Reduced Fat Butter Market Summary

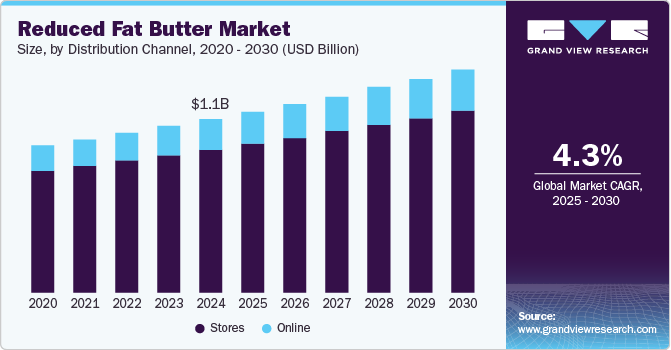

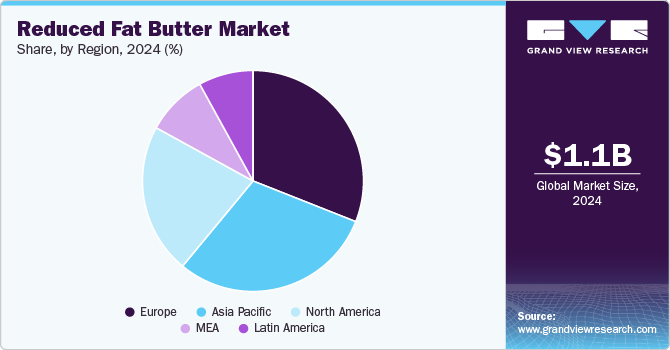

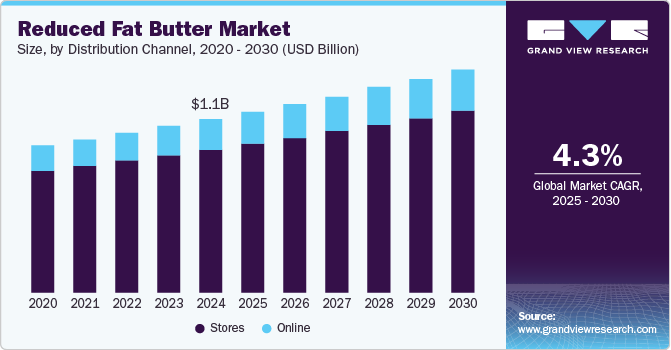

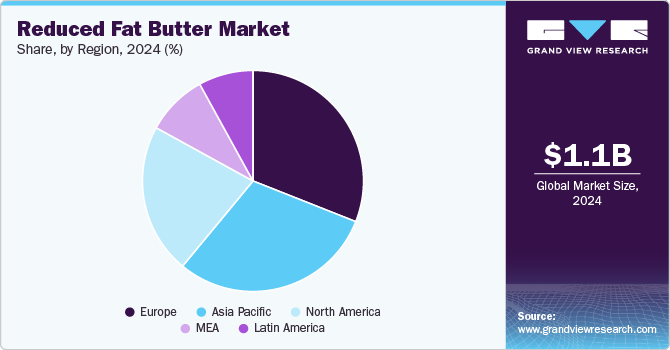

The global reduced fat butter market size was estimated at USD 1.12 billion in 2024 and is projected to reach USD 1.44 billion by 2030, growing at a CAGR of 4.3% from 2025 to 2030. The market growth is attributed to the rising health consciousness among consumers, who increasingly opt for healthier food alternatives.

Key Market Trends & Insights

- The Europe reduced fat butter market dominated the global market with the largest revenue share of 30.8% in 2024.

- The North America reduced fat butter market is expected to grow at the fastest CAGR of 4.9% over the forecast period.

- Based on distribution channel, the stores dominated the market with the largest revenue share of 82.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.12 Billion

- 2030 Projected Market USD 1.44 Billion

- CAGR (2025-2030): 4.3%

- Europe: Largest market in 2024

- North America: Fastest growing market

Reduced butter, with its lower fat content, aligns with the dietary preferences of health-conscious individuals seeking to reduce their fat intake without compromising on taste. The growing prevalence of lifestyle-related diseases such as obesity and cardiovascular issues has prompted consumers to choose low-fat options. Also, companies are introducing different product forms, such as spreads and non-spreads, which are likely to contribute to the reduced-fat butter market growth.

Manufacturers' product innovation, including the introduction of flavored and fortified reduced butter variants, also plays a significant role in attracting consumers. The expansion of modern retail formats and e-commerce platforms has made reduced butter products more accessible, further driving market growth.

Distribution Channel Insights

Stores dominated the market with the largest revenue share of 82.5% in 2024. Traditional retail stores, including supermarkets, hypermarkets, and specialty food stores, offer consumers the convenience of immediate purchase and the ability to physically inspect products before buying. The widespread presence of these retail outlets ensures easy accessibility to reduced butter products for a broad consumer base. Additionally, stores often provide promotional deals, in-store sampling, and personalized customer service, enhancing the shopping experience and encouraging repeat purchases. The trust and reliability associated with physical stores also contribute to their strong market position, as consumers feel more confident in the quality and authenticity of the products they buy from established retail locations.

The online channel is expected to grow at the fastest CAGR of 4.7% over the forecast period. The increasing popularity of e-commerce platforms provides consumers with a convenient and efficient way to purchase reduced butter products from the comfort of their homes. Online shopping offers the advantage of a wider product selection, allowing consumers to compare different brands and find products that best meet their dietary needs. Additionally, the growth of digital marketing and social media influences consumer purchasing decisions, driving traffic to online stores.

Regional Insights

North America reduced fat butter market is expected to grow at the fastest CAGR of 4.9% over the forecast period. Consumers are increasingly opting for products that help manage weight and reduce the risk of heart disease. Major brands such as Kerrygold USA and Land O'Lakes are introducing innovative reduced-fat butter products, catering to the demand for healthier spreads.

U.S. Reduced Fat Butter Market Trends

The U.S. reduced fat butter market is expected to grow significantly over the forecast period. With a focus on health and wellness, American consumers are turning to reduced fat butter as a healthier alternative to traditional butter.

Europe Reduced Fat Butter Market Trends

Europe reduced fat butter market dominated the global market with the largest revenue share of 30.8% in 2024. The strong consumer preference for healthier food alternatives in Europe drives the demand for reduced-fat butter. The region's high awareness of the health benefits associated with reduced fat products, including better weight management and lower cholesterol levels, encourages consumers to opt for these alternatives. Additionally, the presence of stringent food regulations and quality standards in Europe ensures the availability of high-quality, reduced-fat butter products. The growing trend towards clean-label and natural food products also supports market growth, as consumers seek out minimally processed and additive-free options.

Asia Pacific Reduced Fat Butter Market Trends

Asia Pacific reduced fat butter industry was identified as a lucrative region in 2024. Countries such as India, Vietnam, and Malaysia are leading the way, with traditional butter-eaters transitioning to healthier alternatives. The market is expected to continue its upward trajectory as more consumers become aware of the benefits of reduced fat butter, such as lower cholesterol levels and reduced risk of cardiovascular diseases

Key Reduced Fat Butter Company Insights

Some key companies in the reduced fat butter market include Palsgaard, AMUL DAIRY, Agral S.A., Ornua Co-operative Limited, Finlandia Cheese, Inc., and others. Companies focus on new product development and capacity expansion to estimate existing and future demand patterns from upcoming product segments.

-

Palsgaard is a key player in the reduced fat butter industry. The company is renowned for its innovative approach to producing emulsifiers and stabilizers that enhance the texture and taste of reduced-fat butter. Palsgaard's products are designed to maintain traditional butter's creamy mouthfeel and spread ability while significantly reducing its fat content.

-

AMUL Dairy is a leading dairy cooperative in India and a significant player in the global reduced fat butter industry. AMUL introduced Amul Lite, a reduced-fat butter that caters to health-conscious consumers. Amul Lite is low in saturated fat and contains essential vitamins and omega-3 and omega-6 fatty acids, which help maintain healthy cholesterol levels.

Key Reduced Fat Butter Companies:

The following are the leading companies in the reduced fat butter market. These companies collectively hold the largest market share and dictate industry trends.

- Palsgaard

- AMUL DAIRY

- Agral S.A.

- Ornua Co-operative Limited

- Finlandia Cheese, Inc.

- Saputo Dairy Australia Pty Ltd

- Kerrygold USA

- Land O'Lakes, Inc.

- Fonterra Co-operative Group

Recent Developments

-

In April 2024, Lactalis launched the Président Lighter Slightly Salted Spreadable Butter in the UK and Ireland, catering to health-conscious consumers. This innovative product contains 50% less fat than traditional butter and is distinguished by the absence of vegetable oils, enhancing its spreadability.

Reduced Fat Butter Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 1.17 billion

|

|

Revenue forecast in 2030

|

USD 1.44 billion

|

|

Growth Rate

|

CAGR of 4.3% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Distribution Channel, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Brazil, UAE

|

|

Key companies profiled

|

Palsgaard; AMUL DAIRY; Agral S.A.; Ornua Co-operative Limited; Finlandia Cheese, Inc.; Saputo Dairy Australia Pty Ltd; Kerrygold USA; Land O'Lakes, Inc.; Fonterra Co-operative Group

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Reduced Fat Butter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global reduced fat butter market report based on distribution channel, and region:

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)