- Home

- »

- Water & Sludge Treatment

- »

-

Produced Water Treatment Market Size & Share Report 2030GVR Report cover

![Produced Water Treatment Market Size, Share & Trends Report]()

Produced Water Treatment Market Size, Share & Trends Analysis Report By Treatment (Physical Treatment, Chemical Treatment, Biological Treatment), By Application (Onshore, Offshore), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-273-0

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Produced Water Treatment Market Trends

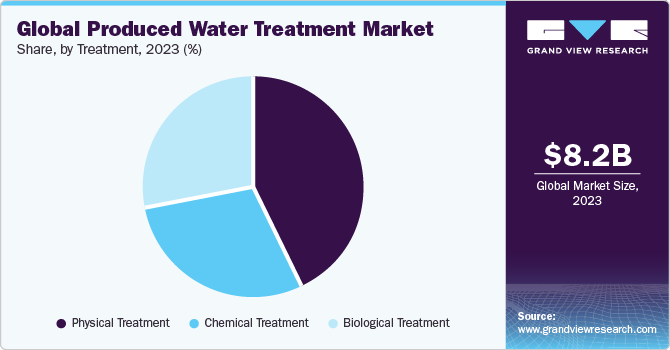

The global produced water treatment market size was estimated at USD 8.16 billion in 2023 and is anticipated to grow at a CAGR of 7.8% from 2024 to 2030. The market is expanding as a result of the growing exploration of oil & gas globally. The rising urbanization and population growth is responsible for surging demand for fossil fuels such as crude oil and natural gas mainly from the transportation and industrial activities. In order to fulfill the demand and reduce the supply demand gap, companies and governments are carrying new onshore and offshore exploration activities, thereby driving the market growth. Produced water is generated as a byproduct of oil and gas exploration and production operations. In the oil and gas industry, produced water is treated using various primary, secondary, and tertiary separation procedures to remove oil droplets, sediments, mud particles, heavy metal particles, salts, hydrocarbons, and other organic compounds.

The produced water generated during the oil and gas exploration is either discharged into the environment such as water bodies or disposed of through saltwater disposal wells, or lined evaporation pits. The introduction of stringent regulations in order to protect the environment, the produced water needs to be treated before releasing into the environment. For instance, in the U.S., Environment Protection Agency (EPA) regulation mandates that any discharge of produced water to the sea must not have oil content higher than 15 mg/liter.

Such regulations have become more stringent due to the increased water scarcity aggravated by the climate change and rising environmental concerns across the world. According to the United Nations, by 2030, approximately 700 million people could be affected by the intense water scarcity. Hence, the installation of produced water treatment solutions at the onshore as well as offshore locations is likely to rise over the forecast period.

Furthermore, increased oil & gas drilling activities around the world is likely to result in a massive amount of produced water. Various chemicals used in drilling activities also interact with water, making it more hazardous to the environment. As a result, it is critical to clean the produced water. For instance, in December 2023, in Guyana, ExxonMobil submitted the sixth development plan in the exploration and drilling program. Guyana’s EPA has approved a significant well exploration project comprising 35 wells which is slated to occur between 2023 and 2027. These factors are expected to drive the demand for offshore & onshore drilling activities, thereby driving the demand for the produced water treatment systems.

Governments of various countries are investing to increase domestic oil and gas production and reduce the dependency on imported fossil fuels such as crude oil & natural gas. For instance, India's Ministry of Petroleum and Natural Gas has outlined plans to drill 60 new wells in the 2024 fiscal year, with a focus on Assam and Arunachal Pradesh. This initiative aims to explore domestic resources and potentially reduce the country's dependence on imported fossil fuels. Such initiatives by the governments are increasing the number of oil & gas exploration activities and thereby boosting the demand for the produced water treatment over the forecast period.

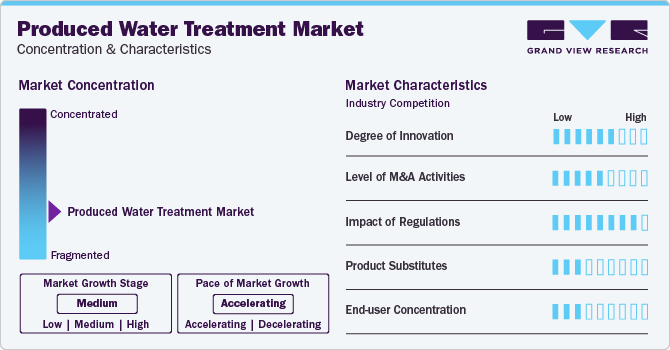

Market Concentration & Characteristics

Market growth stage is medium and the pace of growth is accelerating. The market is characterized by a high degree of innovation, which is attributable to the rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

Stringent environmental regulations governing the disposal and treatment of produced water, particularly in industries like oil and gas, are driving the demand for innovative treatment solutions. These regulations mandate the reduction of harmful contaminants and the protection of ecosystems, spurring investment in advanced treatment technologies such as membrane filtration, electrocoagulation, and chemical treatment processes. Compliance with these regulations necessitates continual innovation and adoption of efficient, cost-effective treatment methods, stimulating market competition and driving research and development efforts.

The degree of innovation within the market is significantly influenced by various factors, including technological advancements, market demand, and regulatory requirements. Furthermore, increasing awareness of water scarcity and environmental concerns fuels market demand for innovative solutions that minimize freshwater usage, reduce energy consumption, and mitigate environmental impact. This demand, coupled with regulatory mandates, fosters a competitive landscape where companies strive to differentiate themselves through technological innovation.

The end-user concentration for the produced water treatment industry, particularly in industries like oil and gas, significantly influences market dynamics and innovation. Low to moderate concentration among major operators and service providers fosters strategic partnerships, driving the development of tailored solutions to meet specific industry needs. This concentration can create barriers to entry for new competitors while incentivizing existing players to continuously innovate to maintain competitiveness. Conversely, a fragmented end-user market may offer opportunities for niche players to enter with specialized solutions. Understanding the distribution and preferences of end-users is essential for companies navigating this market, as it directly impacts their ability to innovate and capture market share.

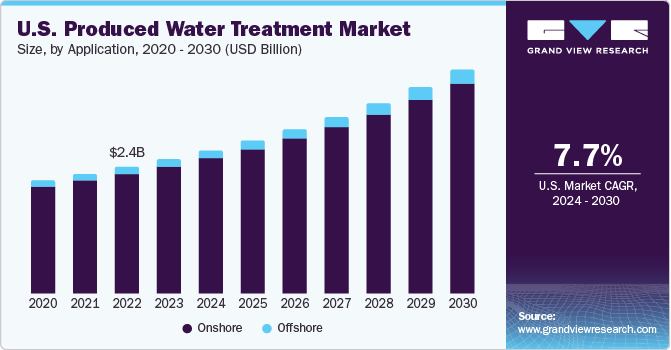

Application Insights

The on-shore application segment accounted for more than 71% of the global revenue share in 2023. Produced water is a waste stream that occurs during onshore oil and gas exploration and production when water is drawn up from the reservoir along with the oil/gas. The treatment can include physical, chemical, and biological approaches, as well as a combination of these, for onshore activities, although biological treatment technologies are frequently unsuitable for offshore operations owing to their huge environmental footprint.

The offshore application segment is expected to witness a lucrative CAGR over the forecast period. Offshore produced water can be re-injected into reservoirs, or discharged to the sea after appropriate treatment, or carried onshore for appropriate treatment and disposal. For instance, in July 2023, Egypt announced a plan to invest USD 8.1 billion in offshore gas exploration. Within this investment, the country is expected to drill approximately 35 exploratory gas wells until July 2025. Furthermore, in December 2023, Shell announced a USD 5 billion plan to invest in Nigeria’s offshore oil production. In addition, the company has pledged to spend USD 1 billion over five to ten years to raise the natural gas output in Nigeria. Such developments across the globe likely to positively impact the growth of the demand for offshore produced water treatment over the forecast period.

Treatment Insights

The physical treatment segment held the largest revenue share in 2023. Technological advancements in physical treatment methods, such as membrane filtration, electrocoagulation, and flotation, have enhanced treatment efficiency and reliability, further driving adoption. Moreover, the cost-effectiveness and simplicity of physical treatment technologies compared to chemical or biological methods make them attractive options for end-users. Furthermore, the versatility of physical treatment processes in handling a wide range of contaminants and varying water compositions contributes to their widespread adoption.

The chemical treatment segment is anticipated to showcase lucrative growth from 2024 to 2030. Chemical treatments offer versatility in targeting a wide range of contaminants, including oil, grease, heavy metals, and organic compounds, making them indispensable in addressing complex water composition challenges. Moreover, the scalability and adaptability of chemical treatment processes allow for customization according to specific treatment needs and varying water quality parameters. Additionally, ongoing advancements in chemical treatment formulations and delivery systems enhance treatment efficacy, efficiency, and environmental compatibility, further fueling market growth.

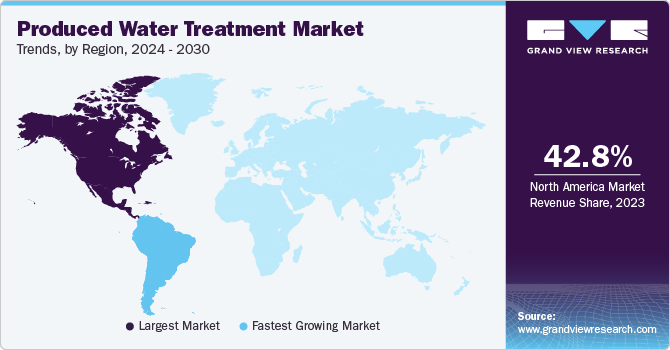

Regional Insights

North America dominated the market and accounted for a share of 42.8% in 2023. Strong presence of crude oil reserves in the U.S. and Canada is expected to increase the usage of water management services. Primarily, the region's booming oil and gas industry, particularly in the U.S. and Canada, generates substantial volumes of produced water as a byproduct of extraction processes. This abundance of produced water necessitates efficient treatment solutions to meet stringent environmental regulations and ensure compliance. Moreover, increasing concerns over water scarcity and contamination further emphasize the importance of treating produced water before disposal or reuse.

U.S. Produced Water Treatment Market Trends

The market in the U.S. held the largest share in 2023 in terms of revenue owing to the rising oil & gas exploration, stricter environmental regulations, and advancements in treatment technologies like membrane filtration and desalination.

Europe Produced Water Treatment Market Trends

The produced water treatment market in Europe was the second-largest regional segment in 2023. New regulations are being implemented to incentivize companies to adopt advanced water treatment technologies. Government bodies and regulatory agencies, such as the European Water Association, are actively involved in formulating policies and regulations aimed at limiting the disposal of untreated produced water.

The Russia produced water treatment market is expected to grow significantly. Russia’s oil and gas industry generates significant volumes of produced water as a byproduct of extraction operations, and the country has stringent environmental regulations governing its treatment and disposal.

The produced water treatment market in the UK is expected to grow significantly. The UK adheres to the OSPAR Convention, which sets strict limits on oil and gas discharges. This incentivizes operators to invest in effective treatment technologies to comply, driving market growth.

Asia Pacific Produced Water Treatment Market Trends

The produced water treatment market in Asia Pacific is anticipated to witness significant growth from 2024 to 2030. As industrial activities, including oil and gas production, continue to expand across APAC countries, the volume of produced water generated is also increasing. This surge in production necessitates effective treatment solutions to meet stringent environmental regulations and ensure sustainable water management practices.

The China produced water treatment market is estimated to grow at a significant CAGR over the forecast period. The country's rapid industrialization and expanding oil and gas exploration activities have led to a significant increase in the volume of produced water generated.

Central & South America Produced Water Treatment Market Trends

The produced water treatment market in Central & South America is estimated to grow rapidly over the coming years owing to the rising oil & gas exploration and production activity, particularly in pre-salt fields of Brazil and offshore Guyana.

The Brazil produced water treatment market is expected to grow at a significant CAGR over the forecast period due to the increasing need for efficient treatment solutions to manage and mitigate the environmental impact of produced water disposal.

Middle East & Africa Produced Water Treatment Market Trends

The produced water treatment market in Middle East & Africa is growing due to the rising oil & gas exploration and production activity, particularly in Saudi Arabia, UAE, Iraq, and Angola.

The Saudi Arabia produced water treatment market is expected to grow at a lucrative rate due to increased exploration and production activities, particularly in onshore fields which is expected to demand advanced water treatment solutions.

Key Produced Water Treatment Company Insights

The market is fragmented with various global and regional product manufacturers offering innovative systems and technologies. Various industry participants' strategies typically involve new product development, product upgrades, and expansions to boost market penetration and respond to the changing technical needs of the application industries. The major players form technical partnerships to innovate and develop novel product lines, therefore expanding their consumer base. In addition, evolving consumer preferences along with quality requirements, as well as energy efficiency, are projected to offer new opportunities for key participants in the coming years.

Key Produced Water Treatment Companies:

The following are the leading companies in the produced water treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Weatherford International

- Halliburton Company

- NOV

- Enviro-Tech Systems

- Baker Hughes

- Mineral Technologies, Inc.

- TechipFMC plc

- Alderley plc

- CETCO

- Ovivo

- Veolia Environnement S.A.

- Schlumberger Limited

- Cannon Artes S.p.A.

Recent Developments

-

In February 2024, LiqTech International, Inc. partnered with Razorback Direct Oilfield Solutions and Services LLC to distribute LiqTech’s produced water treatment filtration solution. This collaboration aims to commercialize the solution for re-injection, reuse, and lithium harvest across five states in the U.S., namely Texas, Oklahoma, Louisiana, Ohio, and Pennsylvania.

-

In November 2022, LiqTech International, Inc., a company specializing in clean technology and the production of specialized filtration products and systems, entered into a distribution agreement with National Energy Services Reunited Corp. The collaboration seeks to market LiqTech's produced water treatment filtration solution for reinjection across fifteen chosen countries in the Middle East, Northern Africa, and Southeastern Asia.

Produced Water Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.71 billion

Revenue forecast in 2030

USD 13.71 billion

Growth rate

CAGR of 7.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Norway; UK; Italy; Netherlands; Denmark; Russia; China; India; Indonesia; Malaysia; Australia; Brazil; Venezuela; Argentina; Saudi Arabia; Iran; Iraq; Algeria; Kuwait; UAE; Nigeria

Key companies profiled

Weatherford International; Halliburton Company; NOV; Enviro-Tech Systems; Baker Hughes; Mineral Technologies, Inc.; TechnipFMC plc; Alderley plc; CETCO; Ovivo; Veolia Environment S.A.; Schlumberger Limited; Cannon Artes S.p.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Produced Water Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the produced water treatment market report based on treatment, application, and region:

-

Treatment Outlook (Revenue, USD Million; 2018 - 2030)

-

Physical Treatment

-

Filtration

-

Flotation

-

Other

-

-

Chemical Treatment

-

Precipitation

-

Oxidation

-

Other

-

-

Biological Treatment

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Norway

-

UK

-

Italy

-

The Netherlands

-

Denmark

-

Russia

-

Asia Pacific

-

China

-

India

-

Indonesia

-

Malaysia

-

Australia

-

Central & South America

-

Brazil

-

Venezuela

-

Argentina

-

Middle East & Africa

-

Saudi Arabia

-

Iran

-

Iraq

-

Algeria

-

Kuwait

-

UAE

-

Nigeria

-

Frequently Asked Questions About This Report

b. The global produced water treatment market size was estimated at USD 8.16 billion in 2023 and is expected to reach USD 8.71 billion in 2024.

b. The global produced water treatment market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 13.71 billion by 2030.

b. North America dominated the produced water treatment market with a revenue share of 42.8% in 2023. Strong presence of crude oil reserves and high adoption of water treatment in the U.S. and Canada is expected to increase attributed to the increased demand for produced water treatment market.

b. Some of the key players operating in the produced water treatment market include Weatherford International, Halliburton Company, NOV, Enviro-Tech Systems, Baker Hughes, Mineral Technologies, Inc., TechnipFMC plc, Alderley plc, CETCO, Ovivo, and among others.

b. The key factors that are driving the produced water treatment market are the increasing demand for fossil fuels and crude oil & natural gas production driven by the rapid urbanization and population growth, stringent regulations, and rising environmental concerns across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."