- Home

- »

- Consumer F&B

- »

-

Popcorn Market Size, Share & Growth, Industry Report 2033GVR Report cover

![Popcorn Market Size, Share & Trends Report]()

Popcorn Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Ready-to-Eat Popcorn, Microwave Popcorn), By Distribution Channel (B2B, B2C), By Region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-008-4

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Popcorn Market Summary

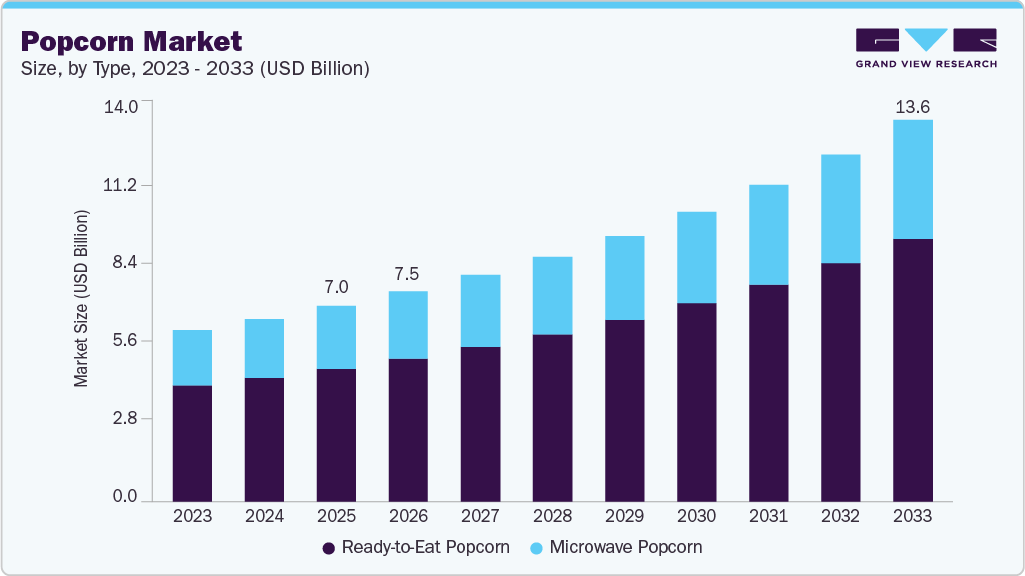

The global popcorn market size was estimated at USD 7.0 billion in 2025 and is projected to reach USD 13.6 billion by 2033, growing at a CAGR of 8.9% from 2026 to 2033. The market growth relies on the global consumer trend toward well-being. Additionally, the industry is being driven by shifting consumer behavior patterns for food and beverages globally.

Key Market Trends & Insights

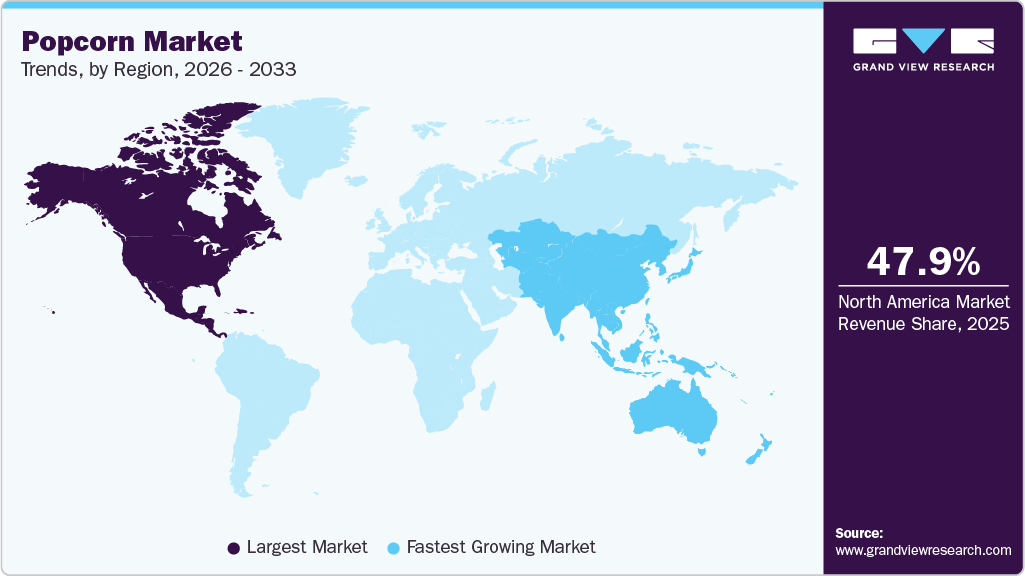

- The North America popcorn market held the largest global share of 47.9% in 2025.

- The popcorn industry in the U.S. is expected to grow at a CAGR of 7.9% from 2026 to 2033.

- By type, the ready-to-eat popcorn segment held the largest share of 68.1% in 2025.

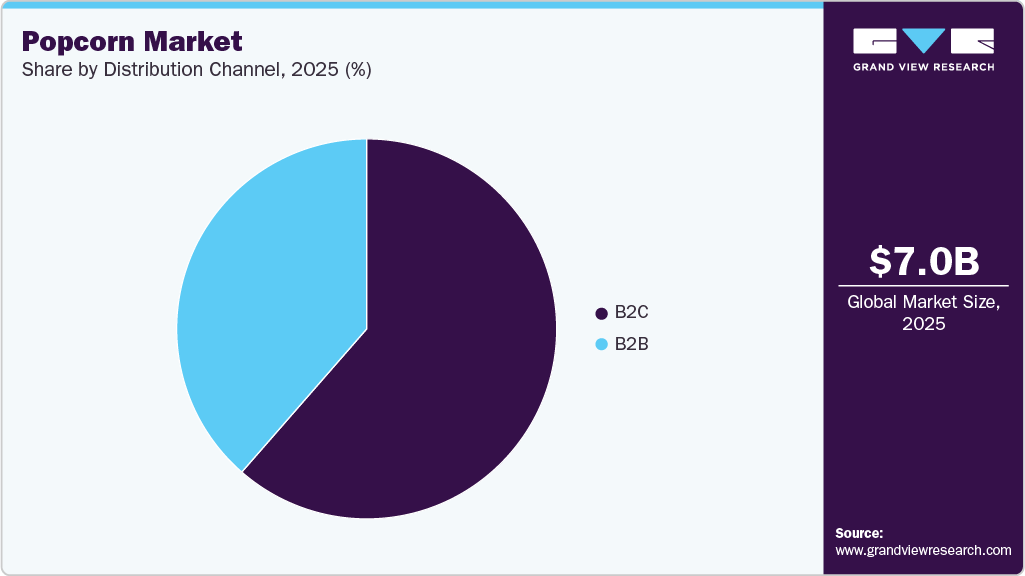

- By distribution channel, B2C channel led the market with a share of 61.4% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 7.0 Billion

- 2033 Projected Market Size: USD 13.6 Billion

- CAGR (2026-2033): 8.9%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The global popcorn supply chain and distribution channel were disrupted by the coronavirus outbreak, resulting in the closure and imposition of restrictions on convenience stores, as well as supermarkets and hypermarkets.Personal health and sustainable development, once relegated to the category of "niche" interests, are now at the forefront of buyers' minds, especially when it comes to food purchases. Demand for healthy, convenient, and sustainably-produced foods is on the rise, and plant-based proteins are more popular than ever. People are making more personal purchasing decisions based on sustainability and are becoming increasingly health-conscious due to the pandemic, resulting in a significant shift in consumer expectations. Additionally, the demand for popcorn with various flavors is also driving the market growth.

The global demand for ready-to-eat snacks is increasing, significantly affecting the food and beverage market. Ready-to-eat (RTE) products dominate the industry. An expanding range of exciting new flavors, consistent product development, and innovation attract consumers and are attributable to the increased demand for gourmet flavored RTE popcorn. Sea salt flavor, for instance, is becoming increasingly popular, and PepsiCo, Inc. is capitalizing on this trend with its Smartfood Delight Sea Salt Popcorn. Companies in the RTE popcorn industry are taking steps to increase their market share through attractive product packaging, a diverse product portfolio, and the promotion of products on online platforms.

Flavor innovations have played a significant role in grabbing consumers' attention. Popcorn manufacturers have introduced a wide range of new and bold flavors, from sweet varieties like caramel and chocolate to savory options such as cheddar, truffle, and sriracha. These diverse offerings cater to a range of consumer preferences, from those seeking indulgence to those seeking healthier alternatives. Additionally, globally inspired flavors like Mexican chili lime or Japanese matcha cater to the increasing consumer interest in trying multicultural and exotic tastes, creating a broader appeal across markets.

Health-focused flavor innovations are also gaining traction, with brands offering lower-calorie or more natural flavorings, such as sea salt and olive oil, to meet the needs of health-conscious consumers. Meanwhile, limited-edition and seasonal flavors are helping brands create excitement and urgency among snackers. Seasonal offerings, like pumpkin spice in the fall or peppermint during the holidays, capture attention and drive purchases by appealing to the desire for novelty and timely treats. These new flavors, along with creative marketing and packaging strategies, keep consumers engaged and curious, driving continuous growth in the popcorn industry.

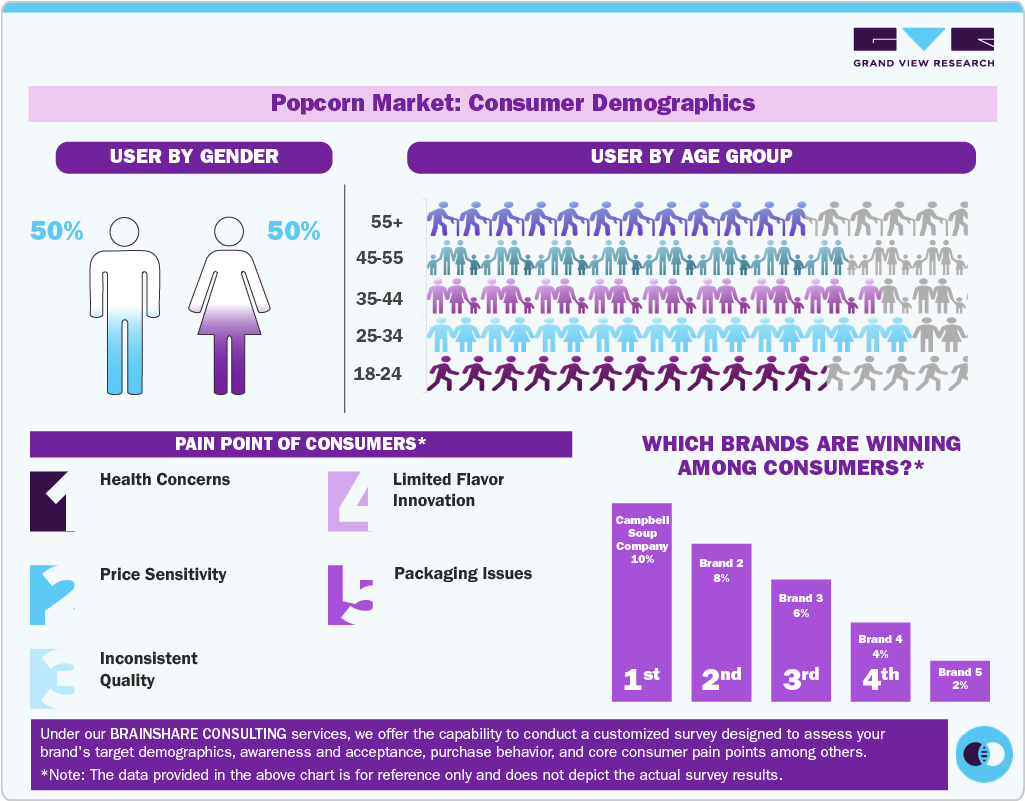

Consumer Insights for Popcorn

The RTE popcorn market continues to gain strong consumer traction as buyers increasingly seek convenient, ready-to-eat snacking formats that fit busy lifestyles. Health-conscious consumers are gravitating toward low-calorie, clean-label, and air-popped variants, while premium flavors such as caramel, cheese blends, and spicy fusions attract indulgence-driven buyers. Younger consumers, especially Gen Z, prefer portable packs and innovative textures that offer both taste and guilt-free satisfaction. Rising movie-at-home trends and online snacking purchases further boost demand, making RTE popcorn a versatile, impulse-friendly FMCG product.

Growing awareness about healthy homemade snacks is positively influencing consumer behavior, contributing to the expansion of the hot air popcorn maker market. Consumers are increasingly opting for home-prepared popcorn, as it enables them to control the amount of oil, seasoning, and calories, aligning with wellness-oriented lifestyles. Kitchen appliance trends on social media, along with rising interest in DIY snacking, further support the adoption. Families and young adults appreciate the freshness, customization, and cost-effectiveness of home-popped options. Additionally, the shift toward compact, energy-efficient appliances increases demand, making hot-air popcorn makers a popular choice among modern household consumers.

Type Insights

Ready-to-eat popcorn led the popcorn industry, accounting for a revenue share of 68.1% in 2025. The rising consumption of RTE popcorn at home and in theatres, coupled with a rise in the spending capacity of consumers, is expected to drive the demand for RTE popcorn. The demand is also likely to be driven by the rising health consciousness among individuals. Additionally, a growing range of new flavors, consistent product development, and innovations attract consumers. In November 2021, AMC planned to open five popcorn stores in the first half of 2022, or counters and kiosks in shopping malls in the U.S., including kiosks in select retail locations in malls across the nation.

The microwave popcorn market is expected to grow at a CAGR of 8.6% from 2026 to 2033. Microwave popcorn provides a quick and easy snack option that can be prepared in minutes, appealing to busy consumers seeking a hassle-free way to enjoy popcorn at home. Microwave popcorn often comes in pre-measured servings, making it easier for consumers to control portion sizes. Additionally, healthier microwave options are available, such as low-calorie or air-popped varieties, catering to health-conscious snackers. The availability of a wide range of flavors, from classic butter to gourmet and healthier options, has made microwave popcorn more appealing to a broader audience.

The microwave popcorn industry is also benefiting from the rise of at-home entertainment trends, where consumers increasingly prefer convenient snacks for movie nights and casual gatherings. Growing retail penetration, attractive promotional offers, and the expansion of private-label brands are making microwave popcorn more accessible and affordable. Manufacturers are focusing on clean-label formulations and innovative packaging to enhance freshness, reduce waste, and meet evolving consumer expectations for healthier, flavorful, and easy-to-prepare snacking options.

Distribution Channel Insights

Sales through B2C led the popcorn market, accounting for a revenue share of 61.4% in 2025. People's buying habits have been significantly altered by the internet distribution channel, as well as by a variety of options available at supermarkets/hypermarkets & convenience stores, which offer benefits, such as doorstep service, simple payment options, substantial savings, and availability of a wide choice of items on a single platform. Due to increased internet usage and customer preference for shopping apps, major market participants are rapidly building e-commerce websites in potential areas. Consumer inclination towards e-commerce is expected to drive segment growth. In addition, the prices of products in supermarkets/hypermarkets vary according to brand, and customers have the option of selecting from a variety of brands to fit their budget. Consumer demand for salty snacks, including popcorn, has increased in product portfolio expansions at supermarkets and hypermarkets.

Sales of popcorn through B2B channels are expected to grow with a CAGR of 8.3% from 2026 to 2033. Popcorn is gaining popularity in the hospitality sector, including hotels, resorts, and event catering. Businesses in these sectors often offer popcorn as a complementary or added-value snack for guests, helping to enhance customer experience. Popcorn is also being introduced as part of catering menus for corporate events, conferences, and parties due to its affordability and universal appeal. The growing number of businesses in the hospitality industry seeking unique snacks for their offerings has boosted B2B popcorn sales. Additionally, popcorn remains a staple snack for movie theaters, driving consistent demand in the B2B space. As the cinema industry recovers and grows post-pandemic, theaters are stocking up on bulk popcorn to meet increasing foot traffic.

Regional Insights

The North America popcorn market accounted for a revenue share of 47.9% in 2025. The rise of streaming platforms like Netflix, Hulu, and Disney+ has transformed the way North Americans consume entertainment, with many opting for home-based movie nights and binge-watching sessions. Popcorn, long associated with cinema culture, has naturally become a go-to snack for these occasions. The convenience of microwave and ready-to-eat (RTE) popcorn, along with its affordability, makes it an easy choice for families and individuals seeking a traditional snack to enjoy while watching movies or TV shows at home.

Additionally, the growing interest in home cooking and DIY snacking has supported the popcorn seeds market in the region, as consumers seek fresher, customizable alternatives to packaged products. Many health-conscious buyers prefer popping kernels at home to control oil, seasoning, and portion sizes. Retailers are expanding their offerings of organic, non-GMO, and specialty popcorn seeds. At the same time, the increasing use of air poppers and stovetop methods continues to drive demand among households seeking healthier, more flavorful snacking experiences.

U.S. Popcorn Market Trends

The popcorn industry in the U.S. is expected to grow at a CAGR of 7.9% from 2026 to 2033. As American consumers increasingly prioritize healthier snack options, popcorn has gained popularity due to its low-calorie, high-fiber profile. Many people perceive popcorn as a healthier alternative to chips, candy, or other processed snack foods. Air-popped and lightly flavored popcorn varieties align with health trends, particularly those emphasizing clean-label ingredients, non-GMO, gluten-free, and whole-grain products. This has led to increased demand, particularly among health-conscious individuals seeking satisfying yet guilt-free snack options.

Europe Popcorn Market Trends

The Europe popcorn industry is expected to grow at a CAGR of 8.8% from 2026 to 2033. European consumers are becoming more health-conscious and seeking snacks that align with their nutritional goals. Popcorn, particularly air-popped or lightly seasoned varieties, is perceived as a healthier alternative to traditional snacks like crisps or sugary treats. Its low-calorie, high-fiber content appeals to those looking for a guilt-free option that still provides satiety. Many European brands are also promoting popcorn as a gluten-free and whole-grain snack, making it attractive to individuals following specific diets or lifestyle choices.

Asia Pacific Popcorn Market Trends

The Asia Pacific popcorn industry is expected to grow at a CAGR of 10.7% from 2026 to 2033. The Asian consumers are increasingly drawn to innovative and gourmet popcorn flavors, moving beyond classic butter or salted varieties. Unique offerings such as truffle, Mediterranean herbs, chili, and caramel have expanded the appeal of popcorn, catering to a wide range of taste preferences. The growing interest in indulgent, premium snacks has fueled the demand for artisanal and gourmet popcorn, particularly among younger consumers and food enthusiasts who seek out diverse flavor experiences.

Key Popcorn Company Insights

The presence of numerous well-established and emerging players characterizes the global popcorn market. Manufacturers are implementing a range of strategic initiatives to stay ahead of evolving consumer demands and market trends. For instance, in August 2023, Joe & Seph's launched a new range of limited-edition air-popped popcorn flavors inspired by popular baked treats. This exciting collection includes Chocolate Fudge Cake, featuring chocolate caramel with cream cheese and vanilla; Millionaire’s Shortbread, coated in smooth caramel with shortbread and dark chocolate; Birthday Cake, covered in smooth caramel with raspberry and cream cheese frosting; and Peanut Butter Blondie, wrapped in white caramel sauce with crunchy peanut butter.

Key Popcorn Companies:

The following are the leading companies in the popcorn market. These companies collectively hold the largest market share and dictate industry trends.

- Campbell Soup Company

- PepsiCo Inc.

- Conagra Brands, Inc.

- Weaver Popcorn, Inc.

- Quinn Foods LLC

- The Hershey Company

- Eagle Family Foods Group LLC

- PROPER Snacks

- JOLLY TIME

- Intersnack Group GmbH & Co. KG.

Recent Developments

-

In June 2024, Netflix expanded beyond streaming by launching its line of popcorn called "Netflix Now Popping." The popcorn comes in two flavors: "Cult Classic Cheddar Kettle Corn" and "Swoonworthy Cinnamon Kettle Corn," priced at USD 4.50 per bag. This initiative is part of Netflix's broader strategy to enhance its brand presence, which includes plans for "Netflix Houses" and a pop-up restaurant in Los Angeles featuring dishes from its shows.

-

In October 2024, 4700BC launched a new gourmet popcorn range in collaboration with Netflix, featuring flavors inspired by popular Netflix shows. The collection includes “Caramel & Cheese,” “Spicy Jalapeno,” and “Truffle & Cheese.” This partnership aims to enhance the viewing experience for Netflix subscribers, offering unique snack options that complement their favorite shows.

Popcorn Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 7.5 billion

Revenue forecast in 2033

USD 13.6 billion

Growth rate

CAGR of 8.9% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa

Key companies profiled

Campbell Soup Company; PepsiCo Inc.; Conagra Brands, Inc.; Weaver Popcorn Inc.; Quinn Foods LLC; The Hershey Company; Eagle Family Foods Group LLC; PROPER Snacks; JOLLY TIME; Intersnack Group GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Popcorn Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global popcorn market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Ready-to-Eat Popcorn

-

Microwave Popcorn

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

B2B

-

B2C

-

Supermarket/Hypermarket

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global popcorn market size was estimated at USD 7.0 billion in 2025 and is expected to reach USD 7.5 billion in 2026.

b. The global popcorn market is expected to grow at a compounded growth rate of 8.9% from 2026 to 2033 to reach USD 13.6 billion by 2033.

b. Microwave popcorn is expected to growth with a CAGR of 8.6% from 2026 to 2033. Microwave popcorn offers a quick and easy snack option that can be prepared in minutes, appealing to busy consumers looking for a hassle-free way to enjoy popcorn at home.

b. Some of the key players operating in the popcorn market include Campbell Soup Company, PepsiCo Inc., Conagra Brands, Inc., Weaver Popcorn Company, Inc., Quinn Foods, LLC, The Hershey Company, Eagle Family Foods Group LLC, Proper Snacks, JOLLY TIME, Intersnack Group.

b. The key factors that are driving the popcorn market include growing popcorn health and wellness trends among consumers globally, increasing millennial interest in salty snacks, and shifting consumer behavior patterns for food and beverage products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.