- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyethylene Vapor Barrier Films For Under Slab Market Report, 2028GVR Report cover

![Polyethylene Vapor Barrier Films For Under Slab Market Size, Share & Trends Report]()

Polyethylene Vapor Barrier Films For Under Slab Market Size, Share & Trends Analysis Report By Product (HDPE, LLDPE), By Application, By Thickness, By End-use, By Grade, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-518-0

- Number of Report Pages: 102

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Bulk Chemicals

Report Overview

The global polyethylene vapor barrier films for under slab market size was valued at USD 1.18 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.9% from 2021 to 2028. The growing construction activities are significantly fueling the growth of the market. Polyethylene (PE) vapor barrier films are widely used in the construction industry for under slab applications to block water vapors coming up from the ground underneath a building. These films play a major role in mitigating damage caused by trapped moisture below flooring and foundation, which, in long term, result in the formulation of mold and mildew, releasing airborne mold spores that can lead to serious respiratory ailments and deterioration of building materials. Therefore, to mitigate the aforementioned risks and increase the life of buildings, the construction industry has increasingly started the application of polyethylene vapor barrier films in new construction as well as refurbished walls, ceilings or floors, and under slabs.

Rising population, increasing urbanization rate, and industrial growth have resulted in the rising need for construction and infrastructure development across the globe, especially in emerging regions such as Asia Pacific, Central and South America, and the Middle East. Countries such as China, India, Japan, and other Southeast Asian countries are significantly contributing to the growth of the construction industry in Asia Pacific. All these factors are expected to drive the demand for PE vapor barrier films for under slab applications in the construction industry.

Rising infrastructure spending in China is expected to potentially fuel the growth of the construction industry over the forecast period. For instance, according to the National Development and Reform Commission (NDRC), in January 2019, China announced to invest USD 142 billion on 26 infrastructure projects including rail projects in Chengdu, Kunming, Chongqing, Zhengzhou, and Xian and the expansion of Xianyang International Airport.

In addition, according to an article published by the World Resources Institute in 2019, China is expected to invest USD 13 trillion in construction activities by 2030. All these steps taken by the Chinese government to boost the growth of the construction industry are expected to drive the demand for polyethylene vapor barrier films for under slab applications over the forecast period.

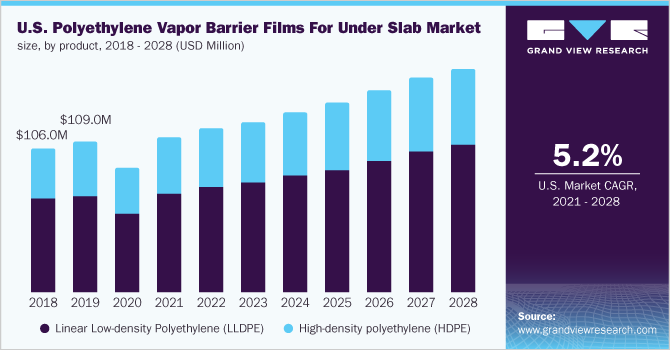

Product Insights

The linear low-density polyethylene (LLDPE) product segment led the market and accounted for a revenue share of more than 64.0% in 2020. The segment is anticipated to maintain its lead over the forecast period. Low cost, durability, and high puncture resistance are the primary factors propelling the growth of the linear low-density polyethylene segment.

Excellent impact and puncture resistance of metallocene linear low-density polyethylene (mLLDPE) is anticipated to fuel its demand in residential and non-residential vapor barrier film applications. High-density polyethylene has great moisture-resistant characteristics and is generally preferred if the barrier is expected to be subjected to heavy foot and vehicle traffic. It also offers strength and lower permeance for a higher level of integrity in under the slab applications.

Thickness Insights

The 10-15 mil segment led the market and accounted for a revenue share of more than 46.0% in 2020. The segment is anticipated to maintain its lead over the forecast period. The 10-15 mil polyethylene vapor barrier films are considered to be adequately effective in most environments for preventing the penetration of moisture and water vapor through the slab into the structure, which reduces fungus, mildew, and mold growth.

PE vapor barrier films with thickness above 15 mil are mostly preferred for extreme weather conditions and project locations where the construction site is expected to witness high moisture. Above 20 mil polyethylene vapor barrier films for under slab offer enhanced performance compared to 10-15 and 15-20 mil polyethylene vapor barrier films. They offer higher tensile strength, puncture resistance, less water vapor permeability, and low methane transmission rate than 10-15 and 15-20 mil polyethylene vapor barrier films and are used for extremely humid environments.

Grade Insights

The concrete segment led the market and accounted for a revenue share of more than 67.0% in 2020. Rising infrastructural development in the residential and commercial sectors has propelled the demand for vapor barrier films made of polyethylene. Water vapors diffuse through concrete, raising the pH level and alkalinity of the slab. Higher pH and alkalinity at the floor adhesive to slab interface can compromise the adhesion of expensive finished flooring systems. This has been driving the adoption of PE vapor barrier films for concrete applications.

Furthermore, vapor diffusion through an unprotected concrete slab causes high relative humidity, mold, mildew, and degradation of the concrete slab and its components. Therefore, to avoid such damages, the adoption of polyethylene vapor barrier films for under slab applications has witnessed growth in recent years. Foundation (or basement) is a major part of infrastructure and is often vulnerable to moisture seepages from concrete floors underneath. Foundation vapor proofing is considered mandatory to avoid mold growth, which can cause respiratory complications including bronchitis, pneumonia, and asthma.

Application Insights

The new construction segment led the PE vapor barrier films for under slab market and accounted for a revenue share of more than 70.0% in 2020. This segment is anticipated to dominate the market over the forecast period. With the rising concerns over trapped moisture leading to mold and fungus growth, PE vapor barrier films for under slab applications are being preferred in new construction owing to their low-moisture vapor permeability, decay resistance, high puncture resistance, and tensile strength, among others.

The increasing population in urban areas, coupled with favorable government initiatives for providing affordable homes, is expected to fuel the growth of new construction projects, propelling the demand for polyethylene vapor barrier films for under slab applications. For instance, in April 2019, the Mayor of Atlanta, Georgia, the U.S., in partnership with Atlanta Housing and Invest Atlanta, announced a funding of USD 60 million for affordable housing projects. This fund is projected to create and preserve more than 2,000 new affordable housing units in the city of Atlanta. In addition, the Mayor of Atlanta pledged to invest USD 1.0 billion to increase housing in order to construct and preserve 20,000 units of affordable housing within Atlanta by 2026.

End-use Insights

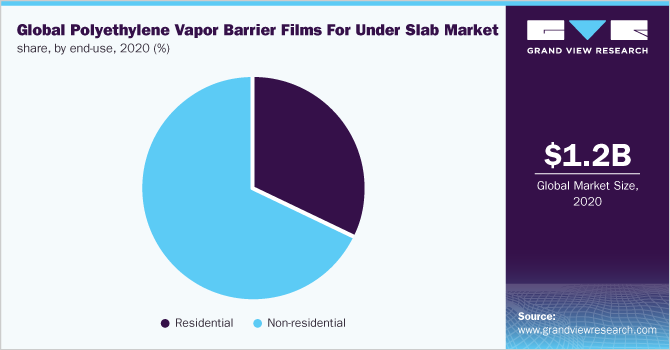

The non-residential end-use segment led the market and accounted for a revenue share of more than 67.0% in 2020. The segment is anticipated to maintain its lead over the forecast period. The non-residential end-use segment includes the consumption of polyethylene vapor barrier films for slabs in commercial and industrial buildings. The demand for PE vapor barrier films from commercial and industrial building construction is expected to grow over the forecast period due to gas and moisture migration resistance, puncture resistance, low water vapor permeance even after exposure to severe field conditions, and other beneficial properties of polyethylene vapor barrier films.

Rapid urbanization and industrialization, especially in developing economies, and the growth of the infrastructure and manufacturing sectors boosted by investments from both the private and public sectors are projected to positively impact the market growth over the forecast period. However, the slowdown in construction activities, restriction in supply and transport, and shortage of labor due to the outbreak of COVID-19 are negatively impacting the growth of the construction industry, which, in turn, is anticipated to impact the growth of the market.

Regional Insights

Asia Pacific dominated the market and accounted for a revenue share of over 50.0% in 2020. China led the APAC market in 2020 in terms of both volume and revenue. Growing construction activities are expected to boost the demand for polyethylene vapor barrier films for under slab in the region. The industrial and manufacturing sectors in Asia Pacific have been attracting significant investments from leading MNCs. The availability of cheap labor and close proximity to raw material suppliers are further luring investors to the region.

China and India are expected to mainly drive the regional market over the forecast period. Thus, the growing manufacturing and industrial sectors are fueling the growth of the construction industry in the region, which, in turn, is expected to generate the demand for polyethylene vapor barrier films for under slab, and in turn, trigger the market growth over the forecast period. However, the growth of the market in Asia Pacific is projected to be negatively impacted by COVID-19 owing to restrictions in movement and slowdown in construction activities.

Key Companies & Market Share Insights

The market is fragmented with the presence of various key players, along with small- and medium-sized global and regional players. Companies offer distinct products to overcome the competitive environment. For instance, A. Proctor Group Ltd. offers Procheck 500, a strong reinforced polyethylene vapor control film with high vapor resistance of 533MNs/g. Reef Industries provide Griffolyn, a line of internally reinforced polyethylene under slab vapor retarders and barriers providing high puncture resistance and impact and tensile strength.

The rise in the construction of family houses, along with residential and commercial development, has propelled the market growth. Polyethylene vapor barrier films prevent the flow of moisture and other gases from soil to the home that can cause damage by ruining floor systems and encouraging the growth of mold, fungus, rust, stains, and odor, which pose serious health issues. The aforementioned factors have increased the demand for polyethylene vapor barrier films in under slab applications. Some prominent players in the global polyethylene vapor barrier films for under slab market include:

-

Exxon Mobil Corporation

-

LyondellBasell Industries Holdings B.V.

-

Repsol

-

SABIC

-

Dow Inc.

-

Poly-America, L.P.

-

A. Proctor Group Ltd.

-

Reef Industries

-

Layfield Group

-

RKW Group. Ltd.

-

W. R. Meadows, Inc.

-

Cover-Tech Inc.

Polyethylene Vapor Barrier Films for Under Slab Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 1.47 billion

Revenue forecast in 2028

USD 2.18 billion

Growth rate

CAGR of 5.9% from 2021 to 2028

Market demand in 2021

967.2 kilotons

Volume forecast in 2028

1,379.4 kilotons

Growth Rate

CAGR of 5.2% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2021 to 2028

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, thickness, grade, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; Brazil; GCC Countries; South Africa

Key companies profiled

Exxon Mobil Corporation; LyondellBasell Industries Holdings B.V.; Repsol; SABIC; Dow Inc.; DuPont de Nemours, Inc.; INEOS AG; BASF SE; LG Chem; Sumitomo Chemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global polyethylene vapor barrier films for under slab market report on the basis of product, thickness, grade, application, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

High-density polyethylene

-

Linear Low-density Polyethylene

-

Higher Alpha-olefin Linear Low-density Polyethylene (HAOLLDPE)

-

Metallocene Linear Low-density Polyethylene (mLLDPE)

-

-

-

Thickness Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

10-15 mil

-

15-20 mil

-

Above 20

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Concrete

-

Foundation

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

New Construction

-

Refurbishment

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Residential

-

Single Family

-

Multi-family

-

-

Non-residential

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The PE vapor barrier films for under slabs market size was estimated at USD 1.18 billion in 2020 and is expected to reach USD 1.47 billion in 2021.

b. The PE vapor barrier films for under slabs market is expected to grow at a compound annual growth rate of 5.9% from 2021 to 2028 to reach USD 2.18 billion by 2028.

b. The new construction segment dominated the PE vapor barrier films for under slabs market with a share of 70.0% in 2020. This is attributable to the increasing population in urban areas coupled with favorable government initiatives for providing affordable homes.

b. Some key players operating in the PE vapor barrier films for under slabs market include Exxon Mobil Corporation; LyondellBasell Industries Holdings B.V.; Repsol; SABIC; Dow Inc; DuPont de Nemours, Inc; INEOS AG; BASF SE; LG Chem; Sumitomo Chemical Co., Ltd; among others.

b. Key factors that are driving the PE vapor barrier films for under slabs market growth include growing construction activities and rising demand for green buildings.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."