- Home

- »

- Next Generation Technologies

- »

-

Quantum Computing Market Size And Share Report, 2030GVR Report cover

![Quantum Computing Market Size, Share & Trends Report]()

Quantum Computing Market Size, Share & Trends Analysis Report By Offering (System, Services), By Deployment, By Application (Optimization, Simulation, Machine Learning), By End-user, By Region, And Segment Forecast, 2024 - 2030

- Report ID: GVR-4-68040-155-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Quantum Computing Market Size & Trends

The global quantum computing market size was estimated at USD 1.21 billion in 2023 and is expected to grow at a CAGR of 20.1% from 2024 to 2030. The quantum computing ecosystem is expanding, with an increasing number of startups entering the market. These startups were focusing on various aspects of quantum technology, from hardware and software to applications. Furthermore, the market has been witnessing a surge in investments from both governments and private sectors. Governments were allocating substantial funds to quantum research and development to maintain a competitive edge in emerging technologies.

Quantum computing is still considered an emerging technology with significant potential. Unlike classical computers that use bits, quantum computers use quantum bits or qubits, which can represent both 0 and 1 simultaneously due to the principles of quantum mechanics. This makes quantum computers well-suited for specific types of complex calculations.

Quantum computing has the potential to revolutionize various industries due to its unique and powerful computational capabilities, which arise from the principles of quantum mechanics. One of the most significant potential applications of quantum computing is in the field of cryptography. Quantum computers can efficiently solve certain mathematical problems that are currently the basis of modern encryption techniques.

Furthermore, the pharmaceutical industry can benefit significantly from quantum computing. Drug discovery involves simulating complex molecular interactions, which is a computationally intensive process. Quantum computers can accelerate the simulation of molecular structures and interactions, leading to faster drug discovery and the development of more effective medicines. This can potentially save both time and resources in the drug development process.

Quantum cloud services refer to cloud-based platforms that provide access to quantum computing resources and tools over the internet. Some companies were beginning to offer quantum cloud services, allowing researchers and developers to access quantum computing resources through the cloud. This democratized access to quantum computing power. Quantum computers are highly specialized and expensive machines that require specialized expertise to operate. By offering quantum computing capabilities through the cloud, more researchers, businesses, and developers can access these resources without the need for significant investments in hardware, infrastructure, or in-house expertise.

Market Concentration & Characteristics

The quantum computing market is characterized by a high degree of innovation as innovations in quantum hardware design and engineering are crucial for developing more powerful and efficient quantum computers. Researchers are exploring new materials, architectures, and fabrication techniques to increase the number of qubits (quantum bits), improve qubit coherence times, and reduce error rates. This includes advancements in superconducting circuits, ion traps, photonic systems, and topological quantum computing.

Quantum computing companies are actively acquiring businesses with advanced quantum algorithms, hardware, and software expertise to enhance their platforms and deliver more powerful solutions to their clients. This trend underscores the growing importance of integrating cutting-edge quantum technology with classical computing systems to drive innovation and provide organizations with a competitive edge. Such mergers and acquisitions enable companies to expand their capabilities, offer improved quantum computing services, and empower clients to make better decisions through advanced simulation, optimization, and problem-solving techniques.

Regulatory mandates are compelling organizations in the quantum computing market to establish stringent data governance frameworks. This involves creating robust data management policies, defining clear data stewardship roles, and implementing lifecycle management processes to safeguard data quality, security, and retention throughout its lifespan. By enhancing data governance, companies can meet regulatory compliance, uphold data integrity, and optimize their use of quantum data assets. This focus on governance ensures that organizations can leverage quantum computing technology effectively while navigating complex regulatory landscapes.

The market for quantum computing is expanding rapidly due to service-based options that provide organizations with flexible, cost-effective access to advanced quantum technologies. These cloud-based solutions enable businesses to access the power of quantum computing for complex simulations and analysis without having to invest in expensive hardware or manage complicated infrastructure. By using these service-based offers, businesses may concentrate on building quantum applications and driving innovation in a variety of industries, while third-party suppliers manage and operate the underlying systems.

End-user concentration in the market is steadily increasing as organizations recognize the transformative potential of quantum technologies for achieving data-driven insights and competitive advantages. Established players with proven quantum expertise and robust infrastructure are attracting a larger share of end-users seeking reliable and scalable quantum computing solutions. This concentration is fueled by trust in the provider's capabilities, strong track records, and the ability to deliver advanced applications across various industries, making it challenging for smaller vendors to compete unless they offer niche solutions or specialized value propositions.

Offering Insights

The system segment dominated the market with a revenue share of over 64.2% in 2023. The system segment involves the development and deployment of quantum computing hardware and associated systems. Quantum hardware, including quantum processors, qubit architectures, and quantum interconnects, was experiencing rapid development. Companies were working on increasing the number of qubits, improving qubit quality, and enhancing error correction techniques. Advancements in hardware were crucial for achieving quantum supremacy and tackling practical problems.

The service segment is expected to grow at the fastest CAGR from 2024 to 2030. This segment includes a range of services related to quantum computing, such as consulting, quantum software development, quantum algorithm design, and quantum cloud services. Consulting firms specializing in quantum computing were in high demand. These firms provided guidance to businesses and organizations on assessing the potential impact of quantum computing on their operations. They helped clients identify quantum-ready applications and develop strategies for incorporating quantum technology into their existing workflows.

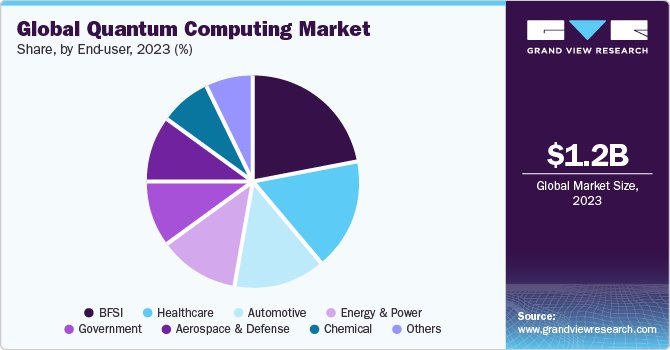

End-user Insights

The BFSI segment dominated the market with the highest revenue share in 2023. The rising demand for quantum computing stems from its rapid data processing capabilities, which provide substantial advantages to the BFSI sector. It equips the financial industry to conduct faster data analysis, specifically for tasks such as fraud detection, understanding customer behaviour, and facilitating decision-making. This prevalent tendency revolves around harnessing the swiftness of quantum computing to extract invaluable insights from extensive datasets, ultimately amplifying the efficiency of diverse financial procedures.

Quantum computing represents a groundbreaking advancement in the field of drug discovery. It facilitates highly accurate simulations of intricate molecular interactions, significantly expediting the identification of potential drug candidates by predicting molecular behaviours with precision. Quantum algorithms offer profound insights into molecular structures, aiding researchers in the more efficient and cost-effective development of medications. This technology holds the promise of expediting the delivery of life-saving drugs to the global population, ultimately benefiting patients across the world.

Deployment Insights

The on-premises segment dominated the market with the highest revenue share in 2023. Some enterprises and research institutions were opting for on-premises quantum computing solutions, where they maintained and operated their own quantum hardware. This approach provided greater control and security for sensitive applications. Quantum software deployment was becoming more common as organizations sought to integrate quantum algorithms into their existing software infrastructure. This involved the development and deployment of quantum software solutions for specific tasks or industries.

Quantum cloud services were gaining popularity for deployment. These services allowed users to access quantum computing resources remotely via the cloud, eliminating the need for on-premises quantum hardware. Quantum cloud providers were expanding their offerings to cater to a broader range of industries and applications. Many organizations were focusing on deploying hybrid quantum-classical computing solutions. These systems combine classical computing resources with quantum processors to leverage the strengths of both types of computing. Hybrid deployment is practical for solving complex problems that require a combination of quantum and classical algorithms.

Application Insights

The optimization segment dominated the market with the highest revenue share in 2023. The optimization segment is one of the key application areas where quantum computing holds significant promise and is expected to have a substantial impact. Quantum computing's ability to solve complex optimization problems more efficiently than classical computers has led to various growth trends in this segment. Quantum computing is being applied to optimize supply chain and logistics operations. It can help businesses find more efficient routes for transportation, reduce shipping costs, minimize inventory holding costs, and improve overall supply chain efficiency. This is particularly valuable in industries with complex distribution networks.

A prominent trend involves the increasing fusion of quantum computing and machine learning, with Quantum Machine Learning (QML) utilizing quantum algorithms and hardware to bolster machine learning operations. This trend is primarily motivated by the capacity of quantum computing to drastically accelerate intricate computations, providing substantial benefits for activities such as optimization, data analytics, and the training of artificial intelligence models. As quantum technology becomes more readily available and robust, the machine learning sector is expected to witness greater exploration and adoption of QML, potentially leading to significant advancements in the realms of AI and data science. Collaboration and research at the juncture of quantum computing and machine learning are well-positioned to fuel innovation and progress in both domains.

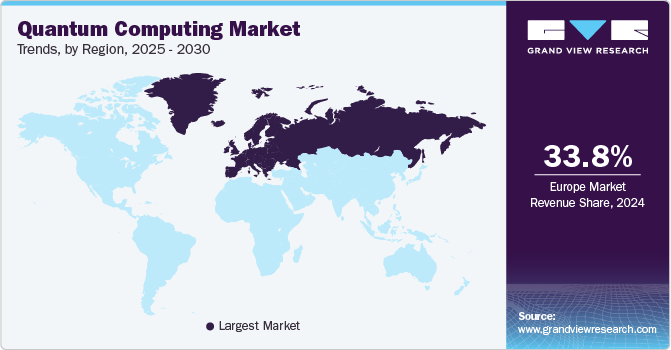

Regional Insights

North America, spearheaded by the U.S. and Canada, dominates the quantum computing landscape. A robust ecosystem of leading companies and research institutions thrives here, fueled by substantial public and private investments. This has positioned North America at the forefront of quantum hardware, software, and cloud solutions. The well-developed North America market for quantum computing prioritizes applications in cryptography, optimization, and scientific research.

U.S. Quantum Computing Market Trends

The quantum computing market in the U.S. is expected to grow significantly in the coming years, driven by increasing government and private sector investment in quantum technologies. This growth is being fueled by the potential of quantum computing to revolutionize various industries, such as materials science, drug discovery, and finance.

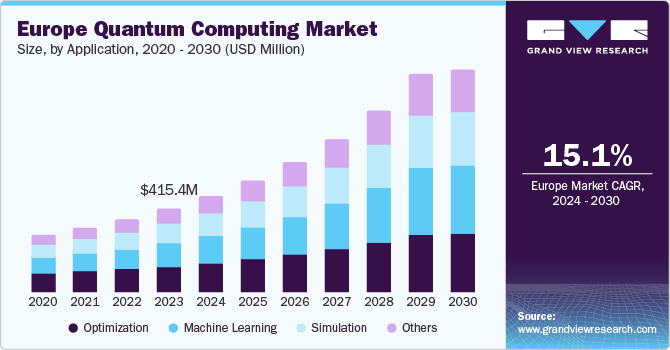

Europe Quantum Computing Market Trends

Europe dominated the quantum computing market with a revenue share of over 34.2% in 2023. The advancement of quantum computing technologies necessitates a profound grasp of fundamental physics and applied engineering. As a result, there is a rising pattern of cooperation between the industrial and academic sectors within the Europe market for quantum computing. This collaboration is expediting the progression of fresh quantum computing technologies and applications. Illustrate, numerous European quantum computing enterprises are partnering with universities and research institutions to create novel quantum algorithms and software solutions.

The quantum computing market in the UK has witnessed a surge in the number of quantum computing startups, driven by the availability of funding and a supportive ecosystem. These startups are focused on various aspects of quantum computing, including hardware development, software solutions, and application-specific quantum algorithms.

The France quantum computing market is experiencing significant growth, driven by government investment, and increasing interest from private companies. This trend is expected to continue in the coming years, with France positioning itself as a major player in the global quantum computing race.

Asia Pacific Quantum Computing Market Trends

One of the key trends in quantum software development across Asia Pacific is the emphasis on creating open-source quantum software. This strategy contributes to enhancing the accessibility and affordability of quantum software for companies, regardless of their size. Another notable trend involves the creation of quantum software tailored to sectors such as healthcare, finance, and materials science. This approach plays a pivotal role in expediting the integration of quantum computing within these industries.

The China quantum computing market is rapidly emerging as a leader in the quantum computing competition, with significant government investment and a growing number of startups and research institutions dedicated to the field. This trend is expected to accelerate in the coming years, with China poised to make major breakthroughs in quantum computing technology.

The quantum computing market in India is poised for significant growth, driven by government initiatives, and increasing interest from both domestic and international players. This trend is expected to accelerate in the coming years, with India emerging as a key player in the global quantum computing landscape.

The Japan quantum computing market is rapidly expanding, driven by significant government funding and a strong focus on innovation. This trend is expected to accelerate in the coming years, with Japan emerging as a global leader in quantum computing research and development.

Middle East & Africa (MEA) Quantum Computing Market Trends

The Middle East & Africa (MEA) quantum computing market is in its early stages, but it is expected to experience significant growth in the coming years, driven by factors such as rising government investments and increasing awareness of the technology's potential benefits. This trend is being fueled by a growing need for faster and more efficient computing solutions in sectors such as finance, healthcare, and materials science.

Key Quantum Computing Company Insights

The market is marked by intense competition, with a small number of global competitors holding substantial market share. The primary emphasis is on creating innovative products and fostering collaboration among the key industry participants. For instance, in April 2023, Moderna unveiled a partnership with IBM to investigate the use of quantum computing and artificial intelligence to advance and speed up mRNA research and scientific progress.

In another instance, In March 2023, the Cleveland Clinic, collaborating with IBM, introduced the inaugural installation of an IBM-managed quantum computer on-site in the U.S. within the private sector, primarily for healthcare research.

Key Quantum Computing Companies:

The following are the leading companies in the quantum computing market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture Plc.

- D-WaveSystem Inc.

- Google LLC

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Quantinuum Ltd.

- Rigetti & Co, Inc.

- Riverlane

- Zapata Computing

Recent Developments

-

In February 2024, D-Wave released their latest prototype, the Advantage2, boasting over 1,200 qubits, through their Leap quantum cloud service. This enables current Leap subscribers to access the new hardware instantly, while newcomers can register for Leap and enjoy up to one minute of free usage of the Advantage2 prototype, alongside other quantum processing units (QPUs) and solvers available on the platform.

-

In December 2023, IBM announced a collaboration with Keio University, The University of Tokyo, Yonsei University, Seoul National University, and The University of Chicago to enhance quantum education initiatives across Japan, Korea, and the United States. Through this partnership, IBM aims to provide educational programs, alongside inputs from each participating university, with the goal of training up to 40,000 students over the next decade. This effort seeks to equip students with the necessary skills for the emerging quantum workforce and foster the development of a thriving quantum computing ecosystem.

-

In December 2023, as outlined in NVIDIA's technical blog, the release of version 23.10 of its software development kit (SDK) cuQuantum marked a noteworthy advancement in quantum computing capabilities. Designed to augment libraries and tools for quantum computing tasks, this toolkit now demonstrates improved compatibility with NVIDIA Tensor Core GPUs, resulting in notable speed enhancements for quantum circuit simulations.

-

In November 2023, Rigetti Computing successfully obtained Phase 2 funding from DARPA (Defense Advanced Research Projects Agency). This funding, potentially totaling USD 1.5 million, aims to assist Rigetti in the creation of benchmarks designed to gauge the efficacy of large-scale quantum computers in practical, real-world scenarios.

-

In April 2023, Q-CTRL launched a new feature called the Quantum Approximate Optimization Algorithm (QAOA) Solver in their Fire Opal Error Mitigation software package. This Python-based software automates and optimizes the quality of answers when running QAOA on actual quantum computers. The QAOA Solver is designed to boost the performance and efficiency of quantum computing applications.

- In January 2023, Multiverse Computing and PINQ2 announced a partnership aimed at merging their expertise in quantum and classical computing. This collaboration is designed to advance industrial projects by combining knowledge from both academia and industry to promote innovation in the field.

Quantum Computing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.41 billion

Revenue forecast in 2030

USD 4.24 billion

Growth rate

CAGR of 20.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Market revenue in USD million/billion, CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments Covered

Offering, deployment, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Accenture Plc.; D-WaveSystem Inc.; Google LLC; IBM Corporation; Intel Corporation; Microsoft Corporation; Quantinuum Ltd.; Rigetti & Co, Inc.; Riverlane; Zapata Computing

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Global Quantum Computing Market Report Segmentation

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global quantum computing market based on offering, deployment, application, end-user, and region:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

System

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-Premises

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Optimization

-

Simulation

-

Machine Learning

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Aerospace & Defense

-

BFSI

-

Healthcare

-

Automotive

-

Energy & Power

-

Chemical

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global quantum computing market size was estimated at USD 1.21 billion in 2023 and is expected to reach USD 1.41 billion in 2024.

b. The global quantum computing market is expected to grow at a compound annual growth rate of 20.1% from 2024 to 2030 to reach USD 4.24 billion by 2030.

b. Europe dominated the quantum computing market with a share of 34.2% in 2023. This is attributable to the rising pattern of cooperation between the industrial and academic sectors within the European quantum computing market. These collaborations are expediting the progression of fresh quantum computing technologies and applications.

b. Some key players operating in the quantum computing market include Accenture Plc., D-WaveSystem Inc., Google LLC, IBM Corporation, Intel Corporation, Microsoft Corporation, Quantinuum Ltd., Rigetti & Co, Inc., Riverlane, and Zapata Computing

b. Key factors that are driving the market growth include increasing demand for high-performance computing, increase in government funds and strategic alliances, and early adoption of quantum computing in the banking and finance sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."