- Home

- »

- Healthcare IT

- »

-

Practice Management System Market, Industry Report, 2030GVR Report cover

![Practice Management System Market Size, Share & Trends Report]()

Practice Management System Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Integrated, Standalone), By Component (Software, Services), By Delivery Mode (Web-based, On-premises), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-282-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Practice Management System Market Summary

The global practice management system market size was estimated at USD 14.45 billion in 2024 and is projected to reach USD 25.54 billion by 2030, growing at a CAGR of 10.19% from 2025 to 2030. Increasing digitalization of healthcare systems, rising demand for operational efficiency & cost containment, and increasing regulatory and reimbursement compliance requirements contribute to practice management system (PMS) market growth.

Market Size & Trends:

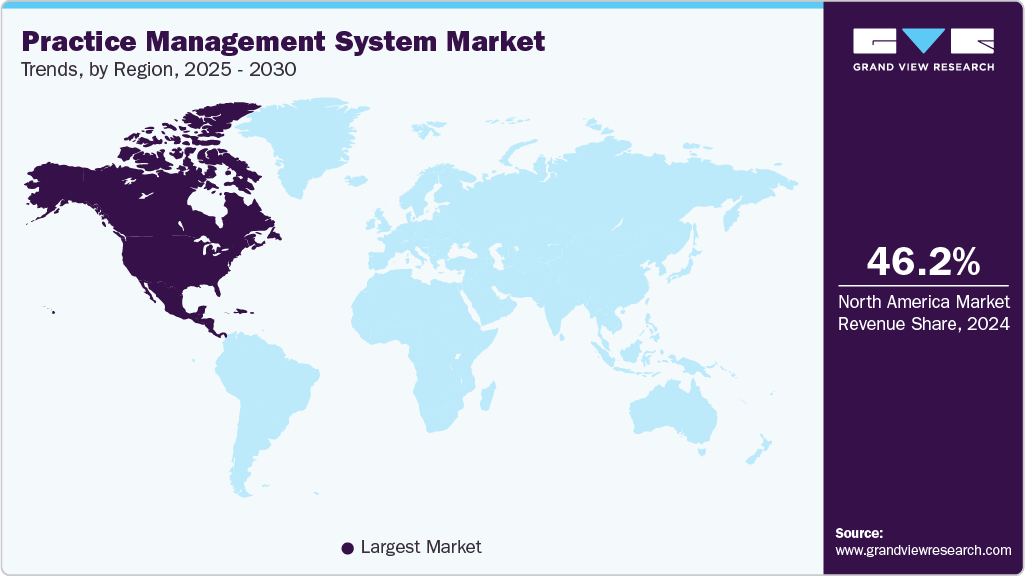

- North America practice management system market held the largest revenue share of 46.24% in 2024.

- The U.S. practice management system industry held the largest share in 2024.

- In terms of segment, the integrated systems segment accounted for the largest revenue share of 74.87% in 2024.

- Based on delivery mode, the web-based delivery mode segment accounted for the largest share of 47.81% in 2024.

- In terms of segment, The software segment accounted for the largest revenue share of 66.39% in 2024.

Key Market Statistics:

- 2024 Market Size: 14.45 Billion

- 2030 Estimated Market Size: 25.54 Billion

- CAGR: 10.19% (2025-2030)

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

In addition, growing focus on interoperability, integration with telehealth & remote monitoring platforms, and the emergence of AI-driven analytics propel market growth further. Favorable government initiatives, coupled with increasing penetration of IT in the healthcare sector, are expected to fuel the growth of the practice management system industry. For instance, in October 2024, the federal government proposed the Federal IT Strategic Plan 2024-2030, which focuses on improving the access, exchange, and usage of electronic health information. As providers move from paper-based to digital workflows, PMS platforms offer essential tools to manage appointments, billing, patient records, insurance claims, and regulatory documentation within a centralized ecosystem.

Moreover, developing countries are increasingly investing in digital health infrastructure to improve access and efficiency, creating a significant demand for entry-level, cloud-based PMS solutions. Healthcare providers worldwide are experiencing growing pressure to enhance operational efficiency while lowering costs. Practice management systems help meet this challenge by automating administrative and financial workflows, including patient registration, appointment scheduling, claims management, and billing reconciliation.

The increasing telehealth adoption has significantly boosted demand for practice management systems that support virtual care delivery. As healthcare providers increasingly offer video consultations, remote monitoring, and digital follow-ups, PMS platforms have evolved to integrate telehealth modules for appointment scheduling, virtual waiting rooms, e-prescriptions, and secure payment processing. For instance, companies such as Tebra and Athenahealth now offer built-in or third-party telehealth plug-ins directly within their PMS workflows. This integration enhances patient satisfaction, improves continuity of care, and ensures compliance for billing and documentation of telehealth visits.

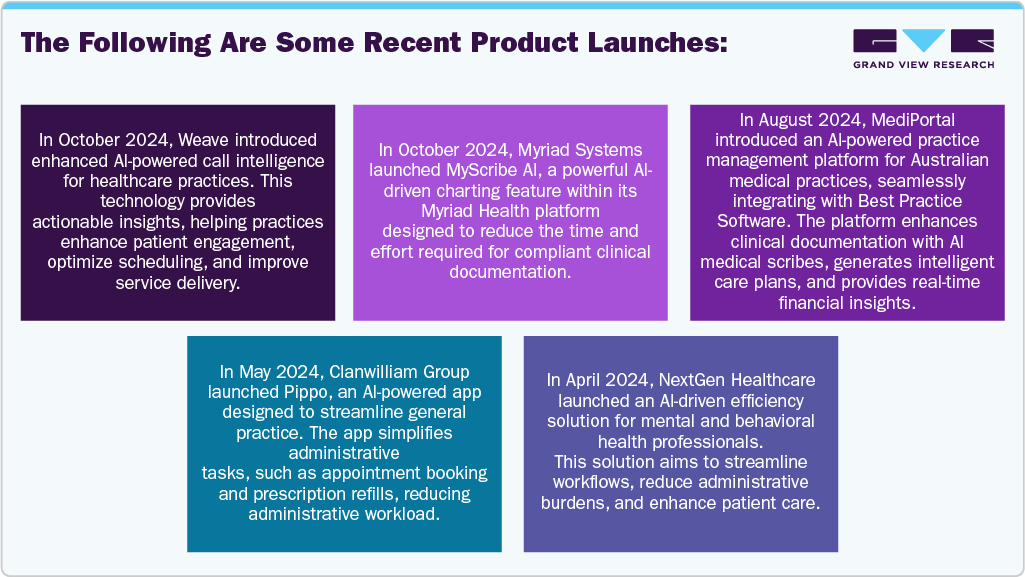

Integration of Artificial Intelligence in Practice Management Systems

The integration of artificial intelligence in practice management systems is enabling smarter, data-driven decision-making and improving clinical and administrative outcomes. AI-enabled PMS platforms offer predictive analytics for appointment no-shows, automated coding assistance, revenue cycle optimization, and intelligent workload distribution for front-desk and billing staff. In addition, AI's ability to automate repetitive tasks, such as data entry, coding suggestions, and patient communication, reduces human error and enhances compliance. As healthcare organizations rely more on real-time insights, AI-integrated PMS platforms are expected to gain traction in the coming years.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the practice management system market is fragmented, with many platforms and service providers entering the market. The degree of innovation is high, and the level of mergers & acquisitions activities is moderate. The impact of regulations on the industry and the regional expansion is high.

The degree of innovation in the industry is high. The market is experiencing significant innovation as numerous providers introduce new products to meet demand for scientific data integration solutions in various industries. For instance, in April 2025, Motivity expanded its platform to include a comprehensive, all-in-one, enterprise-ready practice management system tailored for Applied Behavior Analysis (ABA) providers. The platform streamlines billing, scheduling, and workflows while ensuring compliance-driven precision, smart scheduling, and real-time insights through intuitive dashboards.

The level of mergers & acquisitions in the industry is moderate due to a rise in the acquisition of emerging players by major players to increase their capabilities, expand product portfolios, and improve competencies. For instance, in May 2025, Promptly acquired MDprospects' and Patient Spectrum's software solutions, including MDprospects, MDidentity, Referify, and Appointec, significantly expanding its all-in-one practice management platform.

The impact of regulations on the market is high. Regional and international regulations on data privacy, patient safety, software certification, and interoperability standards govern the global practice management system market. In the U.S., PMS platforms that store or transmit patient data must comply with the Health Insurance Portability and Accountability Act (HIPAA). In Europe, the market is governed by the General Data Protection Regulation (GDPR). In addition, the European Union's Medical Device Regulation (MDR) impacts software classified as medical devices, necessitating compliance with stringent safety and efficacy standards before market entry.

The level of regional expansion in the industry is moderate to high. The increasing demand for practice management system solutions in developing countries further drives market growth. In addition, companies are launching to consolidate their market presence. For instance, in October 2024, Maxim Software Systems launched Mint Ops for dental clinics across Canada. Mint Ops integrates practice management software, patient communication, marketing, staffing, and remote administrative services under one brand.

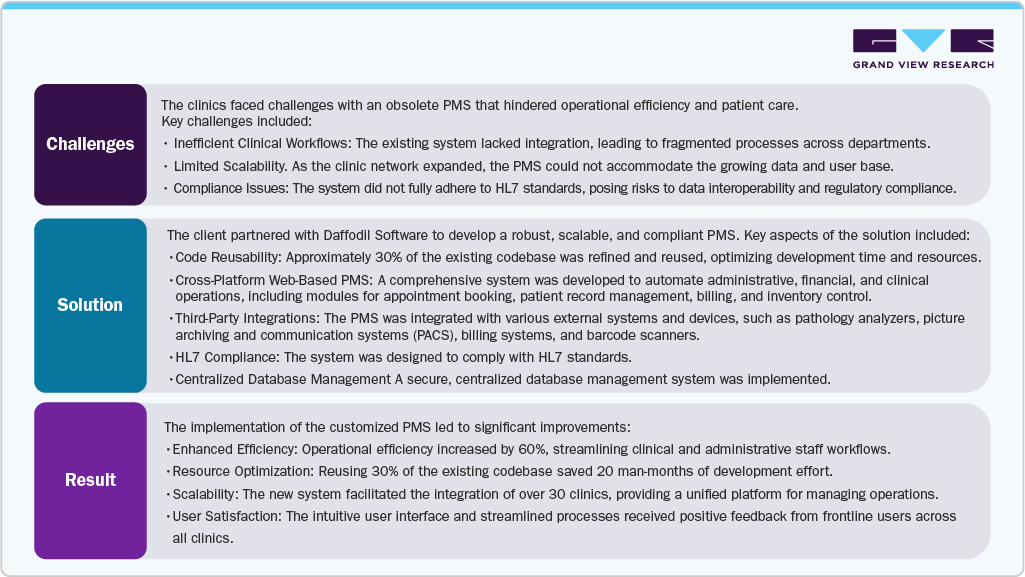

Case Study Insights: Enhancing Operational Efficiency for a UK-Based Clinic Chain through a Customized Practice Management System

A leading UK-based chain of clinics, operating over 30 locations and serving more than 100,000 patients annually, sought to modernize its healthcare delivery. Facing challenges with an outdated practice management system (PMS), the organization partnered with Daffodil Software to develop a comprehensive, scalable, and efficient PMS tailored to its specific needs.

Product Insights

The integrated systems segment accounted for the largest revenue share of 74.87% in 2024, owing to the benefits associated with the product. The segment is projected to grow at the fastest rate over the forecast period. The integrated solutions comprise e-Prescription, Electronic Health Records (EHR), billing systems, and patient engagement. These systems offer several benefits, such as systematic medical billing, streamlined practitioner and patient communication, etc.

The rising complexities associated with patient care and payments, coupled with the centralization in the healthcare industry, are fueling the segment's growth. Moreover, the standalone system segment growth can be attributed to the freedom for physicians to access all facets of practice and business, including prescribing, practice administration, billing, as well as patient communication portals. In addition, the standalone systems focus primarily on functions associated with administrative and billing, particularly scheduling.

Delivery Mode Insights

Based on delivery mode, the web-based delivery mode segment accounted for the largest share of 47.81% in 2024. The web-based management system is gaining popularity as it automatically gets updated as the changes occur, thus causing little disruption to the workflow. On-premise solutions provide patient data security, easy retrieval, and ease of access. The inclination toward on-premise solutions is primarily due to the complete access to the information within the premises. For large healthcare systems and organizations that can store large data, pay high upfront costs, and maintain servers, on-premise systems are a much more reliable option.

The cloud-based segment is estimated to expand at the fastest CAGR, owing to the advantages associated with it, like higher reliability and faster processing. Cloud-based solutions allow easy accessibility of readily available information even at remote locations. In turn, improved communication capacity, data storage, lowered IT costs, scalability, accessibility, and other benefits have contributed to the growth of this segment. However, the adoption of cloud-based delivery mode is comparatively low in rural areas but is anticipated to increase over the forecast period.

Component Insights

The software segment accounted for the largest revenue share of 66.39% in 2024. Software is easy to install, use, and retrieve records owing to intuitive user interfaces and continuous product upgrades. They are used by providers, hospitals, and health systems to drive the quality of care and increase patient satisfaction. Regulatory authorities, especially in developed nations, are also focused on the wider implementation of practice management software for improving the delivery of healthcare services, which is also expected to boost market growth. For instance, in May 2024, Clanwilliam launched iMedDoc, a cloud-based practice management system for private healthcare in the UK, complementing its existing DGL Practice Manager.

“Private healthcare is developing rapidly in the UK, as patients look for a faster, more personalised service than an under-pressure NHS can deliver. We saw a requirement for a different kind of IT system to support the clinics and specialists that are looking to deliver that service, and iMedDoc fulfils that requirement. It brings the mobile technology that we have all adopted in our daily lives to bear on practice management tasks, so clinicians can save time and focus on what really matters to them - their patients.”

-Eileen Byrne, managing director at Clanwilliam

However, the services segment is expected to witness the fastest CAGR over the forecast period, owing to the rising demand for training and assistance in installing the software and upgrading the system in line with the escalating growth of IT. Practice management system services include consulting, implementation and training, support and maintenance, and other services, such as interoperability and access to EHR data. Increasing healthcare IT spending in developing countries further contributes to the growth of the practice management system industry.

End Use Insights

The physician back-office segment held the largest revenue share of 56.16% in 2024. The segment growth is attributed to the digitization of documents and databases. Furthermore, the increasing technological advancements in these settings have boosted work efficiency. The practice management software manages operations including accounting, billing, and scheduling, thereby enhancing the work efficiency of the healthcare settings. Such factors are propelling the growth of the physician back-office segment.

The pharmacies segment is anticipated to grow significantly from 2025 to 2030. Pharmacies are increasingly becoming primary care hubs, offering services such as vaccinations, chronic disease management, medication therapy reviews, and basic diagnostics. This expansion requires integrated systems to manage patient scheduling, clinical documentation, billing, and compliance tracking, thus driving the adoption of practice management systems across these settings.

Regional Insights

North America practice management system market held the largest revenue share of 46.24% in 2024. This growth is attributed to the robust healthcare IT infrastructure, increasing need for operational efficiency, enhanced documentation with minimal errors, and financial viability for physicians' practices.

U.S. Practice Management System Market Trends

The U.S. practice management system industry held the largest share in 2024, driven by advanced healthcare infrastructure, widespread adoption of electronic health records (EHRs), and a focus on operational efficiency. For instance, in December 2023, Veradigm LLC launched a conversational AI agent for Practice Fusion Billing Services, aiming to simplify the billing process for independent healthcare providers. In addition, the integration of PMS with telehealth platforms and the emphasis on value-based care models have further accelerated market growth. Moreover, supportive government initiatives, such as the Medicare and Medicaid EHR Incentive Programs, have accelerated the adoption of PMS solutions.

Europe Practice Management System Market Trends

The Europe practice management system industryis anticipated to grow significantly over the forecast period. Increasing adoption of practice management systems to meet regulatory requirements, a growing need for automation, and technological advancements are key factors propelling market growth. Moreover, supportive government initiatives propel market growth further. For instance, France's focus on eHealth and implementing the "Ma Santé 2022" strategy, which aims to digitize healthcare services, drives the PMS market.

The UK practice management system market is expected to grow significantly over the forecast period.This growth is fueled by the National Health Service's (NHS) digital transformation initiatives and the increasing adoption of integrated PMS solutions. The shift towards cloud-based systems enhances data security and remote accessibility, aligning with the UK's emphasis on modernizing healthcare infrastructure. Moreover, key players are undertaking strategic initiatives to enhance their market presence. For instance, in January 2025, Cority acquired Meddbase, a cloud-based occupational health and enterprise practice management software provider.

The practice management system market in Germany is expected to grow significantly over the forecast period. This growth is driven by the country's strong healthcare infrastructure and the emphasis on digital health solutions. The integration of PMS with EHRs and other health IT systems is becoming increasingly prevalent.

Asia Pacific Practice Management System Market Trends

The Asia Pacific practice management system industryis expected to witness the fastest growth over the forecast period. This growth is driven by the increasing demand for high-quality healthcare services, the growing geriatric population, and the rising prevalence of chronic diseases. Government initiatives promoting digital health and investments in healthcare IT infrastructure further bolster market expansion. Furthermore, companies are engaged in strategic initiatives to expand their market presence. For instance, in February 2025, the U.S.-based Banyan Software acquired the Auckland-based health IT company Medtech Global, supporting Medtech’s continued innovation and market expansion in the region.

China practice management system market held the largest share in 2024. China's rapid healthcare expansion and the government's Healthy China 2030 initiative promote the adoption of digital health solutions, including PMS. The rise of private healthcare providers and the emphasis on smart hospitals further contribute to market growth.

The practice management system market in Indiais expected to grow significantly over the forecast period. Increasing investments in healthcare IT, fueled by government initiatives such as the Digital India campaign and the National Digital Health Mission (NDHM), which aim to digitize healthcare services, propel market growth further. In addition, the increasing number of private clinics and hospitals adopting PMS solutions also drives market expansion.

Latin America Practice Management System Market Trends

The Latin America practice management system industry is anticipated to grow significantly due to increasing investments in healthcare infrastructure, a rising focus on enhanced care management, and the growing use of smartphones and internet connectivity.

Middle East & Africa Practice Management System Market Trends

The Middle East & Africa practice management system industryis expected to grow significantly over the forecast period. This growth can be attributed to the rising adoption of cloud-based solutions, stringent regulatory requirements, technological advancements, and increasing investments in healthcare IT infrastructure.

Key Practice Management System Company Insights

The market is highly fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key Practice Management System Companies:

The following are the leading companies in the practice management system market. These companies collectively hold the largest market share and dictate industry trends.

- Allscripts Healthcare, LLC (Veradigm LLC)

- OmniMD

- Henry Schein, Inc.

- AdvantEdge Healthcare Solutions

- Athenahealth

- Cerner Corporation (Oracle)

- Epic Systems Corporation

- GE Healthcare

- McKesson Corporation

- Accumedic Computer Systems, Inc.

- NXGN Management, LLC

- eClinicalWorks

- CoreCloud

- Kareo, Inc.

- Practice Fusion, Inc.

- AdvancedMD, Inc.

- DrChrono, Inc.

- CollaborateMD Inc.

- Greenway Health, LLC

- OfficeAlly Inc.

- PracticeSuite Inc.

- Medical Information Technology, Inc.

- CompuGroup Medical US

- CERTIFY Health

- SimplePractice, LLC

Recent Developments

-

In January 2025, Simplify Healthcare launched SimplifyDocs.AI, an AI-powered solution designed to automate the generation of mandated and non-mandated healthcare documents. It eliminates manual work, ensures error-free language translations, and supports all print and digital output channels, enhancing efficiency and accuracy in healthcare documentation processes.

-

In January 2025, Nelly, a Berlin-based fintech startup, raised USD 51 million in a Series B funding round to digitalize medical practices across Europe. Currently serving over 1,200 practices, Nelly aims to streamline administrative workflows, enabling online patient onboarding, appointment scheduling, and billing, while integrating with existing management systems for enhanced efficiency.

-

In November 2024, Practice Better secured USD 13 million growth capital to accelerate expansion of its all-in-one practice management platform for health and wellness professionals.

-

In October 2024, StrataPT secured USD 25 million in financing to enhance its practice management platform for outpatient physical therapy clinics.

-

In June 2024, PracticeTek launched Ora, an all-in-one dental practice management platform, designed to unify and streamline operations for dental practices and DSOs. It integrates essential tools such as EHR, patient scheduling, billing, imaging, lab management, and automated reminders into a single cloud-based platform, enhancing efficiency, patient care, and scalability.

“Ora is the first platform to fulfill the promise of a unified solution, designed to centralize and streamline practice management, supporting the needs of all dental practices, from small private clinics to large multi-specialty organizations. We’re continuously innovating and enhancing the Ora platform to integrate even more best-in-class solutions to remain at the forefront of dental practice management technology.”

-Marc West, PracticeTek CPO

-

In January 2024, Rectangle Health launched Practice Management Bridge, a new all-in-one cloud-based platform for appointment scheduling, reminders, waitlist management, payment process, and text communication.

“Practice Management Bridge represents a single unified platform that automates interactions between patients and providers, while significantly enhancing practice profitability."

-Sid Singh, CEO of Rectangle Health

-

In July 2023, TPG signed a deal to acquire Tampa-based provider of EMR and practice management software for specialty physician practices, from Thomas H. Lee Partners, for USD 1.4 billion.

Practice Management System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.72 billion

Revenue forecast in 2030

USD 25.54 billion

Growth rate

CAGR of 10.19% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product. delivery mode, component, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Allscripts Healthcare, LLC (Veradigm LLC); OmniMD; Henry Schein, Inc.; AdvantEdge Healthcare Solutions; Athenahealth; Cerner Corporation (Oracle); Epic Systems Corporation; GE Healthcare; McKesson Corporation; Accumedic Computer Systems, Inc.; NXGN Management, LLC; eClinicalWorks; CoreCloud; Kareo, Inc.; Practice Fusion, Inc.; AdvancedMD, Inc.; DrChrono, Inc.; CollaborateMD Inc.; Greenway Health, LLC; OfficeAlly Inc.; PracticeSuite Inc.; Medical Information Technology, Inc.; CompuGroup Medical US; CERTIFY Health; SimplePractice, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Practice Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global practice management system market report based on product, delivery mode, component, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated

-

EHR/EMR

-

e-Rx

-

Patient engagement

-

Others

-

-

Standalone

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

On-Premise

-

Cloud-based

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Physician back office

-

Ambulatory Settings

-

Others

-

-

Pharmacies

-

Diagnostic Laboratories

-

Other Settings

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global practice management system market size was estimated at USD 14.45 billion in 2024 and is expected to reach USD 15.72 billion in 2025.

b. The global practice management system market is expected to grow at a compound annual growth rate (CAGR) of 10.19% from 2025 to 2030 to reach USD 25.54 billion by 2030.

b. North America dominated the global market with the largest revenue share of 46.24% in 2024. This growth is attributed to the robust healthcare IT infrastructure, increasing need for operational efficiency, enhanced documentation with minimal errors, and financial viability for physicians' practices.

b. Some of the key participants in the practice management system market include Allscripts Healthcare, LLC (Veradigm LLC); OmniMD Henry Schein, Inc.; AdvantEdge Healthcare Solutions; Athenahealth; Cerner Corporation (Oracle); Epic Systems Corporation; GE Healthcare; McKesson Corporation; Accumedic Computer Systems, Inc.; NXGN Management, LLC; eClinicalWorks; CoreCloud; Kareo, Inc.; Practice Fusion, Inc.; AdvancedMD, Inc.; DrChrono, Inc.; CollaborateMD Inc.; Greenway Health, LLC; OfficeAlly Inc.; PracticeSuite Inc.; Medical Information Technology, Inc.; CompuGroup Medical US; CERTIFY Health; and SimplePractice, LLC.

b. Key factors that are driving the practice management system market growth include the increasing digitalization of healthcare systems, rising demand for operational efficiency & cost containment, and increasing regulatory and reimbursement compliance requirements contribute to practice management system (PMS) market growth. In addition, growing focus on interoperability, integration with telehealth & remote monitoring platforms, and the emergence of AI-driven analytics propel market growth further.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.