- Home

- »

- Medical Devices

- »

-

Positive Airway Pressure Devices Market Size Report, 2030GVR Report cover

![Positive Airway Pressure Devices Market Size, Share, And Trends Report]()

Positive Airway Pressure Devices Market Size, Share, And Trends Analysis Report By Product Type (CPAP, APAP, BiPAP), By Application (Obstructive Sleep Apnea, Respiratory Failures, COPD), By End User, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-910-4

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global positive airway pressure devices market size was valued at USD 2.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. The growing economic burden and challenges faced by the healthcare industry arising from the increasing prevalence of obstructive sleep apnea are driving the adoption of positive airway pressure (PAP) devices across the globe. According to the American Academy of Sleep Medicine estimates in 2016, the economic burden caused in the U.S. due to undiagnosed & untreated sleep apnea was approximately USD 149.6 billion, whereas, treated sleep apnea cases would benefit the U.S. and help save approximately USD 100 billion every year.

Obstructive sleep apnea is a respiratory disorder wherein, the patient faces irregular breathing patterns with reduced oxygen supply to the brain. According to Up-To-Date estimates on the global prevalence of obstructive sleep apnea published in June 2022, there are approximately 936 million people are suffering from mild to severe sleep apnea, and among these 425 million individuals in the age group of 30 to 69 years are suffering from moderate to severe sleep apnea. Rapid globalization, changing lifestyles, and unhealthy dietary habits are a few factors contributing to the prevalence of sleep apnea. In addition, growing obesity levels and lack of physical activities are driving the incidence rate of obstructive sleep apnea.

According to the WHO estimates in 2016, the global obesity prevalence was recorded to be approximately 2 billion adults, among which, 650 million adults are believed to be affected by obesity. Moreover, sleep apnea causes numerous comorbidities, such as hypertension, diabetes, cardiovascular diseases, and depression. The growing global geriatric population coupled with the lack of diagnosis of obstructive sleep apnea is driving the prevalence rate. Increasing life expectancy is supporting the surge in the prevalence of obstructive sleep apnea in the geriatric population.

According to the estimates published by the United Nations World Population Aging Report in 2019, the global geriatric population was approximately 703 million and is expected to double from 12% in 2015 to 22%in 2050, and obstructive sleep apnea is expected to affect around 13-32% of the global geriatric population in 2020. Various government institutes and agencies across the globe are undertaking initiatives to drive awareness levels toward available treatment options and promote the adoption of PAP devices. Manufacturers in the market are expanding their product portfolio and integrating advanced technologies into their existing solutions to achieve a better compliance rate and provide efficient results.

Market players are innovating comfortable & lightweight masks, softer material & smaller masks, and noise reduction features. Furthermore, advanced technologies being incorporated into products are focused on enhancing the overall efficiency of the PAP device and providing optimum clinical outcomes. Moreover, the rising patient compliance rate has directly supported the adoption of PAP devices and as per studies, 80% of the patients diagnosed with obstructive sleep apnea are treated using PAP devices. In addition, the availability and accessibility of favorable insurance coverages on adherence to the compliance standards of PAP therapy are driving the adoption of PAP therapies in patients.

According to the estimates published by the American Sleep Association, there are approximately 50 to 70 million individuals in the U.S. suffering from some form of sleep disorder. Similarly, as per a study conducted by ResMed in 2018, approximately 175 million individuals in Europe were suffering from sleep apnea. According to studies conducted by Mayo Clinic, it has been studied that, males are 2-3 times more prone to sleep apnea as compared to the female population. Furthermore, people with hypertension and obesity are more susceptible to developing obstructive sleep apnea. According to the WHO estimates, in 2019, 50% of the population is overweight and the average obesity in the European region is 23.3%.

The growing patient pool suffering from obstructive sleep apnea is expected to drive the demand for PAP devices. The growing prevalence of chronic comorbidities across the globe is anticipated to contribute significantly to the incidence rate of obstructive sleep apnea. Chronic ailments, such as obesity, hypertension, diabetes, and cardiovascular diseases, are commonly associated with sleep disorders. The ongoing COVID-19 pandemic restricted the market growth owing to the imposition of lockdowns and travel restrictions to curb the transmission rates. Furthermore, healthcare facilities underwent significant infrastructure changes to accommodate COVID-19 care facilities.

Sleep centers witnessed a decline in diagnostic and therapeutic procedures directly impacting the volume of sleep apnea testing, which restricted the growth of PAP devices. These procedures have a possibility of significantly contributing to the transmission rate, which caused the postponement of elective procedures and disrupted the services’ supply chain, and restrained revenue generation of healthcare facilities. To address the declining volume of sleep studies and procedural volume, the American Academy of Sleep Medicine (AASM) laid down guidelines and protocols to adopt virtual care & consultation.

Product Type Insights

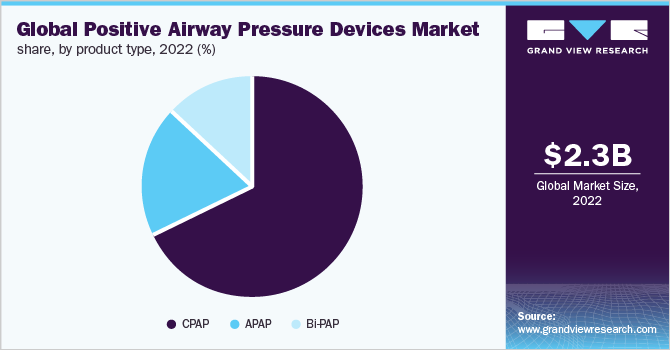

The Continuous Positive Airway Pressure (CPAP) devices segment dominated the market with share of 68.1% in 2022. The segment will grow further at a significant CAGR from 2023 to 2030. The rising incidence rate of obstructive sleep apnea across the globe and increasing awareness among the healthcare fraternity about the available treatment options have contributed to the growth of the segment. The emergence of market participants and the growing focus on innovative product development strategies to offer technologically advanced devices is boosting the growth. Changing lifestyles and growing disposable income have contributed to the growth of the CPAP market. Furthermore, CPAP devices are the first line of treatment for obstructive sleep apnea & snoring and are more economical when compared to other PAP devices.

However, the bi-level positive airway pressure (BiPAP) devices segment is anticipated to grow at a fastest rate of 6.9% over the forecast years owing to the rising incidence of obstructive sleep apnea-associated comorbidities and widespread adoption of PAP devices in disease management. BiPAP devices are the second line of treatment in patients who face difficulties in using CPAP devices. BiPAP devices offer a more efficient breathing pattern coupled with a variable/alternate flow of air. Furthermore, the availability of technologically advanced PAP devices and favorable reimbursement policies are a few driving factors anticipated to bolster the adoption and growth of BiPAP devices.

Regional Insights

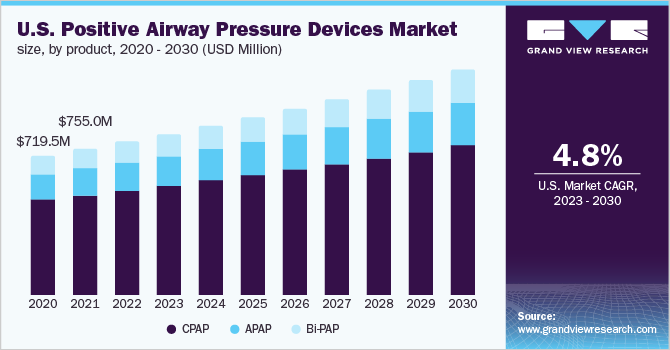

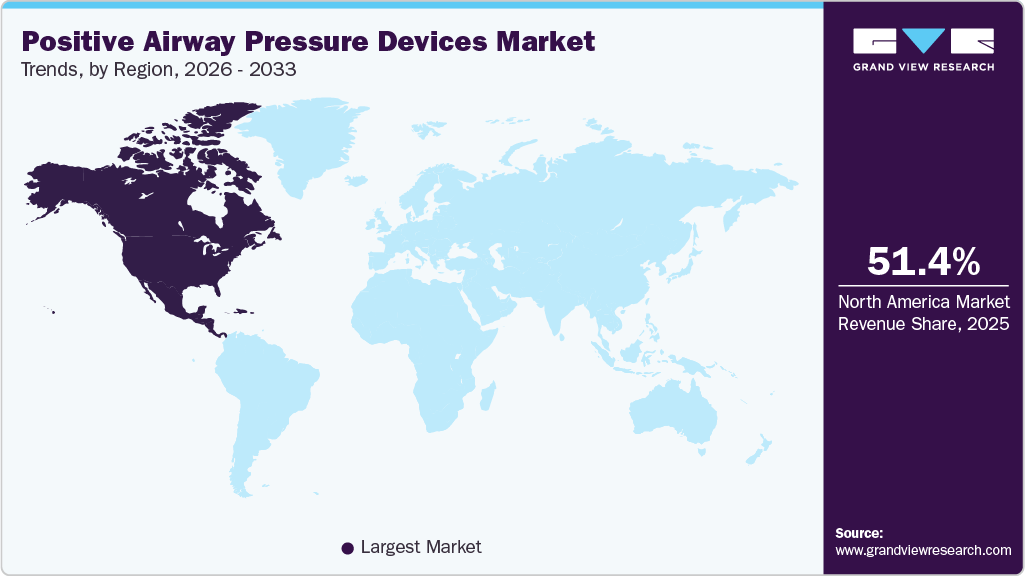

North America segment dominated the market with share of 47.4% in 2022. The growing prevalence of respiratory diseases, such as obstructive sleep apnea, coupled with increasing awareness about the available treatment solutions is driving the growth. According to the estimates published by UpToDate in June 2022, the prevalence of obstructive sleep apnea in North America is recorded to be 10-15% in females and 15-30% in males. In addition, rapid globalization, changing lifestyles, and rising disposable income have contributed to the growth of the North America regional market.

The presence of renowned players and favorable support from government bodies & insurance firms have also supported the region’s growth. For instance, Medicare and other private insurance organizations in the U.S. reimburse approximately 80% of the costs incurred to the patient while purchasing the PAP machine and accessories, thereby, promoting the adoption of sleep apnea treatment solutions. On the other hand, Asia Pacific segment is anticipated to grow at the fastest rate of 7.0% over the forecast period.

This is due to the rapidly increasing geriatric population and growing prevalence of hypertension, Cardiovascular Diseases (CVDs), chronic respiratory disorders, cancer, and hypertension. The rising incidence rate of chronic disorders is anticipated to directly contribute to the growing prevalence of obstructive sleep apnea. According to the National Library of Medicine estimates, the prevalence of obstructive sleep apnea in Asian females ranges from 2.1% to 3.2%, and in males, it ranges from 4.1% to 7.5%. Similarly, as per the Asian Pacific Society of Respirology estimates published in May 2020, the prevalence of mild obstructive sleep apnea in the Asia Pacific ranges from the lowest in Hong Kong (7.8%) to the highest in Malaysia (77.2%).

Key Companies & Market Share Insights

The market is witnessing significant growth owing to the rising demand for PAP devices in managing obstructive sleep apnea and the growing prevalence of associated comorbidities. The oligopolistic market is consolidated with a few renowned and established companies. Key players are focusing on devising innovative products and expanding their customer base through impactful mergers & acquisitions and partnerships. For instance, in March 2019, ResMed acquired South Korean-based HB Healthcare to provide PAP devices and treatment to patients diagnosed with obstructive sleep apnea and other respiratory ailments, such as Chronic Obstructive Pulmonary Disease (COPD). Furthermore, market players are partnering with companies to offer additional services. For instance, in February 2021, Philips and Dutch SAZ group entered a strategic partnership to offer a complete suite of monitoring, observation, and self-management services to patients diagnosed with obstructive sleep apnea. Some of the key participants in the global positive airway pressure devices market are:

-

Philips Respironics

-

Fisher & Paykel Healthcare Ltd.

-

Curative Medical Inc.

-

ResMed

-

Drive Devilbliss Healthcare Ltd.

-

Medtronic, Inc.

-

Servona GmbH

-

Armstrong Medical

-

Medical Depot Inc

-

Smiths Group PLC

-

Lowenstein Medical UK Ltd

Positive Airway Pressure Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.5 billion

Revenue forecast in 2030

USD 3.6 billion

Growth rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, UK, Germany, France, Spain, Italy, Japan, China, Australia, India, South Korea, Mexico, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

ResMed; Phillips Respironics; Fisher & Paykel Healthcare Ltd.; Curative Medical, Inc.; Drive DeVilbliss Healthcare, Inc; Invacare Corp.; Somnetics International, Inc.; BMC Medical Co., Ltd.; Compumedics Ltd.; 3B Medical Inc; Apex Medical, Medtronic, Inc., Servona GmbH, Armstrong Medical, Medical Depot Inc., Smiths Group PLC, Lowenstein Medical UK Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Positive Airway Pressure Devices Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For this study, Grand View Research, Inc. has segmented the global positive airway pressure devices market report based on Product type, application, end user, region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

CPAP

-

APAP

-

BiPAP

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Obstructive Sleep Apnea

-

Respiratory Failures

-

COPD

-

-

End User Outlook (Revenue, USD Million, 2017 - 2030)

-

Hospitals and Sleep Labs

-

Home Care

-

- Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include the high economic burden caused by sleep apnea and the rise in patient compliance rate for PAP devices.

b. The global positive airway pressure devices market size was estimated at USD 2.3 billion in 2022 and is expected to reach USD 2.5 billion in 2023.

b. The global positive airway pressure devices market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 3.6 billion by 2030.

b. CPAP devices dominated the positive airway pressure devices market with a share of 68.1% in 2022. This is attributable to the increasing adoption of these devices due to their low cost as compared to other PAP devices.

b. Some key players operating in the positive airway pressure devices market include Koninklijke Philips N.V. (Philips Respironics); Curative Medical; ResMed; Fisher and Paykel Healthcare Limited; Drive DeVilbiss Healthcare Inc.; and Somnetics International, Inc.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."