- Home

- »

- Medical Devices

- »

-

Radiology Positioning Aids Market Size & Share Report, 2030GVR Report cover

![Radiology Positioning Aids Market Size, Share & Trends Report]()

Radiology Positioning Aids Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Wedge X-ray Positioning, Block X-ray Positioning), By Product (Head, Neck, And Brain Positioning), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-304-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Radiology Positioning Aids Market Trends

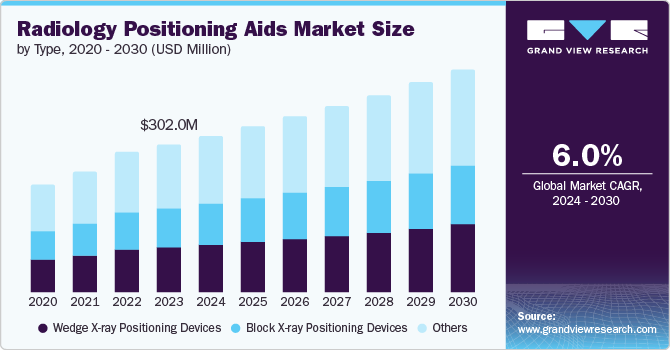

The global radiology positioning aids market was valued at USD 302.0 million in 2023 and is expected to grow at a CAGR of 6.0% from 2024 to 2030. The growing adoption of radiology devices for diagnosing conditions such as cancer, tumors, digestive issues, and infections has significantly impacted the demand for positioning aids. Healthcare providers have increasingly adopted these aids for imaging procedures, enhanced diagnostic precision and treatment planning.

Furthermore, the continuous development of advanced radiology positioning aids has been a major market driver. These aids come in various shapes and sizes, catering to specific anatomical regions such as the head, neck, brain, thorax, and breast. Modern radiology positioning aids are integrated with digital imaging systems, laser alignment, adjustable angles, and patient-specific customization to enhance their functionality. This has been a result of manufacturers increasingly focusing on improving patient comfort, ease of use, and compatibility with modern imaging equipment.

In addition, the rapid expansion of medical facilities, including imaging centers and ambulatory surgical centers, has fueled demand for radiology positioning aids. Such an expanding healthcare infrastructure requires accurate and efficient aids for precise scan imaging to reduce the need for repeat imaging. Moreover, proper positioning aids help minimize radiation exposure to both patients and healthcare professionals. Healthcare providers have increasingly emphasized patient safety which drove the adoption of these aids in clinical settings.

Type Insights

Wedge X-ray positioning devices have secured the dominant market share of 30.8% in 2023 owing to enhanced imaging. Geriatric patients have increasingly preferred these devices for body positioning during radiography, CT scans, and ultrasound tests. The unique design of wedge X-ray devices allows precise alignment of patients, minimizing errors and ensuring accurate diagnostic imaging. In addition, these devices come with a polyurethane coat that resists blood, betadine, barium, alcohol, oils, and other fluids. Some variants of this device also offer antimicrobial and antifungal properties, enhancing infection control.

Block X-ray positioning devices are projected to emerge as the fastest-growing segment during the forecast period. These positioning devices are designed for patient comfort during radiology procedures. Their shape allows effective positioning of anatomical regions such as the knee, head, and neck to ensure precise alignment with diagnostic accuracy. Furthermore, block X-ray devices are versatile radiology tools that cater to the specific needs of elderly patients, who often require more personalized positioning during imaging procedures.

Product Insights

Thorax and breast positioning devices held the dominant market share of 25.0% in 2023 owing to the rising geriatric population who require accurate diagnostic imaging. These devices are essential for mammography, lung imaging, and cardiac studies. Their design allows optimal positioning, resulting in clearer images for diagnosis and treatment planning. These designs also cater specifically to these anatomical regions, ensuring precise scans and minimizing patient discomfort. Furthermore, ongoing advancements in radiology technology have led to the development of more efficient thorax and breast positioning aids. For instance, the Miller Method positioning method ensures consistent, reproducible, and efficient positioning for cranial-caudal (CC) and mediolateral oblique (MLO) views in mammography. Manufacturers have increasingly integrated these devices with digital imaging systems to enhance workflow efficiency and diagnostic accuracy.

Pediatric radiology positioning devices registered the fastest CAGR during the forecast period. These aids specifically tailored for pediatric patients, gained traction due to their specialized design with features including adjustable tables, cushioned supports, and immobilization. Pediatric positioning aids ensure optimal positioning for children during imaging procedures, considering their unique anatomical features and size. Healthcare providers use these devices to prioritize safety, reduce radiation exposure, and ensure a child-friendly experience during X-rays, CT scans, and other imaging modalities. In addition, these devices offer diagnostic accuracy as they enhance precision by minimizing movement artifacts and ensuring consistent alignment.

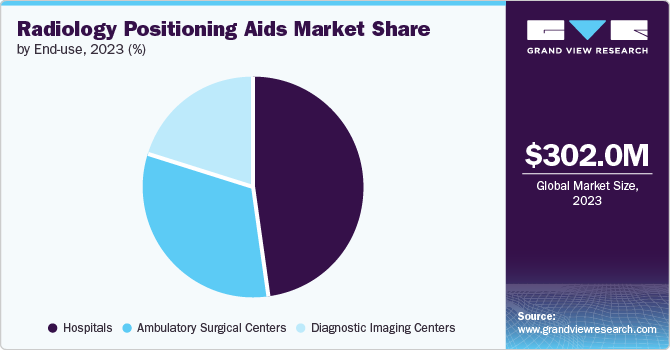

End Use Insights

Hospitals secured the dominant market share in 2023 owing to the increased adoption of radiology positioning aids to enhance patient care and diagnostic accuracy. These aids, developed with advanced technology, are available in various shapes and sizes which allowed healthcare professionals to tailor positioning for specific anatomical regions. In addition, radiology positioning aids minimize radiation exposure, reduce movement artifacts, and ensure consistent positioning. These features have increasingly encouraged widespread adoption in hospitals for enhanced patient outcomes and workflow efficiency.

Ambulatory surgical centers (ASCs) are expected to grow substantially at a CAGR of 6.6% during the forecast period due to their cost-effectiveness when compared to hospitals for outpatient surgical procedures. Their streamlined operations, efficient workflows, and lower overhead costs have alarmingly influenced healthcare providers and patients. Moreover, as ASCs increasingly expand their services beyond basic surgical procedures, they have focused on specialized care with precise patient positioning with accurate imaging which drove the adoption of radiology positioning aids.

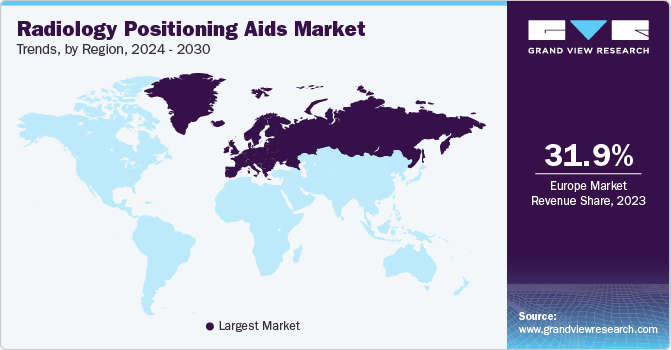

Regional Insights

The radiology positioning aids market in North America held 30.0% of the global revenue share in 2023 owing to the rising adoption of devices for diagnosing conditions such as cancer, tumors, digestive issues, and infections. In addition, the robust healthcare infrastructure in the region led to the development of efficient and patient-friendly radiology positioning aids in various shapes and sizes. This has further influenced adoption in hospitals, ambulatory surgical centers, and diagnostic imaging centers, contributing to market expansion.

U.S. Radiology Positioning Aids Market Trends

The U.S. radiology positioning aids market was propelled by the increasing adoption of radiology positioning aids for precise patient alignment during imaging procedures and accurate diagnosis. Additionally, the market saw a rise in interventional radiology for minimally invasive interventions that necessitate high-quality imaging. Radiology positioning aids played a critical role in real-time imaging guidance, including fluoroscopy or ultrasound to navigate instruments within the body.

Europe Radiology Positioning Aids Market Trends

The Europe radiology positioning aids market secured the dominant global revenue share with 31.9% in 2023 owing to the growing geriatric population. Patients have increasingly favored wedge X-ray positioning devices for body positioning during radiography, CT scans, and ultrasound, which aided the growth of this segment. Moreover, the healthcare facilities in countries such as Germany, France, and the UK surged the demand for reliable positioning aids.

Asia Pacific Radiology Positioning Aids Market Trends

The radiology positioning aids market in the Asia Pacific (APAC) region held 29.0% of the market share in 2023. With massive improvements in healthcare infrastructure in countries including China, India, and South Korea, the region witnessed a surge in demand for precise diagnostic imaging. Furthermore, local manufacturers and market players focused on developing innovative positioning aids tailored to regional needs, further boosting adoption.

Key Radiology Positioning Aids Company Insights

The global radiology positioning aids market is intensely competitive with key players focusing on product development, launches, strategic collaborations, acquisitions, and mergers. Manufacturers have increasingly focused on ongoing research and development efforts to develop innovative positioning aids. Collaborations between manufacturers, healthcare institutions, and research centers have significantly driven product enhancements and addressed specific clinical needs.

-

Bionix LLC, a leader in medical device development, focuses on simplicity and utility to ensure that its products effectively assist healthcare providers. The company caters to various care settings, from primary care to radiation therapy. In addition, Bionix collaborates with inventors to develop solutions that meet the evolving needs of health professionals worldwide.

-

Clear Image Devices LLC specializes in medical imaging equipment, including accessories, x-ray room equipment, and radiology products. The company designs and develops positioning devices for hospitals and clinics. Their field-tested, value-driven auxiliary equipment optimizes imaging results for safety and usability. Moreover, their products are compatible with major commercial imaging systems, supporting medical professionals in delivering high-quality care.

Key Radiology Positioning Aids Companies:

The following are the leading companies in the radiology positioning aids market. These companies collectively hold the largest market share and dictate industry trends.

- Bionix LLC

- Clear Image Devices LLC

- Civco Radiotherapy

- Elekta AB

- Vertec

- AADCO Medical, Inc.

- IZI Medical Products

- Klarity Medical Products

- Varian Medical Systems, Inc.

Recent Developments

-

In May 2023, Bionix, a supplier to the radiation oncology sector in healthcare, introduced IsoMark - the next-generation radiation oncology tattooing device. IsoMark features a retracting, non-cannulated needle concealed within the device, minimizing the risk of needlestick injuries. Its fixed-depth needle ensures accurate tattoo placement and size, enhancing procedure alignment. Additionally, IsoMark boasts an ergonomic design for practitioner comfort.

Radiology Positioning Aids Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 319.2 million

Revenue forecast in 2030

USD 454.0 million

Growth Rate

CAGR of 6.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Bionix, LLC; Clear Image Devices LLC; CQ Medical; Elekta AB; Vertec; AADCO Medical, Inc.; IZI Medical Products; Klarity Medical; Varian Medical Systems, Inc.; MXR Imaging, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Radiology Positioning Aids Market Report Segmentation

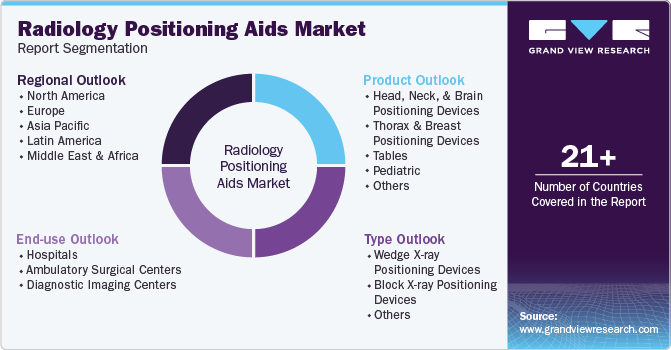

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global radiology positioning aids market report based on type, portability, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Wedge X-ray Positioning Devices

-

Block X-ray Positioning Devices

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Head, Neck, and Brain Positioning Devices

-

Thorax and Breast Positioning Devices

-

Tables

-

Pediatric

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Diagnostic Imaging Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.