- Home

- »

- Pharmaceuticals

- »

-

Psoriasis Drugs Market Size & Share, Industry Report, 2030GVR Report cover

![Psoriasis Drugs Market Size, Share & Trends Report]()

Psoriasis Drugs Market (2025 - 2030) Size, Share & Trends Analysis Report By Class, By Treatment (Topicals, Systemic, Biologics), By Route Of Administration (Oral, Parenteral), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-662-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Psoriasis Drugs Market Summary

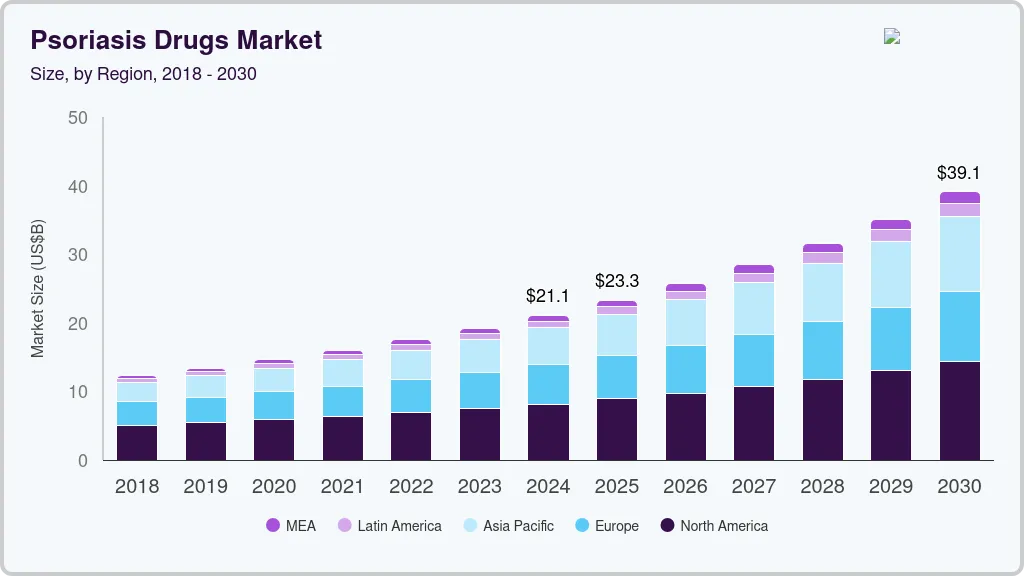

The global psoriasis drugs market size was estimated at USD 21,116.1 million in 2024 and is projected to reach USD 39,113.8 million by 2030, growing at a CAGR of 10.9% from 2025 to 2030. The psoriasis drugs market is driven by increasing disease prevalence, rising awareness of chronic inflammatory conditions, and expanding adoption of biologics and targeted therapies.

Key Market Trends & Insights

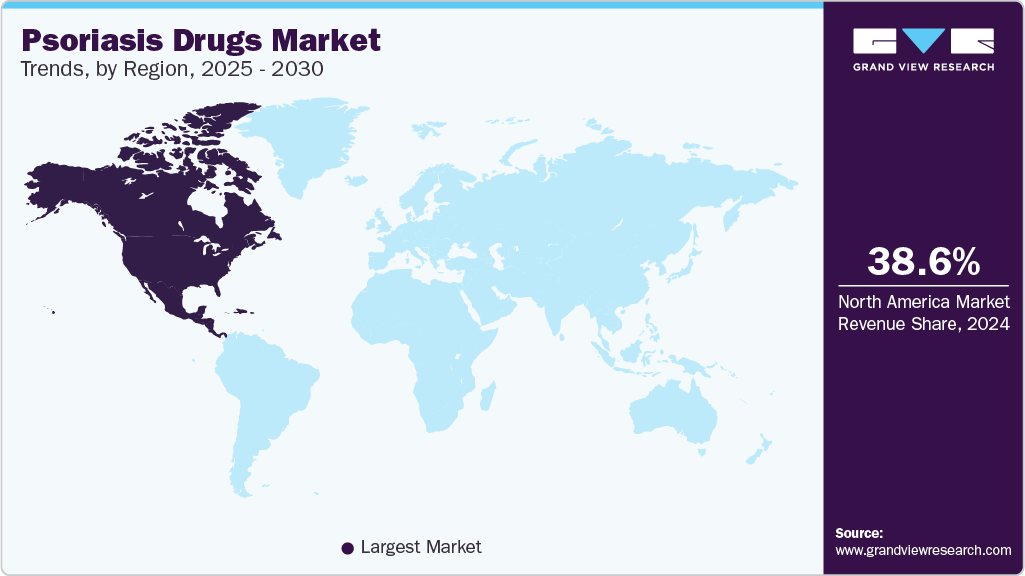

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, UAE is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, tumor necrosis factor inhibitors accounted for a revenue of USD 9,487.9 million in 2024.

- InterleU.S.in Inhibitors is the most lucrative class segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 21,116.1 Million

- 2030 Projected Market Size: USD 39,113.8 Million

- CAGR (2025-2030): 10.9%

- North America: Largest market in 2024

Advances in immunomodulators and favorable reimbursement policies also support market growth. In addition, ongoing R&D and product approvals contribute to treatment innovations, enhancing demand across moderate to severe psoriasis cases. The rising biosimilar competition is a key market driver, particularly impacting established biologics such as Stelara and Humira. Patent expirations and regulatory support for biosimilar approvals reshape the competitive landscape, notably in the U.S. and Europe. Biosimilars such as Imuldosa and Yesintek (ustekinumab biosimilars) received approval in late 2024, offering more affordable options and enhancing market access. Increased payer and healthcare provider acceptance of biosimilars lowers treatment costs and broadens patient access, especially in cost-sensitive markets. While branded biologics are preferred by physicians for new initial treatments, biosimilars are gaining market share through competitive pricing strategies and substitution policies, fundamentally altering the psoriasis therapeutic ecosystem.

The rising global prevalence of psoriasis is a key driver for the psoriasis drugs industry, particularly for biologics. According to Global Psoriasis Atlas estimates (2024), over a million people worldwide are affected by psoriasis, with cases steadily increasing due to urbanization, environmental factors, and associated comorbidities such as arthritis, cardiovascular disease, and metabolic syndrome. Psoriasis imposes a significant burden on healthcare systems and economies, amplifying demand for effective, targeted therapies. Biologic agents, particularly IL-17 and IL-23 inhibitors, offer high efficacy and durable responses. The psoriasis drugs market is growing due to increased diagnoses, better patient understanding, and wider access to treatment, making biologics key to future moderate-to-severe psoriasis care.

Leading pharmaceutical companies have made substantial strides in expanding their psoriasis product portfolios. AbbVie’s Skyrizi and Rinvoq experienced strong revenue growth in 2025 across immunology indications, including psoriasis, supported by their robust clinical profiles and successful global expansion efforts. The approval of new therapies has intensified competition, further advancing the treatment paradigm. For instance, in September 2024, UCB announced that the U.S. FDA approved BIMZELX (bimekizumab-bkzx) for three new indications: active Psoriatic Arthritis (PsA), active Non-radiographic Axial Spondyloarthritis (nr-axSpA) with objective signs of inflammation, and active Ankylosing Spondylitis (AS). However, pricing pressures in Europe and reimbursement hurdles in emerging markets remain challenges for maintaining the premium pricing of newer biologics.

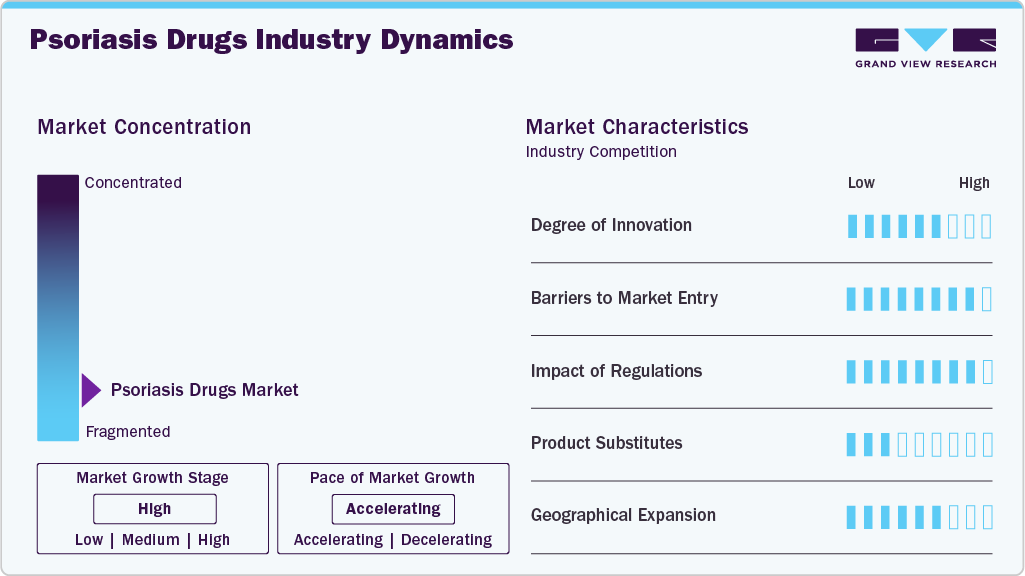

Market Concentration & Characteristics

Degree of Innovation: The psoriasis drugs market is advancing with continuous innovations in biologic therapies, small molecules, and novel mechanisms of action. Next-generation biologics targeting IL-17A/F, IL-23, and TYK2 pathways deliver higher skin clearance rates and faster onset of action. Oral therapies such as TYK2 inhibitors offer new alternatives for patients seeking noninjectable treatments. Innovations focus on improving efficacy, reducing dosing frequency, enhancing patient convenience, and addressing unmet needs in difficult-to-treat psoriasis forms, including scalp, palmoplantar, and erythrodermic psoriasis.

Barriers to Market Entry: The psoriasis drugs market has high entry barriers due to complex biologic drug development, stringent regulatory requirements, and the dominance of established players such as AbbVie, Novartis, and UCB. Significant investments in R&D, clinical trials, and manufacturing capabilities are required to compete effectively. Biologic therapies demand sophisticated production processes and strict quality controls. Intellectual property protections and physician brand loyalty toward proven therapies such as Skyrizi, Cosentyx, and Tremfya further limit new entrant opportunities.

Impact of Regulations: Regulatory agencies, including the FDA and EMA, maintain rigorous standards for the approval of psoriasis drugs, requiring extensive efficacy and safety data from long-term clinical trials. Accelerated approval pathways exist for therapies demonstrating breakthrough outcomes. Pricing and reimbursement policies heavily influence access, particularly given the high cost of biologics. Health Technology Assessments (HTAs) and cost-effectiveness analyses are increasingly critical for securing favorable reimbursement, particularly in Europe and emerging markets, shaping the competitive landscape.

Product Substitutes: Psoriasis treatments compete across a wide therapeutic spectrum. Alternatives include conventional systemic therapies (such as methotrexate and cyclosporine), topical treatments, phototherapy, and biosimilars of established biologics. However, newer biologics and oral agents offering superior efficacy, extended remission periods, and better quality of life outcomes drive patient and physician preference for innovative therapies, limiting the impact of older, less effective substitutes.

Geographical Expansion: Pharmaceutical companies are broadening their psoriasis drug portfolios into high-growth regions, including Asia Pacific, Latin America, and Eastern Europe. Rising psoriasis prevalence, improving healthcare infrastructure, and increased adoption of biologic therapy in these markets drive expansion strategies. Companies focus on obtaining regulatory approvals, developing local partnerships, and adapting pricing models to enhance accessibility. Investment in real-world evidence generation and patient support programs supports deeper market penetration and sustained growth across diverse healthcare environments.

Class Insights

Tumor necrosis factor inhibitors dominated the market and accounted for the highest share of 40.88% in 2024. Their widespread use can be attributed to their proven efficacy in reducing inflammation, established safety profiles, and broad acceptance among healthcare providers and patients. Notably, TNF inhibitors such as adalimumab (Humira), etanercept (Enbrel), and infliximab (Remicade) have been mainstays in psoriasis treatment protocols. Continued innovation in this class is evident. As per an article in immunology in October 2024, Sanofi completed a Phase 1 proof-of-mechanism clinical trial for the first oral TNF receptor 1 (TNFR1) inhibitor aimed at treating psoriasis, indicating ongoing advancements in TNF-targeted therapies.

Interleukin inhibitors are expected to register the fastest CAGR over the forecast period. This rapid growth is driven by their targeted mechanism of action, which offers improved efficacy and safety profiles compared to traditional therapies. IL inhibitors, including agents targeting IL-17 and IL-23 pathways, have demonstrated significant effectiveness in alleviating psoriasis symptoms such as itching, pain, and skin tightness. Recent approvals and clinical successes further support the increasing adoption of these therapies, positioning IL inhibitors as a promising option for patients with mild to severe psoriasis.

Treatment Insights

The biologics segment dominated the market in 2024 with a 46.38% share. They are highly selective in targeting immune pathways related to psoriasis and exhibit faster disease management compared to traditional medicines. In addition, the dominance of biologics in the psoriasis market stems from their precision in targeting immune pathways, enhanced clinical effectiveness, and faster achievement of therapeutic goals. Biologic agents such as Skyrizi (risankizumab), Tremfya (guselkumab), Cosentyx (secukinumab), and Taltz (ixekizumab) have become standard choices for managing moderate to severe psoriasis. In March 2024, Boehringer Ingelheim announced that the U.S. FDA approved SPEVIGO (spesolimab-sbzo) injection for the treatment of Generalized Pustular Psoriasis (GPP) in adults and pediatric patients aged 12 and older, weighing at least 40 kg. This approval follows a similar approval of SPEVIGO by the Chinese National Medical Products Administration (NMPA), which is a humanized IgG1 antibody targeting the interleukin-36 receptor (IL-36R) involved in GPP’s immune pathway.

The topical segment is expected to register a significant growth rate over the forecast period due to its effectiveness, ease of use, and economical nature compared to other complex therapies. In addition, this growth is fueled by the advancement of new topical treatments that deliver effective results with minimal systemic absorption.

Route Of Administration Insights

The parenteral segment dominated the market, accounting for a 41.58% share in 2024 as injectable biologics and systemics are more effective in treating moderate to severe psoriasis than topical and oral medications. This share can be attributed to the widespread use of biologic therapies such as Skyrizi (risankizumab), Cosentyx (secukinumab), and Tremfya (guselkumab). These injectable biologics offer targeted immune modulation and sustained efficacy, making them the standard of care for moderate to severe psoriasis. Their ability to provide durable skin clearance and improved quality of life has reinforced the preference for parenteral delivery among healthcare providers and patients.

The topical segment is projected to grow at the fastest CAGR over the forecast period as many people opt for simpler solutions, with formulations designed to enhance the efficacy of topical remedies. For instance, in December 2024, LEO Pharma received UK MHRA approval for Anzupgo (delgocitinib) cream to treat Chronic Hand Eczema (CHE) in adults who do not respond adequately to topical corticosteroids. Although not approved for psoriasis, this development highlights the rising interest in topical JAK inhibitors and non-steroidal therapies for immune-mediated skin conditions. It also reflects a broader shift toward innovative topical treatments with improved safety profiles—an approach that is becoming increasingly relevant in psoriasis care. These advancements are improving adherence, particularly among patients with mild to moderate disease, and are expected to drive growth in the topical segment. Continued research into novel topical agents and enhanced formulations is anticipated to further support this upward trend in the coming years.

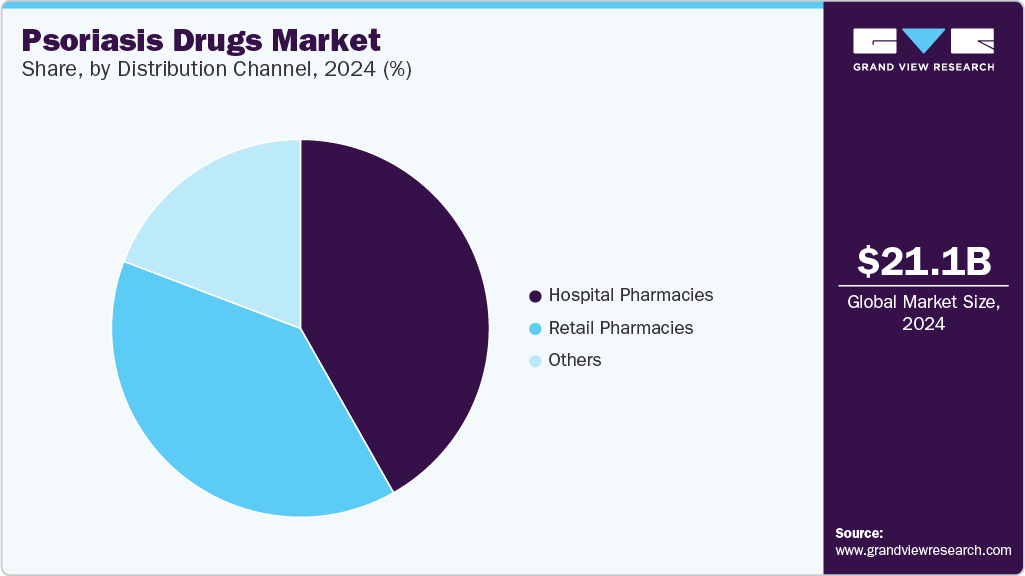

Distribution Channel Insights

The hospital pharmacies segment accounted for a leading share of the psoriasis drugs industry in 2024, owing to hospitals offering expensive, specialized treatments such as biologics and advanced systemic therapies. This growth is driven by the widespread administration of biologic therapies such as Skyrizi, Cosentyx, and Taltz. These treatments often require specialist oversight, making hospital settings the primary point of access. Hospital-based distribution also ensures appropriate patient monitoring and supports adherence to treatment protocols, particularly for moderate to severe cases.

The retail pharmacies segment is projected to grow at the fastest CAGR over the forecast period, supported by the expanding availability of topical and oral therapies, including newly launched options like VTAMA and ZORYVE. Increased accessibility, pharmacist-led patient counseling, and growing insurance coverage have enhanced patient convenience. In addition, digital health integration, home delivery services, and evolving consumer preferences for decentralized care contribute to this segment’s rapid expansion.

Regional Insights

North America psoriasis drugs market held a leading market position in 2024, accounting for 38.65% of the global share. This growth can be attributed to the high prevalence rate of psoriasis and strong healthcare infrastructure. The widespread adoption of biologics, such as Humira, Cosentyx, and Skyrizi, has accelerated market growth. For instance, in October 2024, Accord BioPharma received FDA approval for IMULDOSA (ustekinumab-srlf), a biosimilar to STELARA, for treating chronic inflammatory conditions, including psoriasis, psoriatic arthritis, Crohn’s disease, and ulcerative colitis. The approval covers all indications of the reference product, expanding biosimilar access in North America. In addition, favorable reimbursement policies, increasing patient awareness, and greater insurance coverage drive market expansion. The introduction of novel drugs, including newer biologic therapies with improved safety profiles, continues to shape prescribing trends. Hospital pharmacies remain the primary distribution channel, but retail and online pharmacies are gaining traction due to enhanced accessibility and convenience.

U.S. Psoriasis Drugs Market Trends

The U.S. psoriasis drugs market accounted for a dominant share of North America psoriasis drugs industry, driven by the high adoption of biologics for moderate-to-severe psoriasis. The U.S. dominated the market due to advanced pharmaceutical regulations, active patient engagement, and significant investments in biologic therapies. Regulatory approvals of innovative treatments reshape the treatment landscape. In August 2024, Amgen announced that Otezla (apremilast) is available in the U.S. for pediatric use, following an FDA approval for treating moderate to severe plaque psoriasis in children and adolescents aged 6 and older, weighing at least 20 kg. Otezla is now the only FDA-approved oral treatment for this age group, offering a new option for young patients who are candidates for systemic therapy or phototherapy. Retail pharmacies in the country are increasingly significant, facilitated by patient convenience and the availability of digital healthcare solutions. Telemedicine platforms have also improved patient access to treatments, while online pharmacies provide discreet purchasing options, further expanding market penetration.

Europe Psoriasis Drugs Market Trends

Europe’s psoriasis drugs market is expected to grow steadily, led by Germany, the UK, and France. The region benefits from a robust clinical research infrastructure, strong government support for healthcare initiatives, and increasing adoption of biologic therapies. For instance, in June 2024, Almirall, a Spanish company, announced 52-week interim results of the real-world POSITIVE study showing that Ilumetri (tildrakizumab) significantly improved wellbeing in patients with moderate to severe plaque psoriasis to levels comparable with the general population by Week 16, with benefits sustained for up to 1 year. The findings were presented at the IFPA Conference 2024 in Stockholm. Regulatory approvals for newer treatments, such as Rinvoq and Ilumya, contribute to market expansion. In countries like Germany and the UK, biologics are becoming the first-line treatment for moderate to severe psoriasis, with increasing awareness of patient access and healthcare programs.

The UK psoriasis drugs market is experiencing steady growth, driven by the increasing adoption of advanced biologic therapies, a robust healthcare system, and advanced pharmaceutical manufacturing capabilities. Biologics are being used more extensively to treat psoriasis, with hospital pharmacies being the dominant distribution channel. The expanding role of online pharmacies is also improving patient access to psoriasis therapies.

The psoriasis drugs market in Germany leads the European psoriasis drug industry, driven by its strong healthcare system and advanced pharmaceutical manufacturing capabilities. Psoriasis treatment with biologics is expanding, with hospital pharmacies leading their distribution. The expanding role of online pharmacies is also improving patient access to psoriasis therapies.

France psoriasis drugs market benefits from growing regulatory support and public healthcare initiatives for dermatological diseases. Increased awareness of biologics and supportive government reimbursement policies drive market adoption. Hospital pharmacies remain the primary distribution channel for psoriasis treatments, but retail pharmacies are gradually gaining ground due to improved patient engagement and accessibility.

Asia Pacific Psoriasis Drugs Market Trends

The Asia Pacific psoriasis drugs market is experiencing rapid growth, driven by increasing psoriasis prevalence, rising healthcare investments, and greater access to biologics. China, Japan, and India are leading the markets, supported by domestic pharmaceutical manufacturing and expanding healthcare infrastructure. For instance, in February 2025, Biocon Biologics, headquartered in India, received marketing authorization in the EU for YESINTEK, a biosimilar of Ustekinumab, to treat plaque psoriasis, psoriatic arthritis, and Crohn’s disease. This approval enhanced treatment options in the psoriasis drugs industry, mainly by providing cost-effective biologic alternatives, underscoring the increasing importance of biosimilars in managing immune-mediated diseases such as psoriasis. The region is experiencing an uptick in biologic treatments, with a growing adoption of newer therapies.

The psoriasis drugs market in Japan is expanding due to government initiatives promoting the treatment of chronic diseases, including psoriasis. The large aging population and rising awareness of biologic therapies are key growth drivers. Retail pharmacies continue to dominate, while hospital pharmacies are pivotal in managing severe cases.

China psoriasis drugs market is witnessing rapid expansion, driven by increasing healthcare modernization, government support, and a rising number of psoriasis patients. The adoption of biologic therapies such as Cosentyx and Tremfya is growing, with greater access through hospital and retail pharmacies. Government healthcare reforms are expected to further improve the accessibility and affordability of psoriasis drugs.

Latin America Psoriasis Drugs Market Trends

Latin America psoriasis drugs market is expected to experience moderate growth, driven by Brazil and Mexico. Growing healthcare investments, increasing awareness of psoriasis treatments, and improving access to biologic therapies contribute to market expansion. Government healthcare programs are also supporting the adoption of biologics.

Brazil psoriasis drugs market is expanding due to the rising prevalence of psoriasis and increasing healthcare access. The adoption of biologics for severe psoriasis is growing, with local partnerships helping improve availability. Retail pharmacies are playing an important role in distributing psoriasis therapies.

Middle East & Africa Psoriasis Drugs Market Trends

Middle East and Africa psoriasis drugs market is experiencing increasing demand for psoriasis treatments, particularly biologic therapies, due to rising healthcare investment and growing patient awareness. Countries like Saudi Arabia and the UAE are experiencing higher adoption rates of advanced psoriasis therapies. Government initiatives aimed at improving healthcare access and affordability drive the regional market growth.

Saudi Arabia psoriasis drugs market is expanding, driven by the rising rate of psoriasis and increasing government healthcare reforms. The market is supported by investments in biotechnology and improved healthcare systems, with hospital and retail pharmacies serving as key distribution channels.

Key Psoriasis Drugs Company Insights

Some key companies in the global psoriasis drugs industry include AbbVie Inc.; Amgen Inc.; Johnson & Johnson Services, Inc.; and Novartis AG. The players in the market are focusing on increasing their customer base to gain a competitive edge in the market. Moreover, key players are undertaking several strategic initiatives, such as mergers & acquisitions and partnerships, with other major companies.

Key Psoriasis Drugs Companies:

The following are the leading companies in the psoriasis drugs market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie Inc.

- Amgen Inc.

- Johnson & Johnson Services, Inc.

- Novartis AG

- Eli Lilly and Company

- AstraZeneca

- Celgene Corporation

- UCB S.A.

- Merck

- Boehringer Ingelheim International GmbH

Recent Developments

-

In March 2025, Johnson & Johnson shared new data from its Phase 3 trial for icotrokinra (JNJ-2113), an investigational oral IL-23 receptor blocker for moderate to severe plaque psoriasis. In the ICONIC-LEAD study, 65% of patients achieved clear or almost clear skin (IGA 0/1) and 50% achieved PASI 90 by Week 16, compared to 8% and 4% on placebo (p<0.001).

-

In September 2024, Arcutis Biotherapeutics announced that the FDA accepted its supplemental New Drug Application (sNDA) for ZORYVE (roflumilast) foam 0.3% for treating scalp and body psoriasis in patients aged 12 and older. This once-daily PDE4 inhibitor offers a novel, non-greasy alternative to traditional creams, especially for hard-to-treat scalp psoriasis. The FDA set a target decision date of May 22, 2025.

-

In September 2024, Bristol Myers Squibb announced positive Phase 3b/4 results from the PSORIATYK SCALP trial, showing that Sotyktu (deucravacitinib) significantly improved scalp psoriasis symptoms in patients with moderate to severe disease.

Psoriasis Drug Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.27 billion

Revenue forecast in 2030

USD 39.11 billion

Growth rate

CAGR of 10.94% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Class, treatment, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AbbVie Inc.; Amgen Inc.; Johnson & Johnson Services Inc.; Novartis AG; Eli Lilly and Company; AstraZeneca; Celgene Corporation; UCB S.A.; Merck; Boehringer Ingelheim International GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Psoriasis Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global psoriasis market report based on class, treatment, route of administration, distribution channel, and region:

-

Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Tumor Necrosis Factor Inhibitors

-

Interleukin Inhibitors

-

Vitamin D Analogues

-

Corticosteroids

-

Others

-

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Parenteral

-

Topical

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Parenteral

-

Oral

-

Topical

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.