- Home

- »

- Petrochemicals

- »

-

Precipitated Calcium Carbonate Market Size Report, 2030GVR Report cover

![Precipitated Calcium Carbonate Market Size, Share & Trends Report]()

Precipitated Calcium Carbonate Market (2023 - 2030) Size, Share & Trends Analysis Report By Grade (Food, Pharmaceutical, Cosmetic, Reagent), By Region (North America, Asia Pacific, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-005-6

- Number of Report Pages: 65

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Precipitated Calcium Carbonate Market Summary

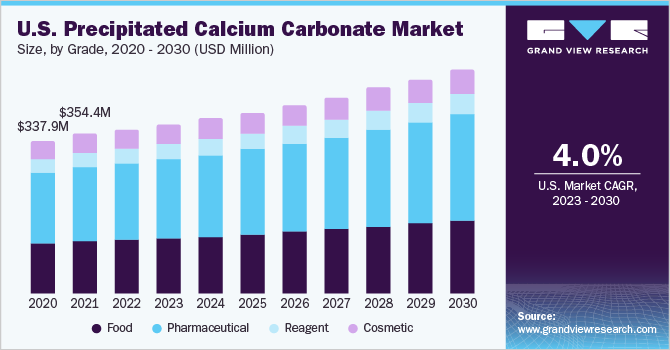

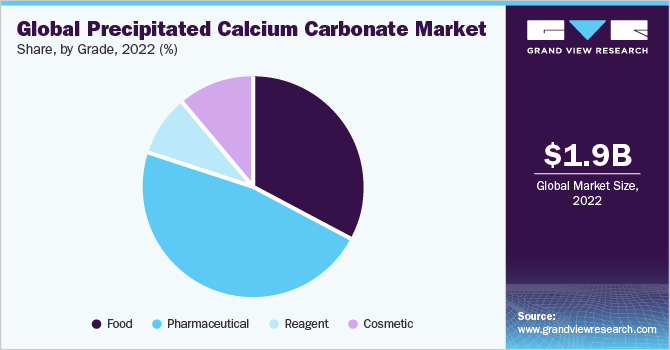

The global precipitated calcium carbonate market size was estimated at USD 1.98 billion in 2022 and is projected to reach USD 2.88 billion by 2030, growing at a CAGR of 4.7% from 2023 to 2030. The growth of the product market is attributed to factors such as the growing demand for precipitated calcium carbonate (PCC) in the pharmaceutical and cosmetics industries.

Key Market Trends & Insights

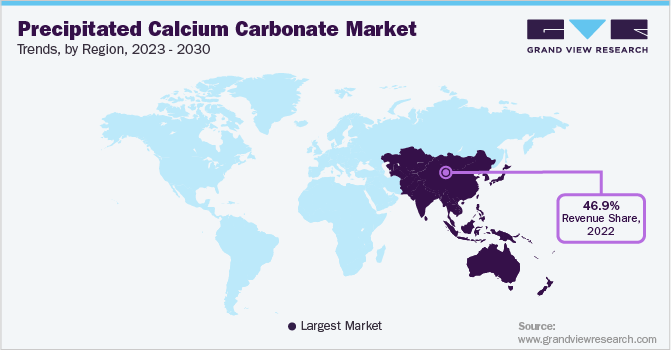

- Asia Pacific dominated the global precipitated calcium carbonate market with the largest revenue share of 46.9% in 2022.

- The precipitated calcium carbonate market in China led the Asia Pacific market and held the largest revenue share in 2022.

- By grade, the pharmaceuticals segment led the market, holding the largest revenue share of 46.8% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 1.98 Billion

- 2030 Projected Market Size: USD 2.88 Billion

- CAGR (2023-2030): 4.7%

- Asia Pacific: Largest market in 2022

The fine particle size of PCC makes it more favorable in medicines like antacids and calcium mineral supplements used in healthy diets. Moreover, the small particle size helps in developing good taste in calcium-fortified food items. The rapidly growing pharmaceutical research and development activities in emerging economies like Brazil, China, and India created more opportunities for PCC.

As per the European Federation of pharmaceutical industry and association, the markets in China, Brazil, and India grew by 11.3%, 4.8%, and 10% during the period 2015-2020. Thus, the growing pharmaceutical industry in these regions is expected to drive the demand for PCC. However, issues related to the mining and transportation of raw materials are acting as restraining factors for industry growth. The establishment of new quarries and plants is a slow process. It requires around 2 years to set up a cement plant and the permission process takes a long time. Such challenges restrict the establishment of quarries.

However, many companies are still trying to expand and improve their plants. Moreover, most of the mined limestone is used for aggregate or crushed applications. The maximum crushed stone in North America is obtained from limestone. Although limestone production is increasing in the U.S., the country still imports several limestone products from countries such as China, Mexico, and Canada. The increasing distance in transportation impacts the prices of the final products, thus acting as a restraining factor for market growth. The U.S. was the largest product consumer in North America in 2022.

This is attributed to the expanding agricultural, food, cosmetics, and pharmaceutical industries in the country. According to FORBES, the U.S. is among the largest beauty market in the world, accounting for 20% of the global share, followed by China and Japan. In addition, according to Atradius Collections, a global trade-invoice-collection services company, the pharmaceuticals industry in the country accounted for around 22% of the global production in 2022, making the U.S. a lucrative market for the growth of PCC demand. Thus, driving the product demand in the country.

Grade Insights

The pharmaceuticals segment dominated the market in 2022 with a revenue share of 46.8% of the overall revenue. This growth is attributed to the fact that calcium plays a vital role in the human body as it is an essential micronutrient. The global healthcare and pharmaceutical industries have been growing rapidly over the last few years, owing to the increasing population and rising awareness among the masses about healthy living. Although COVID-19 severely impacted different industries worldwide, it boosted the growth of the global healthcare and pharmaceutical industries. The pandemic further made people highly conscious and aware of the benefits of a healthy diet and proper intake of micronutrients and macronutrients, such as calcium.

This, in turn, led to a rise in demand for precipitated calcium carbonate, thereby fueling the growth of the market. The food segment is estimated to witness the fastest CAGR over the forecast period due to the fact that food-grade precipitated calcium carbonate is used as a calcium supplement and food additive in the food industry. Food products, such as noodles, biscuits, bread, and chewing gums, contain PCC as an active ingredient. It is added to the food consumed for the growth of bones and the body. The increasing global population and demand for healthy food products worldwide are driving the growth of the market for food-grade PCC.

Regional Insights

Asia Pacific emerged as the dominant region with a revenue share of 46.9% in 2022. This growth is attributed to the fact that Asia Pacific is among the largest markets for pharmaceuticals and personal care & cosmetics. According to the National Investment Promotion & Facilitation Agency, the beauty & personal care market in India is the 8th largest in the world, accounting for USD 15 billion, which is further expected to expand at a CAGR of 12-16% over the coming years. In addition, according to the Hong Kong Trade Development Council, China is the second-largest consumer of cosmetics & personal care items, accounting for around 17.3% of global consumption.

Thus, the growing personal care & cosmetics industry is anticipated to drive the demand for PCC, which is used as a filler in several cosmetics products. Europe will also witness strong growth over the forecast period. According to the European Industrial Pharmacists Group, pharmaceuticals production in Europe has witnessed an increase from USD 135.3 billion in 2000 to USD 318.4 billion in 2021, registering a growth of 11.7%, 6.7%, and 11.8% in France, Germany, and Italy, respectively. Thus, the increasing usage of PCC as a calcium supplement, and in pills, medicines, and ointments in the pharmaceutical industry is driving the demand in the regional market.

Key Companies & Market Share Insights

The market is highly competitive with the presence of a large number of independent small- and large-scale manufacturers and suppliers. While large-scale companies concentrate on mergers, expansions, and product development, small-scale players primarily compete based on product prices. Players are entering into mergers and partnerships to establish their position in the market. For instance, Mineral Technologies Inc. formed an agreement with India-based Satia Industries to set up a 42,000 metric tons per year capacity satellite PCC plant in its paper mill in India. This development aims at helping the former strengthen its position in the Asia Pacific. Some of the prominent players in the global precipitated calcium carbonate market include:

-

Fujian Sanmu Nano Calcium Carbonate Co., Ltd.

-

Guangdong Qiangda New Materials Technology Co.

-

Minerals Technologies Inc.

-

NanoMaterials Technology

-

EZ Chemicals Inc.

-

Nanoshel LLC

-

GCCP Resources Ltd.

-

Gulshan Polyols Ltd.

Precipitated Calcium Carbonate Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.06 billion

Revenue forecast in 2030

USD 2.88 billion

Growth rate

CAGR of 4.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, region

Regional scope

North America; Europe; Asia Pacific

Country scope

U.S.; Japan; Oceania

Key companies profiled

Fujian Sanmu Nano Calcium Carbonate Co., Ltd.; Guangdong Qiangda New Materials Technology Co.; Minerals Technologies Inc.; NanoMaterials Technology; EZ Chemicals Inc.; Nanoshel LLC; GCCP Resources Ltd.; Gulshan Polyols Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precipitated Calcium Carbonate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global precipitated calcium carbonate market report on the basis of grade and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food

-

Pharmaceutical

-

Reagent

-

Cosmetic

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Asia Pacific

-

Japan

-

Oceania

-

-

Frequently Asked Questions About This Report

b. The global precipitated calcium carbonate market size was estimated at USD 1.98 billion in 2022 and is expected to reach USD 2.06 billion in 2023.

b. The global precipitated calcium carbonate market is expected to grow at a compound annual growth rate of 4.7% from 2023 to 2030 to reach USD 2.88 billion by 2030

b. Asia Pacific dominated the PCC market with a share of 46.9% in 2022. This is attributable to the increasing use of pharmaceuticals and cosmetics market in the region

b. Some key players operating in the precipitated calcium carbonate market include Fujian Sanmu Nano Calcium Carbonate Co., Ltd., Minerals Technologies Inc., NanoMaterials Technology, EZ Chemicals Inc, and Nanoshel LLC

b. Key factors that are driving the market growth include increasing demand for the product in the cosmetic and pharmaceutical industry across regions owing to its fine particle size

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.