- Home

- »

- Homecare & Decor

- »

-

Portable Fire Extinguisher Market Size, Industry Report, 2030GVR Report cover

![Portable Fire Extinguisher Market Size, Share & Trends Report]()

Portable Fire Extinguisher Market (2025 - 2030) Size, Share & Trends Analysis Report By Agent (Dry Chemical, Carbon Dioxide, Water, Foam), By Fire Type (Class A, Class B, Class C, Class D, Class K), By Application , By Region, And Segment Forecasts

- Report ID: GVR-3-68038-572-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Portable Fire Extinguisher Market Summary

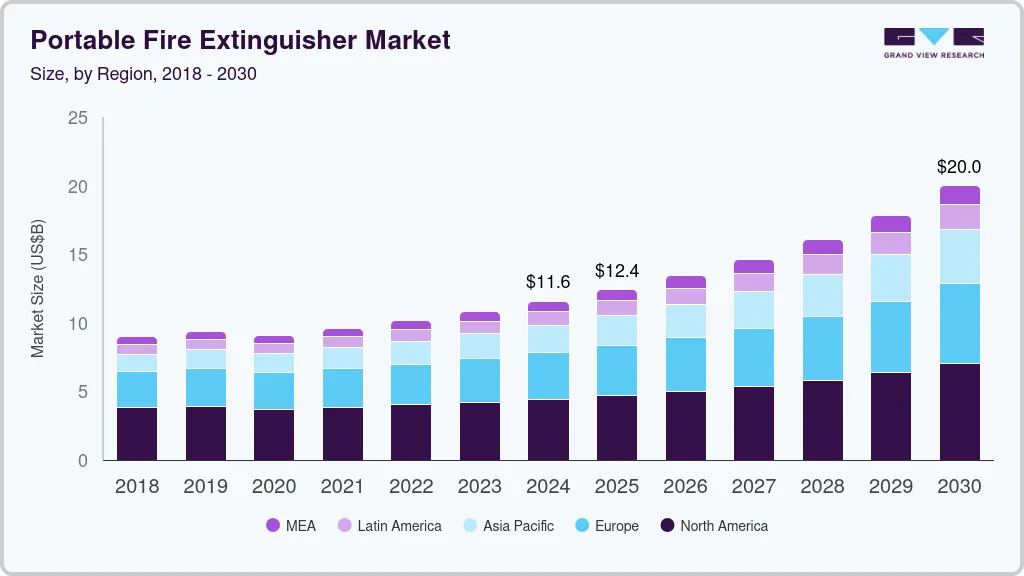

The global portable fire extinguisher market size was estimated at USD 11.57 billion in 2024 and is projected to reach USD 20.00 billion by 2030, growing at a CAGR of 10% from 2025 to 2030. Increasing fire safety regulations across residential, commercial, and industrial sectors are pivotal in driving the portable fire extinguisher market.

Key Market Trends & Insights

- The portable fire extinguisher market in North America accounted for a market share of around 38% in 2024.

- The portable fire extinguisher market in the U.S. accounted for a market share of around 75% in 2024.

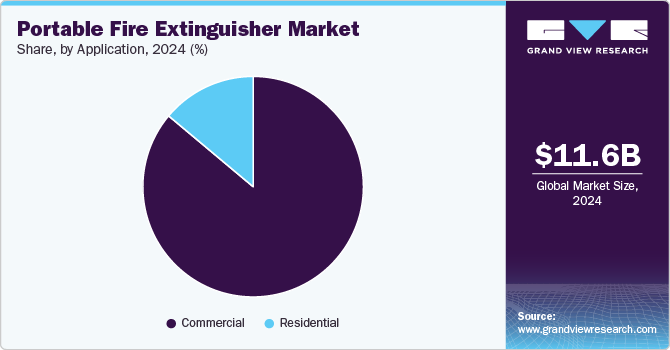

- In terms of application, non-residential application segment accounted for a market share of around 86% in 2024.

- In terms of agent, portable dry chemical fire extinguisher segment accounted for a market share of around 35% in 2024.

- In terms of fire type, portable fire extinguisher for class A fire type segment accounted for a market share of around 30% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.57 Billion

- 2030 Projected Market Size: USD 20.00 Billion

- CAGR (2025-2030): 10%

- North America: Largest market in 2024

Governments and safety organizations enforce strict fire safety codes, mandating that buildings and businesses maintain accessible, functional fire extinguishers as part of their safety compliance. This regulatory pressure ensures that all establishments, regardless of type, prioritize fire preparedness, thus steadily boosting the demand for portable fire extinguishers. As new structures are built and existing ones upgrade their safety equipment to meet evolving standards, the need for reliable, accessible extinguishers increases, leading to growth in the market as both new and replacement units are required across sectors.Moreover, the rapid growth of urban areas and infrastructure expansion has intensified the demand for fire safety equipment, particularly portable fire extinguishers. As new buildings and facilities emerge, especially in densely populated urban centers, ensuring fire safety becomes a priority to protect occupants and adhere to safety regulations. High-density environments amplify the risk of fire hazards, making compliance with fire safety standards essential. This urban expansion leads to a continuous need for portable fire extinguishers in residential, commercial, and industrial spaces, as each new structure is required to meet safety codes, driving sustained growth in the fire extinguisher market.

Growing awareness of fire safety in homes and workplaces significantly boosts the adoption of portable fire extinguishers, as individuals and businesses become more proactive in safeguarding against fire hazards. Educational campaigns that highlight the critical role of extinguishers in early fire suppression raise public awareness and encourage personal responsibility in fire preparedness. As a result, more people are investing in fire-safety equipment to protect their properties and loved ones, creating a ripple effect that fuels steady growth in the portable fire extinguisher market. This heightened awareness, paired with increasing access to affordable, user-friendly extinguishers, strengthens market demand across residential and commercial sectors alike.

Furthermore, innovations in fire extinguisher technology, including lighter designs, improved effectiveness, and environmentally friendly extinguishing agents, are expanding the consumer base for portable fire extinguishers. These advancements make extinguishers more practical and accessible, appealing to individuals and small business owners who prioritize ease of use and environmental impact. Newer models that are simpler to operate and carry encourage adoption among consumers who may have previously found traditional extinguishers too cumbersome or complicated. This user-friendly shift enhances safety and drives demand, particularly in residential and small business settings where convenience is key, fueling market growth.

Agent Insights

Portable dry chemical fire extinguisher accounted for a market share of around 35% in 2024. The demand for dry chemical portable fire extinguishers is driven by increasingly stringent fire safety regulations and building codes. In the U.S., NFPA (National Fire Protection Association) standards, such as NFPA 10, mandate the installation and maintenance of portable fire extinguishers in many types of commercial properties. Compliance with these regulations has spurred the installation of dry chemical portable fire extinguishers in office buildings, retail spaces, and industrial facilities. Additionally, the Occupational Safety and Health Administration (OSHA) enforces similar requirements, adding further pressure on businesses to ensure proper fire protection systems.

The demand for portable carbon dioxide fire extinguisher is expected to grow at a CAGR of 10.9% from 2025 to 2030.The demand for carbon dioxide (CO2) portable fire extinguishers in is primarily driven by their effectiveness in suppressing Class B and Class C fires involving flammable liquids and electrical equipment without leaving any residue. This makes them ideal for use in environments such as data centers, server rooms, and manufacturing facilities with sensitive electronics or hazardous chemicals. As industries increasingly rely on electronic systems, portable CO2 extinguishers have gained prominence for offering non-damaging fire suppression solutions. Another growth driver is the rising global awareness of environmental concerns. CO2 extinguishers are environmentally friendly, as they do not release harmful chemicals into the atmosphere.

Fire Type Insights

Portable fire extinguisher for Class A fire type accounted for a market share of around 30% in 2024. The market for fire extinguishers for Class A fires (combustible materials like wood, paper, and fabric) is experiencing steady growth, driven by increasing fire safety regulations, urbanization, and the need for improved fire protection in commercial spaces such as offices, warehouses, and retail outlets. To address the growing demand for portable fire extinguishers for Class A fires, companies are focusing on enhancing the versatility and safety of their products. In August 2024, Bull Products introduced multi-functional extinguishers, such as the LFX lithium-ion fire extinguisher, which not only tackles lithium-ion battery fires but also provides secondary A-class fire protection.

The demand for portable fire extinguisher for Class B fire type is expected to grow at CAGR of 10.9% from 2025 to 2030. The demand for portable fire extinguishers for Class B fires, which involve flammable liquids such as gasoline, oils, and solvents, is seeing steady growth due to the increased usage of these substances in industries like manufacturing, automotive, and oil and gas. Key trends influencing the Class B fire extinguisher market include innovations in fire suppression agents and enhanced portability for quick deployment. Increasingly, companies are moving away from traditional chemical-based agents and incorporating eco-friendly solutions such as clean agents (e.g., Halotron) and wet chemicals to address environmental concerns. This shift is particularly relevant in sectors that require frequent fire safety checks, such as aviation and marine industries, where portability and effectiveness against fuel-based fires are crucial.

Application Insights

Non-residential application accounted for a market share of around 86% in 2024.The demand for portable fire extinguishers in commercial application is being driven by increasing safety regulations and the rising emphasis on workplace safety culture. The Occupational Safety and Health Administration (OSHA) has specific guidelines requiring the availability of portable fire extinguishers, leading businesses to prioritize fire safety measures. Ensuring proper fire safety measures, including fire extinguishers, is crucial in office environments, where approximately 3,340 fires occur annually, as reported by the National Fire Protection Association. The number of fire extinguishers required in an office is determined by a fire risk assessment that considers the office's size, layout, presence of combustible materials, and the number of employees.

The demand for portable fire extinguisher in residential application is expected to grow at a CAGR of 10.3% from 2025 to 2030. Homeowners are becoming more cognizant of the risks associated with fires and the importance of having accessible fire safety equipment, leading to greater demand for portable extinguishers. Additionally, local building codes and insurance requirements often mandate the presence of fire extinguishers in homes, further propelling their adoption. The growing availability of user-friendly, lightweight models designed specifically for residential use also makes it easier for homeowners to invest in these essential safety tools. Combined, these factors contribute to a robust market for portable fire extinguishers in residential settings, underscoring their vital role in enhancing home safety and preparedness.

Regional Insights

The portable fire extinguisher market in North America accounted for a market share of around 38% in 2024 in the global market. Rising construction and renovation activities in commercial spaces are key drivers for the demand for portable fire extinguishers in commercial spaces North America. With approximately 115 million square feet of office space under construction, as highlighted in a 2023 article by Firmspace, the need for effective fire safety measures is growing. This is especially true for new buildings designed to meet stringent safety regulations and fire codes. As nearly two-thirds of these projects are concentrated in the Sun Belt, where rapid urbanization and commercial growth are prevalent, ensuring

U.S. Portable Fire Extinguisher Market Trends

The portable fire extinguisher market in the U.S. accounted for a market share of around 75% in 2024 in the North American market. Compliance with stringent safety regulations, especially in workplaces and public buildings, plays a significant role in the demand for these devices. The market features various extinguisher types-including water, foam, dry chemical, and carbon dioxide extinguishers-each suited to different fire classes. Companies are investing in technological advancements, such as smart fire extinguishers with IoT integration, which offer real-time monitoring and remote management capabilities. The trend toward eco-friendly extinguishing agents also aligns with environmental sustainability goals, catering to eco-conscious consumers and businesses. Leading players, such as Kidde and Amerex, are expanding their product ranges and forming strategic partnerships to enhance their market position and respond to these evolving demands.

Europe Portable Fire Extinguisher Market Trends

The portable fire extinguisher market in Europe accounted for revenue share of around 30% of global revenue in 2024. As industrial sectors and public facilities are required to meet high safety compliance standards, demand for reliable fire safety equipment, including portable extinguishers, has surged. Additionally, growing urbanization and investments in infrastructure across the region support this demand. Major companies operating in the European market, including Hochiki Corporation, Kidde, Minimax Viking, and Jockel Brandschutztechnik, contribute to the market with a diverse range of extinguishing products designed to meet the varying regulatory requirements across countries like Germany, the U.K., France, and Italy. These companies play a pivotal role in innovating and expanding product offerings to align with evolving European safety standard.

Asia Pacific Portable Fire Extinguisher Market Trends

Portable fire extinguisher market in Asia Pacific is expected to grow a CAGR of 12.2% from 2025 to 2030. The rapid growth of the commercial sector across the Asia-Pacific region, driven by strong economic expansion, urbanization, and the rise of industries such as IT, business process outsourcing (BPO), and startups, has led to an increasing demand for commercial real estate. As more businesses establish offices and expand operations, there is a heightened focus on safety regulations, including fire safety compliance. This, in turn, is fueling the demand for commercial portable fire extinguishers in the region.

Key Portable Fire Extinguisher Company Insights

The portable fire extinguisher market is highly competitive, with several major players vying for market share through a variety of strategies. Key companies such as Amerex Corporation, Carrier Global Corporation, and Johnson Controls focus on product innovation, distribution expansion, and compliance with safety regulations to maintain a competitive edge. Companies are also investing in eco-friendly technologies, which align with increasing environmental awareness and regulatory requirements. Strategic mergers, acquisitions, and partnerships are common as these companies seek to expand their geographical reach and enhance their product portfolios to cater to residential, commercial, and industrial sectors.

Key Portable Fire Extinguisher Companies:

The following are the leading companies in the portable fire extinguisher market. These companies collectively hold the largest market share and dictate industry trends.

- Amerex Corportation

- Carrier Global Corporation

- Johnson Controls

- Minimax Viking Group

- FlameStop Australia Pvt Ltd.

- Feuerschutz Jockel GmbH & Co.

- Jactone Products Limited

- Chubb Fire & Security

- Morita Holdings Corp.

- Hochiki Corp.

Recent Developments

-

In August 2024, Ceasefire Industries Pvt Ltd. participated in the Fire & Safety India Expo (FSIE) 2024, showcasing its latest innovations in fire extinguishers, suppression systems, kitchen suppression, in-panel systems, and accessories. The event took place from August 22 to 24, 2024, at the Jio World Convention Centre in Mumbai, bringing together fire, safety, and security professionals from around the globe.

-

In March 2024, Johnson Controls Inc. was recognized as one of the 2024 World's Most Ethical Companies by Ethisphere, marking the 17th time it received this honor. The assessment involved a rigorous evaluation process, requiring over 240 proof points related to ethics, governance, and social responsibility from participating companies.

Portable Fire Extinguisher Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.42 billion

Revenue forecast in 2030

USD 20.00 billion

Growth rate (Revenue)

CAGR of 10.0% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Agent, fire type, application, region.

Regional scope

North America; Europe; Asia Pacific; Central & South America; & Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Saudi Arabia.

Key companies profiled

Amerex Corportation; Carrier Global Corporation; Johnson Controls; Minimax Viking Group; FlameStop Australia Pvt Ltd.; Feuerschutz Jockel GmbH & Co.; Jactone Products Limited; Chubb Fire & Security; Morita Holdings Corp.; Hochiki Corp.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Portable Fire Extinguisher Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the portable fire extinguisher market report based on service, application, and region.

-

Agent Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dry Chemical

-

Carbon Dioxide

-

Water

-

Foam

-

Others

-

-

Fire Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Class A

-

Class B

-

Class C

-

Class D

-

Class K

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Non-residential

-

Office Building

-

Retail Stores & Shopping Malls

-

Hospitality

-

Educational Institutions

-

Transportation

-

Entertainment, Leisure, & Sports Venues

-

Healthcare Facilities

-

Manufacturing Plants & Factories

-

Warehouses & Distribution Centers

-

Construction Sites

-

Gas/Fuel Stations

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global portable fire extinguisher market was estimated at USD 11.57 billion in 2024 and is expected to reach USD 12.42 billion in 2025.

b. The portable fire extinguisher market is expected to grow at a compound annual growth rate of 10.0% from 2025 to 2030 to reach USD 20.00 billion by 2030.

b. North America region dominated the portable fire extinguisher market with a share of over 38% in 2024. This is owing to the rapid growth of the industrial and commercial sectors in the region.

b. Some key players operating in the portable fire extinguisher market include Amerex Corporation; Carrier Global Corporation; Johnson Controls; Minimax Viking Group; FlameStop Australia Pvt Ltd.; Feuerschutz Jockel GmbH & Co.; Jactone Products Limited; Chubb Fire & Security; Morita Holdings Corp.; and Hochiki Corp.

b. Key factors that are driving the portable fire extinguisher market growth includes the the strict government rules and regulations regarding the installation of extinguishers, and increasing awareness among customers about portable fire extinguishers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.