Market Size & Trends

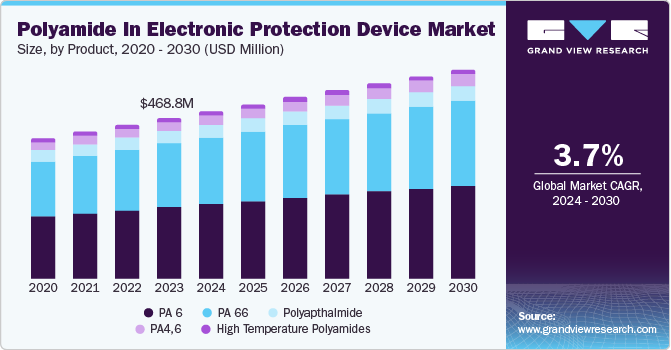

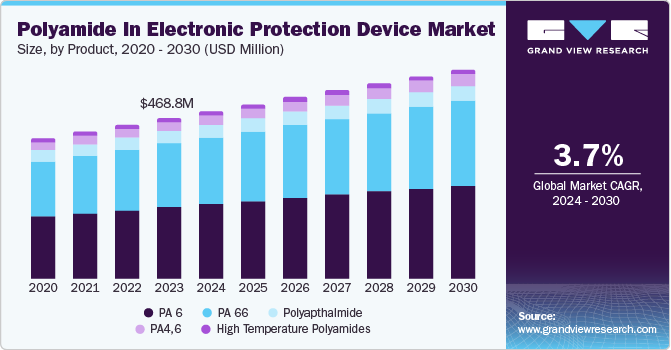

The global polyamide in electronic protection device market size was valued at USD468.8 million in 2023 and is projected to grow at a CAGR of 3.7% from 2024 to 2030. The market is driven by the growing electrical and electronics industries, advancements demanding superior material properties, and the expanding infrastructure in developing nations. Stringent safety regulations and polyamide's cost-effectiveness compared to alternatives also contribute to its market growth.

The surge in electronic devices and appliances is directly driving the demand for EPDs, consequently boosting the consumption of polyamides. The evolution of EPDs towards higher efficiency and reliability is necessitating the use of materials with superior properties, such as polyamides. The transition from traditional power grids to smart grids necessitates enhanced protection solutions that can withstand higher operational stresses. Polyamides, especially high-performance variants like PA 4,6, are being utilized to manufacture advanced miniature circuit breakers (MCBs) and molded case circuit breakers (MCCBs).

The growing construction sector, especially in emerging economies, is fuelling the need for electrical infrastructure, thereby increasing the demand for EPDs and polyamides. Compared to other materials, polyamides offer a good balance of performance and cost, making them a preferred choice for EPD manufacturers. The emphasis on safety in electrical systems is promoting the adoption of EPDs with reliable insulation materials such as polyamides further propelling the market growth. The booming consumer electronics market drives demand for protective solutions that safeguard devices from physical damage and electrical hazards, further enhancing the need for polyamide applications.

Product Insights

The PA 66 segment dominated the market with 39.7% of revenue share in 2023. PA 66 offers ease of fabrication and has a low coefficient of friction, excellent abrasion, and high impact and wear resistance. Cost-effectiveness is a crucial factor in this market as high raw material and development costs contribute to the increased cost of the finished product.

PA 66 demonstrates high dimensional stability, coupled with excellent resistance to wear owing to its lower moisture absorption property. Electrical protection devices require high heat, water, and electromechanical resistance to perform according to established standards. PA 66 has a shorter and stronger bond, which provides a denser and tighter structure in comparison to PA 6.

The PA 6 segment is anticipated to witness the significant CAGR of 3.8% over the forecast period. This upward trend is due to its balance of properties, including good mechanical strength, toughness, and processability, that makes it a versatile choice for various EPD components. In addition, PA 6 offers cost-effectiveness compared to other engineering plastics, making it an attractive option for manufacturers seeking to balance performance and price.

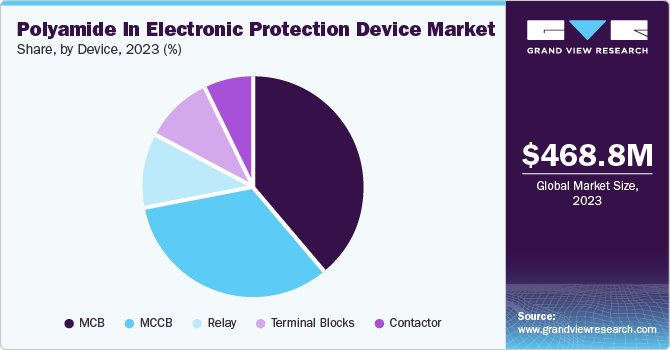

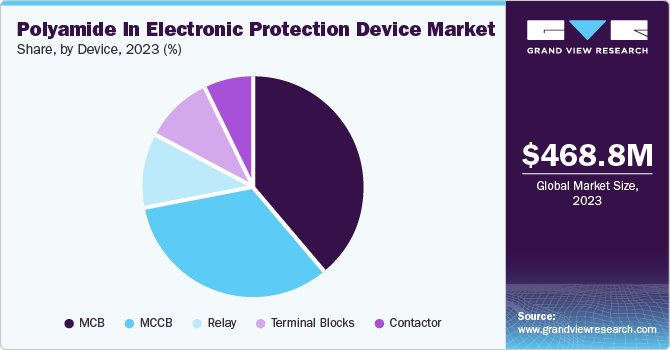

Device Insights

Miniature Circuit Breakers (MCB) devices accounted for the largest market revenue share of 32.9% in 2023. MCBs are witnessing increased use of polyamide due to its lightweight yet robust nature, allowing for compact designs without compromising safety. Moreover, polyamide's excellent electrical insulation properties ensure reliable protection against short circuits and overloads. The growing emphasis on safety and miniaturization in electrical systems is driving the demand for polyamide-based MCBs.

Molded Case Circuit Breakers (MCCB) devices are projected to grow at a CAGR of 3.8% over the forecast period. MCCBs benefit from polyamide's ability to withstand high temperatures and mechanical stresses, making it suitable for the demanding operating conditions of these devices. Furthermore, polyamide's flame retardant properties enhance safety, while its excellent dielectric strength contributes to reliable electrical performance. The increasing complexity of electrical systems and the need for robust protection solutions are fueling the demand for polyamide in MCCBs.

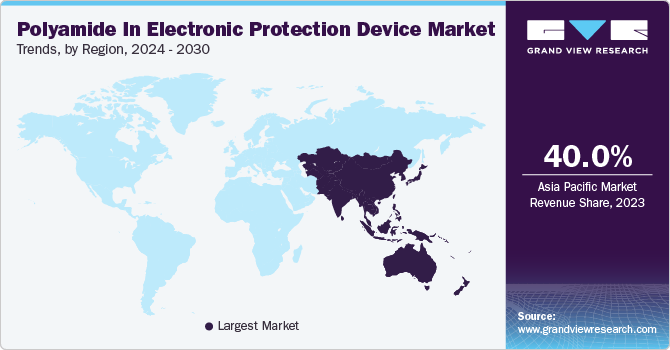

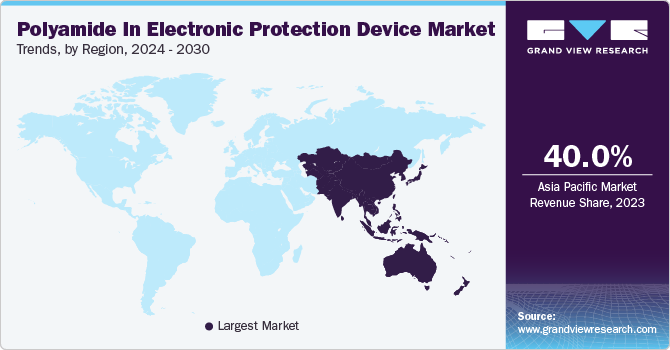

Regional Insights

The North America polyamide in electronic protection device (EPD) market is anticipated to grow at a CAGR of 3.6% during the forecast period. It is attributable to the region's robust industrialization and advanced infrastructure. The presence of key players in the electrical and electronics industry, coupled with stringent safety regulations, has fuelled the demand for reliable and high-performance EPDs.

U.S. Polyamide in Electronic Protection Device Market Trends

The U.S. polyamide in electronic protection device market held a dominant position in 2023. The country's emphasis on infrastructure development, coupled with the growing adoption of smart grid technologies, is creating substantial opportunities for polyamide-based EPDs. Moreover, the presence of a mature electrical equipment manufacturing base in the U.S. is supporting the market's growth.

Europe Polyamide in Electronic Protection Device Market Trends

The Europe polyamide in electronic protection device market was identified as a lucrative region in 2023 driven by a robust industrial base and stringent safety standards. The region's focus on renewable energy and sustainable infrastructure is propelling the demand for advanced electrical components. Moreover, the increasing adoption of electric vehicles and the expansion of charging infrastructure are creating new opportunities for polyamide-based EPDs.

The UK polyamide in electronic protection device market held a substantial market share in 2023, characterized by a well-developed electrical infrastructure and a strong emphasis on safety. The country's commitment to renewable energy and energy efficiency initiatives is driving the demand for reliable and durable EPDs.

Asia Pacific Polyamide In Electronic Protection Device Market Trends

Asia Pacific dominated the marketwith 40.0% of revenue share in 2023. The market is expected to grow due to the rapid industrialization, urbanization, and increasing energy consumption during the forecast period, The region's burgeoning middle class is fueling demand for consumer electronics and appliances, thereby driving the need for electrical protection components.

The China polyamide in electronic protection device (EPD) market held largest market

Key Electronic Protection Device Company Insights

Some key companies in polyamide in electronic protection device (EPD) market include UBE Corporation, TORAY INDUSTRIES, INC., BASF, Ascend Performance Materials, DuPont, and others.

-

TORAY INDUSTRIES, INC specializes in advanced materials and innovative technologies. Company’s diverse product portfolio includes life science products, performance chemicals, fibres & textiles and many more.

Key Polyamide In Electronic Protection Device Companies:

The following are the leading companies in the polyamide in electronic protection device market. These companies collectively hold the largest market share and dictate industry trends.

- UBE Corporation

- TORAY INDUSTRIES, INC.

- NILIT

- BASF

- Ascend Performance Materials

- DuPont

- DSM

- Huntsman International LLC.

- LANXESS

- Advansix

Recent Developments

-

In August 2023, DuPont acquired Spectrum Plastics Group, a key player in specialty medical devices. This strategic move aims to bolster DuPont's healthcare portfolio by incorporating Spectrum's advanced manufacturing capabilities.

Polyamide In Electronic Protection Device Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 488.8 million

|

|

Revenue forecast in 2030

|

USD 609.5 million

|

|

Growth Rate

|

CAGR of 3.7% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 – 2022

|

|

Forecast period

|

2024 – 2030

|

|

Quantitative units

|

Volume in Kilo Tons, Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, device, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Central & South America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, The Netherlands, China, Japan, India, South Korea, Thailand, Australia, Argentina, Brazil, Saudi Arabia, UAE, South Africa

|

|

Key companies profiled

|

UBE Corporation; TORAY INDUSTRIES, INC.; NILIT; BASF; Ascend Performance Materials; DuPont; DSM; Huntsman International LLC.; LANXESS; Advansix

|

|

Customization scope

|

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

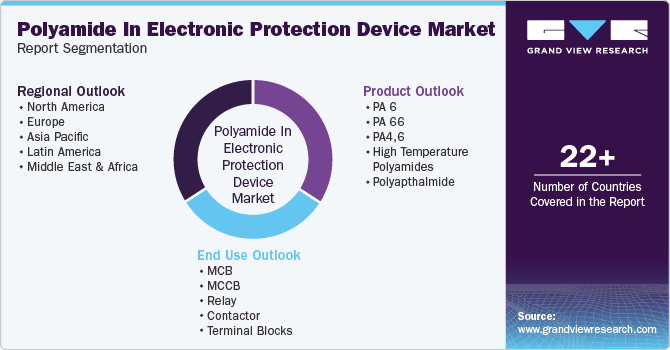

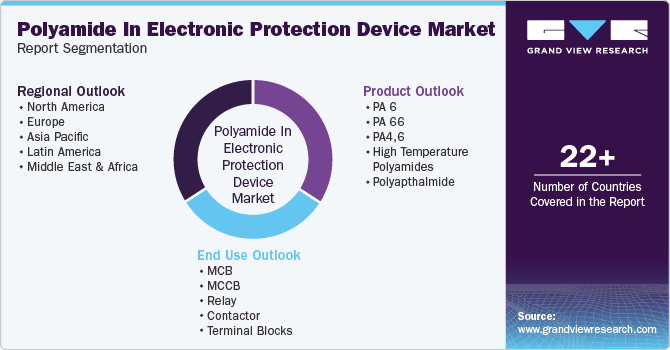

Global Polyamide In Electronic Protection Device Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyamide in electronic protection device (EPD) market report based on product, device, and region.

-

Product Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

End Use Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

MCB

-

MCCB

-

Relay

-

Contactor

-

Terminal Blocks

-

Regional Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)