- Home

- »

- Clinical Diagnostics

- »

-

Rare Disease Genetic Testing Market, Industry Report, 2030GVR Report cover

![Rare Disease Genetic Testing Market Size, Share & Trends Report]()

Rare Disease Genetic Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Disease (Neurological Disorders), By Technology (Next Generation Sequencing, Array Technology, PCR-based Testing), By Specialty, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-695-0

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Rare Disease Genetic Testing Market Summary

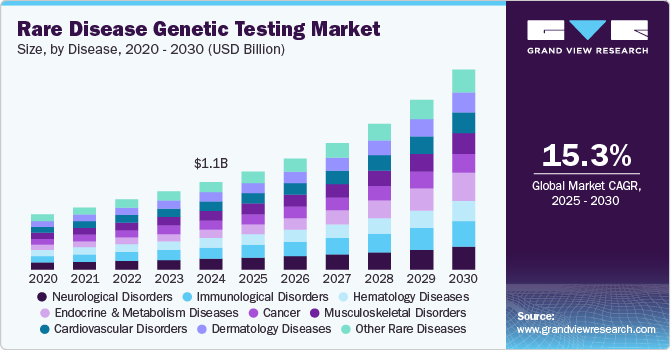

The global rare disease genetic testing market size was estimated at USD 1,101.8 million in 2024 and is projected to reach USD 2,521.4 million by 2030, growing at a CAGR of 15.3% from 2025 to 2030. The market is driven by advancements in next-generation sequencing (NGS), increased awareness of rare genetic disorders, and rising demand for personalized medicine.

Key Market Trends & Insights

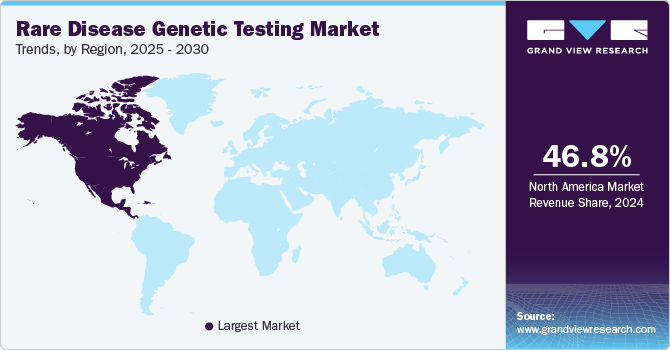

- North America rare disease genetic testing market dominated the global market with a share of 46.79% in 2024.

- Based on disease, the immunological disorders segment held the largest share of 12.56% in 2024 and is expected to continue the trend during the forecast period.

- Based on technology, the Next Generation Sequencing segment held the largest share of 35.50% in 2024.

- Based on specialty, the molecular genetic tests segment dominated the market for rare disease genetic testing market and accounted for the largest revenue share of 41.12% in 2024.

- Based on end-use, the research laboratories & CROs segment dominated the market for rare disease genetic testing market and accounted for the largest revenue share of 46.46% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,101.8 million

- 2030 Projected Market Size: USD 2,521.4 million

- CAGR (2025-2030): 15.3%

- North America: Largest market in 2024

Government initiatives and funding for rare disease research, along with improved accessibility to genetic counseling, further propel market growth. Additionally, decreasing costs of genetic testing and the growing adoption of whole genome and exome sequencing contribute to market expansion. Collaborations between biotech firms and research institutions enhance diagnostic capabilities, boosting market demand.

Rare diseases collectively impact over 300 million people worldwide, with approximately 25 to 30 million cases in the U.S. alone. The diagnostic journey for rare disease patients is lengthy, averaging over six years, and incurs significant healthcare costs of around $10,000 per patient, excluding emotional and productivity losses. Despite advancements, only 40% of patients eventually receive a definitive diagnosis, leaving many without clear treatment pathways. Notably, 50% of diagnosed cases involve children, and 80% of rare diseases have a genetic origin, underscoring the critical role of genetic testing in this field.

The growing adoption of next-generation sequencing (NGS) has been a transformative force in rare disease diagnostics. NGS has enhanced diagnostic accuracy, streamlined workflows, and enabled the identification of novel disease-associated genes. The technology has further revealed the complexity of rare diseases, including de novo mutations, mosaic mutations, and digenic inheritance, allowing for more precise and comprehensive genetic analyses. The continued decline in sequencing costs has further accelerated the adoption of whole genome sequencing (WGS) and whole exome sequencing (WES) for rare disease management.

Several industry leaders are actively expanding their offerings in this space:

-

March, 2025 - MyOme, a frontrunner in clinical whole-genome analysis and polygenic risk assessment, launched its first rare disease diagnostic product at the American College of Medical Genetics and Genomics (ACMG) Annual Meeting. By leveraging WGS, MyOme aims to increase diagnostic accuracy and improve patient access to genetic testing.

-

February, 2025 - MedGenome introduced the #CarefortheRare campaign ahead of Rare Disease Day, focusing on raising awareness about undiagnosed inherited diseases and the importance of early genetic testing. The campaign featured a documentary highlighting the emotional and financial impact of rare diseases on families.

-

August, 2024 - Ambry Genetics, a subsidiary of REALM IDx, Inc., launched ExomeReveal, a multiomic exome sequencing test that integrates RNA analysis to enhance rare disease detection. Unlike conventional DNA-based sequencing, ExomeReveal performs functional RNA studies, resolving variants of uncertain significance and improving diagnostic accuracy. Initial trials showed clinically meaningful results in 1 in 50 patients, with an additional 5% benefiting from long-term genomic reanalysis via the Ambry Patient for Life program.

Moreover, Patient registries have emerged as a key enabler of epidemiological and clinical research, allowing for data pooling, clinical trial feasibility assessment, and improved service planning. These registries not only enhance public health research but also support clinical best practices by integrating patient data into diagnostic workflows. Additionally, the market is witnessing increased collaborations among researchers, patients, regulatory bodies, and industry stakeholders to accelerate rare disease product development. These partnerships aim to improve diagnostic methodologies, enhance patient access to testing, and drive innovation in genetic analysis tools.

Navigating The Landscape Of Clinical Genetic Testing: Insights And Challenges In Rare Disease Diagnostics

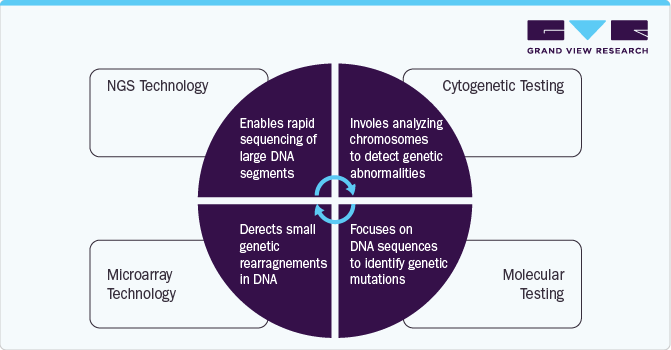

Clinical genetic testing is essential for diagnosing rare diseases, offering cytogenetic, molecular, and biochemical testing methods. Cytogenetic tests detect chromosomal abnormalities using techniques like microarrays (for unbalanced rearrangements) and FISH (for structural variations). Molecular testing, the most common, includes Sanger sequencing (high-accuracy single-gene analysis), PCR (gene amplification), MLPA (deletion/duplication detection), and NGS (comprehensive genome analysis). Biochemical tests, such as Southern blotting, remain relevant for specific disorders.

Test selection depends on factors like cost, turnaround time, and detection capability. While NGS offers broad coverage, it is not the gold standard for detecting CNVs or STRs. A precise clinical diagnosis ensures targeted testing, reducing time and costs. For example, Fragile X syndrome is confirmed via Southern blotting or PCR, while Alport syndrome requires COL4A5 sequencing and MLPA.

Comparative Characteristics of Different Genetic Testing Methodologies

Method

Range

Common Indication

TAT

Cost

Example

Karyotype

Genome-wide

CNVs, Other structural variations

<1 mo

Low

Down syndrome

Chromosomal microarray

Genome-wide

CNVs, UPD (SNP platform)

<1 mo

Average

Challenging cases

FISH

Targeted

CNVs, Other structural variations

<1 wk

Low

Angelman’s syndrome

Target PCR

Targeted

SNVs, Repeat expansions

<1 wk

Low

-

MLPA

Targeted

Small CNV (exon level)

>1 mo

Low

Duchenne muscular dystrophy

Southern blot

Targeted

Small CNV, Repeat expansions

>1 mo

Low

Fragile X syndrome

Sanger sequencing

Targeted

SNVs

>1 mo

Average

Cystic fibrosis

Gene panel

Targeted (wide)

SNVs

>2 mo

High

Long QT syndrome

Exome/genome sequencing

Genome-wide

SNVs, CNVs (only in genome sequencing)

>2 mo

High

Challenging cases

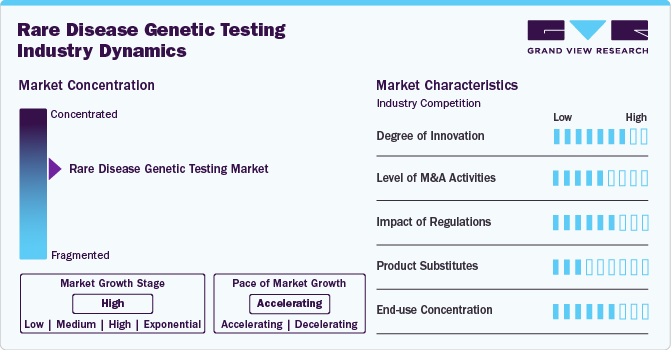

Market Concentration & Characteristics

The rare disease genetic testing market is witnessing significant innovation, driven by advancements in next-generation sequencing (NGS), AI-driven data analysis, and multi-omic approaches. Technologies like whole-genome sequencing (WGS) and RNA sequencing enhance diagnostic accuracy, identifying previously undetectable genetic mutations. Ambry Genetics' ExomeReveal, for example, integrates RNA analysis with exome sequencing, improving variant classification and diagnostic yield. Similarly, MyOme's whole-genome analysis leverages polygenic risk scores to expand detection capabilities. These innovations reduce diagnostic timelines, lower costs, and improve patient outcomes, addressing the longstanding challenge of undiagnosed rare diseases. Ongoing R&D and collaborations continue to push the boundaries of genetic diagnostics.

The rare disease genetic testing market has seen high levels of mergers and acquisitions (M&A) as companies seek to expand their capabilities, enhance technology portfolios, and strengthen market presence. Key drivers include the rising demand for advanced diagnostics, integration of AI-driven genomic analysis, and cost efficiencies. For example, Invitae Corporation acquired ArcherDX to improve precision oncology and rare disease diagnostics, while Labcorp acquired Personal Genome Diagnostics to enhance its genomic profiling services. Similarly, Eurofins acquired DNA Diagnostics Center (DDC) to strengthen its genetic testing portfolio.

Regulatory frameworks play a crucial role in shaping the rare disease genetic testing market, ensuring test accuracy, patient safety, and ethical compliance. Stringent regulations by authorities like the FDA (U.S.), EMA (Europe), and CFDA (China) impact test development, validation, and commercialization. For example, the EU In Vitro Diagnostic Regulation (IVDR) has increased compliance costs, requiring stricter clinical evidence for genetic tests. In the U.S., FDA oversight of laboratory-developed tests (LDTs) affects market entry timelines.

In the rare disease genetic testing market, product substitutes are limited due to the uniqueness of genetic diagnostics. However, alternative diagnostic approaches exist, such as biochemical testing, which detects metabolic abnormalities linked to genetic disorders, like enzyme assays for lysosomal storage diseases. Imaging techniques, including MRI, CT scans, and ultrasound, assist in diagnosing structural abnormalities in congenital disorders. Electrophysiological tests, such as EEG and EMG, play a role in conditions like muscular dystrophies and neurological disorders. Clinical diagnosis and family history analysis remain traditional methods based on symptom observation and hereditary patterns. Despite these alternatives, genetic testing remains superior in precision, early detection, and personalized treatment planning.

The rare disease genetic testing market is experiencing significant geographical expansion, driven by increasing awareness, technological advancements, and government initiatives. North America leads due to strong healthcare infrastructure, regulatory support, and high adoption of next-generation sequencing (NGS). Europe follows closely, with the implementation of the EU In Vitro Diagnostic Regulation (IVDR) shaping market growth. Asia-Pacific is witnessing rapid expansion, fueled by rising investments in genomics, growing healthcare access, and initiatives like China's Precision Medicine Initiative. Emerging markets in Latin America and the Middle East are also gaining traction as governments promote genetic research and diagnostic accessibility, further broadening market reach.

Disease Insights

The immunological disorders segment held the largest share of 12.56% in 2024 and is expected to continue the trend during the forecast period. Advances in next-generation sequencing (NGS), whole-exome sequencing (WES), and whole-genome sequencing (WGS) have improved the accuracy, speed, and affordability of genetic diagnostics. The rising prevalence of immunological rare diseases, including primary immunodeficiency disorders (PIDs), autoimmune diseases, and autoinflammatory syndromes, is driving demand for early and precise diagnosis. Conditions such as SCID, CVID, lupus, and rheumatoid arthritis increasingly rely on genetic insights for better treatment outcomes. Growing awareness and newborn screening programs, such as SCID screening in the U.S. and Europe, further support market expansion. Regulatory support and government initiatives, including the All of Us Research Program in the U.S. and China’s Precision Medicine Initiative, are increasing funding and research efforts in genetic diagnostics. The rise of personalized medicine and targeted therapies, such as gene therapy for SCID and IL-1 inhibitors for autoinflammatory syndromes, is creating higher demand for genetic testing to guide treatment decisions. Additionally, strategic collaborations and mergers and acquisitions, such as those by Invitae, Ambry Genetics, and Blueprint Genetics, are expanding the market by enhancing testing capabilities and global reach.

In addition, the endocrine & metabolism diseases segment is expected to grow at the fastest CAGR during the study period due to advancements in genetic diagnostics, increasing disease prevalence, and the demand for precision medicine. This segment includes disorders such as congenital adrenal hyperplasia (CAH), multiple endocrine neoplasia (MEN), monogenic diabetes (MODY), lysosomal storage diseases (LSDs), and mitochondrial disorders. Genetic testing plays a crucial role in early detection, treatment selection, and disease management. Advancements in next-generation sequencing (NGS), whole-exome sequencing (WES), and whole-genome sequencing (WGS) have improved diagnostic accuracy for complex metabolic and endocrine disorders. For example, identifying GCK, HNF1A, and HNF4A mutations in MODY has allowed for targeted treatment strategies, avoiding unnecessary insulin use. Similarly, genetic screening for MEN1 and RET mutations enables early intervention for multiple endocrine neoplasia, reducing the risk of severe complications.

Technology Insights

The Next Generation Sequencing segment held the largest share of 35.50% in 2024. The wide availability and adoption of NGS-based gene panels for cancer, neurological diseases, cardiovascular diseases, pediatric conditions, psychiatric disorders, and other rare diseases have significantly driven the segment. The increasing use of these panels allows for comprehensive genetic analysis, improving early detection and treatment planning. Strategic activities by key industry players are expected to propel market growth further. For instance, in June 2022, Avesthagen Ltd. formed a strategic alliance with Wipro Ltd. to commercialize its genetic testing offerings, expanding access to advanced diagnostics.

The portfolio of genetic testing solutions includes genome panels that provide highly precise, disease-centric analysis for conditions such as autoimmune disorders, neurodegenerative diseases, cancers, and rare genetic diseases. Whole-exome sequencing (WES) is emerging as a high-potential genetic testing method, particularly for cases where the genetic cause of a rare disease is unknown and difficult to identify. WES is becoming the standard of care for patients with undiagnosed rare diseases due to its ability to analyze exons, constituting approximately 1.5% of an individual's genome but containing 85% of all known disease-causing mutations. This capability is critical for gaining insights into protein synthesis and disease physiology, making WES a valuable tool in clinical genetics.

Specialty Insights

The molecular genetic tests segment dominated the market for rare disease genetic testing market and accounted for the largest revenue share of 41.12% in 2024. The segment is expected to maintain its dominant position, registering the fastest CAGR during the forecast period. Rapid technological advancements and increasing expertise in handling high-throughput technologies in clinical settings are key factors driving this growth. The integration of NGS, whole-exome sequencing (WES), and whole-genome sequencing (WGS) has significantly enhanced diagnostic capabilities, enabling the identification of genetic variations linked to rare and ultra-rare diseases.

Molecular genetic tests play a critical role in detecting mutations in single genes or short DNA sequences that lead to genetic disorders. These tests are widely used not only for diagnosing rare diseases but also for ultra-rare conditions that were previously difficult to detect. The increasing affordability of genome sequencing, coupled with the continuous development of NGS-based tests, has further fueled adoption in both research and clinical settings. The declining cost of sequencing, alongside technological innovations, is making comprehensive genetic testing more accessible, enabling early diagnosis, precision medicine, and better patient outcomes. The expansion of genetic testing portfolios by leading market players and growing investments in personalized medicine and precision diagnostics are expected to further accelerate market growth.

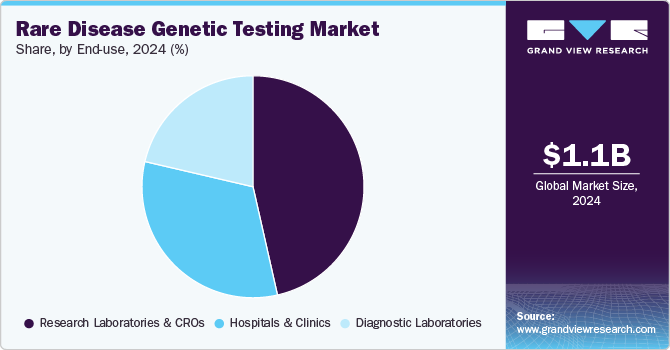

End-use Insights

The research laboratories & CROs segment dominated the market for rare disease genetic testing market and accounted for the largest revenue share of 46.46% in 2024. Laboratories are the key end-users; in the majority of cases, blood samples collected from patients are sent to a laboratory for testing. Laboratories offer testing based on various specialties, including molecular genetic tests, chromosomal genetic tests, and biochemical genetic tests. Moreover, molecular genetic testing-based laboratory testing is rapidly increasing worldwide. Genetic tests are conducted by multiple laboratories, including those that are accredited with CLIA for clinical cytogenetics, pathology, and chemistry among other specialties.

The diagnostic laboratories segment is expected to register the fastest CAGR of 17.36% over the study period. The reason for its growth is the rising number of partnership and collaboration activities of diagnostic laboratories with genetic testing companies. In November 2023, Genomenon and Alexion, AstraZeneca Rare Disease announced a strategic collaboration projected to make important information for the treatment and diagnosis of rare diseases more readily available. The goal of the collaboration is to empower the genetic testing laboratories with the data they need for the diagnosis of rare diseases.

Regional Insights

North America rare disease genetic testing market dominated the global market with a share of 46.79% in 2024. The market is experiencing significant growth due to advanced healthcare infrastructure, high adoption of next-generation sequencing (NGS), and strong government support for rare disease research. The U.S. leads the market, driven by initiatives such as the Rare Diseases Clinical Research Network (RDCRN) and the Orphan Drug Act, which incentivizes research and development. Companies like Invitae and Ambry Genetics offer expanded genetic testing solutions for rare conditions, improving early diagnosis. In 2023, Illumina launched TruSight Software Suite, enhancing rare disease variant interpretation. Increasing patient awareness and collaborations between biotech firms and research institutes further propel market expansion.

U.S. Rare Disease Genetic Testing Market Trends

Rare disease genetic testing market in U.S. is witnessing substantial growth due to rising demand for early diagnosis and advancements in multiomic testing approaches. The increasing prevalence of rare genetic disorders has led to greater adoption of whole-genome sequencing (WGS) and RNA sequencing for more precise diagnostics. In 2024, Mayo Clinic launched an advanced rare disease genomic testing program, leveraging AI-driven analytics for faster detection of genetic variants. Additionally, the integration of cloud-based bioinformatics platforms, such as Fabric Genomics' AI-powered variant interpretation tool, is enhancing diagnostic efficiency. Growing investment in precision medicine and newborn screening programs is further fueling market expansion.

Europe Rare Disease Genetic Testing Market Trends

Rare disease genetic testing market in Europe is expanding due to strong government support, increased funding for genomic research, and advancements in next-generation sequencing (NGS). Countries like Germany, the UK, and France are leading the market, driven by national genomic initiatives such as the UK’s 100,000 Genomes Project and France’s Genomic Medicine Plan 2025. In 2023, Centogene partnered with Takeda to enhance genetic testing for rare metabolic disorders, improving early detection. Additionally, the European Reference Networks (ERNs) are fostering cross-border collaboration for rare disease diagnostics. Growing accessibility to whole-exome sequencing (WES) and AI-driven bioinformatics platforms is further driving market growth.

The France rare disease genetic testing market is growing due to strong government initiatives, increasing adoption of next-generation sequencing (NGS), and expanding precision medicine programs. The France Genomic Medicine Plan 2025 has played a crucial role in integrating genetic testing into the healthcare system, boosting accessibility to whole-exome sequencing (WES) and whole-genome sequencing (WGS). In 2023, SeqOIA, a leading genomic medicine center, expanded its rare disease testing capabilities to improve early diagnosis. Additionally, collaborations between research institutions and biotech firms, such as Genethon’s partnership with hospitals for rare disease gene therapy research, are accelerating advancements in the market.

Rare disease genetic testing market in Germany is expanding due to strong government support, technological advancements, and increased adoption of whole-genome sequencing (WGS) and next-generation sequencing (NGS). The German Human Genome-Phenome Archive (GHGA) is enhancing genomic data accessibility, facilitating rare disease research. In 2023, CeGaT launched an advanced multiomics-based genetic testing service, improving diagnostic accuracy. Additionally, the German National Cohort (NAKO) study is driving innovation by integrating genetic testing into epidemiological research. Collaborations between biotech firms and healthcare providers, such as BioNTech’s expansion into rare disease diagnostics, are further fueling market growth and enhancing patient access to genetic testing.

Asia Pacific Rare Disease Genetic Testing Market Trends

Rare disease genetic testing market in Asia Pacific is experiencing rapid growth due to increasing government initiatives, expanding healthcare infrastructure, and rising awareness of genetic disorders. Countries like China, Japan, and India are leading the market with strong investments in next-generation sequencing (NGS) and whole-genome sequencing (WGS). In 2023, China’s National Rare Disease Registry expanded genetic testing programs, improving early diagnosis. Japan’s Initiative on Rare and Undiagnosed Diseases (IRUD) is driving advancements in clinical genomics. Meanwhile, MedGenome launched a nationwide genetic testing awareness campaign in India to enhance accessibility. Growing collaborations between biotech firms and research institutions are further accelerating market expansion.

The Japan rare disease genetic testing market is growing due to strong government support, advancements in whole-genome sequencing (WGS) and next-generation sequencing (NGS), and increasing collaborations between research institutions and biotech firms. The Initiative on Rare and Undiagnosed Diseases (IRUD), launched by the Japan Agency for Medical Research and Development (AMED), has significantly improved genetic diagnosis for rare diseases. In 2023, Takara Bio expanded its genetic testing services, enhancing precision diagnostics. Additionally, Japan’s Genomic Medicine Initiative is driving the integration of AI-based bioinformatics for rare disease detection. Increased investment in newborn screening programs is further fueling market growth.

Latin America Rare Disease Genetic Testing Market Trends

Rare disease genetic testing market in Latin America is expanding due to increasing awareness, improved healthcare infrastructure, and growing adoption of next-generation sequencing (NGS) and whole-exome sequencing (WES). Countries like Brazil, Mexico, and Argentina are leading the market, supported by government initiatives and private sector investments. In 2023, Brazil’s Fiocruz expanded its genetic testing programs, enhancing early diagnosis for rare conditions. Mexico’s National Institute of Genomic Medicine (INMEGEN) is advancing precision medicine initiatives. Additionally, partnerships between global biotech firms and local healthcare providers, such as Blueprint Genetics’ expansion into Latin America, are improving access to advanced genetic testing solutions.

The Brazil rare disease genetic testing market is growing due to government initiatives, expanding genetic research, and increased adoption of next-generation sequencing (NGS) and whole-exome sequencing (WES). The Rare Diseases National Policy, established by the Brazilian Ministry of Health, has improved access to genetic testing and early diagnosis. In 2023, Fiocruz expanded its genomic research programs, enhancing rare disease detection capabilities. Additionally, the Genomas Brasil Initiative is driving advancements in precision medicine. Collaborations with biotech firms, such as Illumina’s partnership with Brazilian research institutions, are further strengthening the country’s genetic testing capabilities and accessibility.

Middle East & Africa Rare Disease Genetic Testing Market Trends

The Middle East & Africa rare disease genetic testing market is rapidly evolving, driven by government-led genomic initiatives and strategic collaborations. For instance, the UAE Genomics Council has prioritized genetic research, leading to increased adoption of next-generation sequencing (NGS) and whole-exome sequencing (WES). In 2023, M42 expanded its partnerships with global biotech firms to enhance diagnostic capabilities. Additionally, the country is integrating AI-driven bioinformatics into genetic analysis, improving accuracy and efficiency. Collaborations with international players, such as Illumina’s alliance with UAE research centers, are further strengthening the market, ensuring broader accessibility to genetic testing for rare disease patients across the region.

Saudi Arabia rare disease genetic testing market is making significant strides in the rare disease genetic testing market, driven by large-scale genomic initiatives and technological advancements. The Saudi Human Genome Program (SHGP) has been instrumental in identifying genetic variations associated with rare diseases, leading to improved diagnostic accuracy. In 2023, the Ministry of Health partnered with international biotech firms to integrate cutting-edge genetic testing into public healthcare. With increasing adoption of AI-powered bioinformatics and next-generation sequencing (NGS), the country is enhancing early detection capabilities. Collaborations with global players like Illumina and BGI Genomics are further strengthening Saudi Arabia’s position in precision medicine.

Key Rare Disease Genetic Testing Company Insights

Some of the key market players include Quest Diagnostics, Inc.; Centogene N.V.; Invitae Corp.; 3billion, Inc.; Arup Laboratories; among others. These players are undertaking various strategic initiatives to increase their share in the market. New product development, collaborations, and partnerships are some such endeavors.

Key Rare Disease Genetic Testing Companies:

The following are the leading companies in the rare disease genetic testing market. These companies collectively hold the largest market share and dictate industry trends.

- Quest Diagnostics Inc.

- Centogene N.V.

- Invitae Corp.

- 3billion, Inc.

- Arup Laboratories

- Eurofins Scientific

- Strand Life Sciences

- Ambry Genetics

- Perkin Elmer, Inc.

- Realm IDX, Inc.

- Macrogen, Inc.

- Baylor Genetics

- Color Genomics, Inc.

- Health Network Laboratories

- PreventionGenetics

- Progenity, Inc.

- Coopersurgical, Inc.

- Fulgent Genetics Inc.

- Myriad Genetics, Inc.

- Laboratory Corporation of America Holdings

- Opko Health, Inc.

- Artemis DNA

Rare Disease Genetic Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.24 billion

Revenue Forecast in 2030

USD 2.52 billion

Growth rate

CAGR of 15.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disease , specialty, technology, end-use, region

Region scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Quest Diagnostics, Inc.; Centogene N.V.; Invitae Corp.; 3billion, Inc.; Arup Laboratories; Eurofins Scientific; Strand Life Sciences; Ambry Genetics; Perkin Elmer, Inc.; Macrogen, Inc.; Baylor Genetics; Color Genomics; Inc.; Health Network Laboratories; PreventionGenetics; Progenity; Inc.; Coopersurgical; Inc.; Fulgent Genetics Inc.; Myriad Genetics; Inc.; Laboratory Corporation Of America Holdings; Opko Health; Inc.; Artemis DNA

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Rare Disease Genetic Testing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report; Grand View Research has segmented global rare disease genetic testing market report based on disease, technology, specialty, end-use, and region:

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurological Disorders

-

Immunological Disorders

-

Hematology Diseases

-

Endocrine & Metabolism Diseases

-

Cancer

-

Musculoskeletal Disorders

-

Cardiovascular Disorders

-

Dermatology Diseases

-

Other Rare Diseases

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Next Generation Sequencing

-

Whole Exome Sequencing

-

Whole Genome Sequencing

-

-

Array Technology

-

PCR-based Testing

-

FISH

-

Sanger Sequencing

-

Karyotyping

-

-

Specialty Outlook (Revenue, USD Million, 2018 - 2030)

-

Molecular Genetic Tests

-

Chromosomal Genetic Tests

-

Biochemical Genetic Tests

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research Laboratories & CROs

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global rare disease genetic testing market size was estimated at USD 1.10 billion in 2024 and is expected to reach USD 1.24 billion in 2025.

b. The global rare disease genetic testing market is expected to grow at a compound annual growth rate of 15.30% from 2025 to 2030 to reach USD 2.52 billion by 2030.

b. Next Generation Sequencing (NGS) dominated the rare disease genetic testing market with a revenue share of 35.50% in 2024. High penetration of Whole Exome Sequencing (WES) coupled with introduction of Whole Genome Sequencing (WGS)-based new tests has driven the segment share in 2024.

b. Some key players operating in the rare disease genetic testing market include Quest Diagnostics, ARUP Laboratories, Perkin Elmer Inc., and Centogene.

b. Key factors that are driving the rare disease genetic testing market growth include plummeting sequencing cost, expanding patient registry for rare disease, & launch of programs to advance in rare disease diagnosis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.