- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyphthalamide Market Size & Share, Industry Report, 2033GVR Report cover

![Polyphthalamide Market Size, Share & Trends Report]()

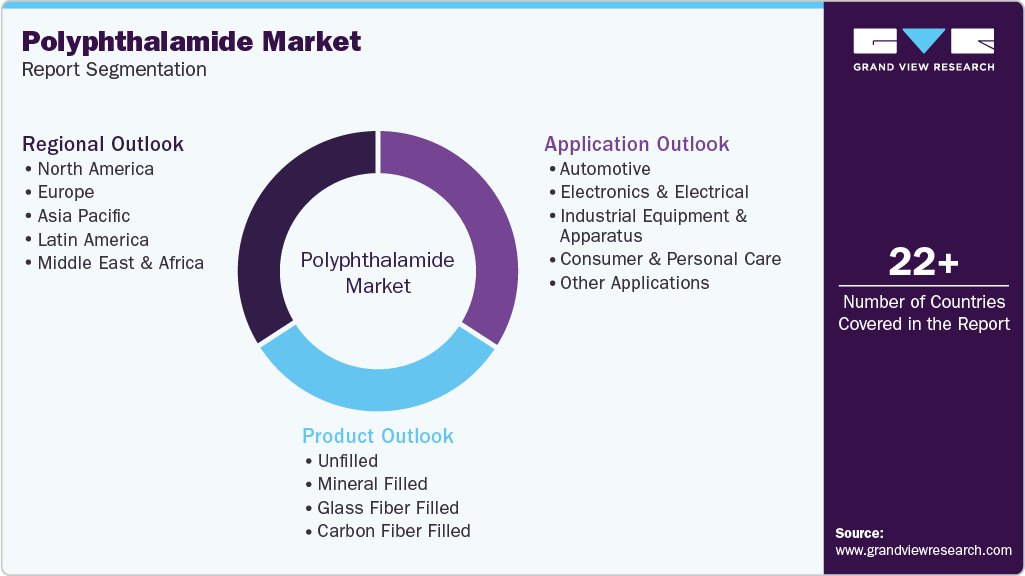

Polyphthalamide Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Glass Fiber Filled, Carbon Fiber Filled), By Application (Automotive, Electronics & Electrical, Industrial Equipment & Apparatus), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-523-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyphthalamide Market Summary

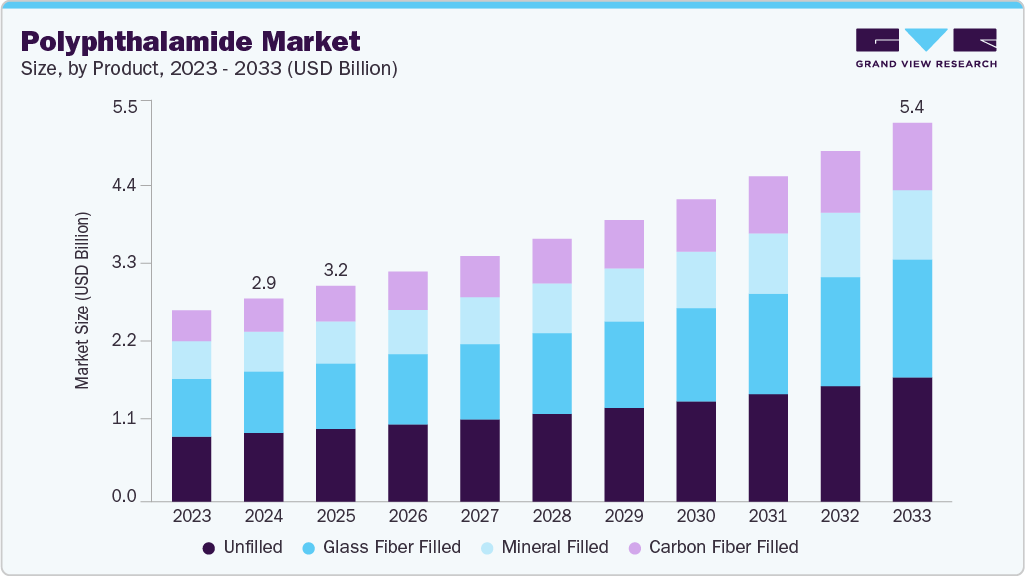

The global polyphthalamide market size was estimated at USD 2.98 billion in 2024 and is projected to reach USD 5.56 billion by 2033, growing at a CAGR of 7.3% from 2025 to 2033. The industry is driven by the rising demand from the electronics and electrical sector, where polyphthalamide (PPA) is used to produce compact, heat-resistant connectors and components for high-performance devices.

Key Market Trends & Insights

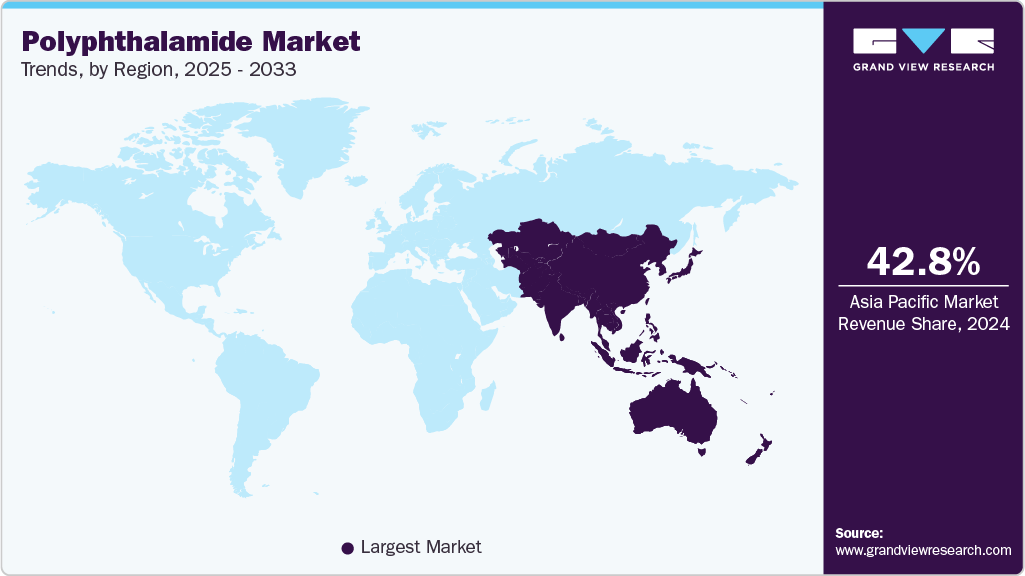

- Asia Pacific dominated the polyphthalamide market with the largest revenue share of 42.77% in 2024.

- The polyphthalamide market in India is expected to grow at a substantial CAGR of 8.6% from 2025 to 2033.

- By product, the carbon fiber filled segment is expected to grow at a considerable CAGR of 8.4% from 2025 to 2033 in terms of revenue.

- By application, the automotive segment is expected to grow at a considerable CAGR of 7.7% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 2.98 Billion

- 2033 Projected Market Size: USD 5.56 Billion

- CAGR (2025-2033): 7.3%

- Asia Pacific: Largest market in 2024

Its excellent dimensional stability and dielectric strength make it ideal for miniaturized and high-voltage applications. The industry is maturing from a niche high-performance polymer into a mainstream engineering material driven by the substitution of metals and standard polyamides in under-the-hood automotive parts and compact electrical connectors. Manufacturers are moving toward glass and carbon fiber reinforced grades and formulation tuning to meet tighter dimensional and thermal cycling requirements associated with electrification and miniaturization.

This shift is accompanied by broader uptake across industrial equipment and consumer electronics, where long-term thermal stability and low moisture uptake are mission-critical.

Drivers, Opportunities & Restraints

The principal commercial driver for PPA adoption is its material performance profile: high continuous-use temperature, superior chemical resistance, and low moisture absorption versus conventional nylons, which together enable direct metal replacement and design consolidation. These properties reduce part count, enable lighter assemblies, and improve reliability in fuel, coolant, and high-density electrical systems, making PPA the preferred choice when thermal endurance and dimensional stability matter. Supplier investments in heat-stabilized and reinforced grades are reinforcing this demand pull.

There is a clear runway for premium PPA applications driven by two parallel trends: the electrification of transport, which increases demand for high-temperature, electrically stable polymers in powertrain and battery thermal management, and the sustainability agenda, which is accelerating R&D into bio-derived monomers and lower carbon PPA chemistries. Producers that can commercialize cost-competitive bio-based PPA or processing solutions that lower energy intensity will capture margin expansion and win design wins with OEMs that prioritize both performance and sustainability.

Growth is constrained by the economics of production and feedstock exposure. PPA requires higher processing temperatures and more complex compounding than commodity polyamides, which raises manufacturing cost and capital intensity for converters. In addition, engineering polyamides remain linked to petrochemical feedstock cycles, so volatility in upstream monomer prices and regional supply disruptions create margin compression and procurement uncertainty for both resin producers and downstream users. These cost and supply risks limit PPA penetration where price sensitivity is high.

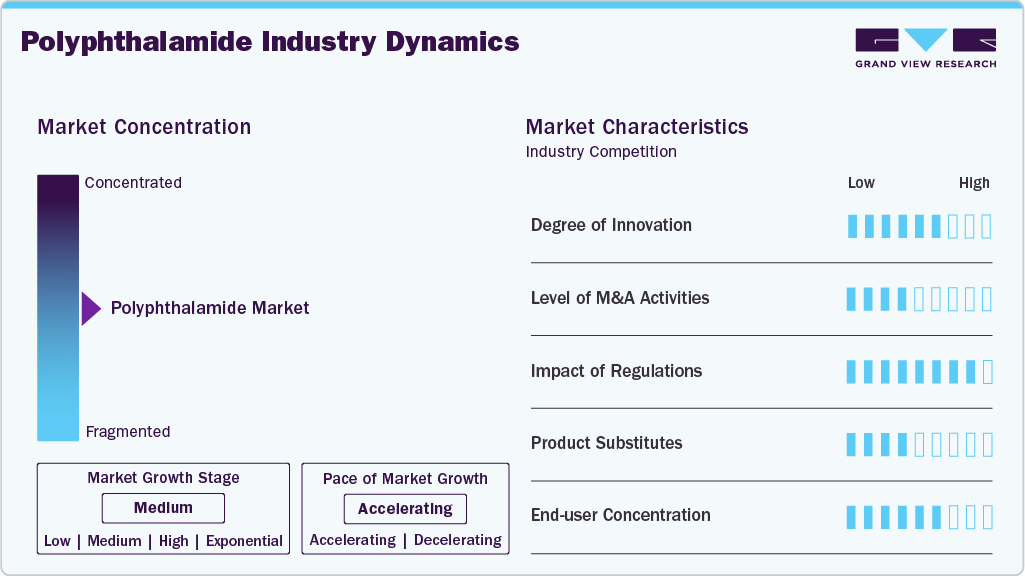

Market Concentration & Characteristics

The growth stage of the industry is medium, and the pace is accelerating. The industry exhibits slight fragmentation, with key players dominating the industry landscape. Major companies like BASF SE, Arkema, Celanese Corporation, Akro-Plastic, Evonik Industries AG, Syensqo, SABIC, KURARAY CO., LTD., Ems-Chemie, RTP Company Inc., Xiamen Keyuan Plastic Co., Ltd., Teknor Apex, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Innovation in the PPA space is increasingly pragmatic and application-led: suppliers are tuning chemistry and compounding to deliver flame-retardant, high-flow, and fiber-reinforced grades specifically tailored for electric vehicle power electronics and high-density connectors, rather than pursuing one-size-fits-all resins. Parallel R&D trajectories focus on bio-derived monomers and lower-carbon production routes to meet OEM sustainability mandates, and on engineered blends that marry PPA performance with improved processability and cost parity versus PA66.

Substitution dynamics vary by performance tier: in mid-performance applications, engineered PA66 or PA6/PA66 blends with improved stabilization compete on price and established supply chains, while premium niches requiring extreme thermal or chemical resistance still default to polymers such as PEEK, PPS, or polyimides, or to metal alloys when structural rigidity and fatigue resistance are paramount.

Product Insights

Unfilled polyphthalamides dominated the market, accounting for a revenue share of 33.86% in 2024, and are forecasted to grow at a 6.9% CAGR from 2025 to 2033. For unfilled PPA grades, the key commercial driver is process economics allied with formulation flexibility. Unfilled PPA offers easier flow and colorability versus fiber-filled grades, enabling efficient injection molding of thin-walled consumer and general industrial parts where extreme stiffness is not required but thermal resistance and chemical robustness still matter. This combination lowers conversion cost and shortens cycle time for mid-volume runs, which makes unfilled PPA the logical choice for appliance housings, fluid-handling components, and other price-sensitive applications that need dependable long-term performance.

The carbon fiber filled segment is anticipated to grow at a substantial CAGR of 8.4% over the forecast period. The defining driver for carbon fiber filled PPA is performance-driven lightweighting for precision structural components. Carbon fiber reinforcement delivers a step-change in stiffness, dimensional stability, and thermal conductivity, allowing designers to replace metal subassemblies in premium automotive and aerospace applications while meeting tight tolerances under thermal cycling. As design engineers push for lower mass without sacrificing heat management or creep resistance, demand for CF-PPA in niche, high-value parts is accelerating, supported by suppliers developing optimized CF coupling and processing packages.

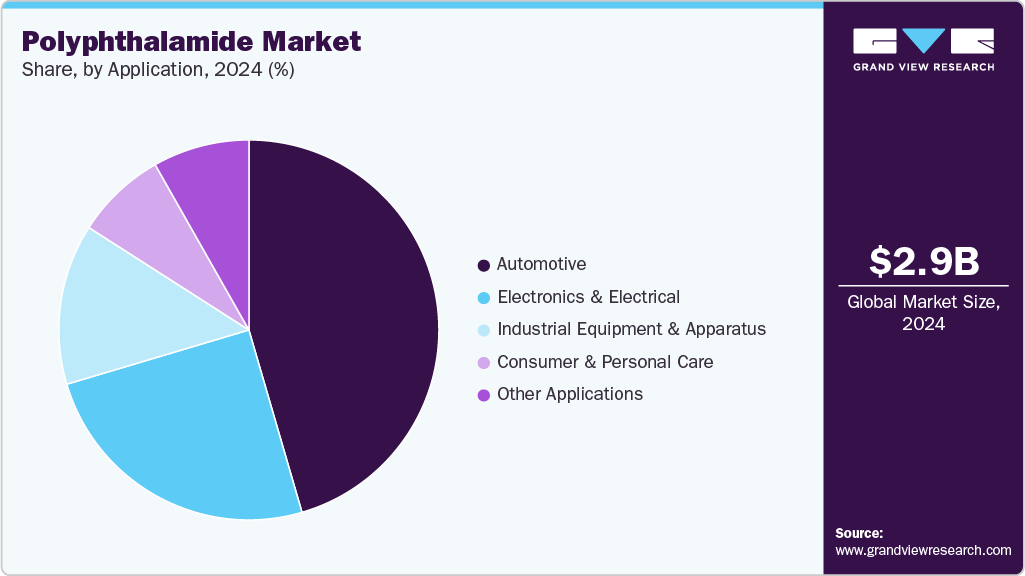

Application Insights

The automotive segment dominated the industry in terms of revenue, accounting for a share of 45.49% in 2024, and is forecasted to grow at a 7.7% CAGR from 2025 to 2033. Automotive adoption is being pulled by the shift to electrified powertrains and the need to consolidate parts in thermally demanding environments. PPA is increasingly specified for high-voltage connectors, inverter housings, and under-hood plumbing because it withstands continuous elevated temperatures, resists automotive fluids, and reduces electrochemical corrosion risk compared with aliphatic nylons. OEMs and tier suppliers are therefore prioritizing PPA where durability and safety at elevated voltages are prerequisites, which raises content per vehicle even as overall weight and part count fall.

The electronics & electrical segment is expected to expand at a substantial CAGR of 7.5% through the forecast period. Miniaturization and higher power densities in electronics are creating a clear technical demand for PPA in E&E components. High flow, heat-stable PPA grades permit production of compact, high-voltage connectors, IGBT, and power module housings that require excellent dielectric strength and low moisture uptake to preserve signal integrity and long-term insulation. The need to manage localized heat in denser assemblies while maintaining tight dimensional tolerances means PPA innovations focused on flowability and flame retardance are rapidly gaining traction with connector and power electronics makers.

Regional Insights & Trends

Asia Pacific polyphthalamide market held the largest share of 42.77% in 2024 and is expected to grow at the fastest CAGR of 7.8% over the forecast period. Rapid electrification and continued electronics manufacturing scale-up are the twin demand engines in the Asia Pacific. Growing EV volumes across India, Southeast Asia, and Japan, together with massive electronics and connector production in the region, are increasing technical specifications for materials that withstand continuous high temperatures and aggressive chemistries. Local compounders who offer tailored, high-flow, and flame-retardant PPA grades alongside supply-chain agility are therefore capturing share as OEMs compress development cycles and prioritize regional sourcing.

China’s polyphthalamide market’s driver is market scale plus industrial policy: very high EV penetration and government nudges to expand domestic content across automotive electronics and semiconductors amplify demand for high-performance polymers in powertrain and power-electronics assemblies. As carmakers and suppliers accelerate verticalization and local procurement, materials that enable lightweighting and thermal management at volume, such as reinforced and flame-retardant PPA grades, are being prioritized for local design wins and large-scale production.

North America Polyphthalamide Market Trends

The polyphthalamide market in North America is influenced by policy-led onshoring and electrification that is reshaping automotive and component supply chains. Incentives and tax credits tied to domestic sourcing have pushed OEMs and tier suppliers to localize battery, power electronics, and connector production, which increases demand for high-performance engineering polymers like PPA that meet thermal and chemical requirements while being manufacturable at scale. Converters and compounders are therefore investing in U.S.-based capacity and technical support to win design-ins with vehicle and industrial OEMs.

U.S. Polyphthalamide Market Trends

In the U.S. polyphthalamide market, the dominant commercial lever is legislative stimulus for clean-technology manufacturing that raises the content-per-vehicle for specialty polymers. Programs created under the recent industrial policy have accelerated investment in battery and power-electronics assembly, creating near-term procurement preferences for locally supplied, high-temperature plastics; this favors PPA for high-voltage connectors, inverter housings, and thermal-management components. Suppliers that can provide validated processing guidance and local inventory are winning priority from OEMs and tiers.

Europe Polyphthalamide Market Trends

The polyphthalamide market in Europe is driven by regulatory pressure toward sustainability and sovereign industrial capability, which is prompting automakers and system suppliers to demand materials that support lighter, longer-life components and easier recycling-ready design. Proposed European measures to boost EV demand and local battery content, alongside stricter circular-economy rules for vehicle design, are pushing OEMs to specify polymers that enable part consolidation and extended service life; PPA’s thermal endurance and chemical resistance fit this brief, particularly where flame retardance and long-term dimensional stability are required.

Key Polyphthalamide Companies Insights

Key players operating in the polyphthalamide market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Polyphthalamide Companies:

The following are the leading companies in the polyphthalamide market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Arkema

- Celanese Corporation

- Akro-Plastic

- Evonik Industries AG

- Syensqo

- SABIC

- KURARAY CO., LTD.

- Ems-Chemie

- RTP Company Inc.

- Xiamen Keyuan Plastic Co., Ltd

- Teknor Apex

Recent Developments

-

In September 2025, Syensqo launched a new medical-grade Amodel polyphthalamide (PPA) designed for advanced single-use medical devices. The glass-filled polymer offered high heat resistance with a melting point over 300 °C and maintained strength at temperatures up to 280 °C, making it ideal for manufacturing processes like surface-mount technology assembly and infrared reflow.

-

In July 2025, SIBUR, Russia's largest polymer producer, began manufacturing a high-performance plastic, polyphthalamide (PPA), using its proprietary technology. This plastic is strong, stable, and resistant to harsh environments, making it suitable for food and pharmaceutical packaging films, automotive engine parts, electrical components, and industrial equipment like pumps and compressors.

Polyphthalamide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.17 billion

Revenue forecast in 2033

USD 5.56 billion

Growth rate

CAGR of 7.3% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

BASF SE; Arkema; Celanese Corporation; Akro-Plastic; Evonik Industries AG; Syensqo; SABIC; KURARAY CO., LTD.; Ems-Chemie; RTP Company Inc.; Xiamen Keyuan Plastic Co., Ltd.; Teknor Apex

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyphthalamide Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global polyphthalamide market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Unfilled

-

Mineral Filled

-

Glass Fiber Filled

-

Carbon Fiber Filled

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Electronics & Electrical

-

Industrial Equipment & Apparatus

-

Consumer & Personal Care

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.