- Home

- »

- Sensors & Controls

- »

-

Position Sensors Market Size, Share & Growth Report, 2030GVR Report cover

![Position Sensors Market Size, Share & Trends Report]()

Position Sensors Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Photoelectric, Linear, Proximity, Rotary, Others), By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-766-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Position Sensors Market Summary

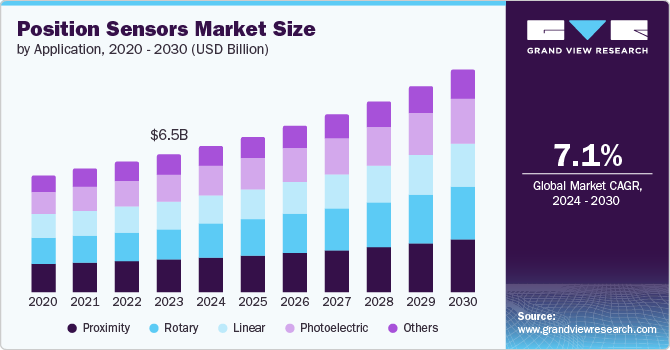

The global position sensors market size was estimated at USD 6.50 billion in 2023 and is projected to reach USD 10.43 billion by 2030, growing at a CAGR of 7.1% from 2024 to 2030. The rapid advancement and proliferation of automation and robotics across various industries drives market growth.

Key Market Trends & Insights

- The Europe held the largest market revenue share with 39.5% in 2023.

- The Asia Pacific is expected to grow at the fastest CAGR of 9.3% over the forecast period.

- Based on application, the proximity segment held the largest market revenue share at 24.5% in 2023.

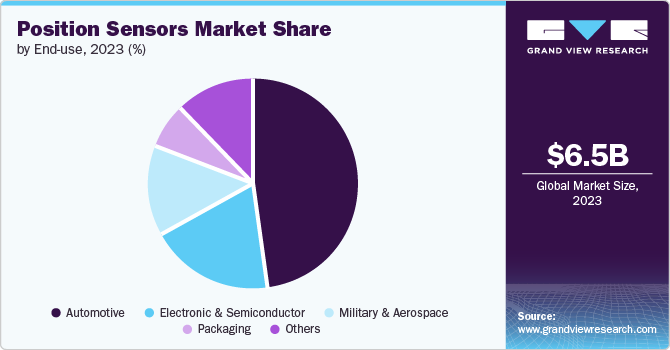

- Based on end-use, the automotive segment held the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6.50 Billion

- 2030 Projected Market USD 10.43 Billion

- CAGR (2024-2030): 7.1%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

As manufacturing processes become increasingly automated, precise and reliable position sensing becomes crucial to ensure accuracy and efficiency. Position sensors are vital in detecting and monitoring various component's movement, alignment, and positioning within automated systems, enhancing overall productivity and reducing the risk of errors.

Another contributing factor is the growing adoption of position sensors in the automotive industry. Modern vehicles have numerous advanced driver-assistance systems (ADAS) and safety features that rely on accurate position sensing to function effectively. Applications such as lane departure warning systems, adaptive cruise control, and automated parking systems depend on position sensors to provide real-time data on the vehicle's surroundings and movements. Additionally, the rise of electric and autonomous vehicles further boosts the demand for sophisticated position sensing technologies to ensure safe and efficient operation.

The consumer electronics sector also influences the demand for position sensors. Devices such as smartphones, tablets, and gaming consoles utilize position sensors to enable screen rotation, motion detection, and enhanced user interaction. As these devices evolve and integrate more complex functionalities, the need for high-performance position sensors grows correspondingly. Moreover, the expanding market for wearable technology, including fitness trackers and smartwatches, relies heavily on position sensors to monitor physical activities and provide accurate health-related data.

Furthermore, the healthcare industry is witnessing a surge in the use of position sensors, particularly in medical equipment and devices. Applications such as surgical instruments, patient monitoring systems, and diagnostic equipment require precise position sensing to ensure accurate measurements and optimal performance. The increasing prevalence of minimally invasive surgeries and the need for advanced diagnostic tools drive the demand for innovative position sensing solutions in healthcare settings.

Lastly, the rise of the Internet of Things (IoT) significantly fuels the global demand for position sensors. IoT devices often require precise position data to enable seamless communication and interaction between interconnected systems. Position sensors are essential in various IoT applications, including smart homes, industrial IoT, and logistics, where they help track and monitor the movement and location of objects in real time. As IoT technology expands and becomes more integrated into everyday life, the demand for reliable position sensors is expected to grow substantially.

Application Insights

The proximity segment held the largest market revenue share at 24.5% in 2023. The increasing integration of proximity sensors is attributed to the rising demand for automation across diverse industries. Proximity sensors allow automated systems to accurately detect and give required responses to objects and their positions, resulting in enhanced efficiency and accuracy throughout the processes. Proximity sensors find significant integration in smart devices, including smartphones, smart watches, tablets, and other gadgets, positively impacting the market growth. Proximity sensors are crucial in working on features such as touch recognition, gesture control, and overall user experience improvement.

The photoelectric segment is projected to grow at the fastest CAGR of 8.3% over the forecast period. Contactless sensing methods reduce the necessity of sensors coming into physical contact with objects. In industrial environments, it is crucial to ensure equipment and people's safety. The sensors capability to detect objects without physical contact helps improve safety measures and is becoming more widely used in manufacturing settings. In sectors where working with fragile materials is frequent, utilizing these sensors for non-contact sensing helps protect the materials from damage. This is especially crucial in electronics production, where accurate and delicate component handling is vital to prevent damage.

End-use Insights

The automotive segment held the largest market revenue share in 2023. The rising demand for position sensors in the automotive sector is attributed to the stringent safety rules that need the incorporation of up-to-date security services such as adaptive cruise control (ACC) and electronic constancy control (ESC). Position sensors are gaining more popularity due to the growing trend of vehicle electrification, known for the appropriate positioning of electric motors and other parts. In addition, position sensors are becoming more integrated into automotive systems due to customer demand for real time driving experiences, including effective handling and fuel efficiency. Moreover, the market growth for position sensors in the automotive industry is fueled by ongoing technological advancements, such as the invention of micro-electromechanical system (MEMS) based sensors and contactless sensing features in modern vehicles.

The packaging segment is expected to grow at the fastest CAGR over the forecast period. One primary driver for increasing demand is the growing adoption of automation and smart packaging solutions across various industries. Position sensors ensure precision and efficiency in automated packaging systems, which are increasingly used to enhance production speed and accuracy, reduce labor costs, and minimize errors. Additionally, the rise in e-commerce and the need for reliable and secure packaging to handle a high volume of shipments has increased the utilization of position sensors. These sensors help monitor and control the movement of packaging materials, ensure proper alignment and sealing, and improve overall operational efficiency.

Regional Insights

North America position sensors market is witnessed as lucrative in this industry. The region's robust automotive industry increasingly incorporates advanced driver-assistance systems (ADAS) and autonomous driving technologies, which rely heavily on precise position sensing for functions like navigation, collision avoidance, and vehicle control. Additionally, the growing adoption of industrial automation and the Internet of Things (IoT) across various sectors, including manufacturing, healthcare, and logistics, is driving the need for accurate and reliable position sensors. These sensors are crucial for monitoring and controlling machinery, ensuring efficiency and safety. Furthermore, the expansion of consumer electronics, such as smartphones and gaming devices, which integrate position sensors for enhanced user experiences, contributes to this demand.

U.S. Position Sensors Market Trends

U.S. position sensor market held the largest market revenue share of 86.7% regionally. The U.S. has a strong industrial sector, including automotive, aerospace, and manufacturing, which significantly drives the demand for position sensors in the market. The demand for position sensors is increasing due to their widespread adoption in autonomous vehicles, industrial automation, consumer durables, and the healthcare sector. This includes advancements in materials, miniaturization, and integration of sensors in various technologies such as IoT and artificial intelligence.

Europe Position Sensors Market Trends

Europe held the largest market revenue share with 39.5% in 2023. The rapidly developing semiconductor industry has resulted in the growing manufacturing processes of application-based and MEMS technology-based sensors, which find application in smart grid infrastructure and home appliances. This is attributed to the increasing popularity of digital platforms and internet services. Key players in the region are introducing innovative products such as the E-Motor Rotor Position Sensor, which is widely used in EVs. For instance, in March 2023, Continental AG announced the launch of its new E-motor position sensor, which utilizes inductive technology to detect rotor position integrated into a synchronous electric machine.

UK market is projected to grow significantly in the coming years. The rapid growth of the UK's industrial automation sector is driving the need for precise and reliable position sensors to enhance productivity and efficiency in manufacturing processes. Additionally, with its shift towards electric and autonomous vehicles, the expanding automotive industry relies heavily on advanced position sensors for accurate navigation and control. The rise of smart infrastructure projects and the adoption of Industry 4.0 technologies also contribute to this demand, as they require sophisticated sensors for monitoring and managing various systems. Furthermore, the UK government's emphasis on innovation and technological advancements, coupled with investments in research and development, fosters an environment conducive to the growth of the position sensor market.

Asia Pacific Position Sensors Market Trends

Asia Pacific is expected to grow at the fastest CAGR of 9.3% over the forecast period. Rapid industrialization and urbanization across countries like China, India, and Japan are driving the need for advanced automation and control systems, where position sensors play a crucial role. Additionally, the expanding automotive sector, which increasingly integrates sophisticated sensor technologies for enhanced vehicle performance and safety, is a significant contributor. The region's growing consumer electronics market also demands high-precision position sensors for smartphone applications, tablets, and wearable devices. Furthermore, the growing adoption of industrial IoT (Internet of Things) solutions, which rely heavily on accurate positioning data, further propels the demand. These combined elements underscore the robust growth trajectory of the position sensor market in the Asia-Pacific region.

India position sensor market is anticipated to witness significant growth in the coming years. The rapid expansion of the automotive industry in India primarily drives the growth. Position sensors are widely used in modern vehicles, driving their increased integration. The continuous evolution in the automotive industry fuels the demand for exact measurements, and in-depth inspection drives the demand for position sensors. The change towards industrial automation has resulted in a rise in demand for position sensors. Position sensors are utilized in several components, such as steering wheel position sensing, float level sensing, and gearbox encoders for transmission.

Key Position Sensors Company Insights

Some of the key companies in the global position sensor market include Honeywell International Inc.; TE Connectivity; MTS Systems Corporation; Infineon Technologies AG; Vishay Intertechnology Inc.

-

Honeywell International Inc provides smart position sensors which allow highly precise motion control, which enhance operational effectiveness and safety. It bears the features such as measuring linear, angular, or rotary movement of a magnet connected with a moving object, their contactless design removes mechanical failure mechanisms, which improves dependability and resilience, and minimizing downtime.

-

TE Connectivity provides a range of industrial linear and angular position, tilt and fluid level sensors. They provide the shelf and custom position sensing solutions featured with basic technologies, such as inductive, potentiometric, magneto resistive, hall effect, reed switch, electrolytic and capacitive sensing.

Key Position Sensors Companies:

The following are the leading companies in the position sensor market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International Inc.

- TE Connectivity

- SICK AG

- ams-OSRAM AG.

- MTS System

- Infineon Technologies AG

- STMicroelectronics

- Balluff Inc

- Vishay Intertechnology Inc

- Baumer

Recent Developments

-

In April 2024, Honeywell and Lilium announced the expansion of their existing partnership. Under this partnership, Honeywell is expected to provide lightweight sensor technology for the Lilium Jet, an electric vertical takeoff and landing (VTOL) aircraft. This new sensor technology enhances the jet's performance and efficiency by providing precise and reliable data critical for safe flight operations.

Position Sensors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.89 billion

Revenue forecast in 2030

USD 10.43 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

Honeywell International Inc.; TE Connectivity; SICK AG; ams-OSRAM AG; MTS Systems; Infineon Technologies AG; STMicroelectronics; Balluff Inc; Vishay Intertechnology Inc; Baumer

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

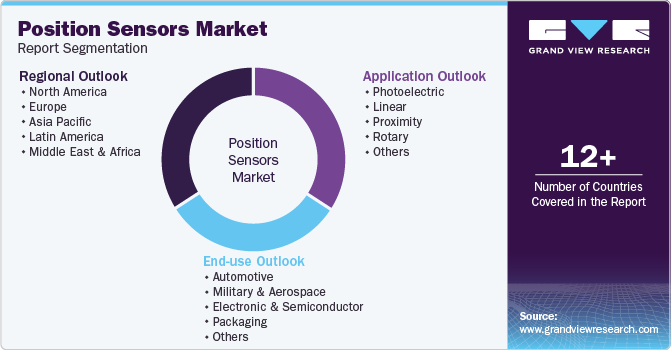

Global Position Sensors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global position sensors market report based on application, end-use, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Photoelectric

-

Linear

-

Proximity

-

Rotary

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Military & Aerospace

-

Electronic & Semiconductor

-

Packaging

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U. S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.