- Home

- »

- Automotive & Transportation

- »

-

Rear Axle Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Rear Axle Market Size, Share & Trends Report]()

Rear Axle Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Drive Axle, Dead Axle, Lift Axle), By Application (Heavy Vehicles, Luxury Vehicles, Economy Vehicles), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-755-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rear Axle Market Size & Trends

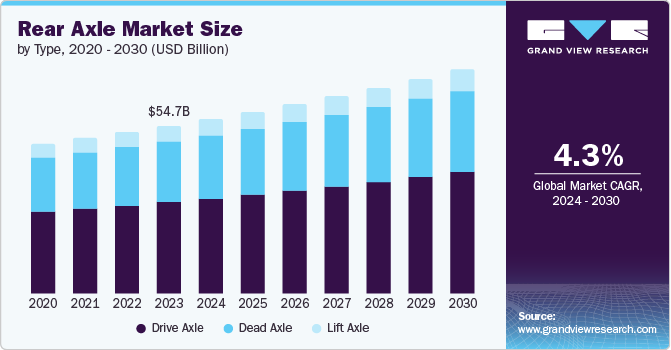

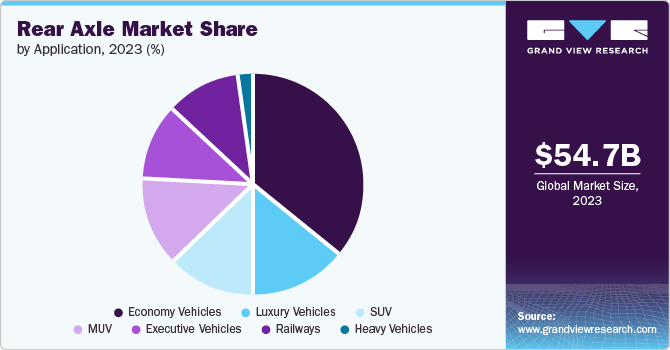

The global rear axle market size was valued at USD 54.7 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. Market growth worldwide is driven by increasing demand for hybrid and luxury vehicles, fueled by consumer preference for improved technology and high disposable income. Moreover, the need for efficient and lightweight automotive components is also propelling growth. Partnerships between original equipment manufacturers and equipment suppliers are key to meeting the demands of car manufacturers.

An increase in the demand for commercial vehicles to transport large loads, particularly with long trailers, is a major factor driving the rear axle market. The strong rear axles required for these vehicles are in high demand. In addition, the growing sales of luxury vehicles that require more torque and performance are contributing to the growth of the rear axle market. As the number of luxury automobiles being sold increases, there is a greater demand for higher-quality rear axles to improve vehicle efficiency.

The automotive industries have been working towards the improvement of technically superior rear axles that are lightweight, and compact in size but more fuel efficient and this can be considered as a major driving factor for the rear axle market. Indeed, these designs enhance efficiency, and performance, and help decrease the general weight of automobiles, including hybrid and electric ones.

New market opportunities can be identified with the aftermarket services offering replacement and repair services for the axles of powertrains. Since automobiles go through a certain amount of wear and tear as they get older or need repair, there is a constant need for new axle replacements which drives rear axle market revenues constantly. Moreover, Governments worldwide are promoting the use of electric and hybrid cars to reduce emissions. This shift in consumer trends is expected to increase demand for rear axles, as these cars require specialized axles for their drive.

Type Insights

The drive axle product segment dominated the global rear axle market with a revenue share of 54.8% in 2023. Drive axles are critical components in distributing power from the engine to the wheels, ensuring optimal performance in both commercial and passenger vehicles. With advancements in design, drive axles have improved in terms of service, strength, and reliability, making them a top choice for the automotive industry seeking to enhance drive systems and optimize vehicle performance.

Lift axles are expected to register the fastest CAGR of 4.6% over the forecast period, driven by their capacity to enhance fuel efficiency by distributing vehicle weight, thereby improving performance and fuel economy. As consumers prioritize safety and comfort, lift axles are gaining traction, offering improved stability and control, particularly in heavy-duty or off-road applications, increasing demand for this technology.

Application Insights

The economy vehicles segment dominated the global rear axle market with a revenue share of 35.6% in 2023. Economy vehicles prioritize affordability, budget, and ROI, making them attractive to a wide range of consumers. Our rear axles in economy vehicles strike a balance between cost-effectiveness and performance, ensuring strength and efficiency. By efficiently transferring torque from wheels to differential, our axles enhance overall fuel economy, aligning with environment-friendly initiatives and driving demand for eco-friendly vehicles.

Luxury vehicles are expected to register the fastest CAGR of 5.2% in the forecast period. Premium consumers seek top-tier safety, comfort, and performance from their luxury vehicles. Luxury vehicles are equipped with high-quality rear axles that deliver a smooth ride and enhanced safety, meeting these exacting standards. With the global luxury market growing rapidly due to increased disposable income and aspirational lifestyles, we’re driven to develop innovative rear axle solutions that meet the evolving needs of this lucrative segment.

Regional Insights

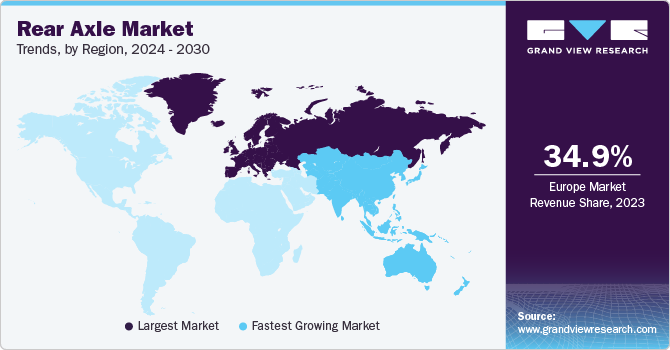

North America rear axle market held a significant market share in the global rear axle market in 2023. The region has established itself as a technological leader in the automotive industry, with significant investments in R&D driving innovation in rear axle performance and efficiency. Cost-reduction initiatives have also been a focus, solidifying the region’s dominance in the rear axle market and positioning it for continued growth and competitiveness.

U.S. Rear Axle Market Trends

The U.S. rear axle market dominated the North America rear axle market with a revenue share of 82.8% in 2023. The U.S. manufacturing industry efficiently produces rear axles in large quantities, meeting both local and export demand. With a vast vehicle market and strong industry partnerships, American companies maintain a leading position in rear axle production.

Europe Rear Axle Market Trends

Europe rear axle market dominated the global rear axle market with a revenue share of 34.9% in 2023. The region’s dominance is aided by its advanced automotive industry. Leading countries like Germany, France, Italy, and the UK manufacture high-quality vehicles that require complex rear axles. The region is also known for producing high-end cars and driving innovations in rear axle technologies to provide a better driving experience for customers.

Germany rear axle market is expected to grow rapidly in the Europe rear axle market in the coming years. Germany is known for its strength in manufacturing, particularly in the production of high-quality automotive parts. This has led to the dominance of German rear axle producers. German manufacturers are recognized for their strict adherence to quality standards and regulations, implementing rigorous controls and measures to ensure the structural integrity of their rear axles.

Asia Pacific Rear Axle Market Trends

Asia Pacific rear axle market is expected to register the fastest CAGR of 5.2% in the global rear axle market over the forecast period. Industry growth in the region is influenced by factors such as the growing automotive industry, increased demand for commercial vehicles, potential adoption of electric vehicles, technological advancements, and government support for sustainability. Moreover, there is a shift towards electric vehicles in the region due to environmental concerns, leading to a demand for new rear axles suitable for electric drive systems.

China rear axle market is expected to grow rapidly in the coming years. The automotive industry in China grew rapidly due to increased demand for passenger cars. As a result, many manufacturers established operations there, leading to China becoming the largest rear axle market. The development of a strong supply chain network, driven by the establishment of manufacturing bases for automotive industries, contributed to the production of rear axles, making China a significant player in the global rear axle market.

Key Rear Axle Company Insights

Some key companies in the rear axle market include American Axle & Manufacturing, Inc.; Dana Limited; Cummins Inc.; and GKN Automotive Limited; among others. Prominent market players are adopting strategic initiatives such as M&A, product innovation, and capacity expansion to capitalize on growing demand and solidify their positions.

-

American Axle & Manufacturing, Inc. (AAM) is a global automotive supplier, designing, engineering, and manufacturing driveline and drivetrain components for various vehicles. Its commitment to R&D ensures its position at the forefront of technological innovation in the industry.

-

Dana Limited specializes in axles, driveshafts, transmissions, and propulsion systems for light, commercial, and off-highway vehicles, with a focus on electrification and energy management innovations. The company is present in over 33 countries and 36,000 employees.

Key Rear Axle Companies:

The following are the leading companies in the rear axle market. These companies collectively hold the largest market share and dictate industry trends.

- American Axle & Manufacturing, Inc.

- Dana Limited

- Cummins Inc.

- GKN Automotive Limited

- HYUNDAI WIA CORP.

- ZF Friedrichshafen AG

- BENTELER International Aktiengesellschaft

- Marelli Holdings Co., Ltd.

- ROC-SPICER LTD.

Recent Developments

-

In June 2024, ZF launched the TraXon 2 Hybrid transmission with enhanced decarbonized mobility solutions and outperformed the market with its portfolio. The company’s e-mobility advancements and broad product range have enabled strong results.

-

In May 2024, Dana launched rear semi-float axles for jeeps. These axles offer a direct fit, bolt-in upgrade solution that emphasizes advanced power both internally and externally. The new semi-float axles are aimed at enhancing the overall performance and durability of Jeep vehicles, especially for off-road enthusiasts.

Rear Axle Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 56.8 billion

Revenue forecast in 2030

USD 73.1 billion

Growth rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

American Axle & Manufacturing, Inc.; Dana Limited; Cummins Inc.; GKN Automotive Limited; HYUNDAI WIA CORP.; ZF Friedrichshafen AG; BENTELER International Aktiengesellschaft; Gestamp Automoción, S.A.; Marelli Holdings Co., Ltd.; ROC-SPICER LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rear Axle Market Report Segmentation

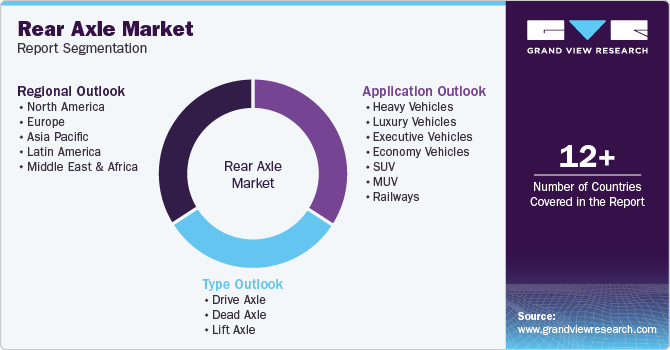

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rear axle market report based on type, application, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Drive Axle

-

Dead Axle

-

Lift Axle

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Heavy Vehicles

-

Luxury Vehicles

-

Executive Vehicles

-

Economy Vehicles

-

SUV

-

MUV

-

Railways

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.