- Home

- »

- Medical Devices

- »

-

Pressure Relief Devices Market Size & Share Report, 2030GVR Report cover

![Pressure Relief Devices Market Size, Share & Trends Report]()

Pressure Relief Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Low-Tech Devices [Foam-based, Gel-based], High-Tech Devices [Dynamic Air Therapy Beds, Kinetic Beds]), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-392-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

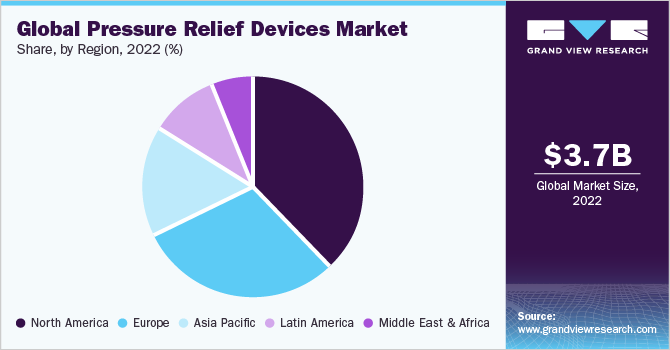

The global pressure relief devices market size was valued at USD 3.67 million in 2022 and is anticipated to grow at a CAGR of 6.9% over the forecast period from 2023 to 2030. The increasing incidence of pressure ulcers due to a highly susceptible and rapidly growing aging population is expected to drive the market growth over the forecast period. The geriatric population is more prone to the development of pressure ulcers that are also known as bedsores. The number of people aged 60 and above has been substantially increasing in recent years.

According to a report by the Population Reference Bureau in 2019, the U.S. population aged 65 and older is anticipated to experience a substantial increase, nearly doubling from 52 million individuals in 2018 to an estimated 95 million by the year 2060. Consequently, the proportion of the total population belonging to the 65-and-older age group is expected to rise significantly, from 16 percent to approximately 23 percent. This factor will be contributing to the market growth. The prolonged stay of bed-ridden patients due to several medical conditions such as multiple bone fractures, cancer, and other severe diseases results in pressure ulcers, which further upsurges the adoption of pressure relief devices. This has tremendously accelerated the demand for pressure ulcer devices globally from medical practitioners and end-users.

The COVID-19 pandemic accelerated the demand for pressure relief devices globally owing to a rise in cases of obesity & overweight patients due to physical inactivity. Furthermore, to eliminate the risk of COVID-19 infection, strict lockdowns were implemented globally, resulting in the increased sedentary lifestyle leading to several lifestyle disorders such as obesity, and cardiovascular disorder, which has resulted in the increased demand for pressure relief devices globally. Moreover, companies are incorporating newer strategies to increase their production capacity to serve the market demand. For instance, in March 2020, Hill-Rom Holdings, Inc. announced proactive measures to provide essential critical care products to customers and caregivers in response to the increased demand for COVID-19 patient requirements. Despite the significant surge in global demand for various crucial products, Hill-Rom Holdings, Inc.'s business operations remain uninterrupted. To meet this heightened demand, the company is diligently working towards significantly expanding the production capacity of respiratory health equipment, ICU and med-surg unit smart beds, as well as patient monitoring and diagnostics. Their objective is to more than double the existing capacity in these areas, ensuring a sufficient supply of these vital products.

According to the Agency for Healthcare Research and Quality, more than 2.5 million people in the U.S. and 0.7 million people in the UK are affected by pressure ulcers every year. Moreover, the treatments for these ulcers cost more than around USD 9 million every year in the U.S. These alarming expenses are contributing to the rising demand for bedsore management equipment. The prevention of these ulcers requires an interdisciplinary approach for its management and well-trained hospital staff. Although some parts of the treatment can be streamlined, specific care has to be given according to the requirements of every patient.

As these ulcers can be prevented with proper management, many campaigns have been launched over recent years for raising awareness. Knowledge of available resources facilitates effortless progression through all levels of care. Some of the campaigns initiated by the UK government include, “Stop the Pressure”, “Zero Pressure”, and “Islandwide Pressure Ulcer Prevention Campaign”.

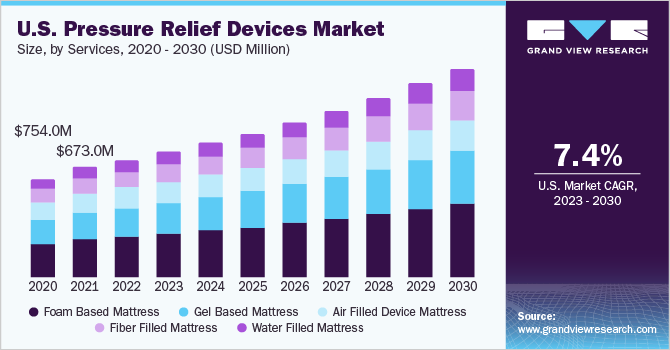

Type Insights

Based on type, the pressure relief devices market is segmented into low-tech and high-tech devices. The low-tech devices segment dominated the market with the largest revenue share of 66.0% in 2022 and is also expected to grow at the fastest CAGR of 7.0% over the forecast period from 2023 to 2030. The factors contributing to the growth of the segment mainly include the cost-effectiveness of the low-tech mattresses, easy availability in the market, and therapeutic benefits for the prevention of bedsores.

The high-tech devices segment is also expected to grow at a significant rate during the forecast period, due to technological improvements in device design. Most of the high-tech devices are powered and are specifically designed for periodic pressure redistribution providing several therapeutic benefits to mobility-impaired patients. Within the high-tech devices segment, the dynamic air therapy beds sub-segment dominated with the highest revenue share in 2022, whereas kinetic beds sub-segment is expected to grow at the fastest CAGR over the forecast period. The demand for these devices is expected to rise during the forecast period as they are highly technology-based.

Regional Insights

North America dominated the market with the largest revenue share of 38.0% in 2022 owing to the growing geriatric population, increasing approvals and R&D investments, inclination towards adopting newer products in the US, and expansion of hospitals. The robust healthcare infrastructure in North America is playing a significant role in driving the growth of the overall market in the region. Furthermore, the escalating rates of obesity among the population are contributing to an increased demand for pressure ulcer devices. According to a report by the World Health Organization, the year 2016 witnessed approximately 1.9 million overweight adults aged 18 years and older, with around 650 million adults falling under the category of obesity. Additionally, the U.S. ranks 12th worldwide in terms of obesity rates, accounting for 36.2% of the total share.

Asia Pacific is expected to grow at the fastest CAGR of 7.3% over the forecast period from 2023 to 2030.The region is witnessing an increase in its elderly population, resulting in a higher occurrence of chronic ailments and conditions like pressure ulcers. As a consequence, there is a growing demand for pressure relief devices to effectively prevent and manage these conditions. Moreover, chronic diseases including diabetes, cardiovascular disorders, and neurological ailments are progressively becoming more prevalent in the Asia Pacific region. Such conditions often necessitate prolonged bedridden care, thereby driving the need for pressure relief devices to mitigate the risks associated with pressure ulcers and related complications.

Europe held a significant revenue share in 2022. The growth can be attributed to various factors such as the rising prevalence of chronic disorders, high adoption of advanced technologies, presence of a large geriatric population, increasing reimbursement for surgical procedures, growing demand for minimally invasive procedures over traditional methods, and high diagnosis & treatment rate of pressure ulcers in Western Europe. Moreover, higher treatment costs may hamper the market in Eastern Europe.

Key Companies & Market Share Insights

The rise in competition is leading to rapid technological advancements and companies are constantly working towards the improvement of their products with a major focus on research and development. Factors such as investment in research & development, compliance with regulatory policies, and technological advancements are constantly driving the introduction of novel techniques. Companies are focusing on various growth strategies to sustain the market competition. For instance, in March 2021, Direct Healthcare Group (DHG) announced the acquisition of Talley Group Ltd. This strategic move aims to bolster Direct Healthcare Group's existing portfolio in pressure ulcer prevention while also facilitating its entry into the markets of Negative Pressure Wound Therapy (NPWT) and Intermittent Pneumatic Compression (IPC) therapy. Through this acquisition, Direct Healthcare Group is strategically positioning itself to expand its product offerings and provide comprehensive solutions in the field of wound care and pressure ulcer management.

Similarly, in June 2022, Smith+Nephew announced the opening of its state-of-the-art manufacturing facility in Penang, Malaysia. Spanning an area of 250,000 square feet, this facility represents a substantial investment exceeding USD 100 million. It is primarily dedicated to supporting the company's orthopaedics business, which is anticipated to experience robust growth in the Asia Pacific region. Aligned with the company's renewed strategy for growth, aimed at fortifying its foundation, this advanced facility empowers Smith+Nephew to serve customers and patients sustainably through cutting-edge manufacturing capabilities.

Furthermore, major companies are also involved in inorganic growth strategies to strengthen their market position. For instance, in October 2020, Bruin Biometrics LLC (BBI) has reached an agreement with Arjo, a provider of medical solutions and devices, regarding the acquisition of a stake in Bruin Biometrics. This strategic collaboration allows for enhanced market penetration and distribution of the SEM Scanner, facilitating improved access to this innovative medical device for healthcare providers and patients. Some of the prominent key industry players operating in the pressure relief devices market include:

-

3M

-

Arjo

-

Essity Health & Medical

-

Hillrom

-

Invacare Corporation

-

PARAMOUNT BED CO., LTD.

-

Smith+Nephew

-

Stryker

-

Talley Group Ltd

Pressure Relief Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.90 billion

Revenue forecast 2030

USD 6.25 billion

Growth Rate

CAGR of 6.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 – 2021

Forecast period

2023 – 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

3M; Arjo; Essity Health & Medical; Hillrom; Invacare Corporation; PARAMOUNT BED CO., LTD.; Smith+Nephew; Stryker; Talley Group Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pressure Relief Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global pressure relief devices market on the basis of type, and region:

-

Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Low-Tech Devices

-

Foam-based Mattress

-

Gel-based Mattress

-

Fiber Filled Mattress

-

Water/Fluid Filled Mattress

-

Air Filled Mattress

-

-

High-Tech Devices

-

Dynamic Air Therapy Beds

-

Kinetic Beds

-

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pressure relief devices market size was estimated at USD 3.67 billion in 2022 and is expected to reach USD 3.9 billion in 2023.

b. The global pressure relief devices market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 6.25 billion by 2030.

b. North America dominated the pressure relief devices market with a share of 37.96% in 2022. This is attributable to a rising aging population and chronic diseases.

b. Some key players operating in the pressure relief devices market include ArjoHuntleigh; BSN medical, Inc.; Hill-Rom Holdings, Inc.; PARAMOUNT BED HOLDINGS CO., LTD..; Acelity; Invacare Corporation; and Talley Group Ltd.

b. Key factors that are driving the pressure relief devices market growth include increasing incidence of pressure ulcer development due to a highly susceptible and rapidly growing aging population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.