- Home

- »

- Network Security

- »

-

Quick Commerce Market Size, Share, Growth Report, 2030GVR Report cover

![Quick Commerce Market Size, Share & Trends Report]()

Quick Commerce Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Category (Clothing, Stationary), By Payment Mode (Cash On Delivery, Online), By Technology, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-151-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Quick Commerce Market Summary

The global quick commerce market size was estimated at USD 68.82 billion in 2022 and is projected to reach USD 323.91 billion by 2030, growing at a CAGR of 22.2% from 2023 to 2030. The market growth is attributed to the growing demand for faster delivery of essential commodities such as household essentials.

Key Market Trends & Insights

- North America held the highest global market share of more than 28.5% in 2022.

- Based on product, the food and groceries segment accounted for the largest share of 18.1% in 2022.

- Based on payment mode, the cash-on-delivery segment accounted for the largest share of 57.0% in 2022.

- Based on technology, the application-based operation segment accounted for a revenue share of 27.7% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 68.82 Billion

- 2030 Projected Market Size: USD 323.91 Billion

- CAGR (2023-2030): 22.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Growing traction towards demand delivery of food, groceries, and household essentials coupled with growing per capita income, large-scale industrialization, and rapid urbanization are driving the market growth. The idea behind quick commerce is to provide a super-fast delivery business model that has a streamlined logistics operation and strategic placement of dark stores near residential areas, thereby providing rapid doorstep delivery within 10 - 30 minutes.

The use of 5G and 4G technology for payment mode purposes is predicted to have a favorable impact on market growth because it offers the user an uninterrupted experience. Furthermore, smartphone use is gaining traction in developing countries, proliferating the customer's reach to online purchasing. Therefore, the growing use of consumer devices such as laptops, smartphones, and tablets is expected to boost the market growth. The growing number of medium and small-scale businesses is further anticipated to augment the demand for quick commerce throughout the projection period. Medium and small-sized firms are expanding rapidly, particularly in South Africa, Russia, and India. Initiatives such as Start-up India and Make in India have aided in the development of a start-up ecosystem in the country that uses e-commerce for business, hence driving market growth.

Regions such as Asia and Western Europe saw a rapid adoption of quick commerce among the population with the age bracket of 20-35 years old. The behavioral shift within the younger demographic bracket happened owing to factors such as pricing, availability of a wide product range and brands, and convenience. Moreover, the growing penetration of the internet in developing countries combined with the e-commerce players entering the market space are further creating growth opportunities for the market.

The adoption of quick commerce is also creating new growth opportunities for the major market players to expand their operations from delivering food to electronics, pet care products, flowers, books, and stationery cosmetics. According to Glovo, in 2022, the company had a 120% surge in non-food retail orders and a 76 % surge in orders from supermarkets, representing new growth opportunities for the quick commerce vendors to increase their service offering while presenting different vendors opportunities to establish their presence in the market space. The expansion of product folio is allowing quick commerce to expand its customer base more easily, resulting in essential exposure to the business. The growing prevalence of online marketing in the quick commerce space is further aiding the expanding reach of quick commerce in 2nd and 3rd tier cities.

Analytics is playing a pivotal role in providing efficient services and a seamless experience to quick commerce customers. With increasing competition, it's difficult for rapid commerce enterprises to get product assortment right, but it's vital to their success. To maximize assortment for rapid commerce retailers, they must first analyze how demand varies by demographic and store. Because speedy delivery necessitates packaged and fresh products, it is even more critical to provide a unique range for each store. Data analytics will assist Q-Commerce enterprises in determining which products are frequently purchased in each store. It also aids in the identification of high-demand holes in rivals' platforms. Assortment analytics assist in identifying shifts in consumer actions across various long- and short-term demands. The key to growing sales is to shape inventory so that it corresponds to the overlap between consumer interest and market opportunity. They can discover the best blend using assortment analytics.

Despite the significant growth witnessed by the quick commerce landscape, factors such as high delivery charges, logistical issues, and regulatory compliances are impeding the growth of the market. The high cost of hub operations, such as maintaining dark stores and last-mile delivery fleets, is another major factor deterring the quick e-commerce market growth. For instance, in June 2023, Getir, a quick commerce delivery service company, announced its exit from France. The company cited factors such as the high cost of maintaining dark stores, lower profitability in the country, and the complex legal environment in the country to cease its operation. The French government's decision to identify dark stores as warehouses enables the local government to decide whether to allow dark store setups in city centers. As dark stores play a pivotal part in building the quick commerce supply chain, restrictions on opening dark stores within the city hamper delivery operations. Another factor restraining the market growth is the high delivery charges levied on smaller orders. Typically, consumers order through quick delivery apps in case of just-in-time groceries or impulse purchases. Large orders tend to have higher delivery charges, which deters the consumer from opting for quick commerce sites.

Product Category Insights

Based on product, the food and groceries segment accounted for the largest revenue share of over 18.1% in 2022. The quick commerce business model revolves around the same-day, instant, and click-and-collect model, with many supermarkets and grocers partnering with third-party delivery companies to establish their quick commerce valuation around contactless shopping and expedited delivery. Quick commerce orders for food and groceries have recorded the highest growth; many major quick commerce companies across the landscape have observed that the orders for food products such as beverages, ready-to-eat food, and snacks are much higher for non-food items. As the practice gained traction, supermarkets, and grocery shop owners have also started to provide a wider range of imported food and groceries to cater to the large consumer base. Moreover, initiatives such as discounts and combo deals for high-frequency order commodities are further driving segmental growth.

The personal care items segment is expected to register a CAGR of 16.6% over the forecast period. As quick commerce has gained traction for delivering groceries and food, the market players saw opportunities to expand their product offerings to include personal care and wellness products. Brands are leveraging quick commerce to market their best-selling product through initiatives such as dedicated brand pages to display their products and launch new products.To draw attention to customers shopping for personal care products, quick commerce businesses are employing targeted marketing and advertising. They intend to interact with their clients via internet pages, social media, and applications.

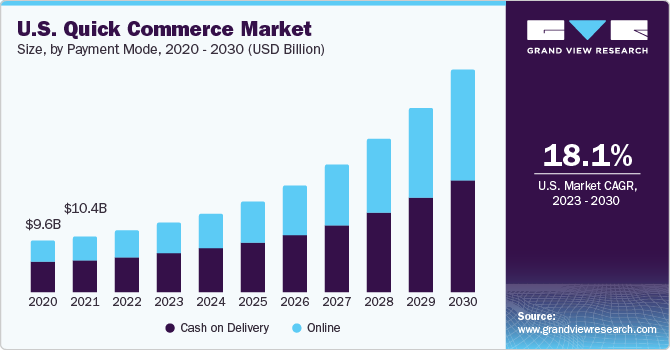

Payment Mode Insights

Based on payment mode, the cash-on-delivery segment accounted for the largest revenue share of over 57.0% in 2022. Many consumers tend to make purchases when they have access to and touch the things before delivering their money, particularly in areas with lower adoption rates for quick e-commerce. Increased customer retention and ongoing sales can result from offering COD and making sure cash-paying consumers have a positive experience. Managing COD payments can be safer and easier for delivery staff than managing big amounts of cash for one purchase. Efficiency and job satisfaction may rise as a result, it will contribute to the growth of the market.

The online payment mode segment is expected to exhibit a CAGR of 24.5% over the forecast period. Online payment methods play a pivotal part in the business model of quick commerce. Online payment options such as UPI, net banking, pay, digital wallets, credit cards, debit cards, and buy now pay later models contribute to the efficient and seamless consumer experience the quick commerce aims to provide, thereby driving the segment growth. Discounts and cashback on using online payment options further prompt customers to use online transaction methods while saving on orders.

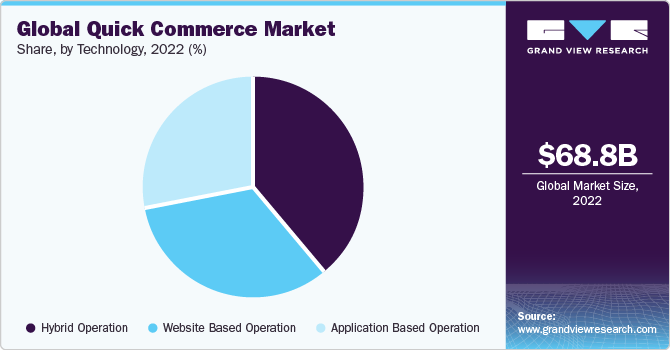

Technology Insights

Based on technology, the application-based operation segment accounted for a revenue share of more than 27.7% in 2022. The ease of accessing the application on mobile devices such as smartphones and tablets allows the customer to use the app anywhere they want. The facilities to save location on the app allow the users to order products while being at a different place. Moreover, easy-to-understand design, navigation throughout the app, ease of adding payment methods, and ease of browsing are among the major factors driving the segmental growth.

The website-based operations segment is expected to exhibit a CAGR of more than 22.0% over the forecast period. Websites provide a comprehensive view of the homepage and connected pages. The ease of browsing and using the website are major factors that drive the segmental growth.Q-commerce websites offer affiliate programs that allow companies to work together and use the platform to reach a broader demographic audience. Moreover, websites are compatible with different types of browsers which makes them easier to use on different search engines.

Regional Insights

North America held the highest market share of more than 28.5% in 2022. Consumers in North America are adopting quick commerce owing to its faster delivery of consumables, personal care products, electronics, and pet care products. Consumers can order anything they need at any time. Quick commerce companies are typically targeting cities and areas that are densely populated, thereby driving market growth.In addition to providing user-friendly websites and mobile applications, Q-commerce companies prioritized the customer experience by including services such as real-time order examining, prompt deliveries, and support for customers.

Asia Pacific is expected to exhibit the highest CAGR of 27.8% over the forecast period. The APAC region is witnessing a rapid expansion of the market. Countries such as India, China, Japan, Indonesia, Singapore, and Thailand are experiencing the rise of quick commerce start-ups owing to their USP of fast delivery and vast model offerings. Start-ups such as Dropezy (USD 2.5 million) and Astro (from Indonesia are receiving significant funding for expanding their operation. With a majority of the population in the working class, quick commerce enables households to order groceries for a week or just in time without visiting the stores. Moreover, in countries such as India, where quick commerce has already become prevalent in metro cities and is establishing itself in tier 2 and tier 3 cities. Major market players such as KiranaKart Technologies Private Limited (Zepto), Blink Commerce Private Limited (Blinkit), and Swiggy Instamart account for 80% of the overall market share in India.

Key Companies & Market Share Insights

The key players in the market in 2022 include Swiggy; Blink Commerce Private Limited;Supermarket Grocery Supplies Pvt Ltd (Big Basket); KiranaKart Technologies Private Limited (Zepto); Quickcommerce Ltd. (Zapp); and others. For these companies, the main competitive factors include parameters such as ease of payment and ordering, pricing offers and discounts, wide product assortment, and fast delivery timelines to sustain themselves in the market. Moreover, to expand their reach in tier 2 and tier 3 cities or different countries, they are consistently debuting in new markets to establish their presence. Likewise, major market players are also partnering with food delivery platforms to expand their reach. For instance, in September 2023, Getir announced a partnership with Uber Eats. Under the partnership, Getir will expand its groceries on-tap operation for Uber Eats users in the UK.

Key Quick Commerce Companies:

- Swiggy

- Dunzo

- Blink Commerce Private Limited

- Supermarket Grocery Supplies Pvt Ltd (Big Basket)

- KiranaKart Technologies Private Limited (Zepto)

- Getir

- Flink

- Yemece.

- Quickcommerce Ltd.(Zapp)

- Delivery Hero

- Gopuff.

- Maplebear Inc.(Instacart)

- Zapp

- foodpanda

- Rappi

Quick Commerce Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 79.70 billion

Revenue forecast in 2030

USD 323.91 billion

Growth rate

CAGR of 22.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; China; India; Japan; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product category, payment mode, technology, region

Key companies profiled

Swiggy; Dunzo; Blink Commerce Private Limited; Supermarket Grocery Supplies Pvt Ltd (Big Basket); KiranaKart Technologies Private Limited (Zepto); Getir; Flink; Yemece; Quickcommerce Ltd.(Zapp); Delivery Hero; Gopuff; Maplebear Inc.(Instacart); Zapp; foodpanda; Rappi

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Quick Commerce Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global quick commerce market report based on product category, payment mode, technology, and region:

-

Product Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Groceries

-

Stationary

-

Personal Care Items

-

Medicines

-

Small Electronics & Accessories

-

Clothing

-

Household Products

-

Others (Pets, alcohol, gifts & flowers)

-

-

Payment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cash on Delivery

-

Online

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Application Based Operation

-

Website Based Operation

-

Hybrid Operation

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global quick commerce market size was estimated at USD 68.82 billion in 2022 and is expected to reach USD 79.70 billion in 2023.

b. The global quick commerce market is expected to grow at a compound annual growth rate of 22.2% from 2023 to 2030 to reach USD 323.91 million by 2030.

b. North America held the highest market share of more than 28.5% in 2022. Consumers in North America are adopting quick commerce owing to its faster delivery of consumables, personal care products, electronics, and pet care products.

b. Some key players operating in the quick commerce market are Swiggy., Dunzo., Blink Commerce Private Limited, Supermarket Grocery Supplies Pvt Ltd (Big Basket), KiranaKart Technologies Private Limited (Zepto), Getir, Flink., Yemece., Quickcommerce Ltd.(Zapp), Delivery Hero, Gopuff., Maplebear Inc.(Instacart), Zapp., foodpanda, and Rappi, among others.

b. The use of 5G and 4G technology for Payment Mode purposes is predicted to have a favorable impact on market growth because it offers the user an uninterrupted experience. Furthermore, smartphone use is gaining traction in developing countries, proliferating the customer's reach to online purchasing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.