- Home

- »

- Healthcare IT

- »

-

Psychiatric Digital Biomarkers Market Size Report, 2030GVR Report cover

![Psychiatric Digital Biomarkers Market Size, Share & Trends Report]()

Psychiatric Digital Biomarkers Market Size, Share & Trends Analysis Report By Type (Wearables, Mobile Based Applications, Sensors), By Clinical Practice (Diagnostic, Monitoring, Predictive And Prognostic), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-367-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Psychiatric Digital Biomarkers Market Trends

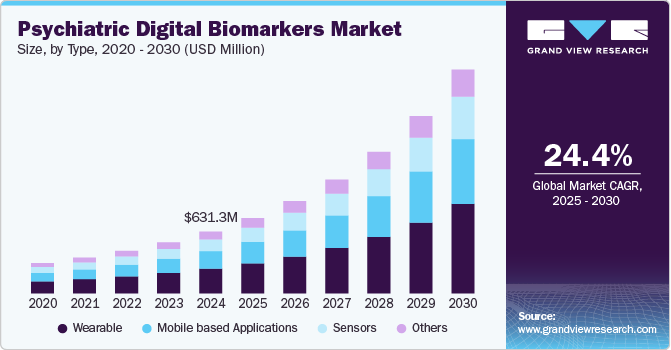

The global psychiatric digital biomarkers market was estimated at USD 521.9 million in 2023 and is projected to grow at a CAGR of 23.9% from 2024 to 2030. The increasing prevalence of mental health disorders, advancements in digital health technologies and growing demand for personalized medicine drive the market. Rising adoption of wearable devices and mobile health apps in mental healthcare contribute to the market growth. In April 2024, Sensors published a review on digital phenotyping's impact on neurological diseases, showing its potential to refine clinical trials and aid in early detection and monitoring through telemedicine and sensor technologies.

The global burden of mental health disorders is on the rise, with conditions such as depression, anxiety, bipolar disorder, and schizophrenia affecting millions of people worldwide. In 2023, Mental Health America, Inc. found that 20.17% of youths aged 12-17 had encountered a major depressive episode, with 15% suffering severe impairment affecting daily activities. This increasing prevalence is driving the need for more effective tools to monitor and manage mental health conditions, leading to a growing interest in psychiatric digital biomarkers. In July 2022, Pervasive and Mobile Computing published findings showing significant differences in mood and digital markers (such as sleep and phone usage) between depressed and non-depressed individuals. It also confirmed that depression status could be accurately predicted using these digital biomarkers alone or combined with mood ratings.

Technological advancements in digital health technologies revolutionize the field of mental healthcare. Innovations such as artificial intelligence (AI), machine learning, and data analytics enable the development of sophisticated digital biomarkers that provide valuable insights into an individual’s mental health status. AI-powered algorithms analyze data from smartphone sensors to detect changes in behavior patterns that indicate early signs of a mental health crisis.

In November 2023, an article in Frontiers in Psychiatry highlighted the potential of digital biomarkers in predicting and managing mood disorders, noting how smartphone data can monitor depression and treatment responses, wearable devices can track mood disorders more accurately in real-world settings, and AI advancements are opening up new diagnostic and therapeutic avenues.

There is a growing demand for personalized medicine in mental healthcare, as healthcare providers seek to tailor treatment plans to individual patients’ needs. Psychiatric digital biomarkers play a crucial role in enabling personalized interventions by providing objective data on patients’ symptoms and treatment responses. The increasing adoption of wearable devices and mobile health apps further fuels this trend, allowing for continuous monitoring of patients outside traditional clinical settings. In March 2022, DTU Health Tech researchers developed a method using voice analysis to identify bipolar disorder in individuals and monitor mood changes in patients, with personalized models providing the most accurate results.

Type Insights

The wearable segment held the largest market share of 40.08% in 2023. Wearable tech is rising in popularity within psychiatric care, offering real-time tracking of mental health through physiological and behavioral data. In July 2023, Harvard Medical School and University of Queensland study found that half the global population might experience mental health issues, based on data from 150,000 adults in 29 countries.

The demand for such innovative diagnostic and management tools is growing. This adoption of wearables for personalized care and monitoring is set to improve outcomes for those with mental health conditions. In February 2024, Empatica was chosen by the U.S. Department of Defense to partner in a PTSD treatment study, using their EmbracePlus wearable to test new therapies. The Phase 2 trial aims to improve care for service members and veterans by evaluating treatment safety, efficacy, and personalization.

The mobile-based application segment is expected to grow at a significant rate over the forecast period. Mobile-based applications transform the psychiatric digital biomarker market by using smartphones to monitor mental health indicators. In October 2023, the GSMA's State of Mobile Internet Connectivity Report 2023 revealed 54% of the global population, or 4.3 billion people, have smartphones.

These apps utilize advanced technology to track mood, sleep, and social interactions, offering a convenient way to improve early detection and monitoring of mental health issues. In June 2022, a review emphasized the role of digital biomarkers in psychiatry, facilitated by smartphones. These devices collect data on user interactions, offering insights into mental health through the analysis of usage patterns, potentially revolutionizing mental health research by providing novel, accessible data collection methods.

Clinical Practice Insights

The diagnostic psychiatric digital biomarkers segment held the largest market share of 32.23% in 2023. This rising burden of mental health conditions underscores the urgency for advanced diagnostic solutions such as psychiatric digital biomarkers to enhance early detection and intervention. Advancements in technology, such as wearable devices and mobile applications, enable the collection of real-time data on various behavioral and physiological parameters, facilitating the identification of digital biomarkers associated with different psychiatric disorders.

In April 2024, Tris Pharma Inc. announced a partnership with Braingaze Ltd to launch Tris Digital Health, focusing on digital diagnostics and therapies for ADHD and neurological disorders. The collaboration will bring to market Braingaze's AI-based digital diagnostic tool for ADHD, utilizing digital biomarkers and eye-tracking technology for assessing attention levels in children and adults.

The monitoring psychiatric digital biomarkers segment is expected to grow at the fastest CAGR over the forecast period. The growing focus on personalized medicine and precision psychiatry is driving the market towards treatments tailored to individuals, considering their unique profiles. Monitoring digital biomarkers, such as sleep and activity patterns, helps in understanding patient responses to treatment and disease progression.

There is growing potential for these biomarkers to predict relapse in mood disorders. This shift towards data-driven, outcomes-focused healthcare encourages the use of digital monitoring solutions to enhance patient care in psychiatry.For instance, in March 2024, Merck joined the LEARNS observational study to investigate digital biomarkers for Parkinson’s disease, aiming to enable early diagnosis and treatment through data from smartphones and wearables.

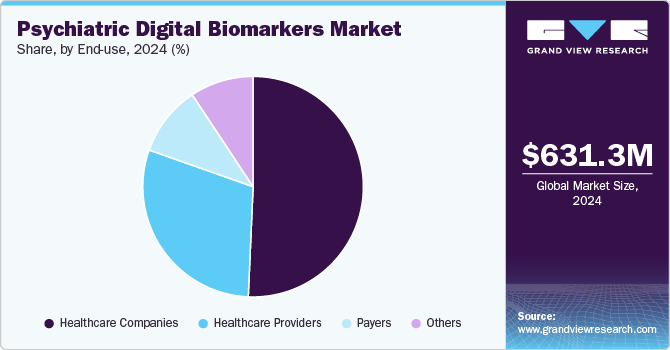

End Use Insights

The healthcare companies segment held the largest market share of 50.66% in 2023. Healthcare companies are increasingly investing in psychiatric digital biomarkers due to the rising demand for personalized mental health solutions. The integration of digital biomarkers into psychiatric care allows for continuous monitoring and early intervention, leading to improved patient outcomes. In March 2024, NeuraMetrix identified typing cadence as a novel digital biomarker for neurological disorders, utilizing it for diagnostic precision through an algorithm that measures typing consistency and correlates it with brain diseases. This innovation promises to significantly enhance diagnostic accuracy in neurology and psychiatry.

The payers segment is expected to witness a fastest CAGR over the forecast period. Payers are recognizing the value of psychiatric digital biomarkers in reducing healthcare costs associated with mental health disorders. By leveraging these innovative technologies, payers can enhance care coordination, optimize treatment plans, and improve patient adherence to therapy In September 2022, the World Health Organization stated that depression and anxiety cost the global economy USD 1 trillion each year, predominantly due to reduced productivity. Insurers such as Cigna and UnitedHealth Group are actively exploring partnerships with digital health companies to incorporate these tools into their coverage offerings, signaling a growing acceptance of psychiatric digital biomarkers in the payer segment.

Regional Insights

North America psychiatric digital biomarkers market dominated with 58.45% market share in 2023. In North America, the psychiatric digital biomarker market is experiencing significant growth driven by the increasing prevalence of mental health disorders and the rising adoption of digital health technologies. This market is fueled by the presence of key players, advanced healthcare infrastructure, and high investment in research and development activities.

The growing awareness about mental health issues and the emphasis on personalized medicine are further fueling the demand for digital biomarkers in psychiatric care across North America. In October 2023, a global study on developing digital biomarkers for Alzheimer's in individuals with Down syndrome received NIH funding. Led by The Cognitive Technology Research Lab at Washington University, it involves multiple sites, including the University of Gothenburg which was awarded USD 820,000. The study focuses on using advanced imaging techniques to probe synaptic integrity in neurodegenerative diseases.

U.S. Psychiatric Digital Biomarkers Market Trends

The psychiatric digital biomarkers market of the U.S. is expected to grow over the forecast period The U.S. is a key player in the psychiatric digital biomarker market, with a strong focus on technological advancements and innovation in healthcare. The U.S. market benefits from robust funding for mental health research, collaborations between technology companies and healthcare providers, and an increasing number of FDA approvals for digital health solutions targeting psychiatric conditions. In May 2023, World Psychiatry published an article reviewing potential biomarkers for diagnosing and gauging treatment responses in ASD, schizophrenia, anxiety, PTSD, MDD, BD, and SUDs. It indicated that these biomarkers, which include genetic, molecular, neuroimaging, and peripheral phenotypes, are still in the early stages of development and validation.

Europe Psychiatric Digital Biomarkers Market Trends

Europe psychiatric digital biomarkers market is anticipated to witness the fastest CAGR of 26.3% from 2024 to 2030. In Europe, the psychiatric digital biomarker market is witnessing steady growth supported by strong government regulations and initiatives promoting digital health solutions and a growing acceptance of telemedicine services. A June 2022 review in Frontiers in Psychiatry mentions that incorporating digital biomarkers into psychiatric studies involves massive data handling, governed by the EU's GDPR. The GDPR guidelines stipulate that personal data must be processed lawfully and transparently, collected and maintained strictly for its intended purpose, limited in scope, securely managed, and held only as long as necessary. Data controllers are also responsible for proving their compliance with these principles. European countries invest significantly in mental health programs that incorporate digital biomarkers to enhance diagnostic accuracy and treatment efficacy. Partnerships between pharmaceutical companies and technology firms are driving innovation in psychiatric care across Europe, leading to the development of novel digital tools for mental health assessment and management.

Asia Pacific Psychiatric Digital Biomarkers Market Trends

The psychiatric digital biomarkers market of Asia Pacific is anticipated to grow at a significant rate over the forecast period. The Asia Pacific region is driven by rapid urbanization, increasing healthcare expenditure, and a rising burden of mental health disorders. Countries in Asia Pacific are increasingly adopting telepsychiatry services and mobile health applications to address gaps in mental healthcare accessibility. In April 2024, Frontiers in Psychiatry highlighted a study on the potential of digital biomarkers for children's mental health screening. It focused on detecting depression, anxiety, and stress, revealing three key insights: the effectiveness of a multimodal approach to depression, variables explaining anxiety, and the impact of age on these correlations. With a growing emphasis on preventive mental healthcare and early intervention strategies, the Asia Pacific market for psychiatric digital biomarkers is poised for significant expansion in the coming years.

Key Psychiatric Digital Biomarkers Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their types and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Psychiatric Digital Biomarkers Companies:

The following are the leading companies in the psychiatric digital biomarkers market. These companies collectively hold the largest market share and dictate industry trends.

- Koneksa

- Biogen Inc.

- Empatica Inc.

- Vivo Sense

- IXICO plc

- Huma

- Sonde Health, Inc.

- Clario

Recent Developments

-

In May 2024, the FDA approved the Apple Watch's atrial fibrillation (AFib) detection tool for clinical trial use, under its Medical Device Development Tools (MDDT) program. This marks the first digital health tool to achieve qualification for medical research purposes, allowing it to be used for arrhythmia detection.

-

In March 2024, Biogen announced interim results from a study called RESPOND, evaluating SPINRAZA in infants and toddlers with certain needs after gene therapy. Early data show promising signs, including reduced neurodegeneration indicators and improved motor function in most participants.

-

In March 2024, Indivi, a MedTech leader based in Basel, Switzerland, entered into a partnership with Biogen to propel digital health innovations, specifically focusing on creating digital biomarkers for Parkinson's disease. As a significant part of this agreement, Biogen licensed its smartphone-based digital biomarker platform, KonectomTM, to Indivi.

-

In November 2023, digital health and AI company Empatica announced that its Empatica Health Monitoring Platform received US FDA 510(k) clearance for two additional digital biomarkers: pulse and respiratory rate. This approval expands the platform to include 6 FDA-cleared digital biomarkers, positioning it among the leading solutions for clinical trials.

-

In February 2022, digital biomarker startup Koneksa raised USD 45 million in a Series C funding round. The funds are earmarked for expanding its platform and enhancing its science team, focusing on the development of its digital biomarker platform and improving its clinical data integration tools.

Psychiatric Digital Biomarkers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 631.3 million

Revenue forecast in 2030

USD 2.29 billion

Growth rate

CAGR of 23.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, clinical practice, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Koneksa; Biogen Inc.; Amgen Inc.; Empatica Inc.; Vivo Sense; IXICO plc; Huma; Sonde Health, Inc.; Clario

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Psychiatric Digital Biomarkers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global psychiatric digital biomarkers market report based on type, clinical practice, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Wearable

-

Mobile based Applications

-

Sensors

-

Others

-

-

Clinical Practice Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Psychiatric Digital Biomarkers

-

Monitoring Psychiatric Digital Biomarkers

-

Predictive and Prognostic Psychiatric Digital Biomarkers

-

Other's (Safety, Pharmacodynamics/ Response, Susceptibility)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare companies

-

Healthcare Providers

-

Payers

-

Others (Patient, caregivers)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global psychiatric digital biomarkers market size was estimated at USD 521.9 million in 2023 and is expected to reach USD 631.3 million in 2024.

b. The global psychiatric digital biomarkers market is expected to grow at a compound annual growth rate of 23.9% from 2024 to 2030 to reach USD 2.29 billion by 2030.

b. The wearable segment held the largest market share of 40.08% in 2023. Wearable tech is rising in popularity within psychiatric care, offering real-time tracking of mental health through physiological and behavioral data.

b. Some key players operating in the market include Koneksa; Biogen Inc.; Amgen Inc.; Empatica Inc.; Vivo Sense; IXICO plc; Huma; Sonde Health, Inc.; Clario

b. Rising adoption of wearable devices and mobile health apps in mental healthcare contribute to the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."