- Home

- »

- Medical Devices

- »

-

Procedure Trays Market Size, Share & Trends Report, 2030GVR Report cover

![Procedure Trays Market Size, Share & Trends Report]()

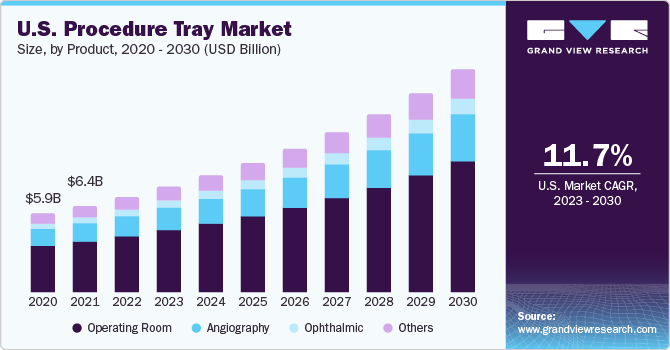

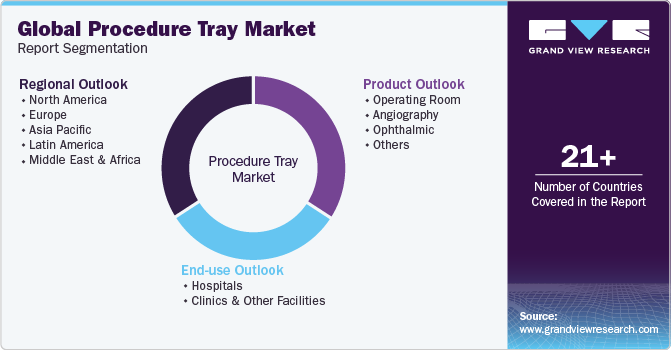

Procedure Trays Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Operating Room, Angiography, Ophthalmic), By End Use (Hospitals, Clinics, & Other Facilities), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-167-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Procedure Trays Market Size & Trends

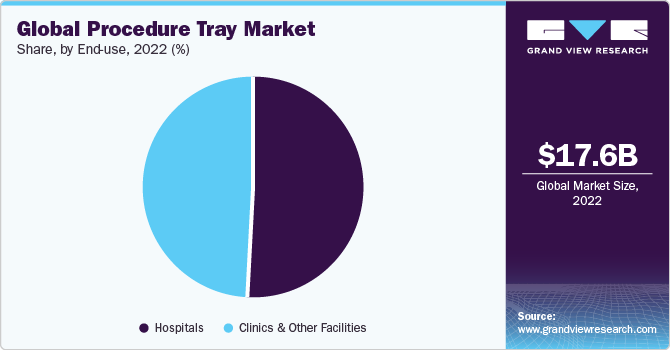

The global procedure trays market size was valued at USD 17.61 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.4% from 2023 to 2030. The growing number of surgeries is a key factor expected to drive the growth of the market for procedure trays during the forecast period. The advent of minimally invasive and non-invasive procedures has increased the number of surgeries performed each year. This is also expected to fuel the product demand in the near future.

Patients choose non-invasive or minimally invasive operations to avoid the risk of surgery-associated infections. Non-invasive operations necessitate shorter hospital stays, saving both time and money. An increase in chronic disorders, the frequency of road accidents, an aging population, and increased healthcare spending in emerging economies are expected to increase the number of procedures performed during the projection period. According to the U.S. Census Bureau, global healthcare spending is expected to exceed USD 25.00 trillion by 2040. Moreover, according to the WHO, the global population aged 60 and up will double by 2050 and reach 2.1 billion.

All the tools and devices needed to perform a specific surgical or diagnostic operation are included in custom procedure kits. Although these kits are not utilized in every medical operation, they are recommended when treating cardiovascular, ophthalmology, and orthopedic ailments and disorders, as well as wound care and dental procedures. Physicians and healthcare practitioners can utilize custom procedure trays to pick clean surgical instruments and tools for single use. The pre-configured and pre-packaged trays and kits minimize the requirement for a massive inventory of individual components. Hence, pre-packaged bespoke procedural solutions help increase the quality of services as they streamline inventory management.

The COVID-19 pandemic positively impacted the procedure trays market due to the increased need for procedure trays to treat the coronavirus-affected population. A continuing shortage of procedure trays, such as testing kits and crucial diagnosis procedure trays, has resulted in supply chain disruption. The acute shortfall is caused by a decline in Chinese shipments. The shortage of vital procedure trays is caused by a drop in shipments owing to closed manufacturers and ports.

Although the demand was 40 times higher than typical, there was no demand fulfillment due to supply chain disruptions. All countries, including India, China, and others, have ended their efforts to save medical procedure trays for their populations. As a result, there is a strong market need for procedure trays.

In addition, companies are developing their end-to-end supply chain to optimize product costs to increase quality and services linked with customized procedure trays. Removing third-party expenditures helps businesses save money. Manufacturers are focused on efficient sterilizing procedures to avoid infections among healthcare practitioners and patients in the wake of the rapidly spreading COVID-19 infections. As a result, firms in the market focus on improving operational performance to increase their global credibility.

Procedure tray manufacturing companies use unique and advanced technologies to design, produce and sell products to diverse customers based on the amount of protection required for distinct job risks. Most manufacturers have their original technology or have licensed it from other industry participants. For instance, in February 2021, Uvamed Ltd, based in the UK, became the creator of the popular Tamper Evident Rainbow Trays and Rainbow Trays for anesthetic medications.

The Trauma Tray crash-box/procedure pack won an Innovate UK award due to their various benefits; these trays are secure and auditable entire procedure packs for usage outside of traditional hospital settings, such as field hospitals, emergency departments, ambulances, care homes, and rescue services, which are projected to drive market expansion. Government initiatives to encourage the adoption of disposable medical supplies to prevent infections in operating rooms are the key factors responsible for the market growth in this region.

The increasing number of surgeries and the geriatric population are the factors that drive the market growth in the U.S. According to Regenexx, more than 7 billion orthopedic surgeries were performed in 2021 in the U.S. According to the National Center for Health Statistics, more than 40 billion surgeries are performed each year. That number is expected to grow exponentially. In addition, according to the American Psychological Association, in 2021, the geriatric population in the country is currently at 46 billion and is supposed to double itself by 2060, which is supposed to increase surgeries coupled with advancements in technology and drive the market growth.

Product Insights

The operating room segment led the market and accounted for more than 55% share of the global revenue in 2022 and is expected to grow at a CAGR of 11.79% over the forecast period. The segment is likely to retain its position throughout the forecast period. One of the major drivers for market expansion is the rising number of operations performed worldwide. Government laws encouraging the use of single-use sterile equipment to prevent infections are helping to fuel the demand for procedure trays. Some components of operating room procedure trays are drapes, gowns, syringes, needles, suction tubes, and swabs.

According to the International Osteoporosis Foundation, osteoporosis affects around 200 billion women worldwide. Furthermore, hip fractures in men are expected to rise by 310% and in women by 240% by 2050. In the U.S., about 44 billion people have osteoporosis, which means that an osteoporotic fracture happens every three seconds. Men over 50 have a 27% chance of developing an osteoporotic fracture. As a result, rising rates of osteoporosis and fractures are predicted to increase the need for orthopedic surgery.

In addition, mergers and acquisitions of well-established market players are one of the key strategies adopted by many market players, which are expected to increase market growth in the near future. For instance, in January 2019, Owens and Minor signed a 5-year agreement with Scripps Health, which is a U.S.-based healthcare system. The company is expected to serve five acute care hospital campuses, non-acute care campuses, clinics, and outpatient centers.

Customers have the choice to customize procedure trays with the exact components required for specific procedures. The selection of procedural trays depends on the number of surgeries performed. If surgeries for a specific indication are performed in large volumes, the usage of procedure trays may be cost-effective.

Angiography is expected to grow at a significant rate during the forecast period. Cardiovascular diseases are one of the major causes of morbidity and mortality across the globe. The increasing prevalence of heart diseases and the availability of technologically advanced devices for surgery are factors expected to fuel the growth of the angiography segment.

According to the American Heart Association, cardiovascular diseases are the leading cause of death, accounting for 17.9 billion deaths per year, and this number is expected to increase to over 23.6 billion by 2030. Angiography is used for the diagnosis of coronary heart disease. It is a non-interventional procedure and is generally performed in radiology units. The level of standardization in angiography trays is high. One of the key components in these trays is fluid management systems.

End use Insights

Hospitals led the segment and accounted for over 50% share of the global revenue in 2022. Surgery departments and operating rooms in hospitals have a wide variety of needs. Sterile supplies for surgeries and decontamination of instruments are crucial for preventing hospital-associated infections. Therefore, doctors and staff in operating rooms are highly dependent on using procedure trays. The adoption of procedure trays helps reduce the incidence of infections. In addition, the use of procedural trays and kits results in a cost reduction.

The clinics and other facilities segment is anticipated to witness the fastest growth, with a CAGR of 11.59% during the forecast period. Healthcare facilities considered in this segment include individual physician offices, dental practices, nursing homes, clinics, and ambulatory care centers. Most nonsurgical procedures that use procedure trays, kits, and packs are performed in outpatient care facilities. The procedures performed at clinics and other ambulatory centers include ophthalmic procedures, urological incontinence procedures, and angiography. Angiography is a key non-interventional procedure performed at outpatient clinics.

Regional Insights

North America dominated the market and accounted for around 45% share of global revenue in 2022. Various government measures to ensure the use of single-use medical supplies to prevent infections, as well as the presence of prominent market participants in the region, are expected to help the region's growth. Furthermore, an increase in the aging population and the prevalence of chronic diseases, such as osteoporosis and heart-related problems, in the region, coupled with high awareness about healthcare and advanced surgical procedures, are likely to increase the demand for surgical procedures in this region. According to an article published by the International Osteoporosis Foundation, by 2020, 44 billion people in America above 50 will have osteoporosis.

Europe is expected to grow at the fastest CAGR of 12.9% during the forecast period. The UK, Germany, France, and Italy are some major contributing countries to the region. The high share of this region is attributed to increasing reimbursement for surgical procedures, the presence of a large pool of geriatric population, high adoption of advanced technology, and rising demand for minimally invasive procedures over conventional methods. In Europe, Cardiovascular Diseases (CVDs) remain the primary cause of death in most countries.

According to The Commonwealth Fund, The French government plays a crucial role in shaping the country's healthcare strategy. It allocates budgets to regional health agencies responsible for planning and delivering services. Joining France's statutory health insurance system is mandatory, covering many healthcare costs such as hospital care, physician services, long-term care, and prescription drugs. Patients may have to bear costs such as coinsurance, copayments, and additional fees for certain medical services. The insurance system is primarily financed through payroll taxes, national income tax, and levies on specific industries and products. To further support citizens, most people also have supplemental insurance to help with out-of-pocket expenses and additional care such as dental, hearing, and vision services.

Key Companies & Market Share Insights

Some of the key players that dominated the global market in 2022 include Teleflex Incorporated, Owens & Minor, Inc.; 3M Healthcare, Cardinal Health, BD, B. Braun Melsungen AG, and Merit Medical Systems. Companies are stressing research and development to develop technologically advanced products to gain a competitive edge, and companies are engaging in mergers, partnerships, and acquisitions, aiming to strengthen their product portfolio and manufacturing capacities and provide competitive differentiation.

For instance, in December 2021, American Contract Systems (ACS), a Minnesota-based provider of sterilizing and kitting services for the Custom Procedure Tray (CPT) solution, was acquired by Owens & Minor, Inc. This acquisition will increase their capacity to surpass and meet their customers' collective needs for surgical procedure trays, a market that is predicted to grow rapidly shortly.

Key Procedure Trays Companies:

- Owens & Minor, Inc.

- Cardinal Health

- 3M

- Teleflex Incorporated

- B. Braun SE.

- BD (Becton, Dickinson and Company)

- Merit Medical Systems

- Mölnlycke Health Care AB

- CPT Medical

- PAUL HARTMANN AG

- Medtronic

Procedure Trays Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 19.45 billion

Revenue forecast in 2030

USD 41.52 billion

Growth Rate

CAGR of 11.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France, Italy; Spain; Denmark; Sweden; Norway; Japan, China; India; Australia; Thailand; South Korea; Mexico; Brazil; Argentina; Chile; Colombia; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Owens & Minor, Inc.; Cardinal Health; 3M; Teleflex Incorporated; B. Braun SE; BD (Becton, Dickinson and Company); Merit Medical Systems; Mölnlycke Health Care AB; CPT Medical; PAUL HARTMANN AG; Medtronic

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Procedure Trays Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global procedure trays market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Operating Room

-

Angiography

-

Ophthalmic

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics & Other Facilities

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global procedure trays market is expected to grow at a compound annual growth rate of 11.44% from 2023 to 2030 to reach USD 41.52 billion by 2030.

b. North America dominated the procedure trays market with a share of 44.6% in 2022. This is attributable to the local presence of key market players and various initiatives undertaken by the government to encourage the use of single-use medical supplies to prevent infections.

b. Some key players operating in the procedure trays market include Owens & Minor, Inc.; Cardinal Health; 3M Healthcare; Teleflex Incorporated; B. Braun Melsungen AG; Becton, Dickinson and Company (BD); and Merit Medical Systems.

b. Key factors that are driving the market growth include favorable government regulations for prevention and control of Healthcare-Associated Infections (HCAI), benefits of customization, and constant increase in the number of surgeries being performed worldwide.

b. The global procedure trays market size was estimated at USD 17.61 billion in 2022 and is expected to reach USD 19.45 billion in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.