- Home

- »

- Medical Devices

- »

-

Prosthetics And Orthotics Market Size, Industry Report, 2030GVR Report cover

![Prosthetics And Orthotics Market Size, Share & Trends Report]()

Prosthetics And Orthotics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Orthotics (Upper Limb, Lower Limb, Spinal), Prosthetics (Upper Extremity, Lower Extremity), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-553-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Prosthetics and Orthotics Market Summary

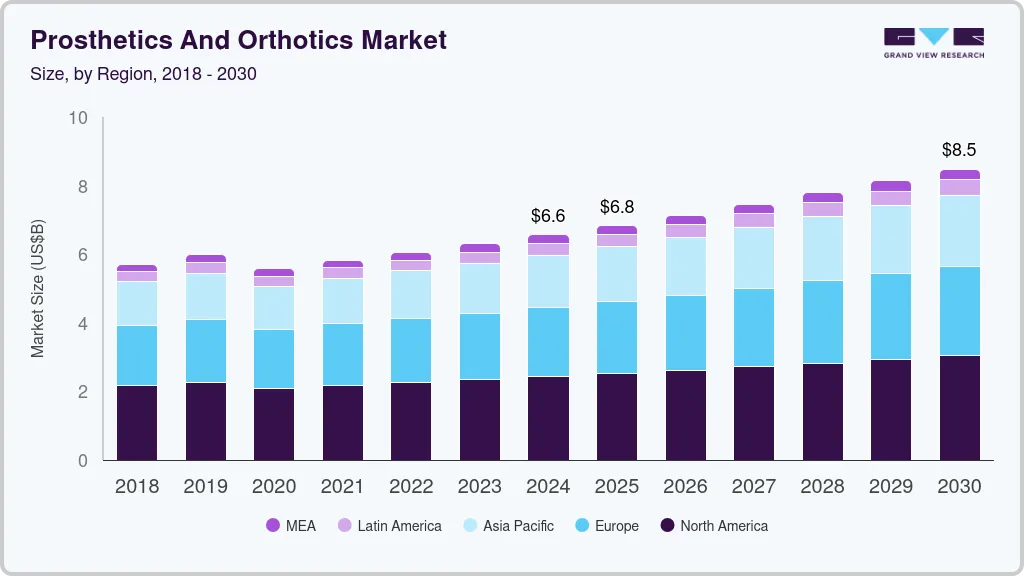

The global prosthetics and orthotics market size was estimated at USD 6.56 billion in 2024 is projected to reach USD 8.48 billion by 2030, growing at a CAGR of 4.4% from 2025 to 2030. The market is driven by several key factors, including the rising incidence of sports injuries, road accidents, and diabetes-related amputations, along with technological advancements in prosthetic and orthotic solutions.

Key Market Trends & Insights

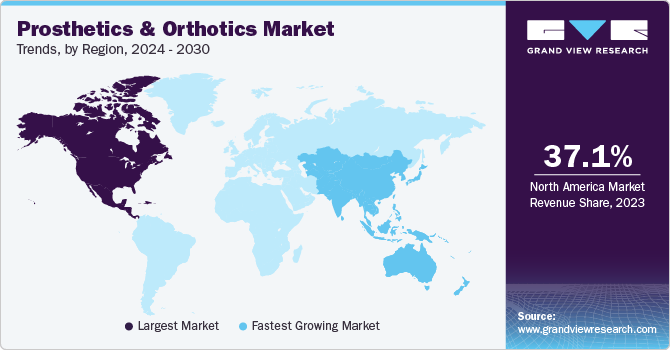

- The North America prosthetics and orthotics industry led the global industry in 2024, capturing the largest revenue share of 40%.

- The U.S. prosthetics and orthotics industry is anticipated to grow significantly over the forecast period.

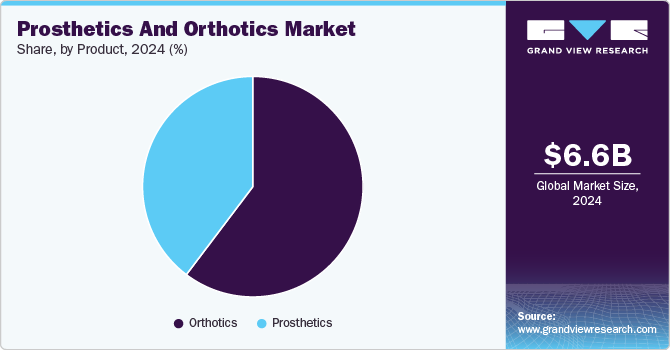

- By product, the orthotics segment dominated the market and accounted for the largest revenue share in 2024.

- By type, the prosthetics segment is expected to grow at the fastest CAGR over the projected period.

- By technology, advancements in 3D printing and myoelectric prosthetics are driving market growth.

Market Size & Forecast

- 2024 Market Size: USD 6.56 Billion

- 2030 Projected Market Size: USD 8.48 Billion

- CAGR (2025-2030): 4.4%

- North America: Largest market in 2024

- Europe: Fastest growing market

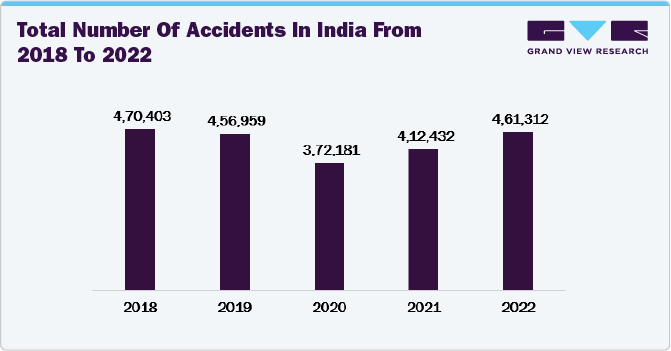

Moreover, rise in incidence of road accidents drives the market growth. For instance, according to data published by the World Health Organization (WHO), around 1.19 million people die annually due to road traffic crashes, and around 20-50 million people across the globe are injured or disabled owing to road accidents. Similarly, according to the Ministry of Road Transport and Highways, around 4, 61,312 road accidents were reported in India in 2022. Such factors are fueling market growth.

Furthermore, rise in the number of diabetes-related amputations fuels the industry growth. Individuals living with diabetes are at a higher risk of developing foot complications due to nerve damage, which can lead to chronic ulcers and amputation. Diabetes-related foot complications are one of the most common and severe complications that affect people with diabetes across the globe. Several studies have shown that the risk of amputation could be up to 25 times higher for people with diabetes than a person without the condition. For instance, according to the American Diabetes Association in the U.S., annually, approximately 154,000 people with diabetes undergo amputation, and diabetes complications cause 80% of non-traumatic lower limb amputations.

Technological advancement in orthotics & prosthetics is expected to boost the industry growth over the forecast period. 3D printed prosthetics by Limb Forge are expected to gain market penetration in developing regions due to their cost-effectiveness and ease of usage. For instance, in July 2023, WillowWood introduced the Fiberglass META Shock X, featuring the company’s META-Unibody platform and a build height of just under 5.5 inches, thus offering several fitting options for various limb lengths.

In addition, in June 2022, Ottobock introduced the C-Leg 4 knee prosthetic. This new model boasts a deep-sleep mode to conserve battery power and a redesigned charger that can be used with one hand for added convenience. It has been designed to perform various functions, including improved stance release, assisted descent on stairs and ramps, better support while sitting down, and 'Stumble Recovery Plus.' All these functions can be adjusted and controlled via the company's 'Cockpit' app.

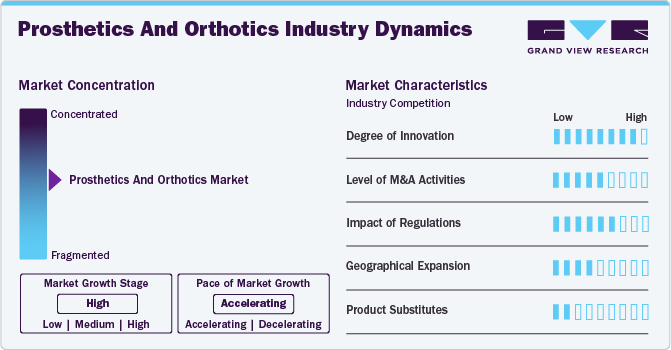

Market Concentration & Characteristics

The industry is characterized by a high degree of innovation due to rapid technological advancements. For instance, in February 2022, Össur introduced its ‘POWER KNEE,’ a microprocessor prosthetic knee designed for people facing above-knee amputation or limb difference. The company has used a motor-powered “smart” prosthesis, which leverages advanced algorithms for detecting patterns in human movement, thus adjusting and learning the user’s rhythm and speed in real time. Furthermore, in October 2022, researchers from Brown University and the Massachusetts Institute of Technology developed sophisticated ways to monitor muscle movements by using a simple set of magnets to make it easier for people with amputations to control their prosthetic limbs.

The industry is characterized by a medium level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to access new technologies in a rapidly growing market. For instance, in August 2022, Össur acquired Naked Prosthetics, a Washington-based company that provides finger prostheses. The acquisition aims to fulfill the needs of the growing number of patients with finger and partial hand loss. In addition, it helps Össur to strengthen its upper limb product portfolio globally.

The structured regulatory framework for prosthetics and orthotics solutions positively impacts industry growth. Data published by WHO reported that according to the Convention on the Rights of Persons with Disabilities (CRPD), Member States must implement effective measures for ensuring personal mobility and promoting accessibility to mobility devices and assistive technologies, including orthoses and prostheses. Over 170 countries have ratified the CRPD since 2006, making it mandatory to ensure availability and affordability of high-quality assistive products such as prostheses and orthoses. In addition, the Therapeutic Goods Administration (TGA) regulates prosthetics and orthotic devices in Australia.

Several industry players are adopting this strategy to expand their product portfolio and market their products in different regions. For instance, in January 2023, WillowWood Global LLC, a manufacturer and distributor of prosthetic products, partnered with Reboocon Bionics B.V., a manufacturer of the motorized prosthetic knee. This partnership focused on distribution of products in the U.S. market and R&D collaboration to advance prosthetics technology.

Several industry players and research institutes are developing robotic arms which can be used as prosthetics. For instance, in May 2022, University of Minnesota Twin Cities researchers collaborated with industry players. This new development in robotics has enabled amputees to control a robotic arm using their brain signals instead of relying on muscle movements.

Product Insights

The orthotics segment accounted for largest revenue share of over 60% in 2024. Growth of this segment is attributed to rising prevalence of osteoarthritis, increasing incidences of sports injuries, and growing penetration of orthopedic technology. For instance, according to data published by the Institute for Health Metrics and Evaluation in August 2023, 15% of people aged 30 and above suffer from osteoarthritis. It is projected osteoarthritis is expected to affect approximately 1 billion people by 2050. Orthotics segment is further segmented into upper limb, lower limb, and spinal. Upper limb orthotics accounted for the largest share owing to various benefits, such as reduced pain and rapid recovery in terms of movement.

Prosthetics segment is expected to register the fastest CAGR from 2025 to 2030. An increase in the disability rate globally is expected to drive the market over the forecast period. For instance, according to WHO, around 1.3 billion people experience significant disability, which accounts for 16% of the global population. Furthermore, approximately 42.5 million Americans are living with disabilities, which represents 13% of the civilian noninstitutionalized population, based on data from the U.S. Census Bureau in 2021. Thus, rise in number of disabled people fuels demand for prosthetics and orthotic devices.

Regional Insights

North America prosthetics and orthotics market dominated the global market with a revenue share of 37.0% in 2024. This growth can be attributed to well-established healthcare infrastructure, increasing R&D investments by companies, and favorable reimbursement policies. Moreover, the rising prevalence of osteosarcoma and increasing incidences of sports injuries are expected to drive market growth. Moreover, the focus of the U.S. healthcare system on the quality of care and value-based services has led to a favorable market environment for prosthetics & orthotics. For instance, in August 2023, LIMBER Prosthetics & Orthotics, Inc., a San Diego startup company, received an investment of USD 388 thousand to develop their prosthetics & orthotics products.

U.S. Prosthetics And Orthotics Market Trends

The prosthetics and orthotics market in the U.S. held the largest revenue share in 2024. Growing government initiatives and the rising launch of educational programs in the country boost the market growth. For instance, in June 2024, East Tennessee State University launched its orthotics and prosthetics program to meet the rising demand for certified prosthetists and orthotists nationally. Similarly, in January 2023, Steeper Group launched the LIMB-art Prosthetic Leg Covers for its lower limb portfolio, featuring unique designs and customizations to increase patient self-esteem and confidence. The covers are available in 4 models -Vent, Core, Wave, and Ultralight - and weigh less than 250 gm each. Moreover, they have been manufactured using high-grade Nylon, which imparts toughness and flexibility to the product.

Europe Prosthetics And Orthotics Market Trends

Europe prosthetics and orthotics market is anticipated to register the fastest growth rate during the forecast period. The region's strong focus on research and development fosters continuous innovation in prosthetics and orthotics technologies, enhancing product efficacy and patient outcomes. Furthermore, robust regulatory frameworks and favorable healthcare policies ensure the quality and safety of prosthetics and orthotics, thereby increasing their market growth.

The prosthetics and orthotics market in Germany is anticipated to register a considerable growth rate during the forecast period. The rising road accident cases in the country contribute to increased demand for prosthetics and orthotics. For instance, according to Statistisches Bundesamt (Destatis), in Germany, around 21,600 individuals were injured in road traffic accidents in February 2023.

The UK prosthetics and orthotics market is anticipated to register a considerable growth rate during the forecast period, owing to a rise in research and development activities. For instance, in October 2024, the University of the West of England (UWE) Bristol developed a technologically advanced prosthetic leg for individuals with above-knee amputations.

Asia Pacific Prosthetics And Orthotics Market Trends

The Asia Pacific prosthetics and orthotics market is anticipated to witness the fastest growth over the forecast periodowing to sports-related injuries and road accidents. The rapidly developing healthcare infrastructure in major countries, such as India, China, & Japan, and the booming medical tourism industry are propelling demand for these devices in the region.

The prosthetics and orthotics market in Australia is anticipated to witness fastest growth. An increasing number of diabetes-related amputations, a rise in number of road accidents, growing funds, and supportive government initiatives drive the regional market growth. For instance, according to the Medical Technology Association of Australia, in the 2021-2022 Federal Budget, the Government has announced AUD 22 million (USD 14.52 million) to bring reforms to the Prostheses List. These reforms aim to gradually decrease the Prostheses List benefits in accordance with the public prices for prostheses. The reforms aimed to ensure that patients have the right to choose their clinician and have access to prosthetic devices.

Latin America Prosthetics And Orthotics Market Trends

Latin America prosthetics and orthotics market is witnessing steady growth due to the increasing awareness regarding the availability and benefits of prosthetics and orthotics for patients and healthcare professionals. Moreover, the rise in diabetic foot amputation cases in this region further drives market growth.

The prosthetics and orthotics market in Brazil is anticipated to register a considerable growth rate during the forecast period. The country's increasing focus on sports and physical activity is fueling market growth. Moreover, the key market players are developing lightweight, technologically advanced, and long-lasting prosthetics to meet users' needs.

Middle East and Africa Prosthetics And Orthotics Market Trends

The Middle East and Africa prosthetics and orthotics market is witnessing lucrative growth. Substantial economic development in the region is one of the major factors attracting international investments. The presence of major players, along with the constantly developing technologies, is further boosting market growth.

The prosthetics and orthotics market in South Africa is anticipated to register a considerable growth rate during the forecast period. The use of biosensor technology, better materials, non-invasive methods, and other tools are behind the rapidly evolving field of prosthetics and orthotics. These advanced technologies are still being developed and tested and are attributed to revolutionizing the country's market.

Key Prosthetics And Orthotics Company Insights

Key participants in the industry are focusing on developing innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Prosthetics And Orthotics Companies:

The following are the leading companies in the prosthetics and orthotics market. These companies collectively hold the largest market share and dictate industry trends.

- Ossur

- Blatchford Limited

- Fillauer LLC

- Ottobock

- WillowWood Global LLC.

- Ultraflex Systems Inc.

- Steeper Group

- Bauerfeind

- Aether Biomedical

- Mobius Bionics

Recent Developments

-

In May 2024, Medical technology firm Ottobock introduced an advanced mechanical prosthetic foot to the global market. The Evanto foot balances dynamics, flexibility, and stability for the first time, marking a significant prosthetic breakthrough.

-

In March 2024, NIPPON EXPRESS HOLDINGS, INC. announced that it had invested in Instalimb, Inc., a company growing its 3D-printed prosthetics operations internationally in the Philippines, India, and other locations. This acquisition occurred as part of the NX Global Innovation Fund in February 2024.

-

In June 2023, Fillauer launched the Myo/One Electrode system, designed in partnership with Coapt. It is a streamlined, waterproof solution with one preamplifier providing two EMG signal channels for myoelectric devices and replaces fabrication aids, sealing rings, cables, and other devices with a cable.

-

In May 2023, WillowWood announced the release of the Alpha Control Liner System, an innovative prosthetic liner with embedded electronics, in partnership with Coapt. The system is of advantage to people using a myoelectric prosthesis, as it enables a more consistent and comfortable electrode contact with the skin, leading to enhanced functional control. Coapt’s Complete Control system leverages machine learning to understand user intentions and control prosthesis actions.

-

In March 2023, Steeper Group announced that it had joined the Eqwal Group, with the latter acquiring 100% of the shares in Steeper Group. The Eqwal Group has its headquarters in Toulouse, France, and is a global patient care services provider in prosthetics and orthotics. Through this development, Steeper Group aims to strengthen its clinical offerings in the United Kingdom and deliver innovative products and services.

Prosthetics And Orthotics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.84 billion

Revenue forecast in 2030

USD 8.48 billion

Growth rate

CAGR of 4.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Össur; Blatchford Limited; Fillauer LLC; Ottobock, WillowWood; Global LLC.; Ultraflex Systems Inc.; Steeper Group; Bauerfeind; Aether Biomedical; Mobius Bionics

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Prosthetics And Orthotics Market Report Segmentation

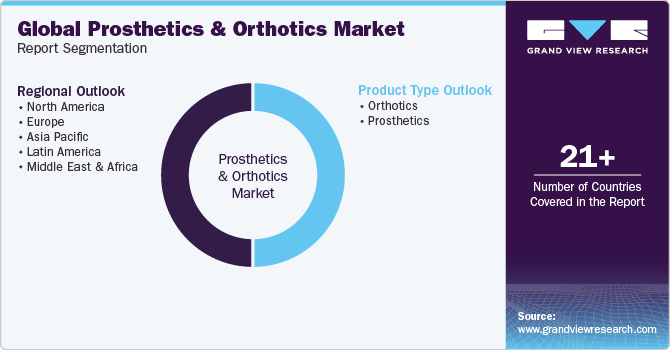

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global prosthetics and orthotics market report based on product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthotics

-

Upper limb

-

Lower limb

-

Spinal

-

-

Prosthetics

-

Upper Extremity

-

Lower Extremity

-

Liners

-

Sockets

-

Modular Components

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global prosthetics and orthotics market size was estimated at USD 6.56 billion in 2024 and is expected to reach USD 6.84 billion in 2025.

b. The global prosthetics and orthotics market is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2030 to reach USD 8.48 billion by 2030.

b. The orthotics segment held the dominant revenue share of 60.3% in the global prosthetics and orthotics market in 2024. This is attributed to the increased incidences of road accidents and the technological advancement in orthotics & prosthetics.

b. North America led the global market for prosthetics and orthotics with a revenue share of over 37.0% in 2024.

b. Some key players operating in the prosthetics & orthotics market include Össur, Blatchford Limited, Fillauer LLC, Ottobock, WillowWood Global LLC., Ultraflex Systems Inc., Steeper Group, Bauerfeind, Aether Biomedical, and Mobius Bionics.

b. Key factors that are driving the prosthetics & orthotics market growth include the increased incidences of sports injuries and the increasing prevalence of osteosarcoma across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.