- Home

- »

- Alcohol & Tobacco

- »

-

Premium Spirits Market Size & Share, Industry Report, 2033GVR Report cover

![Premium Spirits Market Size, Share & Trends Report]()

Premium Spirits Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Vodka, Whiskey, Gin, Rum, Tequila, Brandy), By Distribution Channel (On-Trade, Off-Trade), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-967-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Premium Spirits Market Summary

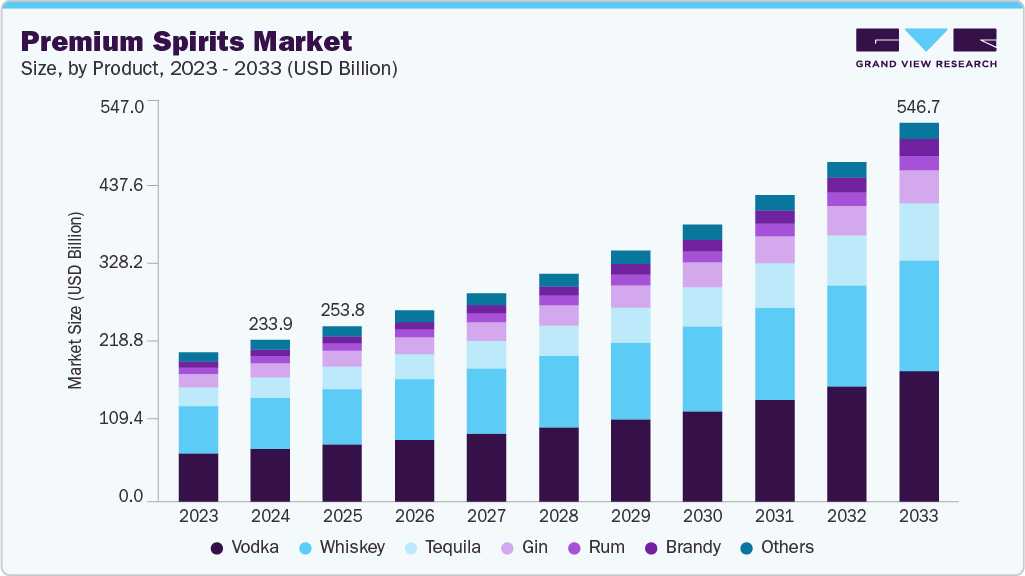

The global premium spirits market size was estimated at USD 233.96 billion in 2024 and is projected to reach USD 546.67 billion in 2033, growing at a CAGR of 10.1% from 2025 to 2033. The growing popularity of high-end drinks among the millennial population has been fueling market growth across the world.

Key Market Trends & Insights

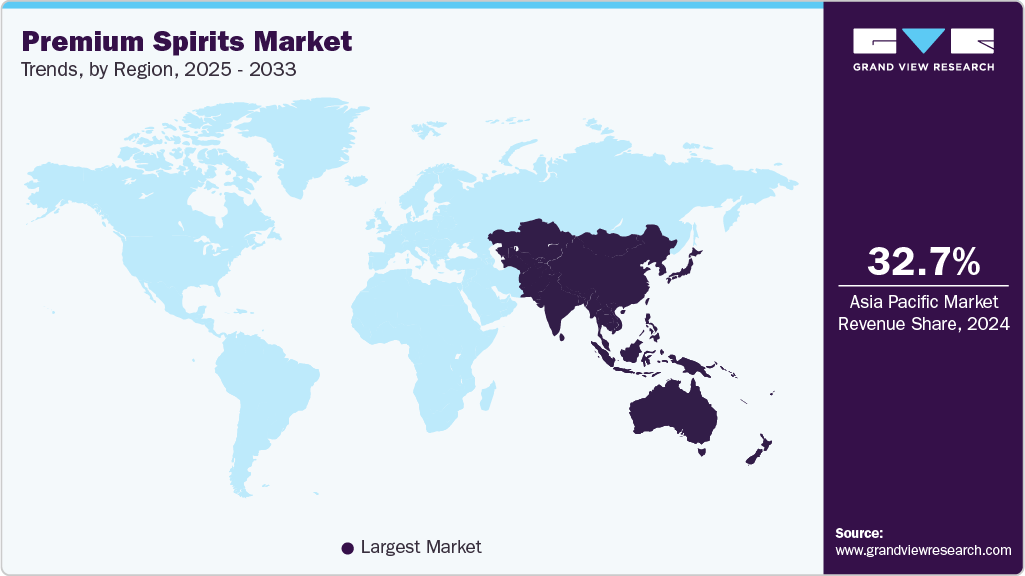

- Asia Pacific dominated the global premium spirits industry in 2024 with a revenue share of 32.7% and is growing at the fastest CAGR over the forecast period.

- Based on product, the vodka segment dominated the market with a share of 32.5% in 2024.

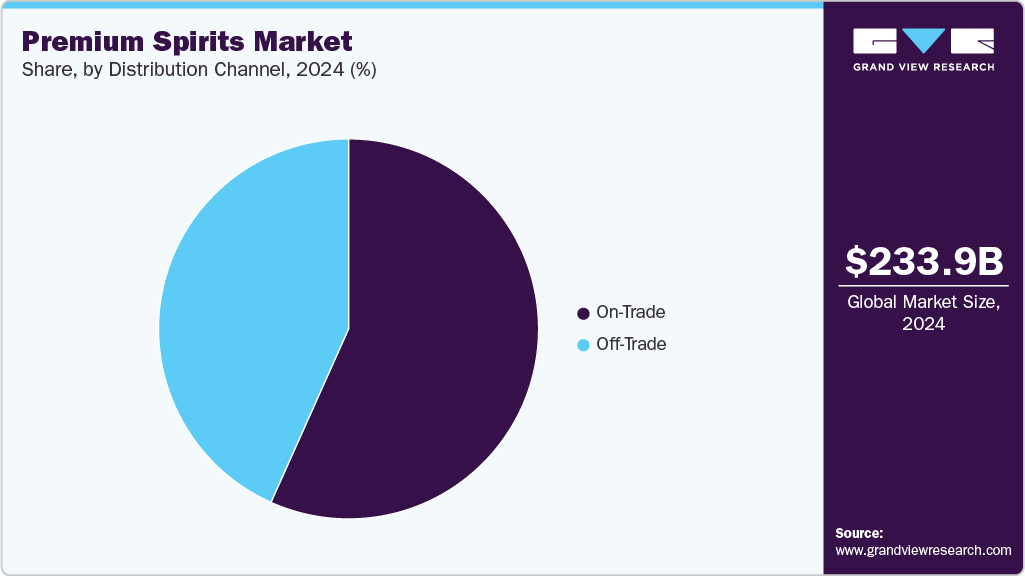

- By distribution channel, the on-trade segment dominated the market with a revenue share of 56.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 233.96 Billion

- 2033 Projected Market Size: USD 546.67 Billion

- CAGR (2025-2033): 10.1%

- Asia Pacific: Largest market in 2024

Cocktails such as margaritas, martinis, and Manhattans have gained remarkable traction in the developed economies of North America and Europe. Furthermore, the growing popularity of the cocktail culture in developing countries, such as China and India, is expected to expand the scope of premium spirits. Over the past few years, the growth of the high-end alcohol segment has been outpacing the growth of the overall segment, and hence, pushing the overall consumption of alcohol all over the world.Another important factor driving the market for premium spirits is the focus on authenticity and provenance. Consumers are increasingly interested in the story behind the products they consume, including where and how the spirits are made. This has led to a growing preference for premium spirits that are produced using traditional methods, high-quality ingredients, and a strong emphasis on craftsmanship and heritage.

In recent years, millennials made up a sizable portion of alcohol consumers, and this trend is projected to continue over the forecast period. The generation has a sizable amount of purchasing power and is over the legal drinking age (LDA). In addition, premium spirits are made from natural ingredients and are of better quality than regular liquor. These factors are expected to drive the market forward over the forecast period.

The premium spirits industry is primarily driven by an increase in disposable income. Customers with high disposable income have access to the best quality spirits. Customers are paying more for high-quality, premium products because they are becoming more conscious of their drinking habits. In addition, the increasing trend of visiting pubs and bars among the youth is expected to drive the market forward.

However, rising government regulations on alcohol, rising health consciousness among consumers, and increasing shifts in consumer preferences toward low or no-alcohol drinks over traditional alcoholic ones are the main factors acting as restraints and are expected to hinder the market growth.

Consumer Insights for the Premium Spirits Market

Consumer trends and preferences in the alcohol industry have been changing gradually over the years. The millennials have been shifting toward premium spirits owing to rising purchasing power. Tequila has been one of the fastest‐growing categories for several years, and the sales of tequila brands such as Patrón, Don Julio, Casamigos Tequila, and Epsolòn Tequila have grown significantly in the last few years.

The ready-to-drink (RTD) spirits category continued to gain popularity, representing 13% of the total RTD market volume in 2022. The top five spirits categories by revenue were Vodka, Tequila/Mezcal, American Whiskey, Brandy and Cognac, and Cordials, with Tequila/Mezcal and American Whiskey showing the most significant growth.

Sales of Irish whiskey in the U.S. increased considerably in 2022, with more than 6.1 million 9-litre cases sold, generating USD 1.4 billion for distillers. This rise significantly contributed to the record-breaking growth of the U.S. spirits industry. The category also benefited from a boost in tourism numbers, attracting 677,000 visitors to whiskey tourism sites in Spain.

The demand for brown spirits, especially bourbon and American whiskey, has been rising increasingly over the years. Global players such as Diageo plc, Pernod Ricard, The Brown–Forman Corporation, and Constellation Brands are investing in expanding their product lines in the brown spirits category.

Another consumer trend that is driving the growth of the market is the rise in demand for natural and organic beverages. Spirits that are made organically and involve less fermentation are in high demand. Several small producers do not use chemicals in their drinks, and these locally produced alcoholic beverages are being highly preferred by consumers. Health and wellness are becoming increasingly important to alcohol consumers, and as a result, consumers across the region are opting for alcoholic beverages made with natural flavors. Manufacturers have been focusing on ingredient quality and transparency, considering the growing trend.

Product Insights

Vodka held the largest share, accounting for 32.5% of the global revenues in 2024. As consumers become more discerning, they are increasingly opting for premium and ultra-premium vodkas that offer superior taste, unique production methods, and distinct branding. This trend is particularly evident among younger demographics, such as Millennials and Gen Z, who value authenticity, craftsmanship, and the overall drinking experience. The rise of craft distilleries and the introduction of innovative flavor profiles have further fueled the demand for premium vodka. In addition, the trend toward health-conscious consumption has led to a preference for vodkas with natural ingredients and no additives. Premium vodka brands are also capitalizing on this trend by emphasizing their heritage, production transparency, and commitment to quality, which resonate with consumers seeking a more refined and luxurious drinking experience.

Tequila is anticipated to grow at a CAGR of 12.4% from 2025 to 2033. Tequila has seen a significant rise in popularity in recent years, now ranking as one of the fastest-growing spirits categories, according to the Distilled Spirits Council of the U.S. in February 2020, Tequila exports marked a 34.1% increase over February 2021, driven by the trend of premiumization and consumers' growing preference for higher-quality tequilas that emphasize a rich history, cultural heritage, and artisanal craftsmanship. In November 2023, critically acclaimed tequila brand Espanita Tequila introduced a new addition to its "Barrel Reserve" collection, the Espanita Double Barrel Añejo Tequila. This tequila is aged in toasted American White Oak barrels for 12 months and then finished in Kentucky bourbon casks for an additional eight to ten months. The result is a complex and smooth tequila with flavors of honey oak, roasted agave, vanilla butterscotch, roasted nuts, caramel sauce, coconut butter, and more.

Distribution Channel Insights

The sale of premium spirits through the on-trade channel accounted for a share of over 56.7% of the global revenues in 2024. The rise of experiential dining and drinking plays a significant role in the on-trade distribution of premium spirits. Consumers increasingly value experiences over products, seeking venues that provide excellent drinks and a memorable atmosphere. Bars and restaurants that offer unique premium spirits-tasting experiences, themed nights, or interactive cocktail-making sessions attract patrons looking for immersive and engaging outings. Premium spirits brands and distributors collaborate with these establishments to create special events, promotions, and limited-edition releases, enhancing the overall customer experience and driving sales in the on-trade sector.

The sales of premium spirits through the off-trade channel are anticipated to grow at a CAGR of 10.8% from 2025 to 2033. The segment includes all retail outlets such as hypermarkets, supermarkets, convenience stores, mini markets, and wine & spirit shops. Consumers prefer these outlets as they provide various discounts and offers on the product. Moreover, retail outlets such as liquor stores, supermarkets, and convenience stores provide consumers with easy access to various premium spirits brands and types in one location. Consumers appreciate the convenience of purchasing premium spirits while shopping for other groceries or household items. Online retail platforms have further enhanced accessibility, allowing consumers to order premium spirits from the comfort of their homes, leading to increased off-trade sales.

Regional Insights

The North America premium spirits industry is expected to grow at a CAGR of 9.1% from 2025 to 2033. The popularity of brands such as Kendall-Jackson, Jack Daniels, and Absolut has resulted in an increased demand for spirits, including cognac, vodka, and whiskey, in the region. Premium brands witness a greater demand due to the perception of alcohol as a status symbol, the association of ‘premium’ labels with better taste and quality, and the rise in per capita income of consumers. In September 2023, Johnnie Walker, known for being the top-selling Scotch whiskies globally, introduced a novel and innovative blend called "Johnnie Walker Blue Label Elusive Umami." This blend is a result of a unique collaboration between Emma Walker, the esteemed Master Blender, and Kei Kobayashi, a globally acclaimed chef. Together, they leveraged their extensive expertise to craft this distinctive blended Scotch whiskey, drawing inspiration from umami, often regarded as the elusive fifth taste.

U.S. Premium Spirits Market Trends

The premium spirits industry in the U.S. held a market share of 68.6% of the North American region in 2024. Consumers in the U.S. are increasingly interested in premium and super-premium alcoholic beverages, opting for quality over quantity. There is a growing interest in craft and artisanal varieties, as well as ethnic-flavored spirits. This has been part of a broader trend toward more diverse and creative offerings in the spirits market. Moreover, the craft spirits boom has introduced a range of new brands that focus on quality and unique packaging design.

Europe Premium Spirits Market Trends

Europe premium spirits industry held a share of 25.6% of the global market in 2024. The rapid rise in demand for premium quality spirits as a result of altering cultural views among the region's young and affluent population is a primary driver of the spirits market's expansion in the region. In comparison to their normal spirit selections, an increasing number of European consumers are looking for new, more exciting offerings, which is driving revenue generation in the spirits sector. This shift to premiumization has spurred a growing interest in exploring the craftsmanship behind spirits, such as wood-aged brandies and whiskies with unique finishes. Consumers are trading up to hand-crafted, vintage products that reflect the distiller's art. This preference for high-quality spirits encourages moderate and responsible drinking, a trend supported by industry bodies. Additionally, premium spirits are often featured in airport stores, showcasing Europe's finest artisan spirits to a global audience and inspiring ongoing innovation among producers.

The premium spirits industry in the UK is expected to grow at a CAGR of 9.9% from 2025 to 2033. The rising demand for premium spirits in the UK is reshaping the alcoholic beverage market, driven by a growing preference for high-quality, savor-worthy drinks. September 2021 data by the Wine and Spirit Trade Association revealed that UK consumers purchased over 1.5 million bottles of tequila alone in the year. This trend was supported by the increasing presence of premium tequila brands such as El Tequileo and the expansion of specialty bars dedicated to agave spirits. The versatility of tequila has shifted perceptions from a mere shot drink or margarita base to a sophisticated choice featured in cocktails like Old Fashioneds and Espresso Martinis. This shift reflects a broader movement towards premium alcoholic beverages as consumers seek to indulge in higher-quality, enjoyable experiences.

Asia Pacific Premium Spirits Market Trends

The Asia Pacific premium spirits industry is expected to grow at a CAGR of 11.2% from 2025 to 2033. According to the Scotch Whisky Association, Asia-Pacific surpassed the European Union as the largest buyer in the £6 billion (USD 7.5 billion) Scotch whisky export market in 2023. Six of the ten major destinations for Scotch exports in the first half of 2023 were in Asia. Pernod Ricard’s Chivas brand saw substantial success, with its Royal Salute whisky achieving a 32% revenue increase, primarily driven by rising consumption in Asia.

The emphasis on cultural relevance and targeted marketing has been instrumental in this growth. Pernod Ricard’s USD 150 million investment in The Chuan Malt Whisky Distillery in China illustrates the luxury experiences offered by the brand. By understanding local market nuances, such as festivals and rituals, these companies have effectively integrated their products into culturally significant events. This strategic method, combined with a growing interest in premium and diverse whisky options, is establishing Asia as a vital market for the future expansion of the premium spirits industry.

The China premium spirits industry is growing at a CAGR of 11.6% from 2025 to 2033, driven by evolving consumer preferences and strategic efforts by major brands. Baijiu, the traditional Chinese liquor, continues to hold cultural significance and dominates the market with luxury brands like Kweichow Moutai and Wuliangye. However, there is a growing desire among younger Chinese consumers for lighter, more modern spirits that fit their everyday consumption habits. This shift has led to increased demand for brandy and whisky, which are favored for their European heritage and sophisticated appeal.

Central & South America Premium Spirits Market Trends

The premium spirits industry in Central & South America is expected to grow at a CAGR of 10.4% from 2025 to 2033. A rich heritage and strong brand presence drive the high demand. In this region, iconic Scotch brands like Johnnie Walker, Old Parr, and Buchanan’s dominate the market, demonstrating a longstanding preference for high-quality whiskies. The local market is also influenced by culturally significant spirits such as Ypioca cachaça in Brazil and Cacique rum in Venezuela, showcasing the importance of traditional beverages alongside international favorites. The trend towards premiumization is evident as consumers seek unique and luxurious experiences, leading to a diversification of offerings. Brands like Smirnoff have innovated with local variants to cater to the evolving tastes and preferences of the Latin American market.

Brazil’s premium spirits industry’s appetite has been growing significantly, with Scotch whisky emerging as a favorite among consumers. According to HMRC (Her Majesty's Revenue and Customs) figures, the country imported the equivalent of 93 million bottles of Scotch in 2022, a 14% increase from 2021, elevating Brazil to fourth place among the category's export markets, just behind India, France, and the U.S. Diageo, the market leader with brands like Johnnie Walker, Buchanan's, and Old Parr, has played a pivotal role in this growth. Johnnie Walker, in particular, has seen impressive traction, with 52% of its growth attributed to new whisky drinkers in 2023. Meanwhile, Old Parr has experienced a 66% growth from new consumers, underscoring the brand's appeal in the Brazilian market.

Middle East & Africa Premium Spirits Market Trends

The Middle East and Africa premium spirits industry is expected to grow at a CAGR of 7.8% from 2025 to 2033. The Middle East & Africa market is anticipated to experience steady growth in the forecasted period. However, the demand for handmade spirits in this region is constrained due to the total prohibition of alcohol in specific areas, such as Saudi Arabia, Iran, Kuwait, Yemen, and the Emirate of Sharjah. The restrictions on alcohol consumption in these regions limit the market potential for handmade spirits in the Middle East.

The premium spirits industry in South Africa is witnessing an increasing number of craft spirit brands, and therefore, the market competition has also increased. Due to this, craft spirits companies have started focusing on innovative offerings and advertising. For example, Hope Distillery, located in the heart of urban Cape Town, has emerged as a key player in the artisanal spirits space. The distillery began by manufacturing its boutique gin and has since expanded its portfolio to include a wide range of spirits. It has also received recognition for distilling on behalf of several craft companies. The Hope Rhum Agricole, a creative take on traditional rum, is the most recent addition to its portfolio.

Key Premium Spirits Company Insights

Key companies operating in the premium spirits industry primarily focus on innovation, flavor diversity, and health-centric offerings. They are investing in product development, strategic partnerships, and sustainable packaging to cater to evolving consumer preferences, expand their footprint, and strengthen competitiveness across regions.

Key Premium Spirits Companies:

The following are the leading companies in the premium spirits market. These companies collectively hold the largest market share and dictate industry trends.

- Asahi Group Holdings, Ltd.

- Diageo plc

- Pernod Ricard

- Constellation Brands, Inc.

- Rémy Cointreau

- Bacardi Limited

- Suntory Holdings Limited

- Davide Campari-Milano N.V.

- SAZERAC CO, INC

- Highwood Distillers

- Heaven Hill Distilleries, Inc

- LVMH

Recent Developments

-

In July 2024, Suntory Holdings announced the establishment of Suntory India Private Limited, which is designed to support corporate functions essential for building a strong business foundation. This initiative aims to accelerate growth in its current spirits sector and create opportunities within the soft drinks and health and wellness markets in India.

-

In June 2024, Pernod Ricard strengthened its dedication to its American Whiskey portfolio by launching a new Global Brand Company in the U.S. named North American Distillers (NADL).

-

In May 2024, Asahi Beverages announced its acquisition of Never Never Distilling Co., a leading super-premium gin distillery in Australia known for its exceptional craftsmanship and multiple awards. Since its founding, Never Never has experienced remarkable growth and recognition in the spirits market. With Asahi's extensive experience in consumer branding and strong connections with customers, the partnership is set to enhance Never Never's development in line with the brand's ambitious goals for the future.

-

In April 2024, Islay distillery, owned by LVMH, unveiled a new whisky named Ardbeg Spectacular. The release marks the first time that an Ardbeg whisky has been aged in Port casks. The notes consist of candied fruit, smoked pecans, and incense candles.

-

In January 2024, Asahi Europe & International (AEI), the international arm of Asahi Group Holdings, officially acquired Octopi Brewing, a well-known contract beverage production and co-packing facility located in Wisconsin, U.S.

Premium Spirits Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 253.77 billion

Revenue Forecast in 2033

USD 546.67 billion

Revenue Growth rate

CAGR of 10.1% from 2025 to 2033

Market size volume in 2025

8,109.8 million liters

Volume Forecast in 2033

13,726.7 million liters

Volume Growth Rate

CAGR of 6.3% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in million liters, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Asahi Group Holdings, Ltd.; Diageo plc; Pernod Ricard; Constellation Brands, Inc.; Rémy Cointreau; Bacardi Limited; Suntory Holdings Limited; Davide Campari-Milano N.V.; SAZERAC CO, INC; Highwood Distillers; Heaven Hill Distilleries, Inc.;LVMH

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Premium Spirits Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global premium spirits market report based on product, distribution channel, and region:

-

Product Outlook (Volume: Million Liters; Revenue, USD Million, 2021 - 2033)

-

Vodka

-

Whiskey

-

Gin

-

Tequila

-

Rum

-

Brandy

-

Others

-

-

Distribution Channel Outlook (Volume: Million Liters; Revenue, USD Million, 2021 - 2033)

-

On-Trade

-

Off-Trade

-

Supermarkets & Hypermarkets

-

Liquor Stores

-

Others

-

-

-

Regional Outlook (Volume: Million Liters; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global premium spirit market size was estimated at USD 233.96 billion in 2024 and is expected to reach USD 253.77 billion in 2025.

b. The global premium spirit market is expected to grow at a compound annual growth rate of 10.1% from 2025 to 2033 and is expected to reach a value of USD 546.67 billion.

b. Asia Pacific dominated the premium spirit market with a share of 32.7% in 2024. This is attributable to the rising demand for low-alcohol content and authentic drinks coupled with the growing bar culture in the region's developing nations.

b. Key factors that are driving the market growth include the growing popularity of high-end drinks among the millennial population, rising cocktail culture in emerging economies, and the launch of innovative products.

b. Some key players operating in the premium spirit market include DAsahi Group Holdings, Ltd., Diageo plc, Pernod Ricard, Constellation Brands, Inc., Rémy Cointreau, Bacardi Limited, Suntory Holdings Limited, Davide Campari-Milano N.V., SAZERAC CO, INC, Highwood Distillers, Heaven Hill Distilleries, Inc, and LVMH.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.