- Home

- »

- Biotechnology

- »

-

Protein Binding Assays Market Size & Share Report, 2030GVR Report cover

![Protein Binding Assays Market Size, Share & Trends Report]()

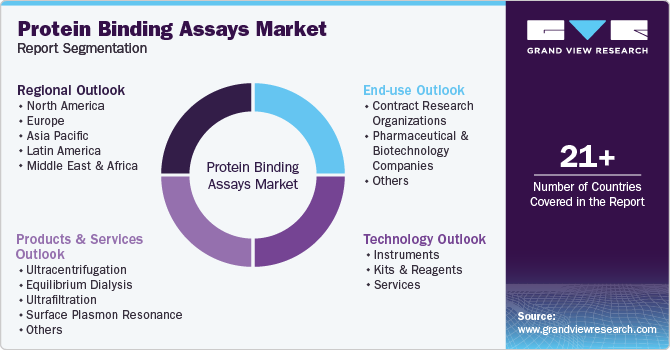

Protein Binding Assays Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Ultrafiltration, Ultracentrifugation), By Product & Services (Instrument), By End Use (CROs), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-593-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Protein Binding Assays Market Summary

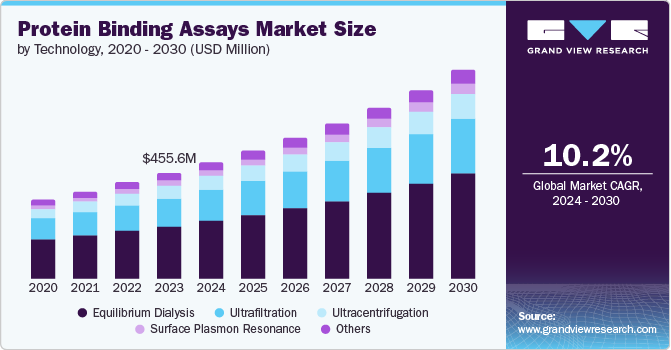

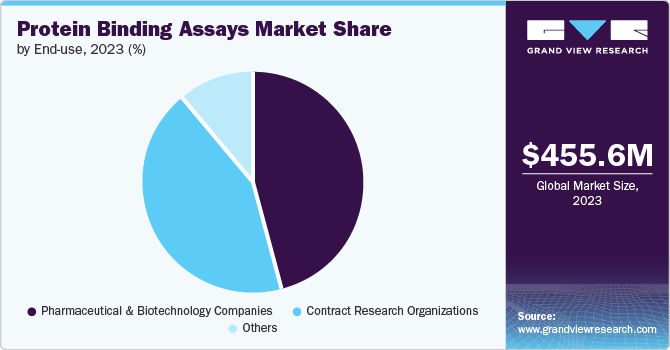

The global protein binding assays market size was estimated at USD 455.6 million in 2023 and is projected to reach USD 896.3 million by 2030, growing at a CAGR of 10.2% from 2024 to 2030. Protein binding assays from biochemistry and molecular biology are assessment methods to study the molecular behavior between proteins, nucleic acid, or a combination of proteins and nucleic acid.

Key Market Trends & Insights

- The North America protein binding assays dominated the global market with a share of 40.8% in 2023.

- Asia Pacific protein binding assays market is expected to be the fastest-growing with a CAGR of 11.1% over the forecast period.

- Based on product & services, the services segment dominated with a market share of 44.7% in 2023.

- Based on end-use, the pharmaceuticals and biotechnology segment dominated with a 46.4% market share in 2023.

- Based on technology, the equilibrium dialysis dominated with a share of 49.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 455.6 Million

- 2030 Projected Market Size: USD 896.3 Million

- CAGR (2024-2030): 10.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The use of advanced technologies for preclinical assessments, and funding for novel drug discovery contribute to the capabilities of these assessments.

The increase in protein binding tests is becoming necessary due to the prevalence of chronic diseases. This drives the need for medications for better treatment in patients. Other factors such as the growth in spending on research and development, and the launch of novel drugs with high efficacy are encouraging market growth. Besides, the rise in research and development has resulted in easy and faster assay methods based on a high frequency of usage.

Protein binding assays enhance the targeted therapies and minimize the quantity of target molecules. The growing demand for protein binding assays in the past few years owing to the significance of proteins for biological processes is driving the market growth. In addition, protein binding tests produce personalized medicine and medical therapy based on individual characteristics. The technological advances lead to the production of assays with accuracy, and sensitivity, that can be incorporated into analytical tools. The protein binding assay methods have become precise, effective, and efficient in the past several years. The partnerships and collaborations between pharmaceutical industries, institutions, and contract research organizations have resulted in the emergence of cutting-edge technologies to facilitate drug discovery and development.

Product & Services Insights

The services segment dominated with a market share of 44.7% in 2023. Technological advancements, strategic investments, and increasing consumer demand constitute market growth. Additionally, the major companies in the sector are focusing on innovation to meet a wide range of needs for their customers, incorporation of advanced technology such as the Internet of Things and artificial intelligence has significantly impacted efficiency and functionality. The launching of new products with enhanced capabilities is made due to which the market is expected to grow.

The kits and reagents segment is expected to witness a fast-growing CAGR of 9.8% over the forecast period. Factors such as ready-to-use customization, and the ability to measure protein biomarkers used for discovering new drugs and disease diagnostics contribute to the segment’s growth. In addition, the increasing number of repeat purchases from laboratories is also significant to the demand.

End-use Insights

The pharmaceuticals and biotechnology segment dominated with a 46.4% market share in 2023. Factors such as a wide and strong distribution network and significant investments in drug discovery boost the segment growth. The pharmaceuticals cater to the end user’s needs and medications are offered based on the disease profile which is prescribed by a medical professional.

The CRO (Contract Research Organization) is expected to be the fastest-growing segment with a CAGR of 10.5% during the forecast period. Factors such as expertise in assisting biologics developers to navigate through complex processes and regulations across various geographies drive their significance. Besides, CRO support for biopharmaceutical assessment methods is crucial. In addition, major organizations are increasingly outsourcing research tasks and activities to third parties to optimize their workload. This further enhances the research quality.

Technology insights

The equilibrium dialysis dominated with a share of 49.7% in 2023. Scientists and researchers prefer this technique due to its low price and high accuracy. In addition, the increased focus on the discovery of new drugs and development in the pharmaceutical and biotechnological industry further fuels the market growth.

The surface plasmon resonance (SPR) market is expected to be the fastest-growing segment with a CAGR of 10.5% during the forecast period. Factors such as the increase in technological adoption in drug discovery and development processes, and real-time monitoring of biomolecular interactions are responsible for its popularity. In addition, the growing demand for high throughput screening methods, advanced techniques for analytics, and cost-effectiveness for drug discovery propel segment growth.

Regional Insights

The North America protein binding assays dominated the global market with a share of 40.8% in 2023. The increasing rate of chronic diseases in the population and government initiatives in countries such as the U.S., Canada, and Mexico contribute to its success. Increasing clinical trials, the rising number of biosimilars and biologics, and the demand for efficient and effective biologics are responsible for the dominance and growth of the market. In addition, the strengthening association between CROs and pharmaceutical companies further boosts market development.

U.S Protein Binding Assays Market Trends

The U.S protein binding assays is a dominating market in the North American region with a share of 78.0% in 2023. Factors such as favorable policies, emphasis on creating novel drugs, and drug efficacies, and participation of CROs and biopharmaceuticals encourage market growth. In addition, the growing initiatives by the government in support of biologics development, and the presence of major pharmaceutical players with innovative strategies further boost the market developments.

Europe Protein Binding Assays Market Trends

Europe protein binding assays market is expected to witness a significant growth in the coming years owing to the factors such as development in pharmacological assays, and discovery of a wide range of drug molecules and receptors are the key factors for the market growth. With the increasing adoption of protein-based drugs and the availability of advanced technologies for protein binding the heavy investments by major players are further boosting the market.

The UK protein binding assays market growth is highly anticipated over the forecast period as government initiatives and technological bases for drug discovery and development catalyze the clinical industry. Besides, the presence of advanced medical technology and heavy investment by the biologics organizations in protein binding have shaped the regional market.

Asia Pacific Protein Binding Assays Market Trends

Asia Pacific protein binding assays market is expected to be the fastest-growing with a CAGR of 11.1% over the forecast period. The increasing number of CRO operations, increasing expenditure for drug discovery, and increasing healthcare expenditure in countries such as China, India, and Japan. Additionally, the rise in research activities by the major players, and the growing interest in molecular technology supplements the regional market developments.

Key Protein Binding Assays Company Insights

Some major players in the protein binding assays market include Thermo Fisher Scientific, Adari Cell Sciences, Sartorius AG, and others. Organizations focus on increasing customer base to gain a competitive edge in the industry. Therefore, key players are undertaking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Thermo Fisher Scientific is a multinational clinical research and life science company that offers a comprehensive range of products and services for protein binding assays ranging from basic protein quantification to complex protein interactions.

-

Beckman Coulter primarily focuses on clinical diagnostics and research instruments that can be used in protein binding strategies. The key areas of relevance are protein chemistry analyzers, flow cytometry, and centrifugation.

Key Protein Binding Assays Companies:

The following are the leading companies in the protein binding assays market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific

- ADMEcell, Inc.

- Beckman Coulter, Inc.

- Sartorius AG

- Bio-Rad Laboratories, Inc.

- Abzena Ltd

- Abcam Limited

- GVK Biosciences Private Limited

- Promega Corporation

- Arryait Corporation

- Charles River Laboratories

- Sovicell

- Eurofins Scientific

- 3B Pharmaceuticals

- Creative Biolabs

- Evotec SE

- BioDuro-Sundia

- Merck KDaA

Recent Developments

-

In May 2024, Beckman Coulter received a clearance from the U.S. Food and Drug Administration for its Access NT-proBNP assay using the Beckman Coulter Dxl 9000 Immunoassay Analyzer that assesses heart failure in less than 11 minutes.

-

In July 2023, Charles River Laboratories announced the acquisition of SAMDI tech. Under this, the companies offer end-to-end drug discovery portfolio, data generation, and fast identification for new drug discovery by combining their platform with premier. The platforms combined accelerate the client’s drug discovery efforts.

Protein Binding Assays Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 500.4 million

Revenue forecast in 2030

USD 896.3 million

Growth Rate

CAGR of 10.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, products & services, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; Kuwait, South Africa

Key companies profiled

Thermo Fisher Scientific Inc.; ADMEcell, Inc.; Beckman Coulter, Inc.; Sartorius Stedim; BioOutsource Limited; Bio-Rad Laboratories, Inc.; Abzena Ltd; Abcam plc; GVK Biosciences Private Limited; Promega Corporation; Arrayit Corporation; Charles River Laboratories; Sovicell GMBH; Absorption Systems LLC; Eurofins Scientific; 3B Pharmaceuticals; Creative Biolabs; Evotec (Cyprotex); Bioduro; Merck KGaA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protein Binding Assays Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global protein binding assays market report based on technology, products & services, end use, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Kits & Reagents

-

Services

-

-

Products & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Ultracentrifugation

-

Equilibrium Dialysis

-

Ultrafiltration

-

Surface Plasmon Resonance

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Contract Research Organizations

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Kuwait

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.