- Home

- »

- Medical Devices

- »

-

Prescription Lens Market Size, Share & Growth Report, 2030GVR Report cover

![Prescription Lens Market Size, Share & Trends Report]()

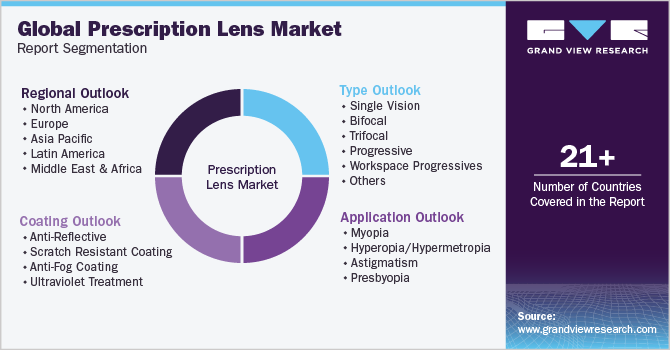

Prescription Lens Market Size, Share & Trends Analysis Report By Type (Single Vision, Progressive), By Application (Myopia, Presbyopia), By Coating, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-763-6

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Prescription Lens Market Size & Trends

The global prescription lens market size was estimated at USD 46.1 billion in 2023 and is projected to grow at a CAGR of 5.36% from 2024 to 2030. The prevalence of vision impairment caused by refractive errors is increasing. Many of these cases go undetected in their initial phases, contributing to the growing count of uncorrected refractive errors (URE). Individuals affected by refractive errors often lack awareness of their condition and are not undergoing treatment. Hence, to control the increase in URE, various organizations are being developed to focus on detecting and treating refractive errors.

Sightsavers, an organization that works in more than 30 countries, focuses mainly on African and Asian regions. The organization forms alliances with local, regional, national & international partners and governments to provide advanced and affordable ophthalmic treatment. The organization has come up with a refractive error strategy to address the problem of URE. The organization is providing refractive error services in line with its twin-track approach. Also, the organization is expanding its program partnerships and is forming collaborations to enhance the services for URE. For instance, in May 2023, Sightsavers India collaborated with Standard Chartered Global Business Services to inaugurate two new mobile vision centers in Chennai, southern India. The presence of such organizations and growing awareness regarding the treatment of refractive errors is expected to drive the market growth.

The market is witnessing steady growth driven by the increasing prevalence of vision disorders worldwide, rising awareness about eye health, and expanding access to healthcare services. For instance, according to WHO, in August 2023, approximately 2.2 billion individuals suffer from either near or distance vision issues, with about 1 billion of them facing preventable or unaddressed vision impairment. Refractive errors and cataracts stand as the primary culprits behind global cases of vision impairment and blindness. In addition, evolving fashion trends and the growing preference for customizable eyewear contribute to market expansion.

Top 10 Countries With The Highest Number of Persons With Vision Loss

Country

Total with vision loss

Blindness

Moderate to severe vision loss

Mild vision loss

Near vision loss

Population

India

275.0M

9.2M

79.0M

49.1M

137.7M

1,422M

China

274.3M

8.9M

51.9M

57.7M

155.7M

1,426M

Indonesia

34.9M

3.7M

10.8M

11.5M

8.9M

265M

Russia

28.6M

0.6M

8.0M

3.7M

18.5M

146M

Brazil

26.6M

1.8M

10.0M

8.3M

8.6M

217M

Bangladesh

26.3M

0.9M

7.5M

4.2M

14.0M

161M

Pakistan

26.3M

1.8M

8.5M

6.0M

10.1M

226M

Nigeria

24.3M

1.3M

5.3M

7.8M

9.9M

226M

USA

16.4M

0.6M

6.7M

4.6M

4.4M

331M

Mexico

16.0M

0.5M

4.7M

4.4M

6.4M

132M

As anticipated, these nations also possess the most significant populations. China and India collectively contribute to 49% of the global prevalence of blindness and vision impairment despite comprising only 37% of the world population.

Key players in the market continuously innovate to introduce cutting-edge lens designs, coatings, and materials to enhance user experience and satisfaction. According to Optica, in February 2024, scientists created a spiral-shaped lens that can maintain clear focus across various distances, even when light conditions change. This groundbreaking lens operates gradually like a lens used for vision correction but without the typical distortions. Moreover, the advent of online platforms for purchasing prescription eyewear has further revolutionized the market landscape, offering convenience and accessibility to consumers.

Market Concentration & Characteristics

The market exhibits moderate industry concentration, with several key players dominating the sector. Characteristics include continual technological advancements in lens materials and designs, catering to diverse vision needs such as myopia, hyperopia, astigmatism, and presbyopia. Increasing demand is propelled by the rising global prevalence of vision disorders and growing awareness of eye health. Online platforms for purchasing prescription eyewear contribute to market accessibility. Key trends include customization options, fashion integration, and the expansion of specialized lenses for specific activities like sports or digital device usage.

The prescription lens industry is characterized by a high degree of innovation, with companies consistently developing products that enhance efficiency and safety. For instance, according to ZDNET in January 2023, Lumus's latest 2D Z Lens technology promises to facilitate the creation of compact, lightweight AR glasses boasting superior image quality, outdoor-friendly brightness, and effortless integration with prescription lenses.

Regulations significantly impact the prescription lens industry, ensuring product safety, quality, and efficacy. Compliance with regulatory standards, such as those set by the FDA in the U.S. or the CE mark in Europe, is crucial for market access. Regulatory requirements influence manufacturing processes, material selection, and labeling practices. They also govern marketing claims and customer disclosures regarding lens performance and health implications. Strict adherence to regulations fosters consumer confidence, promotes market transparency, and mitigates risks associated with substandard products.

Mergers and acquisitions in the prescription lens industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, according to VOX MEDIA, in December 2022, Meta increased its investment in the metaverse by acquiring Luxexcel, a Dutch company known for its expertise in 3D-printing prescription lenses for smart glasses.

Product substitutes in the prescription lens industry offer alternatives to traditional lenses, influencing consumer choices. Contact lenses, LASIK surgery, and advancements like orthokeratology lenses provide alternative vision correction methods. For instance, in September 2023, Acculens introduced NewVision SC, a corneoscleral OrthoK lens cleared by the FDA. These substitutes drive innovation and competition by offering diverse options to address vision needs.

Regional expansion in the prescription lens industry involves extending market presence and operations into new geographical areas. For instance, in February 2023, ZEISS solutions, which help manage progressive myopia, are expected to be accessible in Europe. By strategically expanding regionally, companies can tap into new customer segments, respond to changing market demands, and capitalize on growth opportunities in emerging markets, ultimately strengthening their global footprint and competitiveness in the industry.

Type Insights

The single vision segment held the largest market share of 27.1% in 2023, as it focuses on providing lenses with a single corrective power for a specific distance, such as near or far. These lenses are primarily used to address refractive errors like myopia, hyperopia, or astigmatism. Single-vision lenses offer clear vision at one fixed distance, making them suitable for tasks like reading, driving, or computer work. They are available in various materials and coatings to accommodate different preferences and needs. The single vision segment represents a significant portion of the market, catering to individuals with specific vision requirements.

The progressive segment is anticipated to witness the fastest CAGR over the forecast period, as it focuses on lenses that provide seamless correction for multiple vision distances, offering a gradual transition from near to far vision. These lenses are particularly popular among individuals with presbyopia, providing clear vision at all distances without the need for multiple pairs of glasses. According to MJH Life Sciences, in April 2021, Presbyopia, affecting 128 million Americans, is increasingly common. As millennials age, with 73 million turning 40, and Generation X, numbering 61 million aged 41 to 56, the pool of potential presbyopes expands significantly.

Application Insights

The myopia segment accounted for the largest market share of 30.7% in 2023, as it targets individuals with nearsightedness, a condition affecting a substantial portion of the population. According to Eyes On Eyecare, in April 2023, Myopia stands as the prevalent eye condition, impacting approximately 20% of the world's population. These lenses correct vision for distant objects, catering to the growing prevalence of myopia globally. They offer various options, including single vision and specialized lenses, to address diverse patient needs.

The presbyopia segment shows the fastest CAGR over the forecast period. This segment targets individuals experiencing age-related near vision decline. These lenses provide a clear vision for close-up tasks, such as reading or using digital devices, catering to the needs of aging populations. They offer various options, including progressive and bifocal lenses, to address presbyopic symptoms effectively.

Coating Insights

The anti-reflective segment accounted for the largest revenue share, 30.1%, in 2023. It offers lenses with a specialized coating to reduce glare and reflections, enhancing visual clarity and comfort for wearers. These coatings are popular among individuals seeking improved vision in various lighting conditions, driving demand for high-quality lenses with advanced coatings.

The ultraviolet treatment segment is anticipated to register the fastest CAGR over the forecast period. It provides lenses with specialized coatings to block harmful UV rays, protecting the eyes from potential damage. These coatings are sought after by individuals seeking comprehensive eye protection, driving demand for lenses with UV-blocking capabilities and enhancing overall eye health.

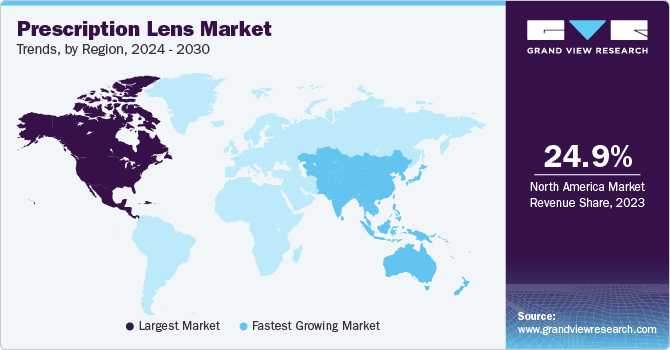

Regional Insights

The North America prescription lens market dominated the overall global market with a revenue share of 24.9% in 2023. Some key factors contributing to the growth include the presence of numerous key players, a well-established healthcare infrastructure, a growing number of awareness programs, a growing number of product launches, and the growing prevalence of refractive errors, such as myopia, hyperopia, astigmatism, and presbyopia. These factors are anticipated to increase the demand for prescription lenses.

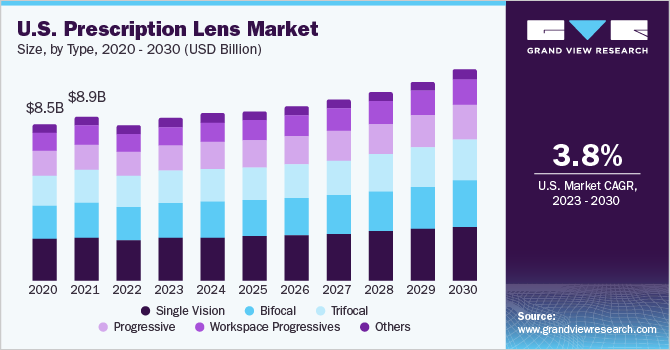

U.S. Prescription Lens Market Trends

The prescription lens market in the U.S. held a significant share in the North America region in 2023, driven by factors such as the growing prevalence of refractive errors, increasing percentage of people wearing glasses, and well-established healthcare infrastructure in the U.S. For instance, according to The Vision Council, in December 2021, the Vision Council members manufacture 90% of the prescription lenses used in the U.S. With 197.6 million adult vision correction users, they account for 75.6% of the population in the U.S.

Europe Prescription Lens Market Trends

The prescription lens market in Europe is witnessing growth fueled by technological advancements. The unveiling of Huawei Eyewear 2 smart glasses with prescription lenses anticipates their imminent launch in Europe, as reported by Notebookcheck in September 2023. These glasses introduce advanced features tailored to enhance user experience. This expansion reflects a growing demand for innovative eyewear solutions that integrate technology seamlessly into daily life, catering to the preferences of European consumers.

The UK prescription lens market is among the major markets in the region. Increasing demand for innovative and cost-effective lens solutions is observed in the UK. Scotland stands as the sole nation providing free universal NHS-funded eye exams. In addition, the NHS optical voucher scheme offers discounts on prescription lenses, contributing to accessibility and affordability for consumers across the UK.

The prescription lens market in France is expected to grow over the forecast period. According to The Local in January 2024, The French government's '100% Santé' initiative guarantees access to quality eye care at no cost when needed. Consequently, this could lead to growth in the market.

The Germany prescription lens market is projected to expand over the forecast period due to the growing prevalence of refractive errors. The National Center for Biotechnology Information (NCBI) in November 2022, reported a myopia rate of 41.3% among German adults aged 18-35; it is expected to drive significant growth in the market, leading to increased demand for vision correction solutions and fostering innovation in the industry.

Asia Pacific Prescription Lens Market Trends

The prescription lens market in the Asia Pacific region is expected to grow at the fastest CAGR during the forecast period. China and Japan are poised to lead the Asia Pacific market in the upcoming period. Moreover, the increasing prevalence of vision loss and the growing refractive errors are expected to drive market growth over the forecast period.

The prescription lens market in Japan is characterized by a strong emphasis on technological innovation and quality craftsmanship and is expected to grow at the fastest CAGR over the forecast period. With a culture that values precision and attention to detail, Japan's market continues to evolve to meet the demands of its perceptive clientele while embracing technological advancements in the industry.

The China prescription lens market trends indicate a significant prevalence of myopia among senior high school students, as reported by a July 2023 study by Springer Nature Limited. Approximately 80% exhibit myopia, with around 10% categorized as highly myopic, indicating a growing market for prescription lens in China.

The prescription lens market in India is marked by a growing demand for affordable yet high-quality vision correction solutions. Consumers increasingly seek stylish frames and lens options that reflect their fashion preferences. With the rise of digital device usage, there's also a surge in demand for lenses with blue light-blocking and anti-reflective coatings. In addition, there is a growing awareness of eye health, leading to an increased preference for regular eye check-ups and prescription lenses. The market is witnessing a shift towards online purchasing platforms, offering consumers convenience and a more comprehensive range of choices nationwide.

Latin America Prescription Lens Market Trends

The prescription lens market trends in Latin America include a rising demand for affordable and accessible vision correction solutions. There is a growing interest in stylish frames and lens options. In addition, there is an increasing adoption of online purchasing platforms for convenience and accessibility to a wider range of products.

The Brazil prescription lens market is expected to experience steady growth in the coming years owing to several factors such as an aging population with a rising need for vision correction. Increasing prevalence of myopia, particularly among young people, due to factors such as screen time and lifestyle changes. Growing middle class with more disposable income to spend on eyewear.

MEA Prescription Lens Market Trends

The MEA prescription lens market offers significant growth potential during the forecast period. Public health initiatives and educational programs are focusing on eye health awareness along with the importance of vision correction. Several market players are focusing on expanding its presence in Middle East & Africa to gain larger market share. In January 2024, SAIF Zone signed an agreement (MoU) with Tokai Optical, a major player, solidifying its place as a leading Middle Eastern free zone.

The Saudi Arabia prescription lens market reflects a growing demand for advanced lens technologies catering to diverse vision needs. For instance, Almadina Optical, a company under the Almadina Group founded in 1976, has over 41 years of experience in the optical industry, with more than 11 branches across Saudi Arabia, particularly in Riyadh. This growth indicates a rising market demand.

The prescription lens market in Kuwait is expected to witness moderate growth, driven by consumers increasingly seeking specialized lenses like blue light blockers and UV-protected coatings. Fashion plays a significant role, with consumers looking for stylish frames and lens options.

Key Prescription Lens Company Insights

The market is highly competitive, with key players such as Essilor, ZEISS Group, and VISION EASE holding significant positions.

For instance, as said by Euan S. Thomson, Ph.D., President of the Ophthalmology Strategic Business Unit and Head of the Digital Business Unit for ZEISS Medical Technology.,

“Our long-proven legacy of innovation continues to meet the ever-evolving needs of healthcare providers and the billions of patients they serve around the world. As we continue to extend our position in digital ophthalmic solutions, ZEISS is proud to unveil our latest workflow innovations that are helping to transform the way surgical care is practiced today. We’ll continue to invest in data-driven solutions that enhance clinical decision-making and help set new standards of care within the cataract and corneal refractive workflows.”

The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Prescription Lens Companies:

The following are the leading companies in the prescription lens market. These companies collectively hold the largest market share and dictate industry trends.

- Essilor

- ZEISS Group

- HOYA

- VISION EASE

- SEIKO OPTICAL PRODUCTS CO., LTD.

- Privé Revaux

- Vision Rx Lab

Recent Developments

-

In April 2024, Ray-Ban is broadening its Meta smart glasses lineup by introducing fresh designs tailored to accommodate a broader range of facial structures. These new styles are specifically crafted to be compatible with prescription lenses.

-

In April 2024, the prescription lenses for Apple Vision Pro will incur an additional charge of USD 149.

-

In September 2023, Zenni Optical partners with Meta to provide prescription lens inserts for Meta Quest 3 VR headset.

Prescription Lens Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 47.8 billion

Revenue forecast in 2030

USD 65.4 billion

Growth rate

CAGR of 5.36% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, coating, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico, UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Essilor; ZEISS Group; HOYA; VISION EASE; SEIKO OPTICAL PRODUCTS CO., LTD.; Privé Revaux; Vision Rx Lab

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Prescription Lens Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global prescription lens market report based on type, application, coating, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single vision

-

Convex

-

Concave

-

Cylindrical

-

-

Bifocal

-

Trifocal

-

Progressive

-

Workspace progressives

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Myopia

-

Hyperopia/Hypermetropia

-

Astigmatism

-

Presbyopia

-

-

Coating Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-reflective

-

Scratch resistant coating

-

Anti-fog coating

-

Ultraviolet treatment

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global prescription lenses market size was estimated at USD 46.1 billion in 2023 and is expected to reach USD 47.8 billion in 2024.

b. The global prescription lenses market is expected to grow at a compound annual growth rate of 5.36% from 2024 to 2030 to reach USD 65.4 billion by 2030.

b. North America dominated the prescription lenses market with a share of 24.9% in 2023. This is attributable to the growing prevalence of refractive errors in the region and the growing adoption of technologically advanced prescription lenses.

b. Some key players operating in the prescription lenses market include EssilorLuxottica, ZEISS International, HOYA VISION CARE COMPANY, VISION EASE, SEIKO OPTICAL PRODUCTS CO., LTD, and Vision Rx Lab.

b. Key factors that are driving the prescription lenses market growth include the growing prevalence of refractive errors, a growing number of awareness programs, and a growing number of product launches.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."