- Home

- »

- Pharmaceuticals

- »

-

Radiation Oncology Market Size, Share & Trends Report, 2030GVR Report cover

![Radiation Oncology Market Size, Share & Trends Report]()

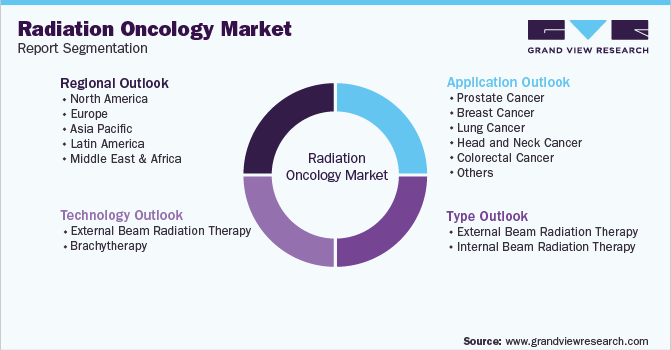

Radiation Oncology Market Size, Share & Trends Analysis Report By Type (External Beam Radiation Therapy, Internal Beam Radiation Therapy), By Technology, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-801-5

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Radiation Oncology Market Size & Trends

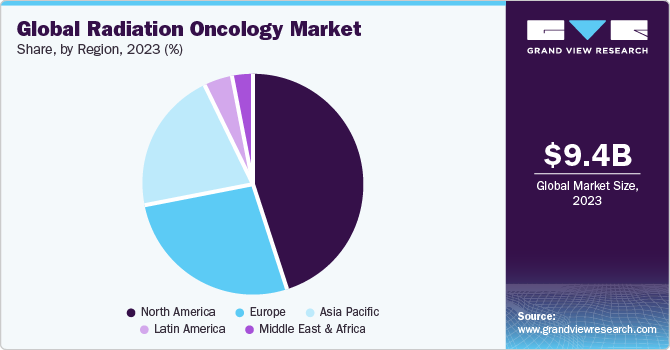

The global radiation oncology market size was valued at USD 9.37 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12.3% from 2024 to 2030. Key factors driving the market include technological advancement in radiation therapy equipment, global rise in cancer cases, and increasing adoption of radiation therapy in oncology treatment.

Furthermore, the radiation oncology market is witnessing increased demand for radiotherapy due to the rising global cancer burden. According to WHO, globally, around 19.3 million people were suffering from cancer, and 10 million died from it in 2022. Moreover, WHO in Europe estimated that there were 4.6 million new people diagnosed with various indications of cancer such as prostate, breast, lung, colorectal, and brain and around 2.1 million people across European countries died from the disease in 2020. As per American Cancer Society’s 2022 report, breast cancer is most common occurring condition which accounts for around 3 lakh and 51,400 new cases in U.S. of invasive and non-invasive breast tumor, respectively.

In the dynamic market outlook of the radiation therapy space, key players are making strategic moves to enhance their market presence. In October 2023, Accuray Incorporated gained approval for its Tomo C radiation therapy system in China, opening new avenues for growth in the region. This regulatory milestone reflects Accuray's commitment to expanding its market reach. Similarly, in June 2023, PharmaLogic Holdings Corp. entered into a Master Services Agreement for the development and production of theranostic candidates VMT-01 and VMT-NET. These radiopharmaceuticals, currently in the research and development phase, aim to address the diagnostic and treatment needs of metastatic melanoma and neuroendocrine cancers. This strategic collaboration underscores PharmaLogic's dedication to advancing innovative solutions in the oncology space.

Market Characteristics & Concentration

Market growth stage is high, and pace of the market growth is accelerating. The radiation therapeutic in oncology is characterized by a high degree of innovation.This can be attributed to advanced technologies and methodologies for transforming treatment practices.The space witnesses a notable M&A activities by the leading players. Leading players are strategically joining forces to expand and enhance their services, gain access to new technologies, consolidate the rapidly growing market, and address increasing strategic importance of radiotherapy.

For instance, in the radiation oncology market, key player IBA has taken a significant step in July 2023 by partnering with Apollo Proton Cancer Centre in India. This collaboration aims to enhance the skills of oncologists in proton beam therapy through specialized training programs. This strategic move by IBA underscores the growing importance of knowledge-sharing and skill development within the radiation oncology sector. The initiative is expected to contribute to the overall advancement of proton therapy applications, potentially impacting the market dynamics positively. As a result, other industry players might consider similar partnerships or training programs to stay competitive and contribute to the overall growth and improvement of radiation oncology practices.

The space is also subject to increasing regulatory scrutiny. Radiation exposure is regulated by governmental agencies such as FDA, Department of Transportation (DOT), Environmental Protection Agency (EPA), and Nuclear Regulatory Commission (NRC). Radiation-emitting devices used in medicine are regulated by Center for Devices and Radiologic Health (CDRH), whereas the use of radiation for medical purposes is regulated by the FDA. Radiation oncology devices are governed under the Radiation Control for Health and Safety Act, 1968.

The Code of Federal Regulations Title 21 governs the use of radiopharmaceuticals in the U.S. The diagnostic and therapeutic applications of radiopharmaceuticals are separately covered under this title in Part 315 & Part 361, respectively. In addition, the Nuclear Regulatory Commission (NRC) regulates the use of radiopharmaceuticals in 37 states. The NRC authorizes utilization and possession of radioactive source material, by product material, and special nuclear material.

CDRH governs the use of radiopharmaceuticals. In addition, it governs use of electron emitting products, including medical devices. However, radioisotopes that produce chemical effects, such as Ra-223, are governed by the Center for Drug Evaluation & Research, and the ones considered biologics, such as I-131 and Y-90, are used for treatment of non-Hodgkin’s lymphoma and are governed by the Center for Biologics Evaluation and Research.

Radiation therapy has significant substitutes like surgeries and chemotherapy that improve many of the anticancer effects but have more side effects. However, any technological advancements in radiation therapy that offer improved technology with high efficacy may be a threat to existing treatment options such IGRT, proton therapy, and 3D-conformity therapy, encouraging patients to shift to advanced treatment options. The lack of effective treatment options for complex cancers and increased side effects of therapies are expected to negatively impact the overall market growth.

Moreover, the industry is witnessing growing number of geographical expansion strategies, for instance, players such as Curium in June 2021, acquired Austrin to expand its presence in Europe for its broad portfolio of life-saving diagnostic solutions. This acquisition will help the company strengthen its positron emission-tomography (PET) radiopharmaceutical business.

Type Insights

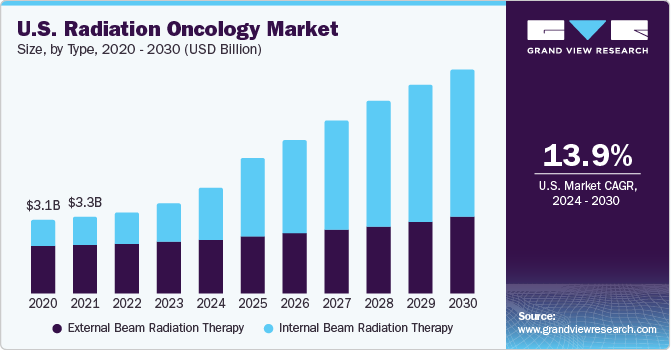

The external beam radiation therapy (EBRT) market, which includes linear accelerators (Linac), and compact advanced radiotherapy systems dominated the overall market with the largest share of 62.41% in 2023 due to increased adoption in treatment of various types of cancers. Furthermore, EBRT products has high ability to kill tumor in the early phases as compared to conventional therapies with less side effects. Moreover, rapid technological advancements and investigation of such technologies on various cancer treatment are increasing demand for LINACs and MR-LINACs, thereby, contributing to the growth of radiation oncology markets. For instance, in December 2022, using Elekta Unity MR-Linac, first ever patient got treated for pancreatic tumor with new advanced radiotherapy motion management.

Linear accelerator (Linac) uses microwave technology like radar to destroy tumor cells by delivering high energy electrons or x-rays near tumor region and spare the surrounding healthy tissue. Introduction of novel linear accelerators contributes to market growth. For instance, in September 2020, Elekta AB announced the launch of the Elekta Harmony linear accelerator, which is the productive Linac for the treatment of cancer by radiotherapy. The launch of the new products may contribute to the market growth by addressing the unmet medical needs.

Technology Insights

The IMRT segment accounted for the largest share of the radiation oncology market in 2023, attributable to a substantial demand for treatment and increased availability of technologically advanced intensity-modulated radiotherapy (IMRT) in countries with unmet treatment needs. However, brachytherapy is estimated to be the fastest-growing segment over the forecast period due to the benefits associated with its high adoption rate and minimal risk of side effects.

3D-CRT projects radiation beams in such a way that the beams match the dimensions of tumor and help physicians to know the exact dimensions of tumor, which limits the damage to healthy tissues. It allows delivery of higher dose levels at the tumor site, thereby increasing its effectiveness to shrink and destroy the tumor by using a multi-leaf collimeter (MLC) in a step-and-shoot technique. 3D-CRT is used to treat head & neck, liver cancer, prostate, lung, and brain cancer.

The advancements in brachytherapy provide precise and targeted dose delivery and personalized treatment options to patients. This technology is mostly used for the treatment of prostate cancer. Compared to conventional treatment techniques, its improved efficacy and reduced setup time are likely to drive the worldwide brachytherapy segment. Moreover, supportive reimbursement policies for products related to brachytherapy reduced the treatment cost, thereby encouraging patients to avail treatment. In May 2020, Isoray announced the approval of billing codes for reimbursement of Cesium-131 for the hospital in a DRG setting. Cesium-131 is used in brachytherapy to treat various organ tumors.

Application Insights

The EBRT segment accounted for the largest revenue size of radiation oncology market by in 2023 and is anticipated to maintain its dominance over the forecast period. This can be attributed to the rising global cancer prevalence and increasing adoption of EBRT systems by cancer centers and hospitals. For instance, in September 2021, Unicancer acquired multilple Radixact Systems of Accuray, Inc. with the ClearRT with aim to provide personalized treatment patients in Europe. Unicancer is French hospital network that provide treatment to 530,000 cancer patients annually.

The market for IBRT is anticipated to witness significant growth over the forecast period due to growing prevalence of cancer in developing countries, and increased product penetration. IBRT is mostly used in conjunction with breast cancer surgery. Brachytherapy for breast tumor involves different techniques for placing devices such as interstitial brachytherapy and intracavitary brachytherapy. Most performed technique for breast cancer is intracavitary brachytherapy. According to a study published by National Cancer Institute (NCI) showed that whole breast irradiation, (WBI), and accelerated partial-breast irradiation (APBI) lowers the rate for cancer recurring in the breast cancer patients.IMRT has become the standard treatment for locally advanced head & neck cancer due to its high conformality. Moreover, Gynecologic cancer is mostly treated with the help of various brachytherapy techniques.

Regional Insights

North America dominated the overall radiation oncology market in terms of revenue share of 45.52% in 2023, owing to the favorable government initiatives and availability of technologically advanced radiotherapy equipment. Furthermore, active participation of key players to increase their market share in region is fueling the market growth. For instance, in December 2022, MVision AI entered partnership with Medron Medical Systems to distribute AI radiotherapy technology of MVision in Canada. The use of AI technology provides high accuracy, leading to improved patient outcomes.

Asia Pacific is estimated to be the fastest-growing region over the forecast period due to improvements in healthcare infrastructure, increase in patient awareness levels, and high unmet patient needs. In addition, rising cancer burden and funding support to major players in the region are expected to offer lucrative opportunity for segment growth. According to Globocan report 2020, about 9.5 million new cancer cases were diagnosed, and 5.8 million died due to this disease in the Asia region, increasing demand for radiotherapy to manage the impact of cancer in the countries.

Key Companies & Market Share Insights

Some of the key players operating in the industry are Accuray, Inc., Varian Medical Systems, Inc., Ion Beam Application (IBA), Elekta AB,Becton Dickinson and Company, and Isoray Medical. The leading players in radiation oncology industry are focusing on growth strategies, such as innovations with radiotherapy, product launches, and R&D investments. Elekta Ab is geographically expanding in markets outside China and an increasing number of installed units are expected to reach the end of the life cycle, further requiring replacements, service, and support.

RaySearch, VisionRT, Sensus Healthcare are some of the emerging market participants in the radiation oncology space. Emerging companies are employing various strategies such as mergers & acquisitions to expand their footprint and grow at a fast pace.

Key Radiation Oncology Companies:

- Varian Medical Systems, Inc.

- Elekta AB

- Accuray Incorporated

- IBA Radiopharma Solutions

- BD (Becton, Dickinson and Company)

- Isoray Inc.

- Mevion Medical Systems

- Nordion, Inc.

- NTP Radioisotopes SOC Ltd.

- Curium

- ViewRay Technologies, Inc.

Recent Developments

-

In October 2023, Accuray incorporated achieved a significant milestone as their Tomo C radiation therapy system gained approval from the Chinese National Medical Products Administration (NMPA). This strategic move by the company reflects its commitment to expanding market presence and catering to the growing demand for advanced radiation oncology solutions in China.

-

In July 2023, in India IBA took a step towards collaboration by forming a partnership with Apollo Proton Cancer Centre (APCC). The purpose was to offer training sessions for oncologists, focusing on proton beam therapy, demonstrating a commitment to knowledge sharing and professional development within the radiation oncology sector.

-

In June 2023, PharmaLogic Holdings Corp., a key player in the radiation oncology market, took a significant step by signing a Master Services Agreement. This agreement focuses on the development and production of theranostic candidates VMT-01 and VMT-NET, aiming to address metastatic melanoma and neuroendocrine cancers. Currently, these radiopharmaceuticals are undergoing research and development, highlighting the company's strategic commitment to advancing diagnostic and treatment solutions in the field.

Radiation Oncology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.54 billion

Revenue forecast in 2030

USD 21.14 billion

Growth rate

CAGR of 12.3% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion/Million and CAGR from 2024 to 2030

Report coverage

Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends

Segments covered

Type, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Denmark; Sweden, Norway; Japan; China; India; Australia; South Korea;Thailand Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Varian Medical Systems, Inc.; Elekta AB; Accuray Incorporated; IBA Radiopharma Solutions; BD; Isoray Medical; Mevion Medical Systems, Inc.; Nordion Inc.; NTP Radioisotopes SOC Ltd.; Curium Pharma; Viewray Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Radiation Oncology Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global radiation oncology market report on the basis of type, technology, application, and regions:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

External Beam Radiation Therapy

-

Linear Accelerators (Linac)

-

Compact advanced radiotherapy systems

-

Cyberknife

-

Gamma Knife

-

Tomotherapy

-

-

Proton Therapy

-

Cyclotron

-

Synchrotron

-

-

-

Internal Beam Radiation Therapy

-

Brachytherapy

-

Seeds

-

Applicators and After loaders

-

Electronic Brachytherapy

-

-

Systemic Beam Radiation Therapy

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

External Beam Radiation Therapy

-

Image-Guided Radiotherapy (IGRT)

-

Intensity Modulated Radiotherapy (IMRT)

-

Stereotactic Technology

-

Proton Beam Therapy

-

3D Conformal Radiotherapy (3D CRT)

-

Volumetric Modulated Arc Therapy (VMAT)

-

-

Brachytherapy

-

Low-Dose Rate Brachytherapy

-

High-Dose Rate Brachytherapy

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

External Beam Radiation Therapy

-

Prostate Cancer

-

Breast Cancer

-

Lung Cancer

-

Head and Neck Cancer

-

Colorectal Cancer

-

Others

-

-

Internal Beam Radiation Therapy

-

Prostate Cancer

-

Gynecological Cancer

-

Cervical Cancer

-

Breast Cancer

-

Penile Cancer

-

Others

-

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of LATAM

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global radiation oncology market size was estimated at USD 8.65 billion in 2022 and is expected to reach USD 9.40 billion in 2023.

b. The global radiation oncology market is expected to witness a compound annual growth rate of 12.3% from 2024 to 2030 to reach USD 21.14 billion in 2030.

b. The IMRT technology segment dominated the market for radiation oncology and accounted for the largest revenue share of 24.5% in 2022. IMRT allows a change in radiation intensity during treatment to specifically target cancer cells and limit the damage to adjoining healthy tissues.

b. Breast cancer treated using EBRT accounted for a significant share in 2022 due to high effectiveness and supporting awareness programs.

b. North America dominated the radiation oncology market in 2022 and accounted for the largest revenue share of more than 44.6%. High healthcare expenditure, advanced healthcare infrastructure, and significant R&D investments are some of the major factors contributing to the market dominance of this region.

b. Based on type, the External Beam Radiation Therapy segment held the largest share of 64.53% in 2022, owing to the relatively higher price of equipment, high installed base, lower side-effects, and ease in delivery as radiologists can control the rate of radiotherapy.

Table of Contents

Chapter 1 Radiation Oncology Market: Methodology And Scope

1.1 Market Segmentation And Scope

1.1.1 Segment Scope

1.1.2 Regional Scope

1.1.3 Estimates And Forecast Timeline:

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database:

1.3.2 GVR’s Internal Database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.3.5 Details Of Primary Research

1.4 Information Or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis

1.6.1.1 Approach: Commodity Flow Approach

1.7 List Of Secondary Sources

1.8 List Of Abbreviations

1.9 Objectives

1.9.1 Objective 1

1.9.2 Objective 2

1.9.3 Objective 3

1.9.4 Objective 4

Chapter 2 Radiation Oncology Market: Executive Summary

2.1 Market Summary

Chapter 3 Radiation Oncology Market: Variables, Trends & Scope

3.1 Market Segmentation

3.2 Market Definitions

3.3 Key Opportunities Prioritized

3.4 Market Dynamic Analysis

3.4.1 Rising Adoption Of Radiotherapy

3.4.2 Technological Advancements In Radiotherapy

3.4.3 Rising Prevalence Of Cancer

3.4.4 Increase In Healthcare Expenditure

3.4.5 Increasing APPLICATION OF Radiopharmaceuticals

3.5 Market Restraint Analysis

3.5.1 Lack Of Skilled Radiotherapy Professionals

3.5.2 Inadequate Radiation Infrastructure

3.5.3 Adverse Effects Of Radiotherapy

3.6 Business Environment Analysis

3.6.1 SWOT Analysis; By Factor (POLITICAL & LEGAL, Economic And Technological)

3.6.2 Porter’s Five Forces Analysis

Chapter 4 Radiation Oncology Market - Segment Analysis, By Type, 2018 - 2030 (USD Million)

4.1 Radiation Oncology Market: Type Movement Analysis

4.2 External Beam Radiation Therapy

4.2.1 External Beam Radiation Therapy Market, 2018 - 2030 (USD Million)

4.2.2 Electron-Emitting High Energy Linear Accelerators

4.2.2.1 Electron-Emitting High Energy Linear Accelerators Market, 2018 - 2030 (USD Million)

4.2.3 Compact Advanced Radiotherapy Systems

4.2.3.1 Compact Advanced Radiotherapy Systems Market, 2018 - 2030 (USD Million)

4.2.3.2 Cyberknife

4.2.3.2.1 Cyberknife Market, 2018 - 2030 (USD Million)

4.2.3.3 Gamma Knife

4.2.3.3.1 Gamma Knife Market, 2018 - 2030 (USD Million)

4.2.3.4 Tomotherapy

4.2.3.4.1 Tomotherapy Compact Market, 2018 - 2030 (USD Million)

4.2.4 Proton Therapy

4.2.4.1 Proton Therapy Market, 2018 - 2030 (USD Million)

4.2.4.2 Cyclotron

4.2.4.2.1 Cyclotron Market, 2018 - 2030 (USD Million)

4.2.4.3 Synchrotron

4.2.4.3.1 Synchrotron Market, 2018 - 2030 (USD Million)

4.3 Internal Beam Radiation Therapy

4.3.1 Internal Beam Radiation Therapy Market, 2018 - 2030 (USD Million)

4.3.2 Brachytherapy

4.3.2.1 Brachytherapy Market, 2018 - 2030 (USD Million)

4.3.2.2 Seeds

4.3.2.2.1 Seeds Market, 2018 - 2030 (USD Million)

4.3.2.3 Applicators And After-Loaders

4.3.2.3.1 Applicators And After-Loaders Market, 2018 - 2030 (USD Million)

4.3.2.4 Electronic Brachytherapy

4.3.2.4.1 Electronic Brachytherapy Market, 2018 - 2030 (USD Million)

4.3.3 Systemic Beam Radiation Therapy

4.3.3.1 Systemic Beam Radiation Therapy Market, 2018 - 2030 (USD Million)

4.3.4 Others

4.3.4.1 Others Market, 2016-2028 (USD Million)

Chapter 5 Radiation Oncology Market - Segment Analysis, By Technology, 2018 - 2030 (USD Million)

5.1 Radiation Oncology Market: Technology Movement Analysis

5.2 External Beam Radiation Therapy (EBRT)

5.2.1 EBRT Market, 2018 - 2030 (USD Million)

5.2.2 Image-Guided Radiation Therapy (IGRT)

5.2.2.1 IGRT Market, 2018 - 2030 (USD Million) (Procedure Volume)

5.2.3 Intensity Modulated Radiotherapy (IMRT)

5.2.3.1 IMRT Market, 2018 - 2030 (USD Million) (Procedure Volume)

5.2.4 Stereotactic Radiotherapy

5.2.4.1 Stereotactic Radiotherapy Market, 2018 - 2030 (USD Million) (Procedure Volume)

5.2.5 Proton Beam Therapy

5.2.5.1 Proton Beam Therapy Market, 2018 - 2030 (USD Million) (Procedure Volume)

5.2.6 3D Conformal Radiotherapy (3D-CRT)

5.2.6.1 3D-CRT Market, 2018 - 2030 (USD Million) (Procedure Volume)

5.2.7 Volumetric Modulated Arc Therapy (VMAT)

5.2.7.1 VMAT Market, 2018 - 2030 (USD Million) (Procedure Volume)

5.3 Brachytherapy

5.3.1 Brachytherapy Market, 2018 - 2030 (USD Million)

5.3.2 Low Dose Rate (LDR) Brachytherapy

5.3.2.1 LDR Brachytherapy Market, 2018 - 2030 (USD Million)

5.3.3 High Dose Rate (HDR) Brachytherapy

5.3.3.1 HDR Brachytherapy Market, 2018 - 2030 (USD Million)

Chapter 6 Radiation Oncology Market - Segment Analysis, By Application, 2018 - 2030 (USD Million)

6.1 Radiation Oncology Market: Application Movement Analysis

6.2 External Beam Radiation Therapy (EBRT)

6.2.1 Prostate Cancer

6.2.1.1 Prostate Cancer Market, 2018 - 2030 (USD Million)

6.2.2 Breast Cancer

6.2.2.1 Breast Cancer Market, 2018 - 2030 (USD Million)

6.2.3 Lung Cancer

6.2.3.1 Lung Cancer Market, 2018 - 2030 (USD Million)

6.2.4 Head And Neck Cancer

6.2.4.1 Head And Neck Cancer Market, 2018 - 2030 (USD Million)

6.2.5 Colorectal Cancer

6.2.5.1 Colorectal Cancer Market, 2018 - 2030 (USD Million)

6.2.6 Others

6.2.6.1 Others Market, 2018 - 2030 (USD Million)

6.3 Internal Beam Radiation Therapy

6.3.1 Prostate Cancer

6.3.1.1 Prostate Cancer Market, 2018 - 2030 (USD Million)

6.3.2 Gynecologic Cancer

6.3.2.1 Gynecologic Cancer Market, 2018 - 2030 (USD Million)

6.3.3 Breast Cancer

6.3.3.1 Breast Cancer Market, 2018 - 2030 (USD Million)

6.3.4 Cervical Cancer

6.3.4.1 Cervical Cancer Market, 2018 - 2030 (USD Million)

6.3.5 Penile Cancer

6.3.5.1 Penile Cancer Market, 2018 - 2030 (USD Million)

6.3.6 Others

6.3.6.1 Others Market, 2018 - 2030 (USD Million)

Chapter 7 Radiation Oncology Market - Segment Analysis, By Region, 2018 - 2030 (USD Million)

7.1 Definition & Scope

7.2 North America

7.2.1 North America, SWOT Analysis

7.2.2 U.S.

7.2.2.1 U.S. Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.2.2.2 Key Country Dynamics

7.2.2.3 Target Disease Prevalence

7.2.2.4 Competitive Scenario

7.2.2.5 Regulatory Framework

7.2.2.6 Reimbursement Scenario

7.2.3 Canada

7.2.3.1 Canada Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.2.3.2 Key Country Dynamics

7.2.3.3 Target Disease Prevalence

7.2.3.4 Competitive Scenario

7.2.3.5 Regulatory Framework

7.2.3.6 Reimbursement Scenario

7.3 Europe

7.3.1 Europe, SWOT Analysis

7.3.2 U.K.

7.3.2.1 U.K. Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.3.2.2 Key Country Dynamics

7.3.2.3 Target Disease Prevalence

7.3.2.4 Competitive Scenario

7.3.2.5 Regulatory Framework

7.3.2.6 Reimbursement Scenario

7.3.3 Germany

7.3.3.1 Germany Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.3.3.2 Key Country Dynamics

7.3.3.3 Target Disease Prevalence

7.3.3.4 Competitive Scenario

7.3.3.5 Regulatory Framework

7.3.3.6 Reimbursement Scenario

7.3.4 France

7.3.4.1 France Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.3.4.2 Key Country Dynamics

7.3.4.3 Target Disease Prevalence

7.3.4.4 Competitive Scenario

7.3.4.5 Regulatory Framework

7.3.4.6 Reimbursement Scenario

7.3.5 Italy

7.3.5.1 Italy Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.3.5.2 Key Country Dynamics

7.3.5.3 Target Disease Prevalence

7.3.5.4 Competitive Scenario

7.3.5.5 Regulatory Framework

7.3.5.6 Reimbursement Scenario

7.3.6 Spain

7.3.6.1 Spain Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.3.6.2 Key Country Dynamics

7.3.6.3 Target Disease Prevalence

7.3.6.4 Competitive Scenario

7.3.6.5 Regulatory Framework

7.3.6.6 Reimbursement Scenario

7.3.7 Sweden

7.3.7.1 Sweden Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.3.7.2 Key Country Dynamics

7.3.7.3 Target Disease Prevalence

7.3.7.4 Competitive Scenario

7.3.7.5 Regulatory Framework

7.3.7.6 Reimbursement Scenario

7.3.8 Denmark

7.3.8.1 Denmark Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.3.8.2 Key Country Dynamics

7.3.8.3 Target Disease Prevalence

7.3.8.4 Competitive Scenario

7.3.8.5 Regulatory Framework

7.3.8.6 Reimbursement Scenario

7.3.9 Norway

7.3.9.1 Norway Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.3.9.2 Key Country Dynamics

7.3.9.3 Target Disease Prevalence

7.3.9.4 Competitive Scenario

7.3.9.5 Regulatory Framework

7.3.9.6 Reimbursement Scenario

7.3.10 Rest Of Europe

7.3.10.1 Rest Of Europe Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.4 Asia Pacific

7.4.1 Asia Pacific, SWOT Analysis

7.4.2 India

7.4.2.1 India Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.4.2.2 Key Country Dynamics

7.4.2.3 Target Disease Prevalence

7.4.2.4 Competitive Scenario

7.4.2.5 Regulatory Framework

7.4.2.6 Reimbursement Scenario

7.4.3 China

7.4.3.1 China Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.4.3.2 Key Country Dynamics

7.4.3.3 Target Disease Prevalence

7.4.3.4 Competitive Scenario

7.4.3.5 Regulatory Framework

7.4.3.6 Reimbursement Scenario

7.4.4 Japan

7.4.4.1 Japan Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.4.4.2 Key Country Dynamics

7.4.4.3 Target Disease Prevalence

7.4.4.4 Competitive Scenario

7.4.4.5 Regulatory Framework

7.4.4.6 Reimbursement Scenario

7.4.5 Australia

7.4.5.1 Australia Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.4.5.2 Key Country Dynamics

7.4.5.3 Target Disease Prevalence

7.4.5.4 Competitive Scenario

7.4.5.5 Regulatory Framework

7.4.5.6 Reimbursement Scenario

7.4.6 South Korea

7.4.6.1 South Korea Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.4.6.2 Key Country Dynamics

7.4.6.3 Target Disease Prevalence

7.4.6.4 Competitive Scenario

7.4.6.5 Regulatory Framework

7.4.6.6 Reimbursement Scenario

7.4.7 THAILAND

7.4.7.1 Thailand Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.4.7.2 Key Country Dynamics

7.4.7.3 Target Disease Prevalence

7.4.7.4 Competitive Scenario

7.4.7.5 Regulatory Framework

7.4.7.6 Reimbursement Scenario

7.4.8 Rest Of APAC

7.4.8.1 Rest Of APAC Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.5 Latin America

7.5.1 Latin America, SWOT Analysis

7.5.2 Mexico

7.5.2.1 Mexico Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.5.2.2 Key Country Dynamics

7.5.2.3 Target Disease Prevalence

7.5.2.4 Competitive Scenario

7.5.2.5 Regulatory Framework

7.5.2.6 Reimbursement Scenario

7.5.3 Brazil

7.5.3.1 Brazil Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.5.3.2 Key Country Dynamics

7.5.3.3 Target Disease Prevalence

7.5.3.4 Competitive Scenario

7.5.3.5 Regulatory Framework

7.5.3.6 Reimbursement Scenario

7.5.4 Argentina

7.5.4.1 Argentina Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.5.4.2 Key Country Dynamics

7.5.4.3 Target Disease Prevalence

7.5.4.4 Competitive Scenario

7.5.4.5 Regulatory Framework

7.5.4.6 Reimbursement Scenario

7.5.5 Rest Of LATAM

7.5.5.1 Rest Of LATAM Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.6 MEA

7.6.1 Middle East & Africa, SWOT Analysis

7.6.2 South Africa

7.6.2.1 South Africa Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.6.2.2 Key Country Dynamics

7.6.2.3 Target Disease Prevalence

7.6.2.4 Competitive Scenario

7.6.2.5 Regulatory Framework

7.6.2.6 Reimbursement Scenario

7.6.3 Saudi Arabia

7.6.3.1 Saudi Arabia Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.6.3.2 Key Country Dynamics

7.6.3.3 Target Disease Prevalence

7.6.3.4 Competitive Scenario

7.6.3.5 Regulatory Framework

7.6.3.6 Reimbursement Scenario

7.6.4 UAE

7.6.4.1 UAE Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.6.4.2 Key Country Dynamics

7.6.4.3 Target Disease Prevalence

7.6.4.4 Competitive Scenario

7.6.4.5 Regulatory Framework

7.6.4.6 Reimbursement Scenario

7.6.5 Kuwait

7.6.5.1 Kuwait Market Estimates And Forecast, 2018 - 2030 (USD Million)

7.6.5.2 Key Country Dynamics

7.6.5.3 Target Disease Prevalence

7.6.5.4 Competitive Scenario

7.6.5.5 Regulatory Framework

7.6.5.6 Reimbursement Scenario

7.6.6 Rest Of MEA

7.6.6.1 Rest Of MEA Market Estimates And Forecast, 2018 - 2030 (USD Million)

Chapter 8 Competitive Landscape

8.1 Public Companies

8.1.1 Company Market Position Analysis

8.1.2 Competitive Dashboard Analysis

8.1.3 Strategic Framework

8.2 Private Companies

8.2.1 List Of Key Emerging Companies/Technology Disruptors/Innovators

8.2.2 Regional Network Map

8.3 Company Profiles

8.3.1 Varian Medical Systems, Inc. (A Part Of Siemens Healthineers)

8.3.1.1 Company Overview

8.3.1.2 Financial Performance

8.3.1.3 Product Benchmarking

8.3.1.4 Strategic Initiatives

8.3.2 Elekta AB

8.3.2.1 Company Overview

8.3.2.2 Financial Performance

8.3.2.3 Product Benchmarking

8.3.2.4 Strategic Initiatives

8.3.3 Accuray Incorporated

8.3.3.1 Company Overview

8.3.3.2 Financial Performance

8.3.3.3 Product Benchmarking

8.3.3.4 Strategic Initiatives

8.3.4 Ion Beam Applications (IBA).

8.3.4.1 Company Overview

8.3.4.2 Financial Performance

8.3.4.3 Product Benchmarking

8.3.4.4 Strategic Initiatives

8.3.5 BD (Becton, Dickinson And Company)

8.3.5.1 Company Overview

8.3.5.2 Financial Performance

8.3.5.3 Product Benchmarking

8.3.5.4 Strategic Initiatives

8.3.6 Isoray Medical

8.3.6.1 Company Overview

8.3.6.2 Financial Performance

8.3.6.3 Product Benchmarking

8.3.6.4 Strategic Initiatives

8.3.7 Mevion Medical Systems

8.3.7.1 Company Overview

8.3.7.2 Product Benchmarking

8.3.7.3 Strategic Initiatives

8.3.8 Nordion Inc.

8.3.8.1 Company Overview

8.3.8.2 Product Benchmarking

8.3.8.3 Strategic Initiatives

8.3.9 NTP Radioisotopes SOC Ltd.

8.3.9.1 Company Overview

8.3.9.2 Financial Performance

8.3.9.3 Product Benchmarking

8.3.9.4 Strategic Initiatives

8.3.10 Curium

8.3.10.1 Company Overview

8.3.10.2 Product Benchmarking

8.3.10.3 Strategic Initiatives

8.3.11 VIEWRAY TECHNOLOGIES, INC.

8.3.11.1 Company Overview

8.3.11.2 Financial Performance

8.3.11.3 Product Benchmarking

8.3.11.4 Strategic Initiatives

8.5 External Beam Radiation Therapy, Company Market Share Analysis, 2023, By Region

8.5.1 North America

8.5.2 Europe

8.5.3 Asia Pacific

8.5.4 Latin America

8.5.5 MEA

8.6 LINACs, Company Market Share Analysis, 2023, By Region

8.6.1 North America

8.6.2 Europe

8.6.3 Asia Pacific

8.6.4 Latin America

8.6.5 MEA

8.7 Internal Beam Radiation Therapy, Company Market Share Analysis, 2023, By Region

8.7.1 North America

8.7.2 Europe

8.7.3 Asia Pacific

8.7.4 Latin America

8.7.5 MEA

8.8 Brachytherapy, Company Market Share Analysis, 2023, By Region

8.8.1 North America

8.8.2 Europe

8.8.3 Asia Pacific

8.8.4 Latin America

8.8.5 MEA

Chapter 9 Conclusion

List of Tables

Table 1 List of Secondary Sources

Table 2 List of Abbreviation

Table 3 List of Parameters

Table 4 List of Distributors

Table 5 Global Radiation Oncology Market, By Region, 2018 - 2030 (USD Million)

Table 6 Global Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 7 Global Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 8 Global Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 9 North America Radiation Oncology Market, By Country, 2018 - 2030 (USD Million)

Table 10 North America Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 11 North America Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 12 North America Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 13 U.S. Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 14 U.S. Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 15 U.S. Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 16 Canada Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 17 Canada Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 18 Canada Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 19 Europe Radiation Oncology Market, By Country, 2018 - 2030 (USD Million)

Table 20 Europe Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 21 Europe Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 22 Europe Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 23 Germany Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 24 Germany Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 25 Germany Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 26 U.K. Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 27 U.K. Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 28 U.K. Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 29 France Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 30 France Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 31 France Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 32 Italy Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 33 Italy Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 34 Italy Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 35 Spain Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 36 Spain Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 37 Spain Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 38 Denmark Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 39 Denmark Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 40 Denmark Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 41 Sweden Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 42 Sweden Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 43 Sweden Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 44 Norway Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 45 Norway Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 46 Norway Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 47 Asia Pacific Radiation Oncology Market, By Country, 2018 - 2030 (USD Million)

Table 48 Asia Pacific Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 49 Asia Pacific Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 50 Asia Pacific Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 51 Japan Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 52 Japan Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 53 Japan Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 54 China Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 55 China Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 56 China Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 57 India Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 58 India Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 59 India Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 60 South Korea Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 61 South Korea Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 62 South Korea Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 63 Australia Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 64 Australia Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 65 Australia Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 66 Thailand Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 67 Thailand Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 68 Thailand Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 69 Latin America Radiation Oncology Market, By Country, 2018 - 2030 (USD Million)

Table 70 Latin America Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 71 Latin America Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 72 Latin America Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 73 Brazil Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 74 Brazil Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 75 Brazil Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 76 Mexico Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 77 Mexico Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 78 Mexico Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 79 Argentina Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 80 Argentina Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 81 Argentina Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 82 Middle East & Africa Radiation Oncology Market, By Country, 2018 - 2030 (USD Million)

Table 83 Middle East & Africa Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 84 Middle East & Africa Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 85 Middle East & Africa Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 86 Saudi Arabia Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 87 Saudi Arabia Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 88 Saudi Arabia Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 89 South Africa Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 90 South Africa Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 91 South Africa Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 92 UAE Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 93 UAE Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 94 UAE Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

Table 95 Kuwait Radiation Oncology Market, By Type, 2018 - 2030 (USD Million)

Table 96 Kuwait Radiation Oncology Market, By Technology, 2018 - 2030 (USD Million)

Table 97 Kuwait Radiation Oncology Market, By Application, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Radiation oncology market segmentation

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value-chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 Radiation oncology market snapshot

Fig. 10 Radiation oncology market segmentation

Fig. 11 Radiation oncology market driver impact

Fig. 12 Radiation oncology market restraint impact

Fig. 13 Key market opportunities

Fig. 14 SWOT analysis, by factor (political & legal economic and technological)

Fig. 15 Porter’s five forces analysis

Fig. 16 Radiation oncology market: Type outlook and key takeaways

Fig. 17 Radiation oncology market: Type movement analysis

Fig. 18 External beam radiation therapy market, 2018 - 2030 (USD Million)

Fig. 19 Electron-emitting high energy linear accelerators market, 2018 - 2030 (USD Million)

Fig. 20 Compact advanced radiotherapy systems market, 2018 - 2030 (USD Million)

Fig. 21 CyberKnife market, 2018 - 2030 (USD Million)

Fig. 22 Gamma Knife market, 2018 - 2030 (USD Million)

Fig. 23 Tomotherapy market, 2018 - 2030 (USD Million)

Fig. 24 Proton therapy market, 2018 - 2030 (USD Million)

Fig. 25 Cyclotron market, 2018 - 2030 (USD Million)

Fig. 26 Synchrotron market, 2018 - 2030 (USD Million)

Fig. 27 Internal beam radiation therapy market, 2018 - 2030 (USD Million)

Fig. 28 Brachytherapy market, 2018 - 2030 (USD Million)

Fig. 29 Seeds market, 2018 - 2030 (USD Million)

Fig. 30 Applicators and after-loaders market, 2018 - 2030 (USD Million)

Fig. 31 Electronic brachytherapy market, 2018 - 2030 (USD Million)

Fig. 32 Systemic beam radiation therapy market, 2018 - 2030 (USD Million)

Fig. 33 Others market, 2016–2028 (USD Million)

Fig. 34 Radiation oncology market: External Beam Radiation Therapy (EBRT) technology outlook and key takeaways

Fig. 35 Radiation oncology market: External Beam Radiation Therapy (EBRT) technology movement analysis

Fig. 36 Radiation oncology market: Internal Beam Radiation Therapy (IBRT) technology movement analysis

Fig. 37 EBRT market, 2018 - 2030 (USD Million)

Fig. 38 IGRT market, 2018 - 2030 (USD Million)

Fig. 39 IMRT market, 2018 - 2030 (USD Million)

Fig. 40 Stereotactic radiotherapy market, 2018 - 2030 (USD Million)

Fig. 41 Proton beam therapy market, 2018 - 2030 (USD Million)

Fig. 42 3D-CRT market, 2018 - 2030 (USD Million)

Fig. 43 VMAT market, 2018 - 2030 (USD Million)

Fig. 44 Brachytherapy market, 2018 - 2030 (USD Million)

Fig. 45 LDR brachytherapy market, 2018 - 2030 (USD Million)

Fig. 46 HDR brachytherapy market, 2018 - 2030 (USD Million)

Fig. 47 Radiation oncology market: Application outlook and key takeaways

Fig. 48 Radiation oncology market: EBRT Application movement analysis

Fig. 49 Prostate cancer market, 2018 - 2030 (USD Million)

Fig. 50 Breast cancer market, 2018 - 2030 (USD Million)

Fig. 51 Lung cancer market, 2018 - 2030 (USD Million)

Fig. 52 Head and neck cancer market, 2018 - 2030 (USD Million)

Fig. 53 Colorectal cancer market, 2018 - 2030 (USD Million)

Fig. 54 Others market, 2018 - 2030 (USD Million)

Fig. 55 Prostate cancer market, 2018 - 2030 (USD Million)

Fig. 56 Gynecologic cancer market, 2018 - 2030 (USD Million)

Fig. 57 Breast cancer market, 2018 - 2030 (USD Million)

Fig. 58 Cervical cancer market, 2018 - 2030 (USD Million)

Fig. 59 Penile cancer market, 2018 - 2030 (USD Million)

Fig. 60 Others market, 2018 - 2030 (USD Million)

Fig. 61 Radiation Oncology market: Regional outlook and key takeaways

Fig. 62 Radiation Oncology Market: Regional Movement Analysis

Fig. 63 North America

Fig. 64 North America radiation oncology market estimates and forecast, 2018 - 2030

Fig. 65 U.S.

Fig. 66 U.S. radiation oncology market estimates and forecast, 2018 - 2030

Fig. 67 Canada

Fig. 68 Canada radiation oncology market estimates and forecast, 2018 - 2030

Fig. 69 Europe

Fig. 70 Europe radiation oncology market estimates and forecast, 2018 - 2030

Fig. 71 Germany

Fig. 72 Germany radiation oncology market estimates and forecast, 2018 - 2030

Fig. 73 U.K.

Fig. 74 U.K. radiation oncology market estimates and forecast, 2018 - 2030

Fig. 75 France

Fig. 76 France radiation oncology market estimates and forecast, 2018 - 2030

Fig. 77 Italy

Fig. 78 Italy radiation oncology market estimates and forecast, 2018 - 2030

Fig. 79 Spain

Fig. 80 Spain radiation oncology market estimates and forecast, 2018 - 2030

Fig. 81 Denmark

Fig. 82 Denmark radiation oncology Market, 2018 - 2030 (USD Million)

Fig. 83 Sweden

Fig. 84 Sweden radiation oncology Market, 2018 - 2030 (USD Million)

Fig. 85 Norway

Fig. 86 Norway radiation oncology Market, 2018 - 2030 (USD Million)

Fig. 87 Rest of Europe

Fig. 88 Rest of Europe radiation oncology Market, 2018 - 2030 (USD Million

Fig. 89 Asia Pacific

Fig. 90 Asia Pacific radiation oncology market estimates and forecast, 2018 - 2030

Fig. 91 Japan

Fig. 92 Japan radiation oncology market estimates and forecast, 2018 - 2030

Fig. 93 China

Fig. 94 China radiation oncology market estimates and forecast, 2018 - 2030

Fig. 95 India

Fig. 96 India radiation oncology market estimates and forecast, 2018 - 2030

Fig. 97 South Korea

Fig. 98 South Korea radiation oncology market estimates and forecast, 2018 - 2030

Fig. 99 Australia

Fig. 100 Australia radiation oncology market estimates and forecast, 2018 - 2030

Fig. 101 Thailand

Fig. 102 Thailand radiation oncology Market, 2018 - 2030 (USD Million)

Fig. 103 Rest of APAC

Fig. 104 Rest of APAC radiation oncology Market, 2018 - 2030 (USD Million)

Fig. 105 Latin America

Fig. 106 Latin America radiation oncology market estimates and forecast, 2018 - 2030

Fig. 107 Brazil

Fig. 108 Brazil radiation oncology market estimates and forecast, 2018 - 2030

Fig. 109 Mexico

Fig. 110 Mexico radiation oncology market estimates and forecast, 2018 - 2030

Fig. 111 Argentina

Fig. 112 Argentina radiation oncology market estimates and forecast, 2018 - 2030

Fig. 113 Rest of LATAM

Fig. 114 Rest of LATAM radiation oncology Market, 2018 - 2030 (USD Million)

Fig. 115 Middle East & Africa

Fig. 116 Middle East and Africa radiation oncology market estimates and forecast, 2018 - 2030

Fig. 117 South Africa

Fig. 118 South Africa radiation oncology market estimates and forecast, 2018 - 2030

Fig. 119 Saudi Arabia

Fig. 120 Saudi Arabia radiation oncology market estimates and forecast, 2018 - 2030

Fig. 121 UAE

Fig. 122 UAE radiation oncology market estimates and forecast, 2018 - 2030

Fig. 123 Kuwait

Fig. 124 Kuwait radiation oncology market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 125 Rest of MEA

Fig. 126 Rest of MEA radiation oncology market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 127 Company market share analysis

Fig. 128 Company market position analysis (Total revenue)

Fig. 129 Company market position analysis (Profit margin)

Fig. 130 Competitive dashboard analysis

Fig. 131 Regional Network Map

Fig. 132 Strategic FrameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Radiation Oncology Type Outlook (Revenue, USD Million, 2018 - 2030)

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- External Beam Radiation Therapy

- Radiation Oncology Technology Outlook (Revenue, USD Million, 2018 - 2030)

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- Radiation Oncology Application Outlook (Revenue, USD Million, 2018 - 2030)

- External Beam Radiation Therapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

- Internal Beam Radiation Therapy

- Prostate Cancer

- Gynecological Cancer

- Cervical Cancer

- Breast Cancer

- Penile Cancer

- Others

- External Beam Radiation Therapy

- Radiation Oncology Regional Outlook (Revenue, USD Million; 2018 - 2030)

- North America

- North America Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- External Beam Radiation Therapy

- North America Radiation Oncology Market, By Technology

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- North America Radiation Oncology Market, By Application

- External Beam Radiation Therapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

- Internal Beam Radiation Therapy

- Prostate Cancer

- Gynecological Cancer

- Cervical Cancer

- Breast Cancer

- Penile Cancer

- Others

- External Beam Radiation Therapy

- U.S.

- U.S. Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- External Beam Radiation Therapy

- U.S. Radiation Oncology Market, By Technology

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- U.S. Radiation Oncology Market, By Application

- External Beam Radiation Therapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

- Internal Beam Radiation Therapy

- Prostate Cancer

- Gynecological Cancer

- Cervical Cancer

- Breast Cancer

- Penile Cancer

- Others

- External Beam Radiation Therapy

- U.S. Radiation Oncology Market, By Type

- Canada

- Canada Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- External Beam Radiation Therapy

- Canada Radiation Oncology Market, By Technology

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- Canada Radiation Oncology Market, By Application

- External Beam Radiation Therapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

- Internal Beam Radiation Therapy

- Prostate Cancer

- Gynecological Cancer

- Cervical Cancer

- Breast Cancer

- Penile Cancer

- Others

- External Beam Radiation Therapy

- Canada Radiation Oncology Market, By Type

- North America Radiation Oncology Market, By Type

- Europe

- Europe Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- Europe Radiation Oncology Market, By Technology

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- Europe Radiation Oncology Market, By Application

- External Beam Radiation Therapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

- Internal Beam Radiation Therapy

- Prostate Cancer

- Gynecological Cancer

- Cervical Cancer

- Breast Cancer

- Penile Cancer

- Others

- External Beam Radiation Therapy

- U.K.

- U.K. Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- External Beam Radiation Therapy

- U.K. Radiation Oncology Market, By Technology

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- U.K. Radiation Oncology Market, By Application

- External Beam Radiation Therapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

- Internal Beam Radiation Therapy

- Prostate Cancer

- Gynecological Cancer

- Cervical Cancer

- Breast Cancer

- Penile Cancer

- Others

- External Beam Radiation Therapy

- U.K. Radiation Oncology Market, By Type

- Germany

- Germany Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- External Beam Radiation Therapy

- Germany Radiation Oncology Market, By Technology

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- Germany Radiation Oncology Market, By Application

- External Beam Radiation Therapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

- Internal Beam Radiation Therapy

- Prostate Cancer

- Gynecological Cancer

- Cervical Cancer

- Breast Cancer

- Penile Cancer

- Others

- External Beam Radiation Therapy

- Germany Radiation Oncology Market, By Type

- France

- France Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- External Beam Radiation Therapy

- France Radiation Oncology Market, By Technology

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- France Radiation Oncology Market, By Application

- External Beam Radiation Therapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

- Internal Beam Radiation Therapy

- Prostate Cancer

- Gynecological Cancer

- Cervical Cancer

- Breast Cancer

- Penile Cancer

- Others

- External Beam Radiation Therapy

- France Radiation Oncology Market, By Type

- Spain

- Spain Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- External Beam Radiation Therapy

- Spain Radiation Oncology Market, By Technology

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- Spain Radiation Oncology Market, By Application

- External Beam Radiation Therapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

- Internal Beam Radiation Therapy

- Prostate Cancer

- Gynecological Cancer

- Cervical Cancer

- Breast Cancer

- Penile Cancer

- Others

- External Beam Radiation Therapy

- Spain Radiation Oncology Market, By Type

- Italy

- Italy Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- External Beam Radiation Therapy

- Italy Radiation Oncology Market, By Technology

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- Italy Radiation Oncology Market, By Application

- External Beam Radiation Therapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

- Internal Beam Radiation Therapy

- Prostate Cancer

- Gynecological Cancer

- Cervical Cancer

- Breast Cancer

- Penile Cancer

- Others

- External Beam Radiation Therapy

- Italy Radiation Oncology Market, By Type

- Denmark

- Denmark Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- External Beam Radiation Therapy

- Denmark Radiation Oncology Market, By Technology

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- Denmark Radiation Oncology Market, By Application

- External Beam Radiation Therapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

- Internal Beam Radiation Therapy

- Prostate Cancer

- Gynecological Cancer

- Cervical Cancer

- Breast Cancer

- Penile Cancer

- Others

- External Beam Radiation Therapy

- Denmark Radiation Oncology Market, By Type

- Sweden

- Sweden Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- External Beam Radiation Therapy

- Sweden Radiation Oncology Market, By Technology

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- Sweden Radiation Oncology Market, By Application

- External Beam Radiation Therapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

- Internal Beam Radiation Therapy

- Prostate Cancer

- Gynecological Cancer

- Cervical Cancer

- Breast Cancer

- Penile Cancer

- Others

- External Beam Radiation Therapy

- Sweden Radiation Oncology Market, By Type

- Norway

- Norway Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- External Beam Radiation Therapy

- Norway Radiation Oncology Market, By Technology

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- Norway Radiation Oncology Market, By Application

- External Beam Radiation Therapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

- Internal Beam Radiation Therapy

- Prostate Cancer

- Gynecological Cancer

- Cervical Cancer

- Breast Cancer

- Penile Cancer

- Others

- External Beam Radiation Therapy

- Norway Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Europe Radiation Oncology Market, By Type

- Asia Pacific

- Asia Pacific Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- External Beam Radiation Therapy

- Asia Pacific Radiation Oncology Market, By Technology

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- Asia Pacific Radiation Oncology Market, By Application

- External Beam Radiation Therapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

- Internal Beam Radiation Therapy

- Prostate Cancer

- Gynecological Cancer

- Cervical Cancer

- Breast Cancer

- Penile Cancer

- Others

- External Beam Radiation Therapy

- Japan

- Japan Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- External Beam Radiation Therapy

- Japan Radiation Oncology Market, By Technology

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- Japan Radiation Oncology Market, By Application

- External Beam Radiation Therapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

- Internal Beam Radiation Therapy

- Prostate Cancer

- Gynecological Cancer

- Cervical Cancer

- Breast Cancer

- Penile Cancer

- Others

- External Beam Radiation Therapy

- Japan Radiation Oncology Market, By Type

- China

- China Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- External Beam Radiation Therapy

- China Radiation Oncology Market, By Technology

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- China Radiation Oncology Market, By Application

- External Beam Radiation Therapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

- Internal Beam Radiation Therapy

- Prostate Cancer

- Gynecological Cancer

- Cervical Cancer

- Breast Cancer

- Penile Cancer

- Others

- External Beam Radiation Therapy

- China Radiation Oncology Market, By Type

- India

- India Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Linear Accelerators (Linac)

- Compact advanced radiotherapy systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and After loaders

- Electronic Brachytherapy

- Systemic Beam Radiation Therapy

- Others

- Brachytherapy

- External Beam Radiation Therapy

- India Radiation Oncology Market, By Technology

- External Beam Radiation Therapy

- Image-Guided Radiotherapy (IGRT)

- Intensity Modulated Radiotherapy (IMRT)

- Stereotactic Technology

- Proton Beam Therapy

- 3D Conformal Radiotherapy (3D CRT)

- Volumetric Modulated Arc Therapy (VMAT)

- Brachytherapy

- Low-Dose Rate Brachytherapy

- High-Dose Rate Brachytherapy

- External Beam Radiation Therapy

- India Radiation Oncology Market, By Application

- External Beam Radiation Therapy

- Prostate Cancer