- Home

- »

- Biotechnology

- »

-

Protein Detection And Quantification Market Report, 2030GVR Report cover

![Protein Detection And Quantification Market Size, Share & Trends Report]()

Protein Detection And Quantification Market Size, Share & Trends Analysis Report By Technology (Colorimetric Assays, Chromatography), By Product, By Application, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-504-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

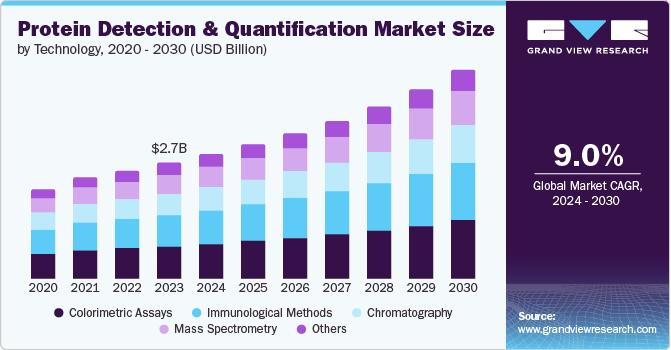

The global protein detection and quantification market size was valued at USD 2.68 billion in 2023 and is projected to grow at a CAGR of 9.0% from 2024 to 2030. The market growth is due to the demand for proteomics research, which is needed to increase knowledge regarding protein interactions, functions, and modifications. There is an increase in the demand for personalized medicine and diagnostics as patients with high disposable income are willing to invest more to get better treatments. Protein detection and quantification are essential for drug identification and optimizing compound leads.

There has been an increase in the investments made by the government and key medical institutions for research and development in proteomics. Protein is an important part of the human body as it performs essential functions such as the transportation of substances, catalyzing enzymes, and storing molecules. The detection and quantification of protein is essential as it aids in identifying biomarkers, drug development, and diagnosis of illnesses.

There is an increased prevalence of chronic diseases such as neurological disorders, cancers, and diabetes. Detecting and quantifying protein is crucial for diagnosing and treating diseases, as proteins affect the development and progression of different health conditions. Medical research companies and governments are investing heavily in improving the treatments of chronic diseases with the help of protein detection and quantification.

Furthermore, increased demand for personalized medicine is driving market revenue growth. Tailoring patient care based on genetic and molecular profiles is growing rapidly. This approach requires identifying specific biomarkers, such as proteins or other compounds, that can indicate the existence of a disease or predict an individual's reaction to a particular treatment. Hence, these factors have resulted in the growth of this market.

Technology Insights

The colorimetric assays segment dominated the market in 2023, with a share of 28.5% in 2023. The market growth is attributed to the increased preference for colorimetric assay for research in clinical laboratories due to its functionality, wide availability of reagents, and low cost. Colorimetric assay is preferred when large-scale quantifying of protein is required. Colorimetric assay functions with the help of color changes by reactions between protein and reagents. Therefore, these factors are responsible for the positive market growth of this segment.

The immunological methods segment is expected to grow at a CAGR of 9.4% during the forecast period. This market growth is attributed to the increased demand for immunological methods as they aid in the specific detection of protein. This method also helps identify and measure protein from complex mixtures. Therefore, these factors contribute to the positive market growth of this segment.

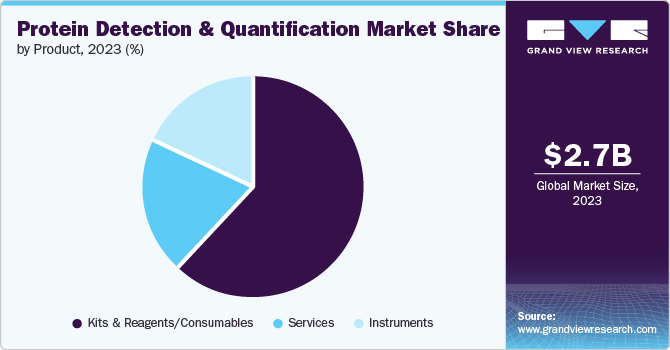

Product Insights

The kits and reagents/consumables segment dominated the market in 2023, with a share of 62.1%. This market growth is attributed to the rising use of reagents and consumables for protein detection and quantification. Kits ensure accuracy and reliability for research and diagnosis. Major companies are investing heavily in the research and development of kits to improve their output and sensitivity. Furthermore, the availability of kits in a wide range aids in the research of protein detection and quantification.

The services segment is projected to grow at a CAGR of 9.0% during the forecast period. This market growth is attributed to increased demand for accurate protein detection and quantification for various applications such as drug development, identifying biomarkers, and diagnosing illnesses. Researchers outsource protein detection processes to experts to improve the quality of results. Hence, these factors have resulted in the market growth of this segment.

Application Insights

The drug discovery and development segment dominated the market in 2023, with a share of 48.3% in 2023. This market growth was due to the increase in investments made by the government and major medical facilities in order to research and develop new and effective drugs. Due to the rise in chronic illnesses such as cancer and brain disorders, there is an increased demand for drugs that are more effective and have fewer side effects. Furthermore, the demand for personalized drug treatment has also resulted in the market, as patients are willing to invest heavily to have a tailor-made therapy based on their genetics. Therefore, these factors have resulted in market growth of this segment.

The clinical diagnosis segment is expected to grow at a CAGR of 9.2% during the forecast period. This market growth is attributed to the increase in the number of patients with chronic illnesses and heavy investments by government and medical facilities in research and development to improve patient diagnosis and treatment. There is an increase in the protein detection and quantification processes, which are essential for disease diagnosis and treatment and can lead to accurate and effective treatment during the due course of the illness. Hence, these factors have been attributed to the market growth of this segment.

End Use Insights

The hospitals and diagnostic centers segment dominated the market in 2023, with a share of 48.3%. This growth was due to the increased number of patients with chronic illnesses and the need for new drug discovery and development. An increase in the identification of biomarkers and illness diagnosis has resulted in the growth of this segment. Furthermore, growth in the healthcare sector and increased investment by the government and major healthcare institutes in research and development to innovate new drugs and treatments have resulted in the market growth of this segment.

The contract research organizations segment is anticipated to grow at a CAGR of 11.0% during the forecast period. This market growth is attributed to increased demand for protein detection and quantification for research. Contract research organizations have technologically advanced equipment for better protein detection and quantification with less time and more accuracy. Researchers prefer to outsource the process due to lack of qualified workforce and to improve time management. Therefore, these factors contribute to the market growth of this segment.

Regional Insights

North America dominated the protein detection and quantification market with a market share of 37.2% in 2023. This market growth resulted from the presence of significant biotechnology and pharmaceutical companies and their major investments in the research and development for innovations in drug discovery and treatments. There is an increase in the occurrences of chronic illnesses such as cancer, diabetes, and brain illnesses. This has increased demand for treatments with better efficiency and fewer side effects. Hence, the region has an increasing demand for advanced protein detection and quantification technologies.

U.S. Protein Detection & Quantification Market Trends

The U.S. held a substantial market share in North America protein detection and quantification market due to a developed healthcare sector and increased government and medical institutes investments to develop new and effective drugs. Populations with high disposable incomes have seen an increase in the adoption of personalized medications. Furthermore, developed healthcare infrastructure aids in better research due to the presence of technologically advanced equipment in the country. Therefore, these factors are responsible for the growth of this segment.

Europe Protein Detection & Quantification Market Trends

Europe protein detection and quantification market was identified as a lucrative region in this industry, as it had a market share of 29.7% in 2023. This growth resulted from the presence of major pharmaceutical and biotechnology companies and their heavy investments in research and development for the development of new drugs and treatments. The increased prevalence of chronic illnesses has resulted in an increased demand for effective drugs in the region. There is an increase in the demand for better technology to detect and quantify protein in this region. Hence, these factors contribute to the market growth in this region.

The UK protein detection and quantification market is expected to grow rapidly due to the increased investments by the government and major medical institutes in researching and developing new and effective drugs with the help of the protein detection and quantification process. Furthermore, increased disposable among the population has increased demand for personalized medication and treatment. Therefore, these factors have contributed to the market growth in this region.

Asia Pacific Protein Detection & Quantification Market Trends

Asia Pacific had a market share of 27.4% in 2023 owing to the increasing emphasis on developing drugs and personalized medicine, along with the growing healthcare industry in countries like China, India, and Japan. Government and private organizations are increasing their investments in research and development activities to mitigate the increasing demand for effective treatments. Furthermore, the rising occurrence of chronic illnesses such as cancer and diabetes has further resulted in market growth in this region.

China dominated the Asia Pacific market in 2023. The factors responsible for the market growth in the country are the growing prevalence of chronic illnesses and the increased demand for better medical treatments. The market is also growing due to growth in the healthcare sector. Furthermore, the increase in the population with high disposable income has resulted in an increased demand for personalized medicines and treatments. Hence, these factors have resulted in the market growth of protein detection and quantification in this country.

Key Protein Detection And Quantification Company Insights

Some of the major companies in the protein detection and quantification market are Agilent Technologies Inc., Bio-Rad Laboratories Inc., Danaher Corporation, General Electric Company, and more. Companies are focusing on investing in research and development to launch innovative products that will improve efficiency and optimize the process of protein detection.

-

Thermo Fisher Scientific Inc. is a clinical research company that specializes in the manufacturing and selling of clinical development solutions, analytical equipment, specialty diagnostics and pharmaceutical services.

-

Agilent Technologies Inc. is a company that specializes in providing instruments, software, and services, for laboratories. The company provides automation, bio reagents, FISH probes, mass spectrometry, and more to clinical markets and analytical laboratories.

Key Protein Detection And Quantification Companies:

The following are the leading companies in the protein detection and quantification market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Danaher Corporation

- General Electric Company

- Inanovate

- Merck KGaA

- PerkinElmer Inc.

- RayBiotech Life Inc.

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

Recent Developments

-

In January 2024, Agilent Technologies Inc. announced the launch of Agilent ProteoAnalyzer System, an automated parallel capillary electrophoresis system for protein analysis to analyze complex protein mixtures.

-

In October 2023, Thermo Fisher Scientific Inc. announced the acquisition of Olink Holdings AB, a company providing next-generation proteomics solutions for advanced proteomics discovery and development that is expected to help biopharmaceutical researchers to understand diseases at protein level.

Protein Detection and Quantification Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.88 billion

Revenue forecast in 2030

USD 4.83 billion

Growth Rate

CAGR of 9.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, Product, Application, End Use, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Agilent Technologies Inc., Bio-Rad Laboratories Inc., Danaher Corporation, General Electric Company, Inanovate, Merck KGaA, PerkinElmer Inc., RayBiotech Life Inc., Shimadzu Corporation, Thermo Fisher Scientific Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protein Detection And Quantification Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global protein detection and quantification market report based on technology, product, application, end use, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Colorimetric Assays

-

Immunological Methods

-

Chromatography

-

Mass Spectrometry

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Kits and Reagents/Consumables

-

Instruments

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery and Development

-

Clinical Diagnosis

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Research Institutes

-

Biotechnology and Pharmaceutical Companies

-

Contract Research Organizations

-

Hospitals and Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."