- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Polyurethane Dispersion Market Size, Industry Report, 2030GVR Report cover

![Polyurethane Dispersion Market Size, Share & Trends Report]()

Polyurethane Dispersion Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Water-based Dispersion, Solvent-based Dispersion), By Application (Textile Finishing, Natural Leather Finishing, Synthetic Leather), By Region, And Segment Forecasts

- Report ID: 978-1-68038-525-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyurethane Dispersion Market Summary

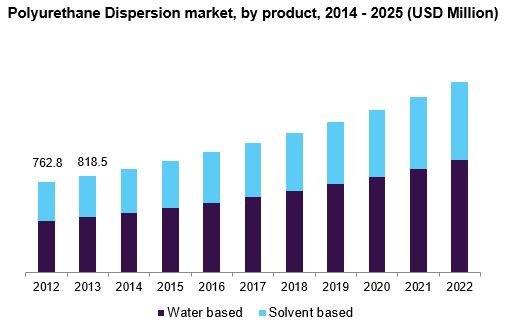

The global polyurethane dispersion market size was estimated at USD 2.48 billion in 2024 and is projected to reach USD 3.81 billion by 2030, growing at a CAGR of 7.5% from 2025 to 2030. The increasing consumption of leather goods and synthetic leather, particularly in footwear and accessories, has created a favorable environment for polyurethane dispersion (PUDs).

Key Market Trends & Insights

- Asia Pacific polyurethane dispersion (PUD) market held a significant share of the global market in 2024.

- The polyurethane dispersion (PUD) market in China is estimated to grow significantly over the forecast period due to substantial investments in infrastructure and construction initiatives.

- Based on product, the water-based dispersion held a substantial market share in 2024.

- Based on application, the paints & coatings segment estimated to occupy a significant market share in 2024

Market Size & Forecast

- 2024 Market Size: USD 2.48 Billion

- 2030 Projected Market Size: USD 3.81 Billion

- CAGR (2025-2030): 7.5%

- Asia Pacific: Largest Market in 2024

These materials are extensively utilized for surface finishing, enhancing the aesthetic and functional properties of leather products. As consumer preferences shift towards high-quality and durable goods, the textile and leather sectors are projected to continue their expansion, further propelling the PUD market.

The trend towards sustainability and eco-friendly solutions is reshaping the PUD landscape. As industries face mounting pressure to adopt environment-friendly products, water-based PUD formulations are gaining traction due to their lower volatile organic compound (VOC) emissions than traditional solvent-based systems. This alignment with stringent environmental regulations and increasing consumer expectations for sustainable options enhances the appeal of PUDs, providing manufacturers with a competitive advantage while maintaining compliance with regulatory requirements.

The automotive industry, particularly in emerging economies, is witnessing a surge in demand for coatings and adhesives that exhibit exceptional properties, such as scratch resistance and durability. PUDs fit this demand perfectly, making them a preferred choice for automotive applications. Concurrently, the construction sector’s expansion necessitates the use of PUDs for diverse applications, further boosting market potential in this space.

Furthermore, the versatility of PUDs across various applications solidifies their market position. PUDs are adaptable materials suitable for use in coatings, adhesives, textiles, and more, enabling them to meet diverse performance requirements across multiple industries. This inherent flexibility broadens the market appeal of PUDs and positions them as a vital component for manufacturers seeking to innovate and enhance their product offerings in an increasingly competitive marketplace.

Product Insights

Water-based dispersion held a substantial market share in 2024, owing to its environment-friendly attributes, reduced VOC emissions, and adherence to stringent regulations. These formulations are easier to handle and safer for end-users while simultaneously offering superior performance characteristics, making them increasingly favored across diverse applications in various industries.

Solvent-based dispersion is expected to register significant growth over the forecast period due to their exceptional performance traits, particularly in durability and chemical resistance. They are preferred in applications that necessitate robust coatings and adhesives, particularly within industries that prioritize high-performance solutions, despite the environmental concerns associated with elevated VOC emissions found in these products.

Application Insights

The paints & coatings segment estimated to occupy a significant market share in 2024, driven by the need for durable, high-performance finishes that adhere to stringent environmental regulations. Polyurethane dispersions are recognized for their excellent adhesion, abrasion resistance, and weatherability, making them well-suited for diverse applications across automotive, construction, and industrial sectors.

Textile finishing is projected to grow lucratively over the forecast period, fueled by its capacity to enhance key fabric properties, including softness, durability, and water resistance. PUDs provide eco-friendly solutions that align with current sustainability trends while delivering outstanding performance characteristics essential for contemporary textile applications.

Regional Insights

North America polyurethane dispersion (PUD) market held a significant share in the global market in 2024. Stringent environmental regulations compel industries to adopt low-VOC solutions, with water-based PUDs gaining significant traction. Moreover, the automotive and construction sectors are driving demand for high-performance, durable coatings.

U.S. Polyurethane Dispersion (PUD) Market Trends

The polyurethane dispersion (PUD) market in the U.S. dominated the North America polyurethane dispersion (PUD) market in 2024 due to robust growth in the automotive and construction industries, which necessitate high-performance coatings and adhesives. The shift towards sustainable products, bolstered by regulatory compliance and consumer demand for low-VOC alternatives, significantly enhances the adoption of polyurethane dispersions across multiple applications.

Asia Pacific Polyurethane Dispersion (PUD) Market Trends

Asia Pacific polyurethane dispersion (PUD) market held a significant share of the global market in 2024, driven by rapid industrialization and urbanization. The expanding automotive and construction sectors boost demand for high-performance coatings and adhesives. Moreover, increased awareness of environmental sustainability encourages manufacturers to adopt water-based and low-solvent formulations, significantly enhancing market growth prospects.

The polyurethane dispersion (PUD) market in China is estimated to grow significantly over the forecast period due to substantial investments in infrastructure and construction initiatives. The government’s commitment to sustainable development fosters demand for eco-friendly coatings and adhesives. Moreover, the thriving automotive sector necessitates durable and efficient materials, further driving growth in polyurethane dispersions tailored for varied applications.

Europe Polyurethane Dispersion (PUD) Market Trends

Europe polyurethane dispersion (PUD) market held substantial market share in 2024, aided by strong regulatory frameworks that advocate for environmentally friendly products. Increasing demand for sustainable coatings across automotive, construction, and textile sectors drives growth. Furthermore, advancements in PUD technology are improving performance characteristics, making these products a preferred option for diverse applications throughout the region.

The polyurethane dispersion (PUD) market in Germany is expected to grow lucratively in the forecast period, supported by a robust industrial base and a commitment to innovation in manufacturing. The country’s stringent environmental regulations promote the adoption of low-VOC and sustainable products. Moreover, Germany’s dominance in the automotive and construction sectors creates significant demand for high-performance polyurethane dispersions.

Key Polyurethane Dispersion Company Insights

Some key companies operating in the market include Covestro AG; BASF; The Dow Chemical Company; Mitsui Chemicals, Inc.; among others. Established players are prioritizing product innovation and strategic partnerships, investing in sustainable solutions to comply with growing environmental regulations and effectively expand their market share.

-

BASF is a prominent global supplier of water-based polyurethane dispersions, branded as “Basonol PU.” These dispersions serve coatings, adhesives, and sealants, offering low VOC solutions to promote sustainability. BASF emphasizes innovation and expanding production capacity to meet growing demand in the automotive and construction sectors.

-

Mitsui Chemicals produces varied PUDs for applications like coatings and adhesives, prioritizing environmental sustainability through low VOC content and high performance. The company is dedicated to developing innovative solutions that enhance durability and functionality across the automotive, textiles, and construction industries.

Key Polyurethane Dispersion Companies:

The following are the leading companies in the polyurethane dispersion market. These companies collectively hold the largest market share and dictate industry trends.

- Covestro AG

- BASF

- The Dow Chemical Company

- Mitsui Chemicals, Inc.

- The Lubrizol Corporation

- Alberdingk Boley GmbH

- Solvay

- Bayer AG

Recent Developments

-

In November 2024, Lubrizol launched Sancure 20898, a PUD that enhances packaging coatings and inks. It is known for its durability and flexibility in high-performance applications, thereby setting new performance standards in the industry.

-

In October 2024, LANXESS signed a contract to sell its Urethane Systems business to UBE Corporation for approximately USD 450 million, utilizing proceeds to reduce net debt and advance its transformation into a specialty chemicals company.

-

In May 2024, BASF announced investments to expand Ultramid and Ultradur capacities in India and inaugurated a Polyurethane Technical Development Center to enhance market development and support customer needs.

-

In May 2024, Dow commenced commercial operations of its new VORATRON adhesive and gap filler production line in Ahlen, Germany, enhancing capacity to meet rising demands in the e-mobility battery assembly segment.

Polyurethane Dispersion Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.66 billion

Revenue forecast in 2030

USD 3.81 billion

Growth rate

CAGR of 7.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; China; Japan; India; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Covestro AG; BASF; The Dow Chemical Company; Mitsui Chemicals, Inc.; The Lubrizol Corporation; Alberdingk Boley GmbH; Solvay; Bayer AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyurethane Dispersion Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyurethane dispersion (PUD) market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Water-based Dispersion

-

Solvent-based Dispersion

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Textile Finishing

-

Natural Leather Finishing

-

Synthetic Leather

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.