- Home

- »

- Clinical Diagnostics

- »

-

Primary Care PoC Diagnostics Market, Industry Report 2030GVR Report cover

![Primary Care PoC Diagnostics Market Size, Share & Trends Report]()

Primary Care PoC Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Disease (Hb1Ac Testing, Coagulation Testing, Fertility/Pregnancy), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-333-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Primary Care PoC Diagnostics Market Trends

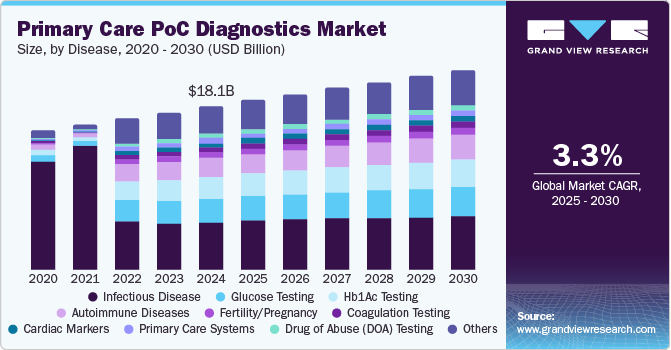

The global primary care PoC diagnostics market size was estimated at USD 18.09 billion in 2024 and is projected to grow at a CAGR of 3.3% from 2025 to 2030. The market growth can be attributed to factors such as the rising prevalence of chronic diseases, the rising number of point-of-care diagnostic devices, and a rise in healthcare expenditures within secondary and tertiary care.

Market growth worldwide is fueled by technological advancements and a rising demand for efficient, accessible healthcare solutions. Innovations such as device miniaturization and artificial intelligence (AI) integration significantly enhanced diagnostic accuracy. Portable, user-friendly point-of-care (PoC) devices enabled quicker results, essential for both routine monitoring and emergencies. Advancements in molecular diagnostics facilitated swift detection of genetic markers and infectious agents, improving patient outcomes.

In addition to technological developments, the applications and products driving the primary care PoC diagnostics market are diverse and critical. Glucose monitoring remains a significant segment, enabling continuous tracking for diabetic patients-a demographic that continues to expand.

Regional trends indicate significant growth attributed to rising chronic disease incidences and ongoing improvements in healthcare infrastructure. In 2024, the Delaware Journal of Public Health reported that six in ten Americans lived with at least one chronic disease, underscoring the demand for effective PoC in evolving healthcare systems. Moreover, global investments in healthcare, particularly in primary care infrastructures, are amplifying market expansion, ensuring that diagnostic solutions are innovative and widely accessible. For instance, in August 2023, CrisprBits partnered with Molbio Diagnostics in India to develop CRISPR-based PoC tests, enhancing rapid, accurate pathogen and genetic marker detection in various healthcare settings.

Companies are abiding by the stringent regulatory scenario by engaging in strategic partnerships and acquisitions, thereby enhancing operational capabilities and driving efficiency in their operations. According to Diabetes Australia , approximately 1.5 million Australians were living with diabetes as of 2024, emphasizing the need for accessible PoC diagnostics, particularly in remote areas. This underscores the necessity for innovative solutions that can effectively address the growing health challenges faced worldwide.

Disease Insights

Infectious diseases dominated the market and accounted for a share of 29.0% in 2024 due to rising prevalence, rapid technological advancements, and the necessity for swift diagnoses. The rising prevalence of diseases such as HIV, tuberculosis, influenza, and hepatitis necessitated rapid diagnostic tools for efficient outbreak management. Technological advancements in microfluidics, nanotechnology, and biosensors improved the speed and accuracy of these tests. From April to June 2024, a ScienceOpen study noted significant outbreaks worldwide, including dengue, particularly in Afghanistan and Brazil, and cholera in Afghanistan and Pakistan. Seasonal influences affected the incidence of diseases, with measles ravaging parts of Africa. Concurrently, there has been a growing trend towards decentralized healthcare systems and home-based testing worldwide, allowing for quicker results and facilitating timely treatment. Continuous surveillance remains essential for monitoring and controlling the spread of infectious diseases globally.

The cancer markers segment is expected to register the fastest CAGR of 5.3% over the forecast period, driven by rising cancer incidences, increased demand for screening, and technological advancements. In 2022, the International Agency for Research on Cancer reported 20 million cancer cases and 9.7 million deaths, highlighting the urgency for effective diagnostic tools. Common tumor markers such as alpha-fetoprotein (AFP) and carcinoembryonic antigen (CEA) aid in cancer detection. Recent studies emphasize the role of biomarkers and aptamers, which offer high sensitivity and specificity for early diagnosis. Future innovations will integrate AI and machine learning into PoC diagnostics, enhancing accuracy. The development of portable devices is crucial for providing rapid testing in decentralized healthcare settings, improving patient outcomes.

Glucose testing accounted for a share of 14.7% in 2024. The rising prevalence of diabetes is driving the growth of the segment. According to the World Health Organization (WHO) report published in April 2023, more than 95% of diabetic people have type 2 diabetes. The rising health concerns are driving companies to innovate testing devices that the patient can conduct to examine and record their glucose levels. A wide range of glucometers are available in the market, such as Abbott’s FreeStyle Libre 3, FreeStyle Libre 2 enabled with real-time alarm, Ascensia Diabetes Care Holdings AG’s contour blood glucose monitoring systems, contour plus elite, contour next EZ, and others. In addition, various companies are innovating advanced systems. For instance, Prevounce launched a new cellular-connected glucose testing device dedicated to remote patient monitoring in June 2024.

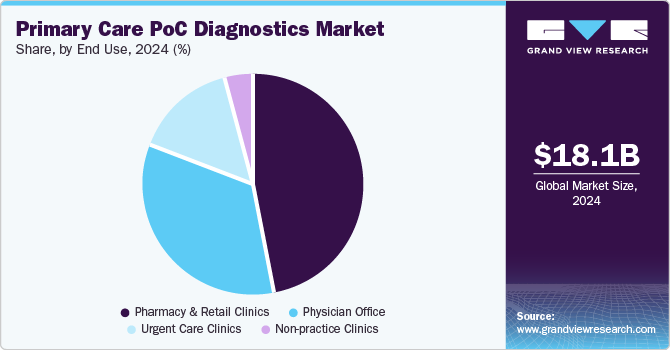

End Use Insights

The pharmacy & retail clinics segment led the market with a revenue share of 47.3% in 2024. The increasing coverage of health plans has reduced healthcare costs and improved access to care, enabling pharmacies and retail clinics to offer PoC testing. There has been a rapid rise in pharmacists conducting tests, including blood glucose monitoring, pregnancy tests, hemoglobin assessments, rapid strep tests, urinalysis, and COVID-19 tests. In addition, the growing prevalence of chronic and infectious diseases has heightened the demand for timely diagnostics.

The physician’s office segment is expected to grow significantly over the forecast period. The rising prevalence of chronic and infectious diseases is driving patient visits to physician offices for diagnosis and treatment. This segment is expanding as healthcare professionals utilize PoC tests to inform treatment decisions. Companies such as Siemens Healthcare provide PoC solutions, enabling diabetes testing and urinalysis, thereby improving treatment outcomes and enhancing the efficiency of patient care.

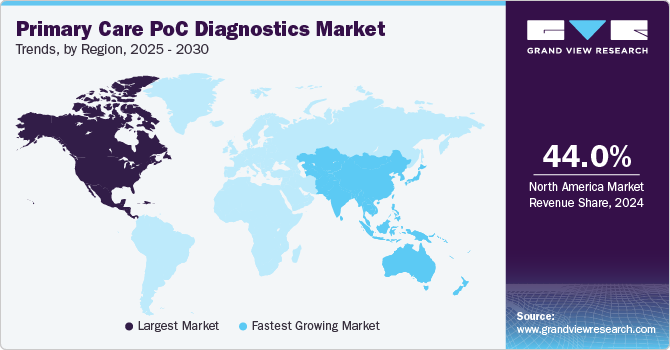

Regional Insights

North America primary care PoC diagnostics industry dominated the global market with a revenue share of 44.0% in 2024. Chronic diseases emerged as the leading cause of death and disability in Canada, as reported by the Ontario Agency for Health Protection and Promotion. In 2021, the Canadian government estimated that lung, breast, colorectal, and prostate cancers accounted for 46% of all cancer diagnoses. Meanwhile, in Mexico, regulatory bodies such as COFEPRIS (Comisión Federal para la Protección contra Riesgos Sanitarios) have been instrumental in overseeing the approval and market entry of diagnostic tests. This regulatory support aims to decentralize healthcare and enhance accessibility, driving market growth across North America.

U.S. Primary Care PoC Diagnostics Market Trends

The primary care PoC diagnostics market in the U.S. dominated the North America market with a revenue share of 90.9% in 2024. The National Cancer Institute estimated 2,001,140 new cases of cancer and 611,720 deaths in 2024 in the U.S. Government initiatives to address chronic diseases such as cancer are further accelerating the country’s growth. The U.S. government reignited the Cancer Moonshot initiative in 2022 to foster collaboration and accelerate scientific discovery in research to reduce the death rate caused by cancer by 2047. In addition, the presence of market leaders such as Abbott, Thermo Fisher Scientific Inc., and BD in the country is expected to drive market growth.

Europe Primary Care PoC Diagnostics Market Trends

Europe's primary care PoC diagnostics market held a substantial market share in 2024. According to the WHO, half of the countries in the region are at risk for respiratory infectious diseases, including respiratory syncytial virus (RSV), which accounts for 20% of acute lower respiratory tract infections in children under six months of age. These rising incidences are driving demand for primary care PoC diagnostics. Furthermore, the European Center for Disease Prevention and Control has been diligent in assessing PoC testing devices for infectious diseases, helping key players recognize effective PoC testing devices and ensure superior regulatory standards, enhance diagnostic accuracy and improve public health response in Europe. Major market players from the region include BIOMÉRIEUX, BD, and Abbott.

The primary care PoC diagnostics market in Germany is expected to grow lucratively over the forecast period. A study revealed that general practitioners (GPs) increasingly rely on PoC tests, driven by technological advancements that enhance diagnostic accuracy and expand test availability. Among these, C-reactive protein (CRP) PoC tests have gained traction, guiding antibiotic prescriptions for respiratory infections and helping to reduce unnecessary usage. The 6th German PoCT Symposium in September 2024 further highlighted innovations and emphasized the importance of quality assurance and regulatory compliance in PoC testing.

The primary care PoC diagnostics in the UK is driven by the rising chronic and infectious diseases. According to the government of UK, COVID-19 infections increased, with an estimated one in forty people testing positive as per the report published in March 2023. Such incidences demand early detection of the condition for immediate treatment. Companies such as LumiraDx provide point-of-care diagnostic devices to conduct various COVID-19, CRP, D‑Dimer, Flu, HbA1c, and RSV tests. Such instances are expected to drive market growth in the nation.

Asia Pacific Primary Care PoC Diagnostics Market Trends

Asia Pacific primary care PoC diagnostics market is expected to register the fastest CAGR of 4.9% in the forecast period. The growth in demand for PoC diagnostic devices is largely attributed to the increasing incidence of chronic diseases. A study published in November 2023 highlighted their significant utility in conducting tests across rural and remote regions of Australia, prompting market growth in the country.

The primary care PoC diagnostics market in China dominated the Asia Pacific market in 2024. In 2023, a World Health Organization report indicated a significant rise in respiratory illnesses among children in China. Concurrently, the National Health Commission observed a nationwide increase in respiratory diseases. This alarming trend has heightened the demand for advanced PoC diagnostics. As China enhances its primary care infrastructure, the focus on innovative PoC devices is becoming crucial to effectively address health challenges posed by these rising illnesses as of 2025.

The rising prevalence of diabetes is the primary factor in India for the region’s market growth. According to the World Health Organization (WHO), approximately 77 million people above the age of 18 are affected with type 2 diabetes, with more than 50% unaware of the condition. This health challenge is pushing the country’s capabilities to discover advanced alternatives. Various companies offer POC devices, such as glucometers, to detect and record blood sugar levels. Some glucometers available in the market are Accu-Chek Active Blood Glucose Monitoring System, Dr. Morepen Gluco One Blood Glucose Monitoring System, and Accu-Chek Instant S Blood Glucose Monitoring System. Various companies that are involved in offering point-of-care diagnostic devices are Molbio Diagnostics Pvt. Ltd, Siemens Healthcare Private Limited, and Morepen Laboratories. Companies are innovating technologically advanced alternatives; for instance, BlueSemi, an Indian startup, launched a non-invasive blood glucose monitoring gadget in March 2023. Such innovations are expected to drive market growth in the nation.

Key Primary Care PoC Diagnostics Company Insights

Some key companies in the primary care POC diagnostics market include F Hoffmann-La Roche Ltd; Danaher Corporation; and Abbott. Key companies are involved in strategic initiatives such as in innovating new products, collaborating with institutions and other industries, and establishing partnerships.

- Siemens Healthineers offers medical imaging, laboratory diagnostics, POC devices, and reading solutions for healthcare applications. The company’s POC offerings include PoC devices for blood gas products such as RAPIDPoint 500e, epoc Blood Analysis System, and Urinalysis products such as CLINITEK Status+ Analyzer and CLINITEK Advantus Urine Chemistry Analyze.

- F Hoffmann-La Roche Ltd. specializes in medicines for oncology, virology, immunology, urinalysis, and blood screening. The company extends a range of POC devices for diagnostics including a multiplate analyzer, SARS-CoV-2 Rapid Antigen Test 2.0, BM-Lactate, Accutrend Cholesterol, cobas Strep A, Urisys 1100 analyzer, and cobas pulse system.

Key Primary Care PoC Diagnostics Companies:

The following are the leading companies in the primary care PoC diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- F Hoffmann-La Roche Ltd.

- Danaher

- Abbott

- Siemens Healthineers

- BIOMÉRIEUX

- QIAGEN

- Nova Biomedical

- Johnson & Johnson Services, Inc.

- OraSure Technologies, Inc.

- BD

Recent Developments

-

In February 2025, BD announced its board approved plans to separate its Biosciences and Diagnostic Solutions business, enhancing focus and growth in the medical technology sector.

-

In January 2025, bioMérieux acquired Norwegian start-up SpinChip, enhancing its POC diagnostics with an innovative immunoassay platform, aimed at improving patient outcomes and reducing emergency healthcare costs.

-

In December 2024, BD and Babson Diagnostics launched innovative fingertip blood testing in the U.S. health system. This product aimed to improve access and convenience in ambulatory care settings through simplified technology.

-

In July 2024, Roche integrated LumiraDx’s technology platform, enhancing its focus on PoC diagnostics in near-patient care, aiming to accelerate innovation and improve healthcare delivery across various settings.

-

In July 2024, Danaher launched two CLIA and CAP-certified innovation centers in Washington, aimed at accelerating the development of companion and complementary diagnostics to enhance precision medicine and improve patient outcomes.

-

In June 2024, BIOMÉRIEUX received FDA approval for its BIOFIRE SPOTFIRE Respiratory/Sore Throat, a POC platform.

-

In May 2024, Cipla signed an agreement for an investment in Achira Labs Private Limited, responsible for the commercialization of point-of-care test kits in India.

Primary Care PoC Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.76 billion

Revenue forecast in 2030

USD 22.09 billion

Growth rate

CAGR of 3.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disease, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

F Hoffmann-La Roche Ltd; Danaher Corporation; Abbott; Siemens Healthcare GmbH; BIOMÉRIEUX; QIAGEN; Nova Biomedical; Johnson & Johnson Services, Inc.; OraSure Technologies Inc.; BD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Primary Care PoC Diagnostics Market Report Segmentation

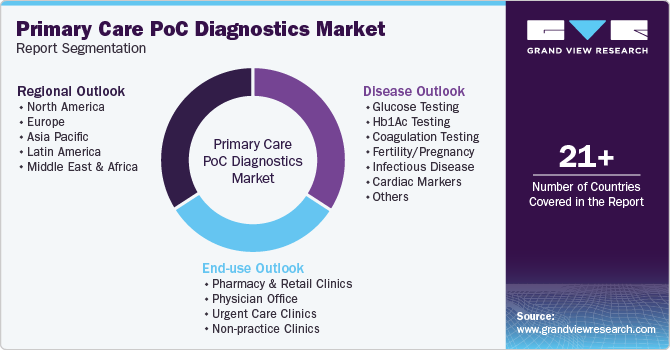

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global primary care PoC diagnostics market report based on disease, end use, and region:

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Glucose Testing

-

Hb1Ac Testing

-

Coagulation Testing

-

Fertility/Pregnancy

-

Infectious Disease

-

Cardiac Markers

-

Thyroid Stimulating Hormone

-

Hematology

-

Primary Care Systems

-

Decentralized Clinical Chemistry

-

Feces

-

Lipid Testing

-

Cancer Marker

-

Blood Gas/Electrolytes

-

Ambulatory Chemistry

-

Drug of Abuse (DOA) Testing

-

Autoimmune Diseases

-

Urinalysis/Nephrology

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmacy & Retail Clinics

-

Physician Office

-

Urgent Care Clinics

-

Non-practice Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.