- Home

- »

- Next Generation Technologies

- »

-

Process Orchestration Market Size And Share Report, 2030GVR Report cover

![Process Orchestration Market Size, Share & Trends Report]()

Process Orchestration Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (Cloud, On-premise), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-987-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Process Orchestration Market Size & Trends

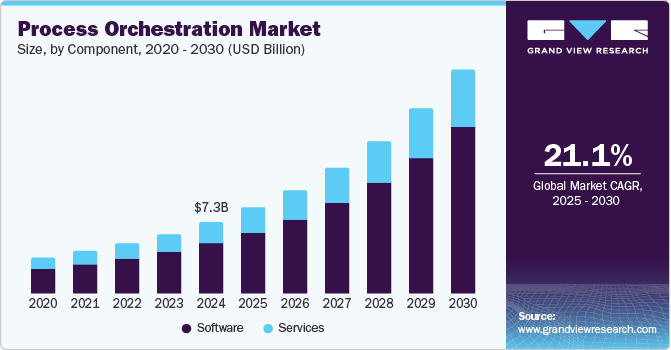

The global process orchestration market size was valued at USD 7.32 billion in 2024 and is expected to reach USD 22.80 billion by 2030, growing at a CAGR of 21.1% from 2025 to 2030. The rising footprint of business process orchestration tools is mainly attributed to reduced cycle time, decreased cost of ownership, and enhanced compliance.

Key Market Trends & Insights

- North America process orchestration market leads the global industry, accounting for a leading share of 33.8% in 2024.

- The process orchestration market in the U.S. held a dominant position in 2024.

- Based on component, the software segment accounted for the largest market share of 70.5% in 2024.

- Based on deployment, on-premises segment accounted for the largest market share in 2024.

- Based on enterprise size, the large enterprises segment accounted for the leading revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.32 Billion

- 2030 Projected Market Size: USD 22.80 Billion

- CAGR (2025-2030): 21.1%

- North America: Largest market in 2024

In recent years, industry participants have banked on process orchestration solutions that can cash in on business process management (BPM) with analytics and automation. With machine learning and IoT gaining traction globally, orchestration could provide impetus to BPM, fueling the market’s growth.

Process orchestration has become highly sought-after to foster resiliency, boost mean time to resolution (MTTR), and integrate advanced tools and technologies with a single orchestrated platform. It plays an invaluable role in executing, managing, and monitoring business processes. The platform enables users to optimize workflows involving several steps, leveraging users to emphasize high-value work. Prominently, it leverages organizations to streamline operations and complements strategic decision-making. Some upsides, such as freeing up invaluable IT resources, minimizing cost, and boosting operational efficiency, have propelled process orchestration market forecast. Furthermore, process orchestration tools have also received an uptick to minimize CAPEX & OPEX and bolster agility.

The COVID-19 pandemic compelled industries to seek work-from-home norms amidst health and economic crisis, prompting a major shift in working patterns. Process orchestration tools witnessed robust demand to streamline robotic tasks and orchestrate workflow across the human and digital workforce to propel brand positioning. Industry players anticipate process orchestration to gain further traction to automate decisions, foster data quality, and expedite the deployment and modeling of business process applications.

Component Insights

The software segment accounted for the largest market share of 70.5% in 2024. Stakeholders expect process orchestration software to gain considerable growth during the forecast period. The trend is primarily linked to bullish demand from BFSI, IT & telecommunication, healthcare, and retail sectors, among others. Process orchestration software has received an uptick to connect previously siloed systems. Industry participants are also counting on process orchestration to streamline system integration.

Process orchestration services could witness increased traction in the wake of soaring demand for real-time monitoring. Prominently, expanding penetration of 5G, IoT, AI, and natural language processing (NLP) has provided growth avenues for service providers. Leading companies have also emphasized professional services and cloud orchestration services that could drive the growth of the process orchestration market. Prominently, the use of orchestration services will be noticeable with the growing footfall of smart automation.

Deployment Insights

On-premises deployment accounted for the largest market share in 2024. The leading share can be attributed to the availability of data on demand. Industry players are also poised to seek on-premise for integrating and scheduling tasks. It will gain further traction for managing outages, migrating repositories, and deploying non-repository items. Besides, on-premise deployment will also be sought to install updates, manage releases and handle sensitive information, encouraging leading companies to inject funds into the landscape.

The cloud segment is projected to witness the highest growth rate during the forecast period of 2025 to 2030, partly due to the growing prominence of cloud management solutions. Cloud process orchestration tools, including public and private clouds, will be highly sought-after across the end-use sectors. The use of cloud technologies to integrate automated tasks into a workflow and keep up with the security protocols and policies will augur well for the process orchestration industry forecast. Leading cloud providers, such as Google, AWS, Microsoft, and IBM, are poised to expand their footfall to help businesses boost their productivity at reduced costs.

Enterprise Size Insights

The large enterprises segment accounted for the leading revenue share in 2024 owing to the strong demand for predictive approaches to maintain data security. The growth is also attributed to the adoption of state-of-the-art technologies and bullish investments in the IT portfolio. Organizations are likely to seek process orchestration to monitor and centralize large workflows and integrate novel technologies from one platform. Furthermore, the need to manage audit and compliance requirements from a centralized portal will propel the growth of the industry.

The small and medium enterprises segment is expected to expand with a prominent growth rate. The growth trajectory is largely due to the need to reduce OPEX when automating and streamlining business workflows and manual tasks. SMEs are likely to exhibit an increased inclination for process orchestration to consolidate and coordinate various tools. Furthermore, the ensuing market disruptions against the backdrop of the COVID-19 pandemic prompted SMEs to reimagine their strategies to remold their businesses to improve user experience and emerge more competitive in the global market.

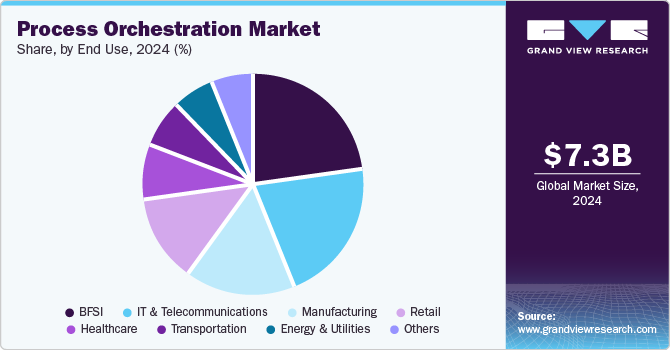

End Use Insights

The BFSI segment held a leading market share in 2024. The BFSI sector has exhibited increased traction for process orchestration following the expanding footfall of digitization across emerging and advanced economies. With remote onboarding and automated account opening receiving impetus, banks and financial institutions will add a fillip to the market growth. Banks and financial institutions are poised to bank on orchestration for regulatory alignment, transparency, and business transformation.

The healthcare sector is estimated to have prominent growth during the forecast period in the wake of technological advancements across the business end use. An uptick in automation has enabled healthcare service providers to optimize time-consuming processes and boost efficiencies with an increased focus on personalized healthcare and connected healthcare devices. Additionally, a notable shift of point-of-care from hospitals to homes has reinforced the growth of digital health, auguring well for leading companies to solidify their positions in the global industry.

Regional Insights

North America process orchestration market leads the global industry, accounting for a leading share of 33.8% in 2024. The leading share is attributable to the region’s robust digital transformation initiatives, particularly across sectors like retail, telecommunications, and financial services. Cloud adoption and AI integration are prominent, with businesses focusing on automating workflows to enhance customer experience and improve operational efficiencies. Retailers are leveraging orchestration tools to optimize inventory management, security, and digital storefronts, spurred on by the surge in e-commerce during the COVID-19 pandemic. North America accounted for a significant share of 36% of the global market in 2021 and continues to present growth opportunities as companies invest in AI and cloud technologies to modernize operations.

U.S. Process Orchestration Market Trends

The process orchestration market in the U.S. held a dominant position in 2024, with a strong focus on integrating AI and cloud-based orchestration tools. The shift toward automation across key sectors, such as banking, healthcare, and manufacturing, is accelerating. U.S. retailers, in particular, have ramped up their use of orchestration solutions to handle the complexities of omnichannel operations and to adapt to the rise in online consumer spending. Moreover, the country’s tech giants, such as AWS, Google, and IBM, are heavily involved in providing orchestration platforms that help streamline business processes and drive digital innovation.

Europe Process Orchestration Market Trends

The process orchestration market in Europe is also growing, with significant traction in industries like finance, telecommunications, and manufacturing. European businesses are increasingly adopting cloud-based orchestration tools to improve efficiency and ensure compliance with stringent regulatory requirements, particularly in the BFSI (Banking, Financial Services, and Insurance) sector.

Countries like Germany and the UK are at the forefront of this trend, with their industries leveraging orchestration to manage complex workflows, such as regulatory reporting and fraud detection. AI and machine learning are enhancing the capabilities of orchestration tools, enabling more real-time decision-making and process optimization.

Asia Pacific Process Orchestration Market Trends

The process orchestration market in Asia Pacific is anticipated to grow at a CAGR of 23.2% from 2025 to 2030. Asia Pacific is experiencing rapid growth in the process orchestration market, driven by widespread digitization and the adoption of AI and cloud technologies. Emerging economies like China and India are leading this trend, particularly in sectors like IT, telecommunications, and financial services. The region’s businesses are increasingly adopting orchestration solutions to manage large-scale operations and optimize resource allocation. The proliferation of mobile and digital services, particularly in China’s tech-driven economy, has accelerated the need for efficient process orchestration. Additionally, healthcare providers in the region are utilizing these tools to streamline patient care workflows, reflecting the growing demand for digital health solutions.

Key Process Orchestration Company Insights

The competitive landscape suggests forward-looking companies will emphasize boosting existing products, launching new products, and optimizing pricing structures. Concerted efforts on organic and inorganic growth strategies are likely to help companies expand their penetration across untapped areas. In addition, leading companies are seeking outside opportunities, including joint ventures and mergers & acquisitions. Industry stakeholders are also focusing on technological advancements and product differentiation.

-

Cisco Systems offers AI-driven automation tools like Cisco Intersight to streamline IT operations, automate infrastructure management, and optimize workloads across hybrid cloud environments. Its orchestration solutions enhance performance, security, and visibility while supporting DevOps pipelines for greater agility.

-

Dell Technologies provides AI-powered automation and orchestration solutions through platforms like Dell Technologies Cloud and VMware Cloud Foundation to simplify infrastructure management and optimize cloud resource provisioning. Its tools enable seamless multi-cloud orchestration, improving IT efficiency and service delivery with predictive analytics and DevOps support.

Key Process Orchestration Companies:

The following are the leading companies in the process orchestration market. These companies collectively hold the largest market share and dictate industry trends.

- SAP SE

- Cisco Systems, Inc.

- Oracle Inc

- Wipro Ltd

- Celonis

- Kyndryl Holdings, Inc.

- Dell Technologies, Inc.

- CA Technologies

- Cortex

- ServiceNow

- Newgen Software

- IBM Corporation

Recent Developments

-

In July 2024, Celonis launched an AI-driven process orchestration solution to deliver end-to-end process optimization, developed in partnership with Emporix. The Emporix Orchestration Engine uses real-time process intelligence to streamline operations and boost agility. Key features include large-scale process transformation, intelligent execution, and reduced complexity, helping companies improve efficiency by continuously optimizing workflows through AI.

-

In January 2024, Kyndryl Holdings, Inc. introduced AI-enabled workflow orchestration services aimed at automating business processes. This solution harnesses artificial intelligence to enhance operational efficiency, streamline productivity, and improve the user experience within digital workplaces. Key features include an intuitive interface, real-time process visibility, robust access controls, and advanced encryption, making it easier to manage complex workflows.

-

In January 2023, Dell Technologies, Inc., acquired Cloudify, an Israel-based open-source platform provider. This acquisition aligns with Dell's strategy to strengthen its cloud orchestration capabilities. By integrating Cloudify's multi-cloud orchestration platform, Dell aims to enhance its cloud automation services, with a particular focus on expanding its edge computing offerings. This move is expected to drive innovation in Dell’s cloud management and orchestration tools, positioning the company to deliver more streamlined cloud solutions across multiple environments.

Process Orchestration Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.77 billion

Revenue forecast in 2030

USD 22.80 billion

Growth rate

CAGR of 21.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Component, deployment, enterprise size, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; South Korea, Australia, Brazil, KSA, UAE, South Africa

Key companies profiled

SAP SE; Cisco Systems, Inc.; Oracle Inc.; Wipro Ltd; Celonis; Kyndryl Holdings, Inc.; Dell Technologies, Inc.; CA Technologies; Cortex; ServiceNow; Newgen Software; IBM Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Process Orchestration Market Report Segmentation

This report offers revenue growth forecasts at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global process orchestration market report based on component, deployment, enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premises

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Manufacturing

-

Healthcare

-

IT & Telecommunications

-

Retail

-

Energy and utilities

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global process orchestration market size was estimated at USD 7.32 billion in 2024 and is expected to reach USD 8.77 billion in 2025.

b. The global process orchestration market is expected to grow at a compound annual growth rate of 21.1% from 2025 to 2030 to reach USD 22.80 billion by 2030.

b. North America dominated the process orchestration market with a share of 33.8% in 2024. This is attributable to the bullish demand to boost resiliency and integrate advanced technologies and tools with a single orchestration platform.

b. Some key players operating in the process orchestration market include IBM Corporation, SAP SE, Cisco Systems Inc., Oracle Inc., Wipro Ltd, TIBCO, Everteam, BMC, CA Technologies, Cortex, ServiceNow, and Newgen Software

b. Key factors that are driving the market growth include increasing adoption of a cloud-based solution, prominent growth of technology, and rising demand for automated systems and solutions

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.