- Home

- »

- Pharmaceuticals

- »

-

Population Screening Market Size Analysis Report, 2030GVR Report cover

![Population Screening Market Size, Share & Trends Report]()

Population Screening Market (2023 - 2030) Size, Share & Trends Analysis Report By Geography (Nation, State), By Product (Hardware Equipment), By Business (Hospitals), By Gender, By Type, By Age, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-014-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Summary

The global population screening market size was estimated at USD 25.18 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.36% from 2023 to 2030. The market is witnessing growth due to factors such as the increasing prevalence of chronic and non-communicable diseases among physicians & patients that propel the demand for screening products. Population screening is being adopted as a major strategy owing to benefits such as early patient identification, which can help reduce the burden of the higher treatment cost of diseases at later stages. The COVID-19 pandemic is expected to have a positive impact on the nation’s population screening market. For instance, in June 2021, Hayatt Med-Tech, a startup, developed the automated Hayatt Thermox-D, a fully automated device for performing rapid COVID-19 testing. This device can screen multiple parameters and identify acute symptoms within 12 seconds, with self-disinfection after each session. Hence, the launch of new analytical technologies is projected to fuel market growth.

The increasing prevalence of cancer is one of the key factors driving market growth over the forecast period. According to WHO, globally, cancer is the second-leading cause of death. In 2020, the incidence of cancer reached 19.3 million, and the number of projected deaths due to cancer was 9.96 million. According to the International Agency for Research on Cancer, cancer incidence is expected to reach 21.9 million by 2025, and by 2030, it is estimated to reach 24.6 million. This rise in the number of cancer cases is expected to compel governments to initiate new programs for cancer screening of the population.

Furthermore, increasing investments in the field of population screening programs are projected to drive market growth. For instance, in May 2021, the UK Health Ministry launched the “Genome UK 2021-2022” implementation plan to enhance the population screening, diagnosis, and treatment of patients with genetic diseases. Under this plan, the genomic project received USD 19.08 million from the UK government. In addition, in February 2022, Nostos Genomics raised USD 4.59 million for the research and development of novel tests for the diagnosis of patients with genetic diseases.

Some of the major challenges associated with the market are the high cost associated with testing and scalability. According to the American Cancer Society, the cost of genomic tests for cancer ranges between USD 300 and USD 10,000 per patient, which results in high out-of-pocket expenditure. Specific genomic tests are not yet fully integrated into electronic health records and not covered by insurance companies as most of the economic models are focused on medicines.

Geography Insights

The nation segment dominated the market in 2022 based on geography, and it is expected to fastest growing segment over the forecast period. This can be attributed to the presence of the wide availability of population screening programs for various diseases at the national level. In the U.S., the U.S. Preventive Services Task Force (UPSTF) is the major governing body working with the CDC to recommend programs for the country’s population. Furthermore, several initiatives are undertaken by governments globally to offer health screening to the population at a free and subsidized cost. For instance, in September 2022, the Health Ministry of France announced free-of-cost medical health checkups to individuals aged 25, 45, and 65 years as part of the nation's prevention-era strategy. Under this strategy, it will offer screenings for non-communicable and preventable diseases, including cardiovascular disease & highly prevalent cancers. This initiative is expected to increase the demand for testing products at the national level and support the growth of the market.

The states segment is expected to show lucrative growth during the forecast period. The rules and regulations for population screening are variable by nation and state. In the U.S., every state regulates and manages its screening programs. In India, in October 2022, the state government of Maharashtra announced a health check-up campaign as a preventive measure for the safety of women living in the state. Under this campaign, various health-related tests will be conducted with a target to complete 30 million women's health tests. In addition, in 2022, the state government of Karnataka planned to provide health screenings for various diseases, including mental health, at the doorsteps of the rural regions of the state under the Gram Panchayat Arogya Amrita Abhiyan. In Japan, Hokkaido University offers a free of cost physical check-up for enrolled graduate and undergraduate students. Physical examinations such as chest X-rays, blood pressure, urine test, BMI indices, and vision test are mandatory for all students studying at the University.

Product Insights

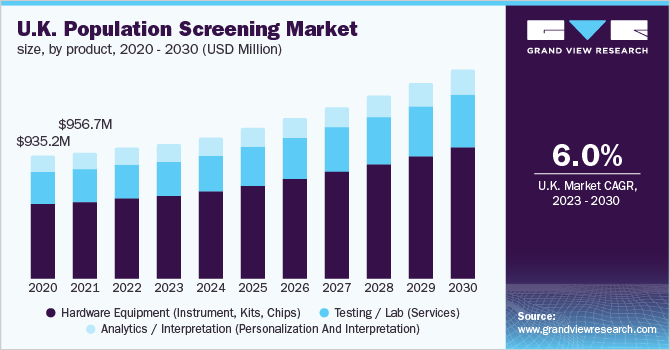

The hardware equipment (instruments, kits, chips) segment held the largest revenue share of 62.5% in 2022. This can be attributed to the approval of novel test kits and equipment for the population screening of more diseases. In July 2022, Fujifilm Corporation inaugurated two new health screening facilities for cancer in India. The launch of these centers was expected to increase the demand for hardware and equipment for laboratory setups, driving the market. Furthermore, in March 2021, Indigital technologies launched a handheld screening device, Kribado, for risk stratification and NGS behavior settings devices for healthcare practitioners and companies. This increasing availability of machines in hospitals and clinics is expected to boost the adoption of related procedures for early identification of risk and help ease the overall financial burden on healthcare.

The testing/lab segment is expected to show the fastest growth over the forecast period. The most common tests performed globally for various diseases include cholesterol measurement, fecal occult blood test, pap test, prostate-specific antigen, mammography, colonoscopy, and diabetes. High cholesterol level is associated with a high risk of stroke & cardiovascular disorders and is a major cause of death. According to WHO, around 17.9 million people died due to CVD, which was accounting for 32% of all deaths globally, as of June 2021. The CDC recommends cholesterol screening tests for people after the age of 20 years. Thus, the importance of population screening for diseases increased over the recent past and is expected to increase over the forecast period.

Business Insights

The hospital segment accounted for the largest revenue share of 52.2% in 2022. Hospitals have experts that can assist patients with appropriate population screening test selection. Factors contributing to market growth include the increasing prevalence of chronic diseases, the availability of multiple testing options, and the launch of new tests for better & more effective screening of patients. For instance, in July 2022, the Tamil Nadu Government Multi-Super Specialty Hospital (TNGMSSH) approached primary health centers in the Greater Chennai Corporation to refer more women for anomaly screening. The hospital will be offering tests, such as genetic biomarker testing, comprehensive blood tests, and ultrasound scans, at USD 12.30 through its advanced master health checkup center package.

The research Institutes segment is expected to show the fastest growth during the forecast period. The growth of the segment is associated with the increasing research activities to determine candidates and established patient diagnoses for research participation is anticipated to drive market growth. For instance, in July 2022, MiRXES Pte Ltd launched the world’s first major large-scale clinical research project (CADENCE) for the development of multi-cancer screening tests, including breast, lung, colorectal, liver, esophageal, and stomach. MiRXES Pte Ltd plans to invest USD 50 million in CADENCE research over the next three years.

Gender Insights

The female segment held a significant revenue share in 2022. The most commonly used tests performed by females are Pap smear, pelvic examination, mammogram, thyroid function test, lipid panel test, and blood pressure test. The Pap smear test is mainly recommended in women screening for cervical cancer. For instance, in November 2022, the Cancer Council Victoria and the Australian Center for the Prevention of Cervical Cancer announced cervical screenings for women during national cervical cancer awareness week. The launch program is anticipated to drive market growth. Females are mostly at a high risk of developing HIV, HPV, cervical, ovary, and breast cancers. Hence, there is an unmet need for screening programs for the early detection and treatment of diseases.

The male segment dominated the market and accounted for a revenue share of 50.4% in 2022. The most commonly recommended health screening tests for men are abdominal aortic aneurysm, blood cholesterol, blood cancer, colon cancer, depression, diabetes, hepatitis C virus, HIV, obesity, and prostate cancer. The increasing prevalence of prostate cancer is anticipated to boost the demand for population screening products. The American Cancer Society estimated that the number of new cases of prostate cancer is about 268,490 with 34,500 related deaths in 2022. The CDC recommended Prostate-Specific Antigen (PSA) tests to measure the level of PSA in the blood of patients.

Type Insights

The mass segment accounted for the largest revenue share of 73.5% in 2022. Mass screening programs for the population are being applied increasingly for the identification of undiagnosed diseases and treatment may improve. Aside from Tuberculosis (TB), there are routine premarital testing services for venereal diseases and population screening programs for the early detection of cancers. For instance, as per a study published in the Lancet Regional Health - Western Pacific, in July 2022, mass screening, peer support, and treatment reduced uncontrolled HIV infection by 40%. However, frequent inability to complete whole population screening may impede the market growth.

The premium segment is expected to show the fastest growth during the forecast period. The premium population screening market is driven by the private programs launched by key players. For instance, in October 2022, Medtronic Labs launched an initiative for ear screening for drivers on the Uber platform across India. In addition, in November 2022, Johnson & Johnson Services, Inc. and Lions Club International offered vision screening for over 500 children on the 20th foundation celebration. Furthermore, in November 2022, Lifeline Screenings launched a home-based lab test kit under the Lifeline Home Tests product line. Customers can order kits online, collect a sample from home, and receive the result in 3 to 5 days. Thus, the launch of a new test kit for screening purposes is expected to drive market growth.

Age Insights

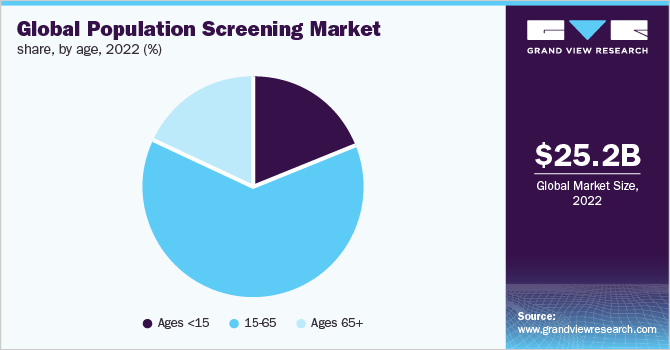

The 15-65 years segment dominated the market and held the largest revenue share of 60.5% in 2022. The dominance of the segment is attributed to the increasing population in the age group of 15 to 65 years. The population between the ages of 15 to 65 years is at high risk of NCDs and cancers such as breast, cervical, prostate, lung, leukemia, and colorectal. According to the American Cancer Society, around 89,500 new cases of cancer and 9,720 deaths occurred in adolescents and young adults. Thus, population screening player’s major important role in the management of cancer incidence and mortality in the coming years.

The 65+ segment is expected to show the fastest growth over the forecast period. The growth of the segment is attributed to the increasing dominance of the geriatric population. The age group is at a high risk of developing NCDs such as Cardiovascular Disorders (CVD), diabetes, cancers, and metabolic disorders due to weak immune systems and high comorbid conditions. According to WHO, life expectancy is likely to exceed 80 years in most developed economies by 2050. Aging is influenced by the interaction of several environmental & genetic factors and is characterized as the single most substantial risk factor for cancer development. Based on the U.S. National Cancer Institute’s Surveillance Epidemiology and End Results (SEER) Database, 43% of men and 38% of women are estimated to develop cancer during their lifetime.

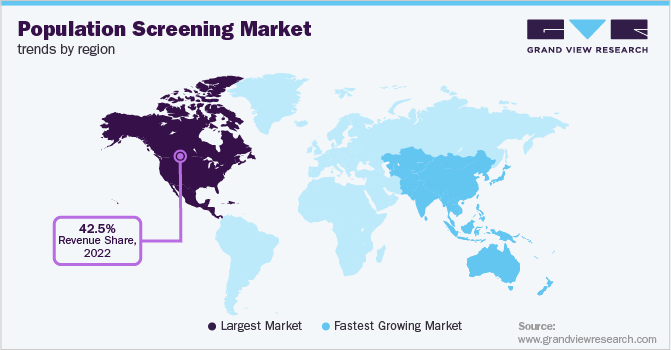

Regional Insights

North America dominated the market and accounted for a revenue share of 42.5% in 2022, This growth is attributed to preventive measures undertaken by governments to stop the progression of diseases. In North America, the U.S. and Canada are two major markets for population screening due to high awareness about the benefits associated with screening among patients & physicians. Furthermore, Tuberculosis (TB) prevention is one of the major reasons boosting the screening rate in the U.S. In 2019, the CDC and the National Tuberculosis Controllers Association (NTCA) updated their recommendations for tuberculosis screening, testing, & treatment of healthcare personnel. Hence, government initiatives to increase screening of the population for early disease diagnosis and treatment are expected to drive market growth.

Asia Pacific is expected to be the fastest-growing region over the forecast period. Japan is expected to be the major market in the Asia Pacific due to increasing investment in the field of screening and the presence of supportive reimbursement policies. For instance, in May 2019, the Central Social Insurance Medical Council approved the price coverage of new genetic population screening for genetic cancers under the public medical insurance program. Under this program, the patient has to pay 10% to 30% of USD 3,818.23 per round of genetic screening from their pockets. Furthermore, municipalities in Japan are encouraged to provide a wide range of periodic tests for hepatitis B & C, lifestyle disorders, osteoporosis, and periodontal disease. Some cancer screenings are covered by employer-based insurers and municipalities that include for women aged 40 years and above, lung, cervical, and colorectal cancer screening.

Key Companies & Market Share Insights

The key players operating in the market are focusing on partnerships, geographical expansion, and strategic collaborations in emerging and economically favorable regions. For Instance, in April 2022, Quest Diagnostics partnered with Intelligent Retinal Imaging Systems (IRIS) to provide diabetic retinopathy testing services through its patient service centers in the U.S. This partnership is anticipated to boost the market. Some of the prominent players in the global population screening market include:

-

Agilent Technologies, Inc.

-

Thermo Fisher Scientific, Inc.

-

QIAGEN

-

F. Hoffmann-La Roche Ltd.

-

Quest Diagnostics

-

Illumina, Inc.

-

ARUP Laboratories

-

Novogene Co., Ltd.

-

LGC Limited

-

Gene by Gene, Ltd.

Population Screening Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 25,715.15 million

Revenue forecast in 2030

USD 38.2 billion

Growth rate

CAGR of 5.36% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

geography, product, business, gender, type, age, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark, Sweden, Norway, China; Japan; India; Australia; Thailand, South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Agilent Technologies, Inc., Thermo Fisher Scientific, Inc., QIAGEN, F. Hoffmann-La Roche Ltd., Quest Diagnostics, Illumina, Inc., ARUP Laboratories, Novogene Co., Ltd., LGC Limited, Gene by Gene, Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Population Screening Market Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the population screening market on geography, product, business, gender, type, age, and region

-

Geography Outlook (Revenue, USD Million, 2018 - 2030)

-

Nation

-

State

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware Equipment (Instrument, Kits, Chips)

-

Testing / Lab (Services)

-

Analytics / Interpretation (Personalization And Interpretation)

-

-

Business Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Research Institutes

-

Diagnostic Labs

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

Age Outlook (Revenue, USD Million, 2018 - 2030)

-

Ages <15

-

15-65

-

Ages 65+

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global population screening market size was estimated at USD 25,183.8 million in 2022 and is expected to reach USD 25,715.15 million in 2023.

b. The global population screening market is expected to grow at a compound annual growth rate of 5.36% from 2023 to 2030 to reach USD 38.2 billion by 2030.

b. North America dominated the population screening market with a share of 42.50% in 2022. This is attributable to preventive measures undertaken by governments to stop the progression of diseases. In North America, the U.S. and Canada are two major markets for population screening due to high awareness about the benefits associated with screening among patients & physicians.

b. Some key players operating in the population screening market include Agilent Technologies, Inc., Thermo Fisher Scientific, Inc., QIAGEN, F. Hoffmann-La Roche Ltd., Quest Diagnostics, Illumina, Inc., ARUP Laboratories, Novogene Co., Ltd., LGC Limited, and Gene by Gene, Ltd.

b. Key factors that are driving the market growth include the increasing prevalence of chronic and non-communicable diseases among physicians & patients, increasing prevalence of diseases, growing geriatric populations, and an increasing investment in population screening tests.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.