- Home

- »

- Biotechnology

- »

-

Rare Biomarkers Specimen Collection And Stabilization Market Report, 2030GVR Report cover

![Rare Biomarkers Specimen Collection And Stabilization Market Size, Share & Trends Report]()

Rare Biomarkers Specimen Collection And Stabilization Market (2025 - 2030) Size, Share & Trends Analysis Report By Biomarker (Circulating Cell Free DNA (ccfDNA), Circulating Tumor Cells (CTCs), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-459-8

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

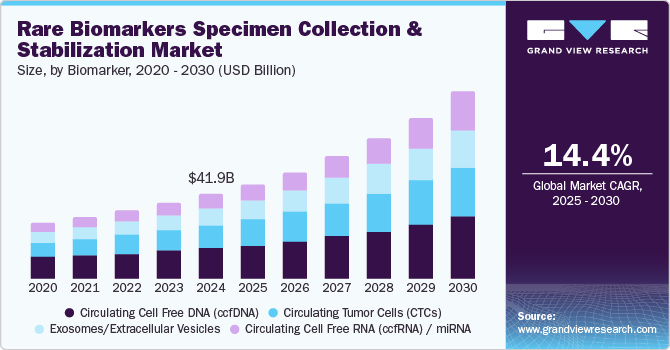

The global rare biomarkers specimen collection and stabilization market size was estimated at USD 41.97 billion in 2024 and is expected to grow at a CAGR of 14.4% from 2025 to 2030. The growing number of research studies focused on the role of circulating biomarkers in disease management is significantly driving market growth. Additionally, the rising preference for non-invasive treatment methods and the growing demand for personalized medicine have had a substantial impact on the market's revenue growth.

In recent years, there has been a significant increase in research studies focused on rare biomarker specimen collection and stabilization methods. The growing number of scientific publications on these topics reflects the expanding interest of healthcare organizations in this market. Furthermore, increasing evidence highlighting the role of rare biomarkers in disease management has spurred investments in clinical applications. For instance, in October 2022, Thermo Fisher Scientific Inc. announced a USD 59 billion investment to expand its laboratory operations in Kentucky, aiming to enhance central lab and biomarker services for clinical research.

The rise of liquid biopsy for cancer management has been instrumental in shaping the dynamics of the rare biomarker specimen collection and stabilization tube market. Companies involved in liquid biopsy or planning to enter the field are key drivers of growth in this market, particularly in clinical settings. Currently, liquid biopsy is mainly used for patients with advanced, metastatic cancer who cannot undergo tissue biopsy. The analysis of liquid biopsy focuses primarily on three types of biomarkers: cell-free nucleic acids, circulating tumor cells, and exosomes.

Despite its potential, regulatory challenges and limited reimbursement have posed significant barriers to the widespread clinical adoption of these tests. However, as data supporting the clinical utility of these assays continues to grow, their adoption is expected to increase. In addition to liquid biopsy, companies are also advancing ccfDNA-based non-invasive prenatal testing (NIPT), which has attracted substantial investment to drive growth in both test volume and revenue.

Despite considerable efforts in this emerging field of research, challenges such as difficulties in characterization and ineffective separation protocols for biomarker specimen collection and stabilization have hindered commercial revenue growth. These obstacles have slowed the broader adoption of rare biomarkers. However, researchers and other key stakeholders are actively working to overcome these challenges by providing more detailed insights into the roles of rare biomarkers in disease progression and their potential therapeutic applications. This ongoing research is essential to unlocking the full potential of rare biomarkers in clinical settings.

Market Concentration & Characteristics

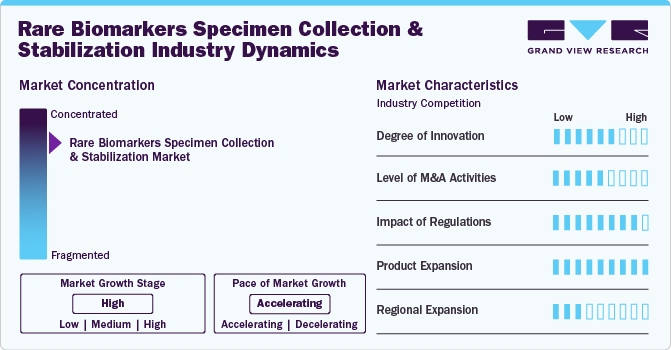

Degree of Innovation Market is characterized by a high degree of innovation, driven by advancements in biotechnological tools, materials science, and the growing demand for precision diagnostics and therapeutics. Modern collection devices, such as microfluidic platforms and capillary-action-based systems, are engineered to handle minute quantities of biomarkers with minimal degradation.

Level of Collaboration and Partnership Activities Market demonstrates a high level of collaboration and partnership activities, as stakeholders recognize the complexity of advancing biomarker collection and preservation technologies. Strategic partnerships between diagnostic companies, biotechnology firms, and academic research institutions are pivotal in accelerating innovation. These collaborations often focus on co-developing advanced specimen collection devices, stabilization solutions, and biomarker-specific protocols to meet clinical and regulatory requirements.

Regulations have a profound impact on the market, shaping its innovation, adoption, and overall growth. Compliance with stringent regulatory requirements, such as those set by the FDA, EMA, and other regional authorities, ensures the safety, efficacy, and quality of specimen collection and stabilization products. These regulations mandate rigorous testing, validation, and documentation of devices and reagents to safeguard biomarker integrity, especially for applications in diagnostics, drug development, and personalized medicine.

Product expansion is a key driver of growth and innovation, as companies strive to address the evolving needs of precision medicine and advanced diagnostics. Manufacturers are introducing a wide range of collection devices tailored for specific biomarkers, such as circulating tumor cells (CTCs), circulating free DNA (cfDNA), microRNAs, and extracellular vesicles. These products are designed to improve sensitivity, reliability, and ease of use while minimizing sample degradation.

Regional expansion in the market is driven by the growing demand for advanced diagnostic technologies and precision medicine worldwide. As healthcare systems become more sophisticated and the focus on personalized medicine intensifies, companies are expanding their market presence across various regions to meet the diverse needs of researchers, clinicians, and pharmaceutical developers.

Biomarker insights

The circulating cell-free DNA (ccfDNA) segment accounted for the largest share of the market at 36.0% in 2024. The growing preference for non-invasive cancer diagnostics has significantly boosted investments in the commercialization of liquid biopsy blood specimen collection and stabilization tubes, which, in turn, supports the revenue growth of cfDNA, exosome, and circulating tumor cells (CTCs). The expansion of cfDNA applications is further supported by the increasing adoption of non-invasive prenatal testing (NIPT) for detecting chromosomal anomalies in fetuses. In May 2022, Tethis S.p.A. launched See.d, a universal blood sample preparation device for liquid biopsy analysis, which automates and standardizes the preparation of blood samples directly at the collection point.

Investments into exploring the diagnostic, prognostic, and treatment monitoring potential of CTCs have created lucrative growth opportunities for companies developing marketing kits, as well as collection and stabilization solutions for CTC isolation. Notable players in this space include Miltenyi Biotec, QIAGEN, Creatv MicroTech, Veridex, Creative-Bioarray, and Genetix, all of which offer products for both research and clinical use.

Exosomes, a type of extracellular vesicle (EV), are the most commonly studied in the context of liquid biopsy. Although several assays have been developed for the profiling and enrichment of EVs, the lack of standardization has posed challenges to growth in this segment in recent years. With emerging applications for exosomes as a third target in liquid biopsies, key developers of rare biomarker specimen collection and stabilization products are increasingly focusing on expanding their portfolios for this segment.

Circulating cell-free RNA (ccfRNA) / miRNA segment is likely to grow at a CAGR of 16.8% over the forecast period. The growing interest in exosomes, primarily due to their significant presence in plasma, is driven by their higher abundance compared to circulating tumor cells (CTCs) or cell-free DNA (ccfDNA). This has contributed to increased attention and investment in exosome-based applications for liquid biopsies. On the other hand, the Circulating Cell-Free RNA (ccfRNA) segment is expected to account for the lowest revenue share in the market, primarily due to its limited implementation outside of research settings.

Circulating microRNA (miRNA), known for its organ tissue specificity, has garnered significant attention within research environments. This has led to growing interest in its potential as a diagnostic and prognostic biomarker, contributing to revenue generation in this segment. The specificity of circulating miRNA to particular tissues makes it a valuable target for further exploration in disease diagnostics and treatment monitoring.

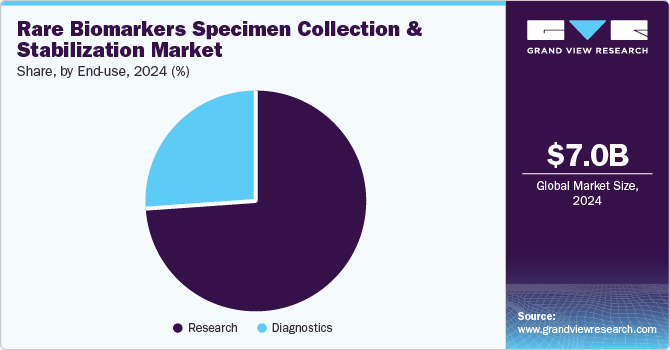

End Use Insights

The research segment captured the highest share of 74.1% in 2024. The dominance of the rare biomarker segment is largely due to the growing number of research studies focused on their implementation. Interest in rare biomarkers, such as exosomes, RNA, DNA, and circulating tumor cells (CTCs), has surged in recent years, driven by their unique roles as intercellular messengers, their therapeutic potential in disease diagnostics, their ability to influence recipient cell bioactivities, and their emerging applications in targeted drug delivery. These biomarkers are increasingly seen as valuable tools for advancing precision medicine and improving clinical outcomes.

In April 2023, QIAGEN launched the QIAseq Targeted cfDNA Ultra Panels, which have been designed to help scientists conducting cancer and disease research create libraries suitable for next-generation sequencing (NGS) from cell-free DNA (cfDNA) liquid biopsies in under eight hours. This innovation significantly enhances the efficiency of research, particularly in the context of liquid biopsy, and further drives the exploration of rare biomarkers in clinical and research applications.

The diagnostics segment expected to expand at the CAGR of 15.0% by 2030. While rare biomarkers such as Circulating Cell-Free DNA (ccfDNA), Circulating Tumor Cells (CTCs), and exosomes have primarily been used in research settings, they are increasingly being explored for diagnostic applications. In recent years, cfDNA and exosomes have emerged as rapidly evolving minimally invasive diagnostic markers, particularly for the early detection and therapy response prediction in solid tumors. Their potential to provide valuable insights into tumor dynamics and treatment efficacy has made them key areas of focus in clinical research.

In May 2023, LabCorp launched the LabCorp Plasma Focus, a liquid biopsy test designed to enable tailored therapy selection for individuals with advanced or metastatic solid cancers. This test leverages the power of liquid biopsy to provide personalized treatment options, marking a significant step forward in the clinical application of rare biomarkers for cancer diagnosis and management.

Regional Insights

North America rare biomarkers specimen collection and stabilization market dominated and accounted for a 52.1% share in 2024. North America is home to a large number of research institutions and pharmaceutical companies that are conducting extensive studies on rare biomarkers. The increasing number of clinical trials investigating the use of rare biomarkers in disease management has further fueled the demand for specimen collection and stabilization technologies.

U.S. Rare Biomarkers Specimen Collection And Stabilization Market Trends

The U.S. rare biomarkers specimen collection and stabilization market is projected to grow significantly during the forecast period. Significant investments in the biomarker and diagnostics sectors, coupled with supportive regulatory frameworks for biomarker-based diagnostics, are also contributing to the market's growth. U.S. has a favorable regulatory environment that encourages the development and commercialization of biomarker-based diagnostic products.

Europe Rare Biomarkers Specimen Collection And Stabilization Market Trends

The Europe rare biomarkers specimen collection and stabilization industry is likely to emerge as a lucrative region, driven by growing demand for treatments tailored to individual biomarker profiles, particularly for conditions like cancer, cardiovascular diseases, and genetic disorders.

UK Rare Biomarkers Specimen Collection And Stabilization Market Trends

The UK Rare Biomarkers Specimen Collection and Stabilization market is projected to grow during the forecast period. The UK is at the forefront of adopting liquid biopsy technologies, which utilize biomarkers like cfDNA, exosomes, and CTCs for non-invasive cancer diagnostics and monitoring. This growing interest in liquid biopsy, along with its potential for early disease detection and therapy response prediction, is driving the market.

France Rare Biomarkers Specimen Collection And Stabilization Market Trends

The France Rare Biomarkers Specimen Collection and Stabilization market is expected to show steady growth over the forecast period. France benefits from a robust healthcare infrastructure and a strong research community, with many academic institutions and biotech companies focused on advancing biomarker technologies. The French government’s support for innovation in healthcare and its push to integrate biomarker-based diagnostics into clinical practice is further fostering market growth.

Germany Rare Biomarkers Specimen Collection And Stabilization Market Trends

The Germany Rare Biomarkers Specimen Collection and Stabilization market is projected to expand during the forecast period. German healthcare system’s emphasis on innovation and the integration of cutting-edge technologies into clinical practice is further driving the market for rare biomarker specimen collection and stabilization solutions. As the demand for early detection and personalized treatments grows, the market in Germany is expected to continue its expansion, supported by technological innovations and regulatory support.

Asia Pacific Rare Biomarkers Specimen Collection And Stabilization Market Trends

The Asia Pacific Rare Biomarkers Specimen Collection and Stabilization market is expected to experience the highest growth rate of 16.0% CAGR during the forecast period owing to region’s rapid adoption of precision medicine, fueled by the increasing awareness of personalized treatment options, is further boosting market growth. Countries like China, Japan, and India are leading the charge in adopting liquid biopsy technologies, with significant investments in research and development.

China Rare Biomarkers Specimen Collection And Stabilization Market Trends

The China Rare Biomarkers Specimen Collection and Stabilization market is projected to expand throughout the forecast period. One of the main drivers is the increasing prevalence of chronic diseases, including cancer, cardiovascular diseases, and metabolic disorders, which has significantly raised the demand for advanced diagnostic technologies.

Japan Rare Biomarkers Specimen Collection And Stabilization Market Trends

The Japan Rare Biomarkers Specimen Collection and Stabilization market is anticipated to grow during the forecast period. The growing demand for personalized treatment options, particularly in oncology, cardiovascular diseases, and genetic disorders, is increasing the need for rare biomarkers, such as cfDNA, exosomes, and CTCs, which are critical for non-invasive diagnostics like liquid biopsy.

Latin America Rare Biomarkers Specimen Collection And Stabilization Market Trends

The Latin America Rare Biomarkers Specimen Collection and Stabilization market is expected to experience significant growth throughout the forecast period. Several countries in Latin America are investing in healthcare infrastructure, including research and development in biotechnology, which is accelerating the discovery of rare biomarkers and the development of related diagnostic technologies.

Brazil Rare Biomarkers Specimen Collection And Stabilization Market Trends

The Brazil Rare Biomarkers Specimen Collection and Stabilization market is anticipated to grow during the forecast period. Brazil has been increasingly adopting personalized medicine, particularly in oncology, where liquid biopsy technologies offer a promising solution for detecting diseases at an early stage and assessing therapy efficacy. The country's growing focus on improving healthcare infrastructure, coupled with rising healthcare awareness, is further boosting the demand for rare biomarker-based diagnostics.

Saudi Arabia Rare Biomarkers Specimen Collection And Stabilization Market Trends

The Saudi Arabia Rare Biomarkers Specimen Collection and Stabilization market is anticipated to experience lucrative growth during the forecast period. Saudi Arabia’s strong commitment to improving healthcare services, as outlined in its Vision 2030 plan, is a significant factor in the growth of the market. The country is investing heavily in the modernization of its healthcare infrastructure and expanding its research capabilities, particularly in genomics and personalized medicine.

Key Rare Biomarkers Specimen Collection And Stabilization Company Insights

The development of new assays, including liquid biopsy assays, along with the rise of microfluidic-based technologies for biomarker separation, has led to increased competition in the market in recent years. As new products are introduced and applications expand, the competitive landscape is expected to grow even more dynamic in the future.Companies are making strategic agreements to gain a competitive edge in exosome isolation. In March 2023, nRichDX partnered with OraSure Technologies, Inc., to jointly market their products for scientists working on liquid biopsy applications using first-void urine samples. Additionally, first-void urine is abundant in biomarkers that can be used for molecular analysis in cases like sexually transmitted diseases, the human papillomavirus, and early-stage cancer.

Key Rare Biomarkers Specimen Collection And Stabilization Companies:

The following are the leading companies in the rare biomarkers specimen collection and stabilization market. These companies collectively hold the largest market share and dictate industry trends.

- QIAGEN

- Charles River Laboratories

- F. Hoffmann-La Roche Ltd

- Thermo fischer Scientific Inc.

- Eurofins Scientific

- PerkinElmer Inc.

- Bio-Rad Laboratories, Inc.

- Agilent Technologies, Inc

- Merck KGaA

- Siemens Healthcare GmbH

Recent Developments

-

In October 2024, Avidity Biosciences, Inc announced that they have initiated a biomarker cohort to study for patients with Facioscapulohumeral Muscular Dystrophy. With the trial initiation, the demand for specimen collection is likely to grow

-

In October 2024, QIAGEN expanded its portfolio with new automated kits for ccfDNA extraction, including the QIAsymphony DSP Circulating DNA Kit and the Maxi Kit. These tools are tailored for both small-scale and high-throughput labs, enabling sensitive analyses like next-generation sequencing (NGS) and digital PCR. Such advancements support non-invasive diagnostics for conditions such as cancer and prenatal abnormalities, adhering to stringent regulatory standards in the U.S. and Europe

Rare Biomarkers Specimen Collection And Stabilization Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 47.25 billion

Revenue forecast in 2030

USD 92.39 billion

Growth rate

CAGR of 14.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Biomarker, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK;, France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa

Key companies profiled

QIAGEN; Charles River Laboratories; F. Hoffmann-La Roche Ltd; Thermofischer Scientific Inc.; Eurofins Scientific; PerkinElmer Inc.; Bio-Rad Laboratories, Inc.; Agilent Technologies, Inc; Merck KGaA; Siemens Healthcare GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Rare Biomarkers Specimen Collection And Stabilization Market Report Segmentation

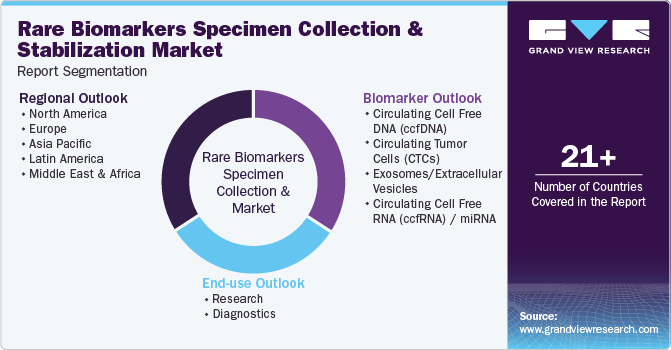

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the rare biomarkers specimen collection and stabilization on the basis of biomarker, end use, and region:

-

Biomarker Outlook (Revenue, USD Million, 2018 - 2030)

-

Circulating Cell Free DNA (ccfDNA)

-

Circulating Tumor Cells (CTCs)

-

Exosomes/Extracellular Vesicles

-

By Product

-

Isolation Kits & Reagents

-

Blood Collection Tubes

-

Systems

-

-

By Specimen Type

-

Serum/Plasma

-

Others

-

-

By Nucleic Acid & Other Biomolecules

-

RNA

-

DNA

-

Others

-

-

By Application

-

NIPT

-

Oncology

-

Research

-

Diagnostics

-

Screening

-

Treatment Monitoring

-

-

-

Transcriptomics

-

Pharmacogenomics

-

Transplant Rejection

-

Population Screening

-

Cardiovascular Diseases

-

Other Applications

-

-

-

Circulating Cell Free RNA (ccfRNA) / miRNA

-

By Product

-

Isolation Kits & Reagents

-

Blood Collection Tubes

-

-

By Application

-

NIPT

-

Oncology

-

Research

-

Diagnostics

-

-

Transcriptomics

-

Pharmacogenomics

-

Transplant Rejection

-

Population Screening

-

Cardiovascular Diseases

-

Other Applications

-

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research

-

Research Labs/CROs

-

Academic Institutes

-

-

Diagnostics

-

Laboratories

-

Hospitals

-

Prenatal Clinics

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global rare biomarkers specimen collection and stabilization market size was estimated at USD 41.97 billion in 2024 and is expected to reach USD 47.25 billion in 2025.

b. The global rare biomarkers specimen collection and stabilization market is expected to grow at a compound annual growth rate of 14.4% from 2025 to 2030 to reach USD 92.39 billion by 2030.

b. Circulating Cell-Free DNA (ccfDNA) dominated the rare biomarkers specimen collection and stabilization market with a share of 52.09% in 2024. This is attributable to the presence of a relatively high number of ccfDNA isolation solutions for clinical use.

b. Some key players operating in the rare biomarkers specimen collection and stabilization market include Agena Bioscience, ANGLE plc., AS ONE INTERNATIONAL, BioChain Institute, Inc., Biolidics Limited, Biomatrica, Bio-Techne Corporation, and OraSure Technologies Inc.

b. Key factors that are driving the market growth include popularity of NIPT services, increasing preference for liquid biopsy, and increasing investment for exploring the utility of CTCs in diagnosis, prognosis, and treatment monitoring.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.