- Home

- »

- Plastics, Polymers & Resins

- »

-

Redispersible Polymer Powder Market, Industry Report 2030GVR Report cover

![Redispersible Polymer Powder Market Size, Share & Trends Report]()

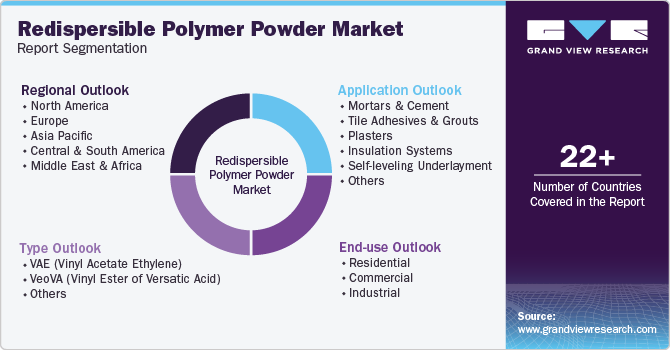

Redispersible Polymer Powder Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (VAE (Vinyl Acetate Ethylene), VeoVA (Vinyl Ester of Versatic Acid)), By End-use (Residential, Commercial), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-507-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Redispersible Polymer Powder Market Summary

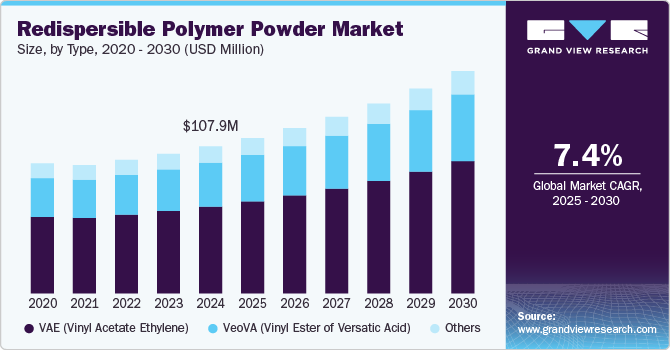

The global redispersible polymer powder market size was estimated at USD 107.9 million in 2024 and is projected to reach USD 163.2 million by 2030, growing at a CAGR of 7.4% from 2025 to 2030. The construction industry's rapid growth, particularly in emerging economies, is a significant factor driving for the redispersible polymer (RDP) powder market.

Key Market Trends & Insights

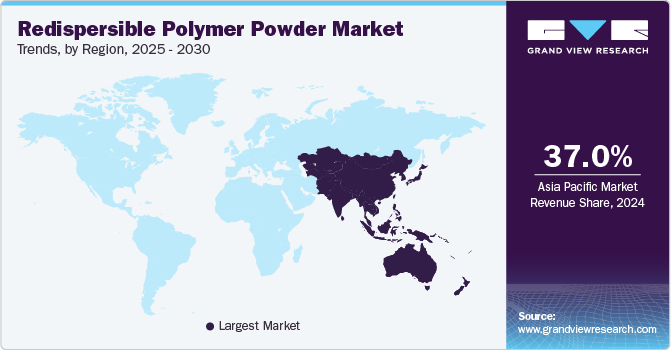

- The Asia Pacific redispersible polymer powder market dominated the market and accounted for the largest revenue share of over 37.0% in 2024.

- The U.S. is primarily driven due to its robust construction and building materials industry.

- Based on type, the vinyl acetate ethylene (VAE) segment recorded the largest revenue share of over 59.0% in 2024.

- Based on end-use, the residential segment accounted for the largest revenue share of over 57.0% in 2024.

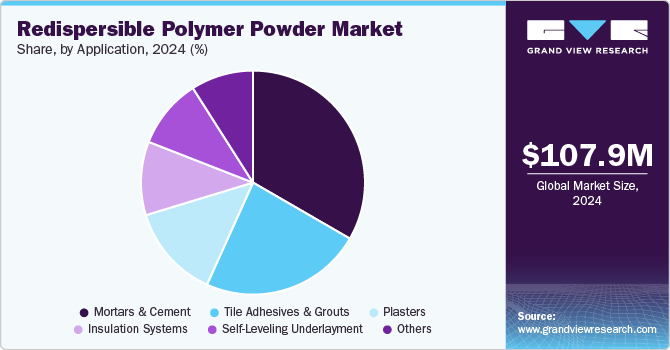

- Based on application, the mortars & cement segment recorded the largest revenue share of over 33.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 107.9 Million

- 2030 Projected Market Size: USD 163.2 Million

- CAGR (2025-2030): 7.4%

- Asia Pacific: Largest market in 2024

RDP powder is extensively used in cement-based products such as tile adhesives, plasters, and self-leveling compounds, enhancing their flexibility, water resistance, and adhesion properties. With increased urbanization and infrastructure development in regions like Asia-Pacific, the demand for high-performance construction materials is soaring. For instance, China’s extensive infrastructure projects under initiatives like the Belt and Road Initiative are boosting the adoption of advanced construction chemicals, including RDP powders, to ensure quality and durability.

The rise in renovation and remodeling activities, particularly in developed markets like North America and Europe, is another critical driver. Consumers' growing preference for modern aesthetics and the need to upgrade aging infrastructure drive the demand for products such as waterproofing membranes, grouts, and renders, all of which benefit from RDP powders. For instance, the U.S. remodeling industry has seen steady growth due to increased home improvement activities, further amplifying the need for high-quality polymer-modified construction materials.

RDP powders are increasingly being utilized beyond traditional construction applications, finding innovative uses in areas such as energy-efficient wall systems and precast concrete elements. The development of advanced building solutions, including thermal insulation systems, is creating new opportunities for RDP powders. These powders enhance the durability and energy performance of such systems, making them indispensable in modern building practices. Countries like India and Brazil, which are experiencing significant growth in affordable housing and urban infrastructure, are emerging as hotspots for these advanced applications.

Type Insights

Vinyl Acetate Ethylene (VAE) segment recorded the largest revenue share of over 59.0% in 2024. VAE-based redispersible polymer powders are widely used in construction applications due to their excellent adhesive strength, flexibility, and water resistance. They provide enhanced mechanical properties to cementitious and gypsum-based formulations, making them ideal for tile adhesives, self-leveling compounds, and exterior insulation and finishing systems (EIFS). VAE powders also exhibit superior compatibility with other additives and fillers, allowing them to be easily integrated into various construction materials.

VeoVA-based redispersible polymer powders are known for their superior hydrophobic properties and resistance to water and alkalis. These characteristics make them highly suitable for exterior applications such as façade renders, coatings, and waterproofing membranes. The growing focus on durability and weather-resistant construction solutions is driving the demand for VeoVA-based RDP powders.

End-use Insights

The residential segment accounted for the largest revenue share of over 57.0% in 2024. This segment includes RDP powders used in construction activities such as residential buildings, apartments, and housing projects. These powders are extensively used in applications like tile adhesives, self-leveling compounds, repair mortars, and external thermal insulation systems (ETICS) to improve flexibility, bonding, and durability.

The commercial end-use segment is expected to grow at the fastest CAGR of 7.66% during the forecast period. The commercial segment covers applications in offices, retail stores, shopping malls, hospitals, and educational institutions. Growth in commercial real estate investments, an increase in public infrastructure spending, and the expansion of urban commercial hubs are significant drivers of the commercial segment.

The industrial segment includes applications in factories, warehouses, and production facilities. RDP powders are employed in industrial construction for their ability to enhance the strength, chemical resistance, and thermal stability of construction materials. They are widely used in industrial flooring, concrete repair, and heavy-duty coatings. The rising demand for durable and low-maintenance industrial spaces, coupled with increased investments in manufacturing and logistics facilities, is driving the industrial segment.

Application Insights

The mortars & cement segment recorded the largest revenue share of over 33.0% in 2024. Redispersible polymer (RDP) powders are extensively used in mortars and cement formulations to enhance workability, adhesion, and flexibility. They improve water retention, prevent cracking during drying, and ensure better binding of the cement with aggregates. The growth of infrastructure development projects globally, especially in emerging economies, drives the demand for RDP powders in mortars and cement.

The insulation systems application segment is anticipated to grow at the fastest CAGR of 8.41% over the forecast period. RDP powders are critical in External Thermal Insulation Composite Systems (ETICS) and other insulation systems. RDP-modified insulation systems also exhibit superior mechanical properties, contributing to their longevity.

Moreover, RDP powders play a vital role in tile adhesives and grouts by improving bonding strength, water resistance, and flexibility. The rising demand for aesthetically appealing interior and exterior tiling, driven by urbanization and remodeling trends, boosts the use of RDP powders in tile adhesives and grouts.

Region Insights

North America redispersible polymer powder market is driving the redispersible polymer (RDP) powder market due to several key factors in its construction, infrastructure, and manufacturing ecosystem. The region's robust construction industry, characterized by significant infrastructure development, renovation projects, and advanced building technologies, creates a substantial demand for high-performance polymer powders.

U.S. Redispersible Polymer Powder Market Trends

The redispersible polymer powder market in the U.S. is primarily driven due to its robust construction and building materials industry. The country's significant infrastructure development, renovation projects, and advanced construction technologies have created a high demand for RDP powders. Moreover, the U.S. market benefits from a mature supply chain, advanced manufacturing infrastructure, and significant investment in green building technologies. These factors create a conducive ecosystem for RDP powder innovation and widespread adoption

Asia Pacific Redispersible Polymer Powder Market Trends

Asia Pacific redispersible polymer powder market dominated the market and accounted for the largest revenue share of over 37.0% in 2024. The construction boom in Asia Pacific, characterized by massive urban development projects, residential complexes, and infrastructure modernization, is creating substantial demand for RDP powder. These polymers enhance cement and mortar performance, improving properties like adhesion, water resistance, and flexibility. For instance, in mega-projects like China's Belt and Road Initiative and India's Smart Cities Mission, RDP powders are critical for achieving high-performance construction materials that can withstand diverse environmental conditions.

The redispersible polymer powder market in China is primarily driven by its government policies and initiatives supporting infrastructure modernization, urbanization, and sustainable construction. The growing emphasis on energy-efficient buildings, earthquake-resistant structures, and improved construction materials has further accelerated RDP powder adoption across various applications such as tile adhesives, wall putty, self-leveling compounds, and thermal insulation systems.

Europe Redispersible Polymer Powder Market

Europe redispersible polymer powder market is driving market through a combination of advanced manufacturing infrastructure, stringent construction quality regulations, and a robust construction industry. The region's sophisticated building technologies and high emphasis on sustainable construction practices have positioned European manufacturers as leaders in developing high-performance RDP powders with enhanced properties like improved adhesion, water resistance, and durability.

Redispersible polymer powder market in the Germany is primarily driven by country's advanced chemical manufacturing capabilities, strong engineering expertise, and strategic focus on innovations in construction and industrial materials. Key factors include leading chemical companies such as BASF and Wacker Chemie AG developing high-performance polymer powders, extensive research investments in improving adhesion and durability, a robust export-oriented manufacturing ecosystem, and specialized RDP formulations that enhance cement-based products, tile adhesives, and protective coatings.

Key Redispersible Polymer Powder Company Insights

The redispersible polymer (RDP) powder industry is highly competitive. Key players range from established packaging manufacturers to specialized firms focusing on sustainable materials, customized packaging solutions, and technology-enabled logistics. Companies are differentiating through innovations in lightweight, durable, and biodegradable materials, while addressing concerns such as protection during transit, environmental impact, and reducing packaging waste. Competitive pressures are intense, with firms striving for cost-efficiency and unique designs to enhance customer satisfaction and brand recognition.

-

In April 2020, Celanese Corporation completed the acquisition of Nouryon's Elotex brand, which specializes in redispersible polymer powders. This acquisition was finalized after meeting all necessary regulatory and operational requirements, allowing Celanese to take ownership of Nouryon's global production facilities located in Europe and Asia Pacific, including sites in Frankfurt (Germany), Geleen (Netherlands), Moosleerau (Switzerland), and Shanghai (China).

-

In March 2020, WACKER Chemie AG launched the first-ever renewables-based dispersible polymer powder, known as VINNECO 5044 N, specifically designed for construction applications. This innovative product is produced using the mass balance approach, which integrates renewable raw materials into the manufacturing process alongside traditional fossil-based resources.

Key Redispersible Polymer Powder Companies:

The following are the leading companies in the redispersible polymer powder market. These companies collectively hold the largest market share and dictate industry trends.

- Wacker Chemie AG

- Dow

- BASF

- Celanese Corporation

- Acquos Pty Ltd

- Synthomer plc

- Ashland Global Holdings Inc.

- Japan Coating Resin Corporation

- Bosson (Beijing) Chemical Co., Ltd.

- Dairen Chemical Corporation

- Organik Kimya

Global Redispersible Polymer (RDP) Powder Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 114.1 million

Revenue forecast in 2030

USD 163.2 million

Growth rate

CAGR of 7.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, Volume forecast, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, application, region

States scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Key companies profiled

Wacker Chemie AG; Dowl; BASF; Celanese Corporation; Acquos Pty Ltd; Synthomer plc; Ashland Global Holdings Inc.; Japan Coating Resin Corporation; Bosson (Beijing) Chemical Co., Ltd.; Dairen Chemical Corporation; Organik Kimya

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Redispersible Polymer Powder Market Report Segmentation

This report forecasts revenue growth at a global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global redispersible polymer powder market report based on type, end-use, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

VAE (Vinyl Acetate Ethylene)

-

VeoVA (Vinyl Ester of Versatic Acid)

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Mortars & Cement

-

Tile Adhesives & Grouts

-

Plasters

-

Insulation Systems

-

Self-leveling Underlayment

-

Others

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global redispersible polymer powder market was estimated at around USD 107.9 million in the year 2024 and is expected to reach around USD 114.1 million in 2025.

b. The global redispersible polymer powder market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2030 to reach around USD 163.2 million by 2030.

b. Residential segment emerged as a dominating end-use with a value share of around 57.0% in the year 2024 owing to the increasing government housing schemes and incentives for affordable housing.

b. The key players in the redispersible polymer (RDP) powder market include Wacker Chemie AG, Dowl, BASF, Celanese Corporation, Acquos Pty Ltd, Synthomer plc, Ashland Global Holdings Inc., Japan Coating Resin Corporation, Bosson (Beijing) Chemical Co., Ltd., Dairen Chemical Corporation, and Organik Kimya.

b. The construction industry's rapid growth, particularly in emerging economies, is a significant driver for the redispersible polymer (RDP) powder market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.