Portable Media Player Market Size & Trends

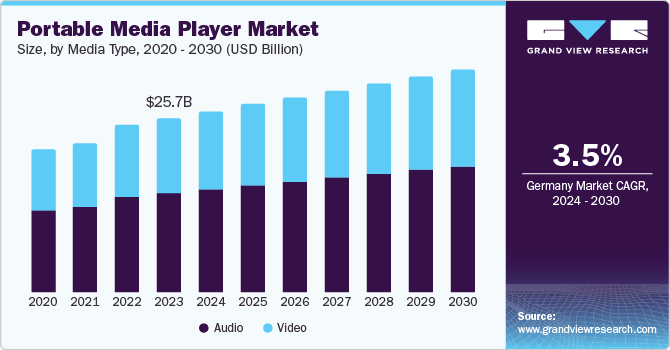

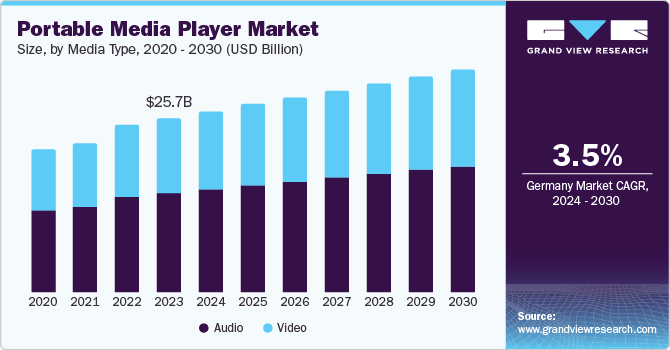

The global portable media player market size was estimated at USD 25.7 billion in 2023 and is projected to grow at a CAGR of 3.5% from 2024 to 2030. Heightened consumer demand for devices supporting multiple media formats has aided market expansion worldwide. The proliferation of podcasts, streaming services, and audiobooks has fueled industry growth with seamless playback and storage capacities.

Manufacturers continually integrate new features into their devices, such as high-resolution displays, extended battery life, and expanded storage capacities. These advancements cater to consumers who value high-quality audio and video services and prioritize convenience and portability.

Incorporating alternatives such as Bluetooth, Wi-Fi, and NFC allows users to stream content and share media with others. In addition, consumer trends are also driving the portable media players (PMP) market. There is a growing demand for high-quality audio and video services among consumers who prefer portable devices for exercising and traveling. The increasing popularity of video content consumption through platforms such as Netflix and Amazon Prime also contributes to the growth of the PMP market. As consumers continue to seek out convenient and portable ways to enjoy their favorite media content, the demand for PMPs is likely to continue to rise.

Media Type Insights

The audio segment dominated the market with a share of 57.0% in 2023. The rise of on-the-go listening habits has driven the demand for portable media players, fueled by advancements in audio technology and storage capabilities. Music streaming services, podcasts, and growing disposable incomes in emerging markets have further accelerated popularity, solidifying the devices’ market relevance.

The portable video players are expected to grow at the fastest CAGR of 3.6% over the forecast period. The demand for PMPs is driven by the surge in streaming services such as Netflix and Amazon Prime as consumers seek heightened accessibility to high-quality video content. Enhanced features, including high-resolution displays and improved battery life, cater to this growing preference, solidifying the devices’ market appeal.

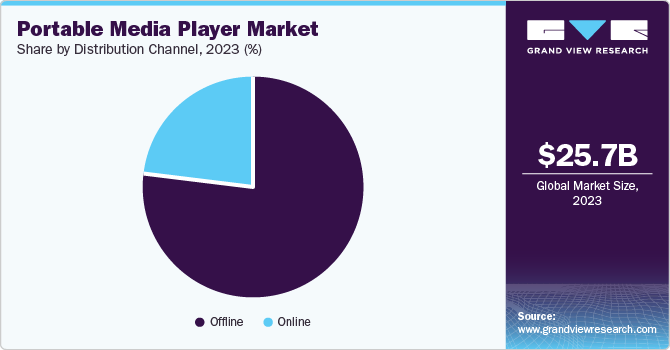

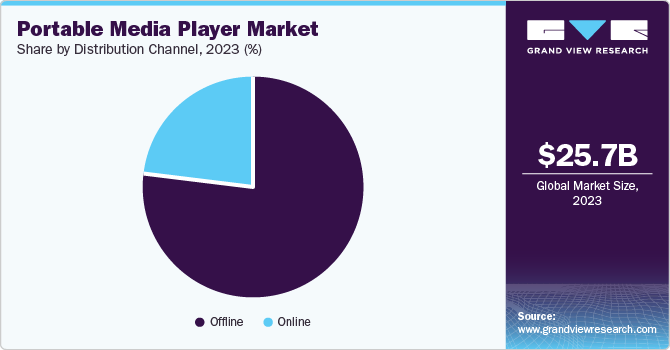

Distribution Channel Insights

The offline segment led the market and accounted for a share of 77.1% in 2023. Consumers value actual, brick-and-mortar shopping for hands-on product experiences, immediate assistance, and demonstrations. This approach fosters customer confidence and trust in purchases. Retailers leverage franchise stores and supermarkets to offer diverse products, boosting sales and providing a seamless shopping experience.

Online distribution channels are projected to grow at the fastest CAGR of 3.7% over the forecast period. The proliferation of e-commerce platforms such as Amazon and eBay has enabled consumers to access various products, often at competitive prices, through convenient online shopping experiences. Effective marketing strategies, such as seasonal promotions and expedited delivery, enhance customer appeal.

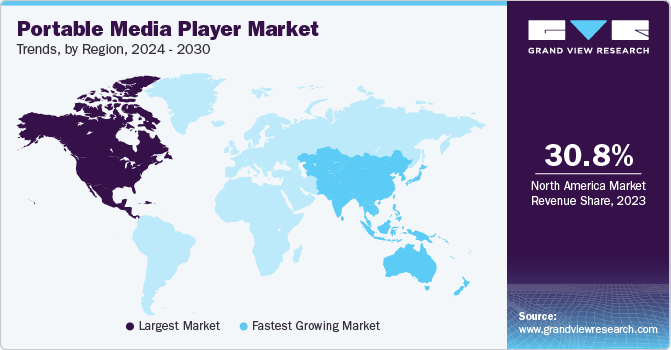

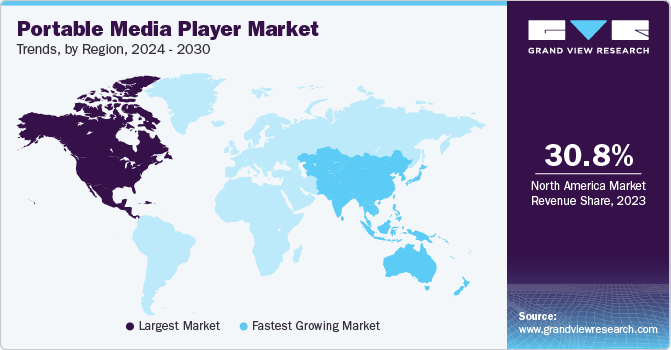

Regional Insights

The North American portable media player market dominated the global market with a revenue share of 30.8% in 2023. The region has witnessed a strong appetite for cutting-edge technologies, driving demand for innovative media players. The presence of prominent industry players and the integration of smart devices have further accelerated market growth. Notably, over 40% of U.S. households own a portable media player, solidifying the region’s dominant position in the global market.

U.S. Portable Media Player Market Trends

The U.S. dominated the North American portable media player market, with a significant revenue share in 2023. The early adoption of innovative devices, such as smartphones and dedicated PMPs, and a thriving entertainment industry drive market growth in the country. Strong demand for portable audio and video solutions has solidified the country’s position in the North American and global markets.

Europe Portable Media Player Market Trends

The European portable media player market held a substantial market share in 2023. The region’s affinity for music and video entertainment propels the popularity of PMPs. Technological advances have enabled the development of high-quality audio and video players catering to diverse consumer tastes. Streaming services’ growing influence drives growth as users seek dedicated devices for enhanced media experiences.

The portable media player market in Germany is expected to grow lucratively in the forecast period. The country houses a tech-savvy population with a strong cultural affinity for music and entertainment. Technological advances drive demand for high-quality audio and video devices, while Germany’s robust retail sector facilitates easy access to various portable media players.

Asia Pacific Portable Media Player Market Trends

The Asia Pacific portable media player market is expected to register the fastest CAGR of 4.1% in the forecast period. The region’s growing demand for entertainment devices is driven by rising disposable incomes and Western cultural influences. The region’s large population, expanding retail sector, and innovative products from local manufacturers support market growth.

The portable media player market in China is driven by the growing influence of Western culture among younger consumers. Rapid urbanization and improved internet access have further increased consumer connectivity here and in the West. Local manufacturers have responded by developing affordable, feature-rich products that cater to consumer preferences.

Key Portable Media Player Company Insights

Some key companies operating in the market include Apple Inc., SAMSUNG, Creative Technology Ltd., and Western Digital Corporation. Market players prioritize product innovation and feature enhancement through strategic initiatives, including expanding online distribution channels, integrating advanced technologies, and leveraging e-commerce platforms to drive sales and reach diverse consumer segments.

-

Apple Inc. offers innovative consumer electronics, software, and services, with its flagship products including the iPhone, iPad, Mac computers, and iPod. The company’s iTunes Store and Apple Music have established its dominance in digital media distribution, further solidifying its market presence.

-

Sony Group Corporation is a diversified technology and entertainment company with a legacy of innovation, including the Walkman and PlayStation. The company operates across sectors, emphasizing quality and innovation, and has undertaken strategic initiatives to enhance operational efficiency and leverage synergies between its technology and media divisions.

Key Portable Media Player Companies:

The following are the leading companies in the portable media player market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- SAMSUNG

- Creative Technology Ltd.

- Western Digital Corporation

- Sony Group Corporation

- ARCHOS

- Microsoft

- Koninklijke Philips N.V.

- Coby

Recent Developments

-

In July 2024, Astell & Kern launched the P1, an affordable, portable hi-fi player that marked a new entry point for the company’s premium audio offerings.

-

In March 2024, FiiO launched the M23 portable audio player and K19 desktop headphone amplifier and DAC, offering feature-rich products for high-res music streaming and digital music playback.

-

In January 2023, Sony Electronics introduced two new Walkman models, the NW-ZX707 and NW-A306, featuring enhanced sound quality, longer battery life, and innovative features for discerning consumers.

Portable Media Player Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 26.7 billion

|

|

Revenue forecast in 2030

|

USD 32.8 billion

|

|

Growth rate

|

CAGR of 3.5% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

October 2024

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Media type, distribution channel, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Country scope

|

U.S., Canada, Mexico, UK, France, Germany, Italy, Spain, India, China, Japan, Brazil, Argentina, South Africa

|

|

Key companies profiled

|

Apple Inc.; SAMSUNG; Creative Technology Ltd.; Western Digital Corporation; Sony Group Corporation; ARCHOS; Microsoft; Koninklijke Philips N.V.; Coby

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Portable Media Player Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global portable media player market report based on media type, distribution channel, and region:

-

Media Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Asia Pacific

-

Latin America

-

Middle East & Africa