- Home

- »

- Communication Services

- »

-

Procurement As A Service Market Size, Industry Report, 2033GVR Report cover

![Procurement As A Service Market Size, Share & Trends Report]()

Procurement As A Service Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Strategic Sourcing, Spend Management, Process Management), By Enterprise Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-121-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Procurement As A Service Market Summary

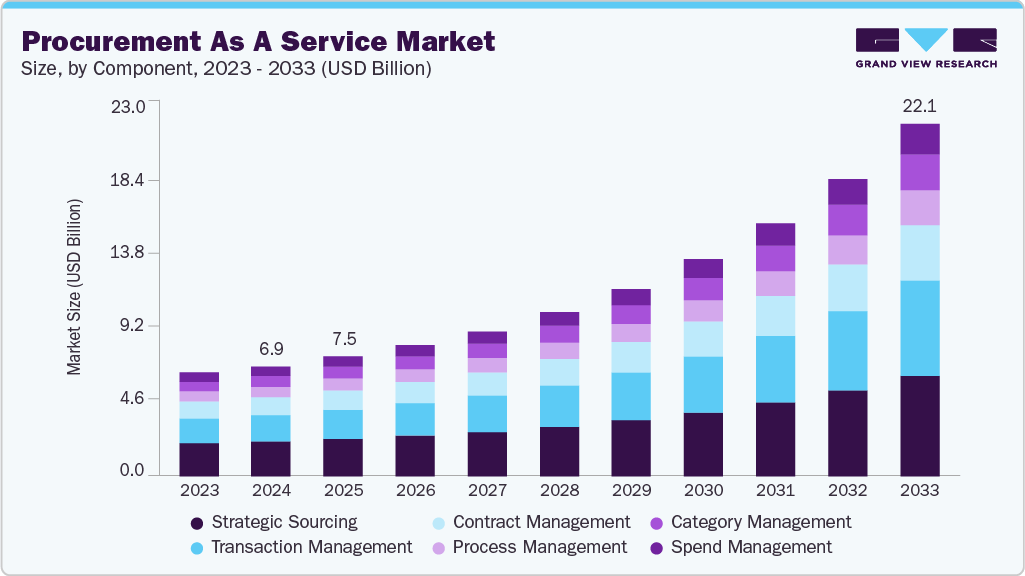

The global procurement as a service market size was estimated at USD 6.89 billion in 2024 and is projected to reach USD 22.10 billion by 2033, growing at a CAGR of 14.4% from 2025 to 2033 due to increasing demand for cost optimization, operational efficiency, and strategic sourcing among businesses across industries.

Key Market Trends & Insights

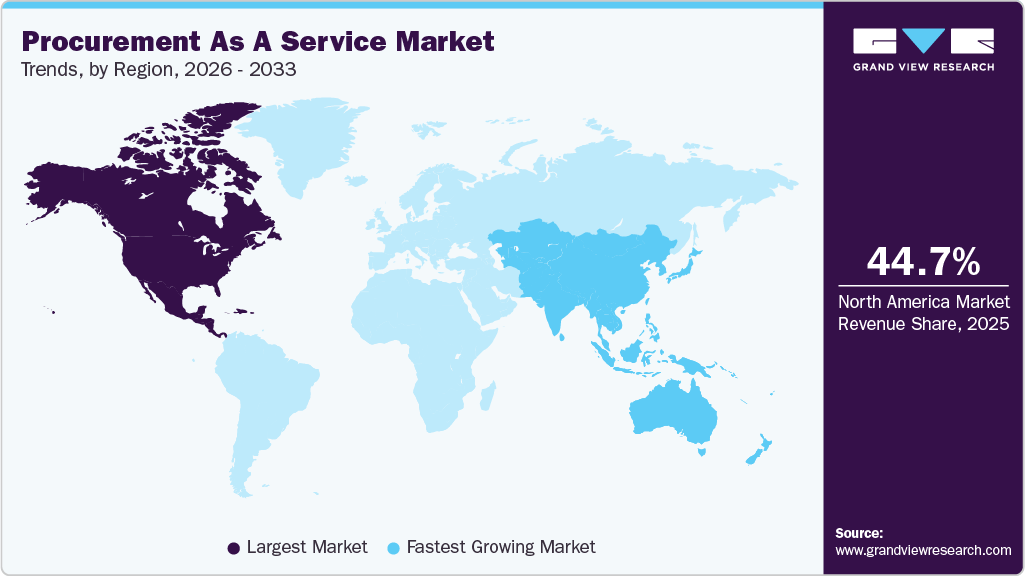

- The North America dominated the market and held a revenue share of over 44.6% in 2024.

- The U.S. is expected to grow significantly at a CAGR of 14.5% from 2025 to 2033.

- Based on component, the strategic sourcing segment dominated the market and accounted for the revenue share of 31.9% in 2024.

- Based on enterprise size, the large enterprises segment dominated the market and accounted for the largest revenue share in 2024.

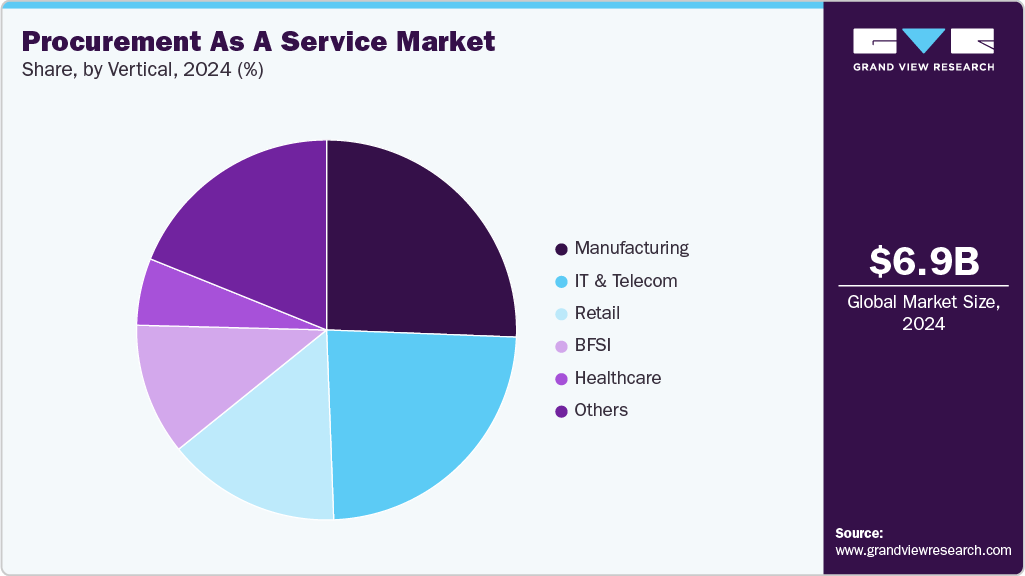

- Based on vertical, the manufacturing segment dominated the market and accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.89 Billion

- 2033 Projected Market Size: USD 22.10 Billion

- CAGR (2025-2033): 14.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Organizations increasingly recognize the need to outsource procurement functions to expert third-party providers to reduce procurement costs, streamline operations, and gain access to advanced procurement technologies. The ability of procurement as a service (PaaS) providers to offer modular and scalable services, such as spend analysis, supplier management, and category management, enables companies to adapt procurement solutions based on specific business needs and growth stages. This flexibility and a growing focus on core competencies drive adoption among small and medium-sized enterprises (SMEs) and large corporations.Moreover, the accelerating digital transformation across supply chains also contributes to the procurement growth as a service industry. Integrating cloud computing, AI, machine learning, and analytics into procurement processes enhances transparency, improves spend visibility, and supports data-driven decision-making. Enterprises increasingly leverage these tools to mitigate supply chain risks, ensure compliance, and drive sustainability initiatives, making digitally-enabled PaaS offerings more attractive. For instance, in May 2024, GEP introduced the industry’s first AI-powered Total Orchestration Solution, designed to enhance enterprise procurement and supply chain operations. The new platform integrates a built-in AI co-pilot, streamlining complex workflows while delivering a more intuitive user experience.

Organizations are moving beyond transactional procurement toward a more strategic approach focusing on long-term value creation, supplier innovation, and risk resilience. Procurement service providers bring specialized capabilities in category management, supplier benchmarking, and strategic negotiations, helping clients make informed sourcing decisions and develop diversified supplier portfolios. In particular, public and private sector initiatives to include minority-owned, women-owned, or local businesses in supply chains have led enterprises to partner with PaaS firms to ensure proper vendor identification, onboarding, and compliance.

Component Insights

The strategic sourcing segment dominated the market and accounted for the revenue share of 31.9% in 2024, driven by the increasing need for businesses to optimize supplier relationships, manage costs proactively, and ensure supply chain resilience. Unlike traditional procurement, which focuses on transactional purchasing, strategic sourcing emphasizes data-driven decision-making, long-term supplier partnerships, and continuous improvement. Companies increasingly rely on PaaS providers for advanced sourcing strategies that balance cost, quality, risk, and innovation in an era marked by volatile supply chains, inflation, and shifting demand patterns. This growing demand for value-added procurement services has positioned strategic sourcing as a significant driver within the PaaS ecosystem.

The transaction management segment is anticipated to grow at a CAGR of 15.9% during the forecast period, driven by the increased adoption of digital procurement tools and platforms. Cloud-based procurement systems, robotic process automation (RPA), and integrated e-procurement solutions enable PaaS providers to offer seamless and scalable transaction management services. These technologies help automate repetitive tasks while ensuring real-time tracking, auditability, and integration with clients' ERP systems. The ability to process high volumes of transactions efficiently, while maintaining data accuracy and regulatory compliance, has made transaction management a cornerstone offering in the PaaS space, especially for large enterprises with complex and decentralized procurement functions.

Enterprise Size Insights

The large enterprises segment dominated the market and accounted for the largest revenue share in 2024. The cost optimization and supplier consolidation strategies fuel PaaS adoption among large enterprises. With high procurement spend under management, even small improvements in sourcing efficiency, contract negotiation, or payment terms can lead to significant savings. PaaS providers offer spend analytics, supplier benchmarking, and category management support to help enterprises drive these efficiencies at scale. Large companies are increasingly adopting PaaS for cost containment and to gain a strategic advantage through smarter sourcing and supplier engagement.

The SMEs segment is expected to grow at a significant CAGR during the forecast period due to the growing. Many small and medium enterprises lack the financial and technical resources to implement sophisticated procurement platforms or data analytics internally. PaaS providers bridge this gap by offering cloud-based, scalable, and modular solutions that enable SMEs to benefit from advanced functionalities like spend analytics, e-sourcing, and supplier management. By outsourcing procurement, SMEs can digitize their procurement operations and improve visibility and control over spending, which are increasingly important in a digital-first business environment.

Vertical Insights

The manufacturing segment dominated the market and accounted for the largest revenue share in 2024, driven by integrating digital technologies in manufacturing supply chains, linked to Industry 4.0 initiatives. Manufacturers are adopting automation, IoT, and data analytics to improve production efficiency, and these technologies are also being extended to procurement. PaaS providers offer advanced digital procurement tools such as AI-powered spend analysis, supplier performance dashboards, and real-time inventory integration, which allow manufacturers to align procurement with production schedules and optimize sourcing decisions. This digital alignment ensures the timely availability of materials while minimizing excess inventory and procurement delays, both critical to production continuity.

The IT & telecom segment is expected to grow significantly over the forecast period. Complex regulatory environments and compliance requirements are driving the adoption of PaaS in IT and telecom. These sectors are required to adhere to stringent data security, privacy laws, and industry-specific standards, which complicate supplier evaluation and contract management. Procurement as a service provider brings specialized knowledge and automated compliance monitoring tools that help companies navigate these challenges while maintaining audit readiness. This reduces legal risks and streamlines vendor onboarding and ongoing governance, which is particularly valuable for multinational IT and telecom firms operating across multiple jurisdictions.

Regional Insights

North America dominated the market and held a revenue share of over 44.6% in 2024, driven by the increasing adoption of AI-driven procurement solutions, particularly in automating supplier risk assessment and contract management. Large enterprises are outsourcing procurement to optimize costs and enhance agility, supported by cloud-based platforms from providers like IBM, GEP, and Accenture.

U.S. Procurement As A Service Market Trends

The procurement as a service market in the U.S. is expected to grow significantly at a CAGR of 14.5% from 2025 to 2033 due to strong digital infrastructure and high demand for spend analytics. Companies are leveraging predictive analytics to reduce procurement cycle times. Government initiatives promoting supply chain resilience and the rise of ESG-compliant procurement further accelerate adoption.

Europe Procurement As A Service Market Trends

The procurement as a service market in Europe is anticipated to grow considerably from 2025 to 2033. Europe’s PaaS expansion is fueled by strict regulatory compliance requirements (e.g., GDPR, CSDDD), which push firms toward transparent, automated procurement. The region also sees growth in sustainable procurement solutions, with businesses prioritizing carbon footprint tracking in supplier selection.

The UK procurement as a service market is expected to grow rapidly in the coming years, owing to the post-Brexit supply chain restructuring. Businesses are adopting PaaS for dynamic supplier diversification and real-time spend visibility. The push for ethical sourcing in public-sector procurement also drives demand.

The procurement as a service market in Germany held a substantial market share in 2024 due to the growing integration of Industry 4.0 principles, where smart procurement tools sync with IoT-enabled supply chains. Mid-sized manufacturers are outsourcing procurement to improve efficiency amid skilled labor shortages.

Asia Pacific Procurement As A Service Market Trends

The procurement as a service market in Asia Pacific is expected to be the fastest-growing region, registering the highest CAGR of 15.4% from 2025 to 2033, due to the rapid digitalization of SMEs, particularly in e-commerce-driven procurement. The region also sees increased cross-border trade automation, with platforms enabling seamless supplier collaboration across emerging markets.

Japan procurement as a service market is expected to grow rapidly in the coming years, driven by aging workforce challenges, prompting firms to automate procurement processes. The government’s Society 5.0 initiative further encourages AI and robotics in supply chain management.

The procurement as a service market in China held a substantial market share in 2024, due to government-backed digital transformation policies, with firms integrating blockchain for supplier verification. The Dual Circulation strategy also boosts domestic procurement outsourcing to reduce reliance on foreign suppliers.

Key Procurement As A Service Company Insights

Key players operating in the procurement as a service industry are Accenture, Genpact, GEP, IBM Corporation, and WNS (Holdings) Limited. The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Accenture and SAP SE partnered to help businesses accelerate digital transformation by enabling connected intelligence across the enterprise in the AI era. Their ADVANCE initiative combines SAP’s integrated business suite, advanced applications, data, and AI with Accenture’s deep industry knowledge and implementation expertise. Together, they offer preconfigured, AI-driven cloud solutions to modernize finance, procurement, supply chain, and workforce operations.

-

In April 2025, Infosys Limited announced a definitive agreement to acquire MRE Consulting Ltd., a technology and business consulting firm, to enhance its capabilities in trading and risk management within the energy sector. The acquisition aims to strengthen Infosys Limited's offerings in advanced procurement solutions, particularly in energy procurement, commodity trading, and supply chain risk management. MRE’s proprietary E/CTRM frameworks will enable faster vendor selection, streamlined solution design, and efficient implementation, boosting supply chain transparency and operational agility.

Key Procurement As A Service Companies:

The following are the leading companies in the procurement as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Aegis Components

- Capgemini

- Genpact

- GEP

- HCL Technologies Limited

- Infosys Limited

- IBM Corporation

- TATA Consultancy Services Limited

- Wipro

- WNS (Holdings) Limited

Procurement As A Service Market Report Scope

Report Attribute

Details

Market size in 2025

USD 7.53 billion

Revenue forecast in 2033

USD 22.10 billion

Growth Rate

CAGR of 14.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

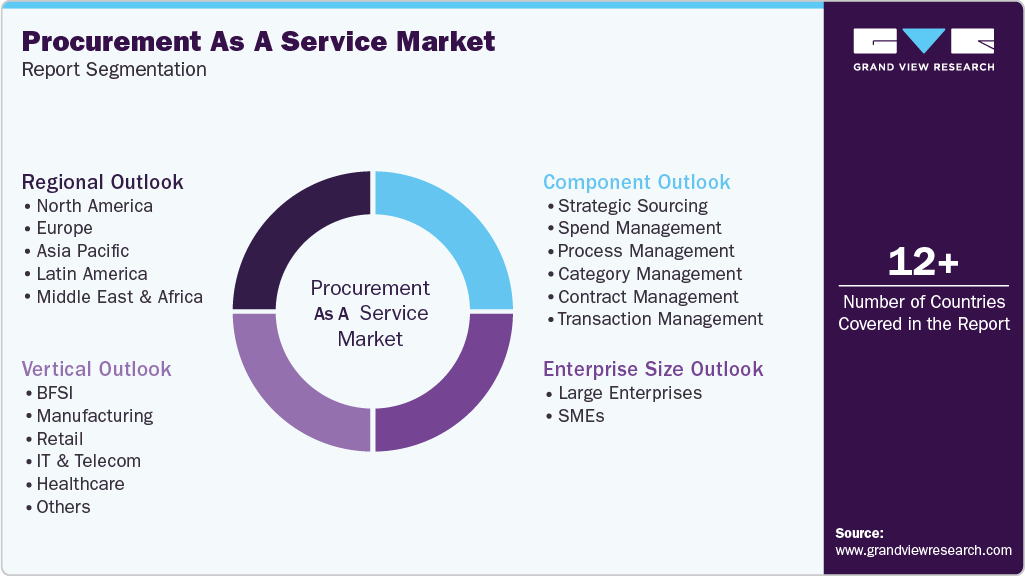

Segments covered

Component, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Accenture; Aegis Components; Capgemini; Genpact; GEP; HCL Technologies Limited; Infosys Limited; IBM Corporation; TATA Consultancy Services Limited; Wipro; WNS (Holdings) Limited

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Procurement As A Service Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global procurement as a service market report based on component, enterprise size, vertical, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Strategic Sourcing

-

Spend Management

-

Process Management

-

Category Management

-

Contract Management

-

Transaction Management

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

Manufacturing

-

Retail

-

IT & Telecom

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. North America dominated the market and held a revenue share of over 44.6% in 2024, driven by the increasing adoption of AI-driven procurement solutions, particularly those that automate supplier risk assessment and contract management.

b. Some key players operating in the procurement as a service market include Accenture, Aegis Components, Capgemini, Genpact, GEP, HCL Technologies Limited, Infosys Limited, IBM Corporation, TATA Consultancy Services Limited, Wipro, WNS (Holdings) Limited

b. Key factors driving the procurement as a service market growth include increasing demand among businesses across industries for cost optimization, operational efficiency, and strategic sourcing. Organizations are increasingly recognizing the need to outsource procurement functions to expert third-party providers to reduce procurement costs, streamline operations, and gain access to advanced procurement technologies.

b. The global procurement as a service market size was estimated at 6.89 billion in 2024 and is expected to reach USD 7.53 billion in 2025.

b. The global procurement as a service market is expected to grow at a compound annual growth rate of 14.4% from 2025 to 2033 to reach USD 22.10 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.