- Home

- »

- Communication Services

- »

-

Premium Messaging Market Size, Industry Report, 2030GVR Report cover

![Premium Messaging Market Size, Share & Trends Report]()

Premium Messaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (A2P SMS, A2P MMS, P2A SMS, P2A MMS), By Application (BFSI, Retail, Entertainment & Media, Hospitality, Outsourcing), By Region, And Segment Forecasts

- Report ID: 978-1-68038-162-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Premium Messaging Market Size & Trends

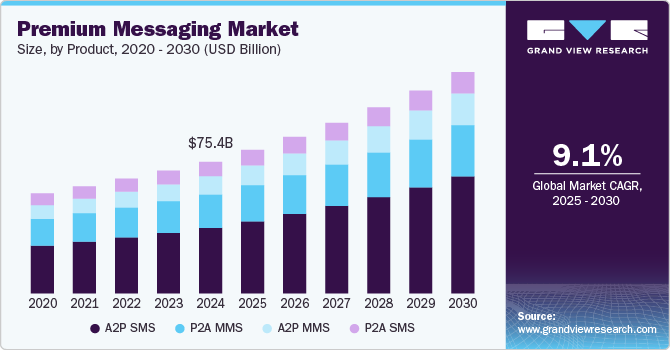

The global premium messaging market size was valued at USD 75.44 billion in 2024 and is projected to grow at a CAGR of 9.1% from 2025 to 2030. Extensive use of SMS as a business communication tool for operational and marketing communications and decreasing costs of premium messaging services are major drivers of this market. Premium messaging has become popular across several business sectors due to continued shifts in Customer Relationship Management (CRM) strategies. As smartphone adoption continues to witness positive growth, the use of more advanced messaging formats that these devices can support has also increased sharply. Customers prefer premium messaging services as they are user-friendly, generate interest in the services offered by a business, and provide significant value to every stakeholder.

Premium messaging holds a substantial appeal among businesses, allowing them to connect directly with customers in a branded, seamless manner. Features including rich media messages (images and videos) and the ability to communicate with customers in real-time are considered critical in creating personalized experiences. According to a report by Mobile Text Alerts published in 2023, 64% of consumers believe that businesses should contact them more frequently through SMS. Furthermore, 75% of users want text messages that contain special offers, highlighting more opportunities for brands to adapt their messages to boost the visibility of their business. Another report by Sender in 2023 found that 98% of consumers stated that they interact with every received text message, with the click-through rate being close to 11.0%. This has made the use of messaging services a highly effective strategy for brands aiming to use targeted marketing campaigns, including push notifications, exclusive offers, and time-bound promotions delivered directly to mobile devices.

Premium messaging services, particularly SMS, provide an immediate and reliable channel to deliver time-sensitive messages, such as order confirmations, transaction alerts, delivery tracking, and marketing offers. Fraud alerts and real-time transaction monitoring are critical to maintaining customer trust, particularly in sectors such as BFSI and e-commerce. A2P messaging allows businesses to send immediate alerts about suspicious activities, unauthorized transactions, or potential fraud, keeping customers informed and minimizing potential losses. The continued rise in the adoption of digital transaction tools has further helped shape positive developments in the market, as premium messaging services are integral for sending secure notifications regarding payment success/failure, transaction amounts, and alerts for digital wallet activity. A prominent application of premium messaging in this segment is Two-Factor Authentication (2FA). Businesses often send one-time passwords via SMS or MMS to verify the identity of users during login or when performing sensitive actions, such as initiating a bank transfer, updating account information, or making a purchase. This ensures extra security and privacy for the involved parties and prevents unauthorized access.

The need to provide a comprehensive and well-rounded brand experience for customers has highlighted the importance of integrating premium messaging with other marketing channels. Premium messaging is considered a vital part of the omnichannel marketing strategy, where retailers ensure consistent messaging across different platforms, such as email, social media, mobile apps, and physical stores. For example, customers can receive a promotional SMS and then have a personalized follow-up through an email or app notification. Another factor encouraging the expansion of the premium messaging industry is the increasing globalization of businesses and the use of cross-border campaigns to engage audiences in different countries or regions. SMS and MMS are universal tools that work across geographies, making them ideal for reaching international customers with localized, relevant content. Premium messaging services also support multilingual communication, which is crucial for retailers operating in multiple countries or regions. Personalized messaging in the local language of customers increases the relevance of the message and improves engagement rates.

Product Insights

The A2P SMS segment accounted for the largest revenue share of 49.8% in the global premium messaging industry in 2024 and is further expected to maintain its leading position during the forecast period. Application-to-Person (A2P) SMS services are widely used for various business communication purposes, including customer engagement, notifications, authentication, marketing, and transactional messaging. The increasing penetration of smartphones globally is a primary driver for the use of A2P SMS services. Mobile messaging is highly effective as it reaches consumers directly on their phones, making it an ideal communication channel for businesses. Businesses are increasingly using A2P SMS to engage customers with personalized promotions, product updates, loyalty rewards, and event invitations. Additionally, A2P SMS is a widely adopted mechanism for two-factor authentication (2FA), as it provides an additional layer of security for users to verify their identity during login or financial transactions.

The A2P MMS segment is expected to advance at a substantial CAGR in the global market from 2025 to 2030. Application-to-Person (A2P) MMS is a form of messaging that allows businesses to send multimedia content such as images, videos, audio files, and rich content to consumers. Consumers increasingly expect rich media, such as images, videos, and infographics, as part of their communication experience. With A2P MMS, companies can send product demos, promotions, or brand messages in a more engaging format, leading to higher interaction rates. Communication service providers are increasingly turning towards this form of messaging to boost their offerings. For instance, in June 2024, the communication platform Infobip began offering A2P RCS Messaging services in the North American region, aiming to enable brands to provide more interactive experiences to their customers.

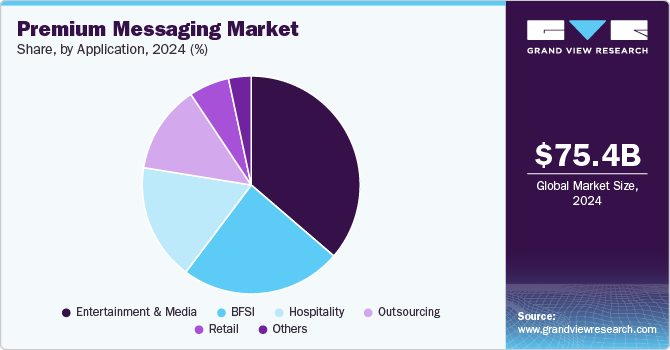

Application Insights

The BFSI segment accounted for the largest revenue share in the global premium messaging industry in 2024. Increasing competition among financial institutions to offer value-added services to their clients and boost their revenue has made premium messaging services a critical part of their growth strategy. Services such as A2P SMS, MMS, and other forms of messaging have become essential tools for companies to engage with customers, ensure their privacy, and facilitate transactions. The security of customer data is a major priority in this sector due to the sensitive nature of financial data. Premium messaging services are extensively used for Two-Factor Authentication (2FA) to ensure secure customer logins, transactions, and account management. SMS-based One-Time Passwords (OTPs) sent via A2P SMS are another trusted security measure, offering an extra layer of protection from unauthorized access. Market players are constantly improving their services to ensure more value for businesses, aiding segment growth.

The retail segment is expected to advance at a substantial CAGR in the global market from 2025 to 2030. The steadily increasing presence of various retail brands globally and the need to offer innovative services to customers to ensure competitiveness have led to the widespread use of communication tools such as premium messaging. Retailers are using premium messaging services to send personalized promotions, discounts, or product recommendations based on the shopping history and preferences of customers. This level of personalization increases the chances of conversion, as customers are more likely to respond to offers customized as per their interests. The service is also widely used in loyalty programs to inform customers about earned points, upcoming rewards, exclusive offers, or anniversary discounts. A survey conducted by Marigold in collaboration with Econsultancy in November 2023 found that around 55% of adults globally considered points and reward systems as the most effective tool to compel them to remain engaged with a brand. Delivering such messages via SMS or MMS thus provides retailers with a better chance to engage customers in a direct, effective, and highly visible manner.

Regional Insights

The North America premium messaging market accounted for a leading global revenue share of 35.2% in 2024, aided by the high rate of smartphone penetration in regional economies such as the U.S. and Canada and the presence of several notable service providers. Furthermore, increasing concerns regarding data security and privacy breaches among citizens have led to a rising demand for messaging platforms that prioritize privacy. Businesses in North America are increasingly relying on premium messaging services for customer engagement, using platforms that allow seamless and multi-channel communication options. This shift is being driven by the need for faster response times, personalized services, and more convenient interactions, aiding market growth. Market players are also leveraging AI-enabled tools to elevate business interactions with customers and enhance the overall communication experience, boosting efficiencies in areas such as customer support, personalization, and automation.

U.S. Premium Messaging Market Trends

The U.S. accounted for a dominant revenue share in the North American market for premium messaging in 2024, aided primarily by the growing demand for features such as end-to-end encryption and secure communication channels in messaging services by consumers. The growing presence of both large- and small-sized businesses across various industries has increased market competition, encouraging brands to leverage messaging platforms that allow them to customize their communication using branded messaging and personalized content. This helps enhance the customer experience, making interactions feel more authentic and enabling businesses to build an audience. Moreover, American consumers are increasingly using messaging apps that support rich media content, including videos, images, voice messages, and even interactive elements such as surveys and polls. Premium messaging services extensively offer these features and help enhance the user experience, which has driven their popularity in the country.

Europe Premium Messaging Market Trends

Europe accounted for a substantial revenue share in the global premium messaging industry in 2024, owing to the stringent data privacy and security regulations in the region and the extensive demand for secure communications among businesses in major economies. Many European organizations are adopting over-the-top (OTT) messaging services to engage with customers, facilitate customer service, and create direct communication channels. Premium versions of these platforms that offer analytics, improved integration with CRM systems, and automated customer service features are driving their adoption across businesses. Among European consumers, subscription models are growing in popularity on messaging platforms. These subscriptions offer features such as advanced security, ad-free experiences, larger file-sharing capabilities, and VIP customer support, which have gained substantial traction in recent years.

Asia Pacific Premium Messaging Market Trends

The Asia Pacific market is expected to expand at a significant CAGR from 2025 to 2030. The fast pace of smartphone adoption in regional economies such as India, China, and South Korea, coupled with the establishment of businesses in sectors such as hospitality, retail, and marketing, has created a notable market for premium messaging services. Additionally, the continued expansion of the middle-class population in economies such as India, Vietnam, and Indonesia is contributing to the increasing adoption of premium messaging services. As disposable incomes rise, consumers are more willing to pay for enhanced features, better security, and richer experiences in their mobile services, which are offered by premium messaging platforms. The expansion of the e-commerce industry presents another notable avenue for industry expansion, owing to the extensive use of AI chatbots. These tools allow businesses to offer 24/7 support and handle a high volume of customer interactions simultaneously, which is a key demand driver for premium messaging solutions.

China accounted for the largest revenue share in the Asia Pacific market for premium messaging services in 2024. The presence of communication ecosystems such as WeChat aids market growth, as premium messaging services within this platform, which offer enhanced features such as larger file sharing, better storage capacity, and business tools, are in high demand. Users are increasingly willing to pay for such features to access a more seamless and enriched experience in messaging, payments, and entertainment. Moreover, the integration of mobile payment systems into messaging services creates a substantial demand for premium offerings that can ensure enhanced security, faster transactions, and additional functionalities, such as business payment solutions. The country also has a promising influencer culture, with premium messaging services being widely leveraged to facilitate exclusive communication between celebrities and their fans. These services allow influencers to create exclusive content and facilitate direct and personalized interactions with their followers.

Key Premium Messaging Company Insights

Some major companies involved in the global premium messaging industry include Deutsche Telecom, Vonage, and Vodafone, among others.

-

Deutsche Telekom is a Germany-based multinational BFSI company that offers a range of products and services for general consumers and business customers. These include fixed-network/broadband, mobile communications, Internet, and IPTV products for consumers, along with information and communication technology (ICT) solutions for business and corporate clients. The company has established its operations in more than 50 economies globally and has over 250 million mobile customers, 22 million broadband connections, and 25 million fixed-network lines. In recent years, Deutsche Telekom has collaborated with companies such as Google and Infobip to offer RCS Business Messaging services for its customers.

-

Vonage, a subsidiary of Ericsson, is an American cloud communications provider that offers unified communications, contact centers, communications APIs, network APIs, and conversational commerce solutions. Under the communications APIs segment, the company's offerings include SMS, MMS, RCS, WhatsApp, and Facebook Messenger. Vonage Messages API allows businesses to improve their services by contacting customers on messaging and social platforms of their choice. The service also enables businesses to deliver timely notifications to customers to increase engagement rates and ensure cost reductions by minimizing delivery attempts, missed appointments, and support fees.

Key Premium Messaging Companies:

The following are the leading companies in the premium messaging market. These companies collectively hold the largest market share and dictate industry trends.

- Deutsche Telekom AG

- Orange Business

- NTT DOCOMO

- China Telecinom Corporation Limited

- Twilio Inc.

- AT&T Intellectual Property

- Vodafone Limited

- Sinch

- SoftBank Corp.

- China Unicom (Hong Kong) Limited

- Vonage America, LLC

- KDDI CORPORATION

Recent Developments

-

In February 2025, Vonage announced a partnership with the German social commerce network mydealz, allowing the latter to utilize Rich Communication Services and thus provide its users with an advanced messaging experience. Through this partnership, mydealz would aim to ensure more personalized, engaging, and interactive communications for its customers. The functionality would allow mydealz to send notifications regarding popular deals in real-time, create personalized offers as per user preferences, and offer an interactive shopping experience via rich media such as images and clickable buttons.

-

In September 2024, Twilio announced the availability of Rich Communication Services messaging for its customers globally through its Programmable Messaging and Verify APIs. The development would empower businesses to send verified and branded messages to strengthen customer loyalty and trust. Twilio RCS's branded messaging feature upgrades SMS messages to RCS automatically at no additional charges on compatible devices for messages with a maximum length of 160 characters. It includes features such as a business logo, tagline, business name incorporation, and Google's trusted sender verification and read receipts. The Twilio Console allows companies to configure their brand and sender verification without requiring any code changes, ensuring the quick sending of trusted communications.

Premium Messaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 82.27 billion

Revenue forecast in 2030

USD 126.90 billion

Growth rate

CAGR of 9.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

Deutsche Telekom AG; Orange Business; NTT DOCOMO; China Telecom Corporation Limited; Twilio Inc.; AT&T Intellectual Property; Vodafone Limited; Sinch; SoftBank Corp.; China Unicom (Hong Kong) Limited; Vonage America, LLC; KDDI CORPORATION

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Premium Messaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global premium messaging market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

A2P SMS

-

A2P MMS

-

P2A SMS

-

P2A MMS

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Entertainment & Media

-

Hospitality

-

Outsourcing

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.