- Home

- »

- Next Generation Technologies

- »

-

Predictive Dialer Software Market Size, Industry Report, 2030GVR Report cover

![Predictive Dialer Software Market Size, Share & Trends Report]()

Predictive Dialer Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (Cloud, On-premises), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-279-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Predictive Dialer Software Market Trends

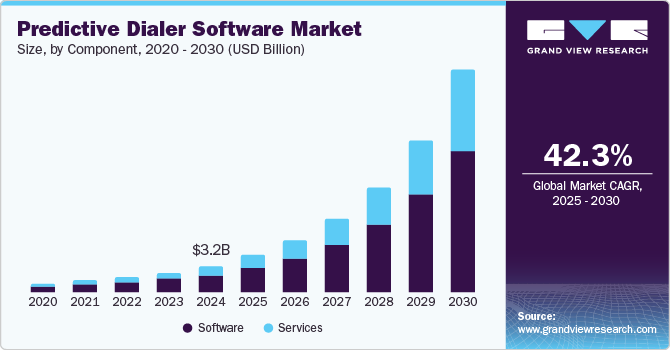

The global predictive dialer software market size was valued at USD 3.20 billion in 2024 and is expected to grow at a CAGR of 42.3% from 2025 to 2030. The market is driven by the increasing need for real-time customer engagement and improved operational efficiency. Businesses are increasingly adopting predictive dialers in contact centers to streamline outbound calling, ensuring that agents connect only with answered calls. This automation enhances productivity and customer satisfaction by reducing wait times and increasing successful connections.

Technological advancements are also a key factor in this growth. Integrating Artificial Intelligence (AI) and machine learning into predictive dialers enables more accurate dialing algorithms that optimize call timing and minimize abandoned calls. In addition, the rise of cloud-based solutions makes these systems more accessible to Small and Medium Enterprises (SMEs), allowing them to utilize advanced features without substantial upfront costs. Cost-effectiveness further drives the adoption of predictive dialer software. Businesses can lower labor costs and enhance resource allocation by automating dialing. Moreover, predictive dialers eliminate idle time between calls, allowing agents to focus on productive interactions. Their flexibility for various applications, including sales and customer support, adds to their appeal across diverse industries.

Hence, the predictive dialer software industry is expanding due to the rising demand for efficient telemarketing solutions, technological innovations that improve dialing accuracy, and the cost-saving advantages of automation. As organizations increasingly implement these systems to enhance customer engagement and operational efficiency, strong market growth is anticipated in the coming years.

Component Insights

The predictive dialer software market is divided into two main components: software and services. In 2024, the software segment held a significant market share of 66.7%, driven by the increasing demand for automated calling solutions in contact centers. This growth can be attributed to enhanced operational efficiency and improved customer engagement, as businesses seek to connect with customers more effectively by ensuring that agents engage only with answered calls.

The services segment includes several key areas: integration & deployment, support & maintenance, training & consulting, and managed services. Integration & deployment ensure that predictive dialers work seamlessly with existing systems while support & maintenance keep the software running efficiently. Training & consulting helps users maximize the software's capabilities, and managed services provide comprehensive operational support. This segment is expected to grow at the fastest CAGR during the forecast period from 2025 to 2030, highlighting the importance of these services in optimizing predictive dialer technology for organizations.

Deployment Insights

The predictive dialer software market is segmented by deployment into cloud-based and on-premise solutions. In 2024, cloud-based systems dominated the market, offering rapid deployment and scalability without the need for significant hardware investments. This model is particularly beneficial for Small- and Medium-sized Enterprises (SMEs), as it reduces IT overhead and allows agents to work from various locations, enhancing flexibility and accessibility.

On-premise solutions are also experiencing significant growth. These systems provide organizations with greater control and customization options, making them ideal for contact centers with specific integration needs. While on-premise deployments require more IT resources for setup and maintenance, the demand for these tailored solutions is increasing as businesses seek to align their operations with their specific requirements. Overall, both deployment types are expected to see continued growth in the predictive dialer software market.

Enterprise Size Insights

The predictive dialer software market is segmented by enterprise size into large enterprises and SMEs. As of 2024, large enterprises dominated the market, leveraging predictive dialer technology to enhance their extensive customer engagement efforts and streamline operations. These organizations benefit from robust systems that can handle high volumes of calls and integrate seamlessly with existing infrastructure, making them well-suited for large-scale telemarketing and customer service initiatives.

SMEs are expected to experience the highest CAGR from 2025 to 2030. This growth is driven by the increasing adoption of predictive dialer solutions among SMEs, which seek cost-effective ways to improve customer interactions and operational efficiency. As these businesses recognize the advantages of automated dialing systems, they are more likely to invest in technology that enhances their outreach capabilities and supports their growth objectives.

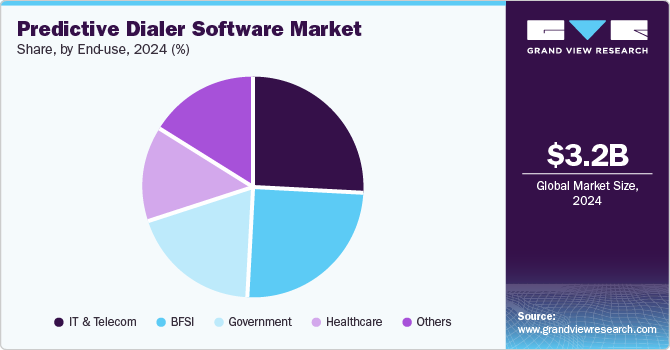

End Use Insights

The IT & telecom segment led the market in 2024, driven by the industry's need for efficient communication and customer engagement strategies. Predictive dialers are particularly effective in this sector as they automate outbound calling processes, enabling companies to manage high volumes of calls while providing technical support and introducing new services. In addition, BFSI and healthcare segments also contribute to market growth. However, the IT & Telecom sector's reliance on predictive dialing technology for customer outreach and support gives it a competitive edge. As businesses in these sectors adopt advanced dialing solutions to enhance operational efficiency and improve customer interactions, the demand for predictive dialer software will rise significantly over the coming years.

The government sector is anticipated to record the highest CAGR over the forecast period from 2025 to 2030. This growth can be attributed to the increasing need for efficient public services and effective communication with citizens. Government agencies widely adopt predictive dialer systems to streamline outreach efforts, enhance service delivery, and improve response times. These systems allow agencies to automate calling processes, ensuring that important information reaches the public promptly while reducing the workload on staff. As various levels of government recognize the benefits of predictive dialing technology, including cost-effectiveness and ease of implementation, the demand for these solutions is expected to rise significantly.

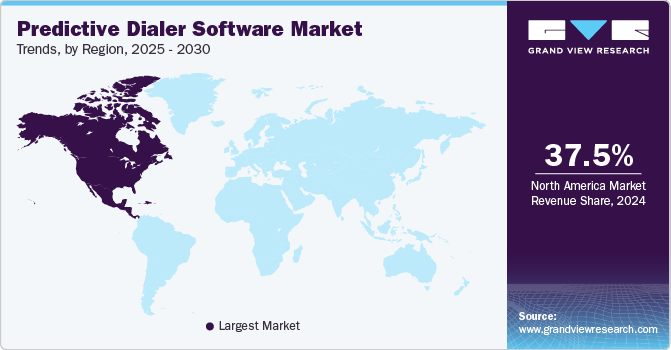

Regional Insights

North America dominated the predictive dialer software market in 2024 with a revenue share of 37.5% and is expected to maintain this lead. This can be attributed to a high regional concentration of contact centers and major industry players. The demand for predictive dialers in the region is fueled by the need for efficient customer engagement and streamlined communication processes across various sectors, including IT & telecom, BFSI, and healthcare. Businesses are increasingly adopting these solutions to enhance agent productivity and improve customer interactions, leveraging advanced features such as AI and machine learning to optimize dialing strategies.

U.S. Predictive Dialer Software Market Trends

Within North America, the U.S. dominated the regional market in 2024, which can be attributed to the ongoing shift toward cloud-based solutions that offer scalability and flexibility, allowing organizations to adapt to changing call volumes and operational demands. In addition, the integration of predictive dialers with CRM systems is enhancing organizations’ effectiveness, further driving adoption among businesses seeking to improve service delivery and customer satisfaction in a competitive landscape.

Europe Predictive Dialer Software Market Trends

Europe is forecasted to remain a key player in the global predictive dialer software industry. The growth is driven by the increasing use of predictive dialers in various sectors, including IT & telecom, BFSI, and government agencies, as organizations aim to improve customer engagement and streamline their operations. Predictive dialers help automate the calling process and enhance agent productivity, making them essential tools for call centers looking to boost efficiency and conversion rates. Countries such as Germany, the UK, and France are leading the market due to their strong telecommunications infrastructure and high demand for advanced communication solutions. The rise of cloud-based technologies is also making it easier for businesses to implement predictive dialer systems, allowing for effective scaling of operations. As more organizations recognize the advantages of predictive dialing technology in reducing errors and maximizing call handling capabilities, the European market is set for strong growth in the coming years.

Asia Pacific Predictive Dialer Software Market Trends

Asia Pacific is anticipated to experience the highest growth in the predictive dialer software industry during the forecast period. This growth is driven by the increasing adoption of predictive dialer systems by both large enterprises and SMEs. The rise of cost-effective and cloud-based solutions plays a crucial role in this expansion as organizations look to enhance their customer engagement and streamline operations. The demand for predictive dialers is further supported by the increasing digitalization of business operations and higher IT budgets among enterprises in the region. As companies seek to improve their call center efficiency and deliver better customer experiences, predictive dialers are becoming essential tools for managing outbound communications effectively.

In 2024, China accounted for the highest revenue share in the region, which can be attributed to the “14th Five-Year Plan.” This plan is focused on digital transformation and automation across industries. Moreover, initiatives undertaken by the Ministry of Industry and Information Technology to enhance cloud computing and big data technologies also drive the country’s market. In addition, the rapid growth of the BPO sector in cities like Shenzhen is driving the demand for predictive dialing solutions as companies seek to improve customer engagement and operational efficiency.

Key Predictive Dialer Software Company Insights

Some key companies in the predictive dialer software industry are agilecrm.com, DialedIn, Convoso, Five9, Inc., and NICE. These organizations are focusing on expanding their customer base and gaining a competitive edge in the market. To achieve this, key players are actively pursuing several strategic initiatives, such as mergers and acquisitions, as well as forming partnerships with other leading companies.

-

agilecrm offers cloud-based CRM solutions designed to enhance sales, marketing, and customer service for small and medium-sized businesses. With its user-friendly platform, agilecrm enables businesses to streamline operations by providing automated tools for lead management, sales tracking, customer segmentation, and marketing campaigns. agilecrm’s features include marketing automation, email tracking, and web engagement tools, which are aimed at improving customer relationships and boosting productivity. The platform also integrates with various third-party applications, allowing businesses to manage customer data and interactions seamlessly across systems for a more personalized and efficient customer experience.

-

Convoso is a cloud-based contact center software designed to enhance outbound call performance with AI-driven tools like predictive dialing, call routing, and real-time analytics. Ideal for sales and support teams, it boosts agent productivity and contact rates. Convoso also enables omnichannel outreach through calls, SMS, and email, helping businesses engage customers more effectively. Its compliance-focused features adhere to industry regulations, ensuring secure and efficient operations.

Key Predictive Dialer Software Companies:

The following are the leading companies in the predictive dialer software market. These companies collectively hold the largest market share and dictate industry trends.

- agilecrm.com

- DialedIn

- Convoso

- Five9, Inc.

- NICE

- PhoneBurner

- RingCentral, Inc.

- Star2Billing S.L.

- VanillaSoft

- Ytel Inc.

Recent Developments

-

In November 2024, RingCentral and Verint formed a partnership to boost employee productivity and enhance customer experiences. This collaboration is expected allow RingCX customers to access Verint's advanced customer experience (CX) and Workforce Engagement Management (WEM) automation solutions, which will work alongside RingCentral's existing AI features.

-

In August 2024, Five9 announced the acquisition of Acqueon, a real-time revenue execution platform, to enhance its Intelligent CX Platform. This acquisition aims to improve omnichannel outreach and customer journey orchestration, enabling businesses to engage customers proactively through AI-driven solutions. Integrating Acqueon's capabilities will optimize outbound interactions, making it a significant advancement for the predictive dialer market by enhancing how companies connect with their customers.

-

In September 2023, VanillaSoft secured a significant growth investment from Tritium Partners to accelerate its expansion and enhance its product offerings. This investment aimed to support the company's strategic initiatives and strengthen its position in the market. The partnership was expected to facilitate further innovation and improvements in customer service.

Predictive Dialer Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.38 billion

Revenue forecast in 2030

USD 25.52 billion

Growth Rate

CAGR of 42.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

agilecrm.com; DialedIn; Convoso; Five9, Inc.; NICE; PhoneBurner; RingCentral, Inc.; Star2Billing S.L.; VanillaSoft; and Ytel Inc..

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Predictive Dialer Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global predictive dialer software market report based on component, deployment, enterprise size, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.