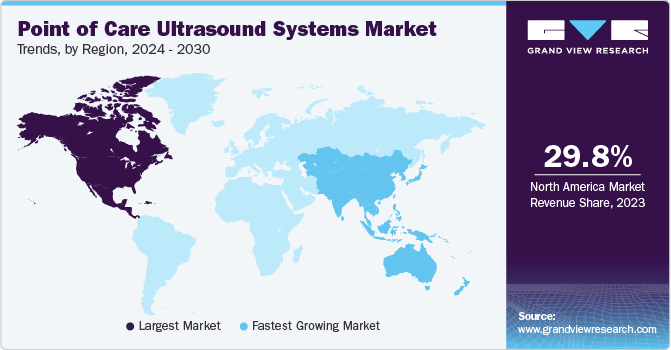

- North America point of care ultrasound systems market dominated the market with a revenue share of 29.8% in 2023.

- The point of care ultrasound systems market in the U.S. is expected to grow rapidly in the coming years.

- Based on portability, Handheld/portable ultrasound systems dominated the market with a revenue share of 58.0% in 2023.

- Based on application, Radiology was recorded as the dominant application segment with a revenue share of 22.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.44 Billion

- 2030 Projected Market Size: USD 7.36 Billion

- CAGR (2024-2030): 4.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Industry growth worldwide is driven by a confluence of technological advancements, clinical demand, and demographic shifts. The development of more compact, portable, and user-friendly devices has expanded the clinical applications of POCUS, enabling real-time assessments and improving ease of use. This has led to an increasing need for immediate and accurate diagnostic information at the patient’s bedside, particularly in emergency and critical care settings.

The growing prevalence of chronic diseases, such as cardiovascular diseases and diabetes, is another key driver of the POCUS market. Healthcare providers are seeking non-invasive and cost-effective solutions for regular monitoring and diagnosis, which POCUS technology can provide. The trend towards decentralized healthcare and point-of-care testing is also propelling the adoption of POCUS devices, allowing healthcare providers to make immediate clinical decisions. Furthermore, the rise of emerging markets presents significant growth potential, as affordable POCUS technology can bridge healthcare gaps and expand access to diagnostic services.

The customization and application diversity of POCUS devices are also driving the market’s growth. Specialized devices are being developed for various medical fields, such as obstetrics and cardiology, catering to diverse clinical needs. This has enabled healthcare providers to employ POCUS systems effectively in a wide range of settings, from emergency departments to ambulatory clinics. The integration of AI algorithms into ultrasound systems has also improved image analysis and practicing procedures, further enhancing the diagnostic capacity of these devices. Overall, the POCUS market is driven by a combination of technological innovation, clinical demand, and demographic trends that are shaping the future of healthcare delivery.

Portability Insights

Handheld/portable ultrasound systems dominated the market with a revenue share of 58.0% in 2023. Portable ultrasound machines are designed for ease of transport, enabling rapid deployment in emergency situations. Advanced interfaces and intuitive controls facilitate use by personnel without radiography expertise. Moreover, handheld systems are more cost-effective than traditional models, making them an attractive option for healthcare providers seeking to enhance patient care while reducing costs.

The cart/trolley-based ultrasound systems segment is expected to register significant growth over the forecast period. Cart/trolley integrated ultrasound systems are designed for seamless mobility within hospitals and clinics, enabling on-demand imaging in emergency departments, ICUs, and outpatient departments. This flexibility increases their visibility and functionality during emergencies, ensuring timely and effective diagnosis. With advanced imaging features, these systems provide high-quality images that support accurate diagnosis and informed patient care.

Application Insights

Radiology was recorded as the dominant application segment with a revenue share of 22.5% in 2023, fueled by improved technology, increased demand for rapid imaging, cost-effectiveness, and clinical convenience. Enhanced training of radiologists enables them to effectively utilize these systems, leading to increased confidence and diagnostic accuracy. This improvement in proficiency enables practitioners to competently interpret images, further solidifying the systems’ role in diagnosis.

The obstetrics/gynecology application segment is expected to register the fastest CAGR of 5.1% over the forecast period. The growing emphasis on prenatal care has driven increased demand for ultrasound services in obstetrics. Pregnant patients require multiple scans to monitor fetal development, detect potential health issues, and ensure a safe delivery. As a result, Point-of-Care ultrasound systems are widely adopted in obstetrics/gynecology practices. This trend enhances patient satisfaction by reducing wait times and providing timely results, driving growth in the segment.

Technology Insights

The 3D/4D technology segment held the highest revenue share of 41.1% in 2023. Three-dimensional ultrasound technology provides volumetric data, enabling clinicians to visualize anatomical structures with precision and accuracy. This enhancement improves diagnosis, particularly in obstetrics and gynecology. Four-dimensional ultrasound, an advanced feature, adds temporal dimensions, allowing for real-time observation of moving structures. Its versatility has made it a valuable tool in various specialties, driving demand as healthcare providers recognize its benefits.

The 2D technology segment is expected to register the fastest CAGR of 4.8% during forecast period. The ease of use and simplicity of 2D ultrasound technology make it a preferred choice for POCUS applications. Unlike 3D ultrasound, 2D provides real-time live feed, easily understandable by clinicians. Moreover, 2D systems are more cost-effective, both in initial purchase and recurring capital expenditures. Improved software algorithms have also enhanced image quality and resolution, while maintaining simplicity.

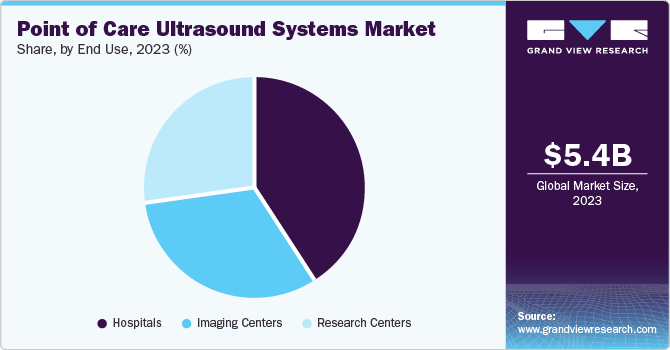

End Use Insights

The hospitals segment dominated the point of care ultrasound systems market with a revenue share of 40.8% in 2023. Many hospitals have incorporated POCUS as a standard tool across various departments, including emergency medicine, cardiology, and obstetrics. This integration enables timely diagnosis and informed management planning. Hospitals also invest in training and education to ensure widespread adoption, as healthcare professionals become proficient in using POCUS systems. This shift towards digital care delivery drives hospital investment in smart technologies that enhance patient experience.

The imaging centers segment is projected to grow significantly over the forecast period, registering a CAGR of 4.4%. Imaging centers are experiencing increased demand for diagnostic imaging procedures due to the growing prevalence of chronic diseases among geriatric populations. Portable and efficient POCUS systems meet the needs of healthcare providers and patients, facilitating timely diagnosis. Telemedicine has further boosted POCUS adoption, enabling remote consultations and image forwarding to specialists for analysis, enhancing integrated healthcare delivery and bridging geographical barriers.

Regional Insights

North America point of care ultrasound systems market dominated the market with a revenue share of 29.8% in 2023. The rapid innovation in ultrasound technology in North America has driven the growth of portable and handheld ultrasound equipment, enabling convenient imaging at the bedside or in remote areas. AI integration has further enhanced diagnosis performance and convenience.

U.S. Point of Care Ultrasound Systems Market Trends

The point of care ultrasound systems market in the U.S. is expected to grow rapidly in the coming years. The country houses prominent players such as GE Healthcare and Philips, which offer cutting-edge interior ultrasound devices. Focused on R&D, they develop innovative, high-quality machines that produce superior images, are lightweight, and easy to operate.

Europe Point of Care Ultrasound Systems Market Trends

Europe point of care ultrasound systems market was identified as a lucrative region in the global point of care ultrasound systems market in 2023. Europe is disproportionately affected by chronic diseases, including cardiovascular diseases and cancer, with statistics from the European Society of Cardiology indicating that CVDs are the leading cause of death globally. This drives demand for accurate diagnostic tools such as POCUS systems, crucial for patient management.

The point of care ultrasound systems market in the Germany dominated the Europe point of care ultrasound systems market with a revenue share of 17.1% in 2023. Germany is a leading healthcare spender, with a significant allocation of GDP dedicated to the sector. This provides ample funding for hospitals and clinics to acquire cutting-edge medical technologies, including POCUS systems, thereby enhancing healthcare infrastructure and patient outcomes.

Asia Pacific Point of Care Ultrasound Systems Market Trends

Asia Pacific point of care ultrasound systems market is expected to register the fastest CAGR of 5.1% during the forecast period. The Asia Pacific region is experiencing an increase in healthcare demand. Governments are investing in healthcare infrastructure, which includes upgrading clinical device and expanding access to superior diagnostic technologies. Moreover, the regulatory policies in many Asia Pacific region has emerge as favorable for medical device approvals.

The point of care ultrasound systems market in the China held a substantial market share in 2023. China has experienced a significant urbanization in recent years, leading to substantial expansion of healthcare industry. This growth has resulted in increase in the medical devices such as point of care ultrasound devices. As patients increasingly prefer non-invasive procedures, ultrasound technology has gained popularity.

Key Point Of Care Ultrasound Systems Company Insights

Some key companies in the point of care ultrasound systems market include GE HealthCare; Koninklijke Philips N.V.; Siemens Healthineers AG; and CANON MEDICAL SYSTEMS CORPORATION;; among others. Owing to increasing competition, market participants have been implementing tactics and strategies such as new product launches, enhanced distribution, new product launches, geographical expansion and more.

-

GE Healthcare is dedicated to delivering innovative healthcare solutions that improve patient care. The company excels in various healthcare sectors, including imaging, monitoring, biomanufacturing, and diagnostics.

-

Koninklijke Philips N.V. is focused on enhancing people’s health and well-being through revolutionary solutions. Philips’ POC ultrasound systems are designed for portability, offering lightweight and battery-powered models that enable clinicians to easily deploy them in various healthcare settings.

Key Point Of Care Ultrasound Systems Companies:

The following are the leading companies in the point of care ultrasound systems market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- CANON MEDICAL SYSTEMS CORPORATION

- SAMSUNGHEALTHCARE.COM

- FUJIFILM Sonosite, Inc.

- BenQ Medical Technology

- CHISON Medical Technologies Co., Ltd.

- Dawei Medical (Jiangsu) Corp., Ltd.

- Viatom Technology Co., Ltd.

- TELEMED

- Butterfly Network, inc

Recent Developments

-

In July 2024, GE HealthCare announced the acquisition of Intelligent Ultrasound’s clinical AI software business, adding innovative image recognition technology and expertise to its portfolio, supporting its precision care strategy.

-

In May 2024, Clarius integrated its Clarius Mobile Health with POCUS Pro, a web-based quality assessment and quality improvement tool, to enhance ultrasound scanning and diagnostic proficiency, providing users with expert reviews and feedback.

-

In May 2024, Samsung Medison announced their acquisition of a fetal ultrasound AI software company—Sonio SAS—to strengthen its position in medical devices that aid in enhancing women and children’s health worldwide.

-

In April 2024, Butterfly Network, Inc. launched the Butterfly iQ3 in the U.S., featuring the P4.3 Ultrasound-On-Chip technology, enabling faster digital image transfer, improved frame rates, and enhanced 3D imaging capabilities on a compact and ergonomic probe.

-

In February 2024, FUJIFILM Sonosite launched Sonosite Voice Assist, a hands-free voice command feature for its point-of-care ultrasound systems, allowing proceduralists to control functions without touching controls, improving workflow and sterility.

Point Of Care Ultrasound Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.67 billion

Revenue forecast in 2030

USD 7.36 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Portability, technology, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

GE HealthCare; Koninklijke Philips N.V.; Siemens Healthineers AG; CANON MEDICAL SYSTEMS CORPORATION; SAMSUNGHEALTHCARE.COM; FUJIFILM Sonosite, Inc.; BenQ Medical Technology; CHISON Medical Technologies Co., Ltd.; Dawei Medical (Jiangsu) Corp., Ltd.; Viatom Technology Co., Ltd.; TELEMED; Butterfly Network, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Point Of Care Ultrasound Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global point of care ultrasound systems market report based on portability, technology, application, end use, and region.

-

Portability Outlook (Revenue, USD Million, 2018 - 2030)

-

Cart/Trolley-based Ultrasound Systems

-

Handheld/Portable Ultrasound Systems

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

2D

-

3D/4D

-

Doppler

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Obstetrics/Gynecology

-

Radiology

-

Orthopedics

-

Anesthesia

-

Emergency Medicine

-

Primary Care

-

Critical Care

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Imaging Centers

-

Research Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global point of care ultrasound systems market size was estimated at USD 5.43 billion in 2023 and is expected to reach USD 7.35 billion in 2024.

b. The global point of care ultrasound systems market is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 to reach USD 7.35 billion by 2030.

b. North America dominated the xx market with a share of 29.75% in 2023. This is attributable to presence efficient reimbursements policies and increasing acceptance towards advanced technology coupled with developed healthcare infrastructure.

b. Some key players operating in the point of care ultrasound systems market include GE HealthCare, Koninklijke Philips N.V., Siemens Healthcare GmbH, CANON MEDICAL SYSTEMS CORPORATION, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Samsung Medison Co., Ltd. FUJIFILM SonoSite, Inc., Konica Minolta Inc. Esaote SpA, BenQ Medical Technology, CHISON Medical Technologies Co., Ltd., Dawei Medical (Jiangsu) Corp., Ltd., Viatom Technology Co., Ltd., Telemed Medical Systems S.r.l., Butterfly Network, Inc., Pulsenmore Ltd., Leltek Inc.

b. Key factors that are driving the market growth include rapid technological advancements in healthcare services and increasing number of patient admissions in emergency care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.