- Home

- »

- Next Generation Technologies

- »

-

Refinancing Market Size & Share, Industry Report, 2030GVR Report cover

![Refinancing Market Size, Share & Trends Report]()

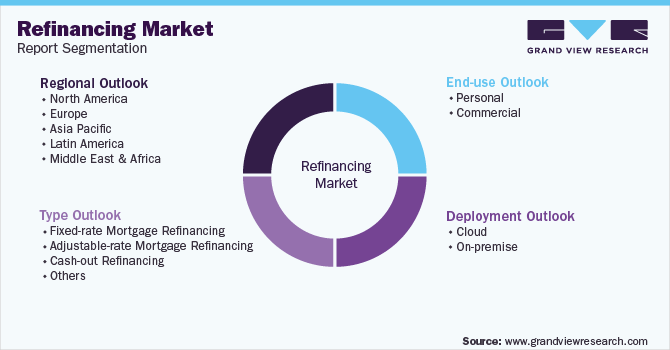

Refinancing Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (Fixed-rate Mortgage, Adjustable-rate Mortgage, Cash-out Refinancing), By Deployment (Cloud, On-premise), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-990-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 – 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Refinancing Market Summary

The global refinancing market size was valued at USD 18.09 billion in 2021 and is expected to reach USD 34.04 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.5% from 2022 to 2030. The growth can be attributed to the rising investments made by banks and other financial institutions to enhance their technology and provide improved refinancing offerings to their customers aimed at boosting their experience.

Key Market Trends & Insights

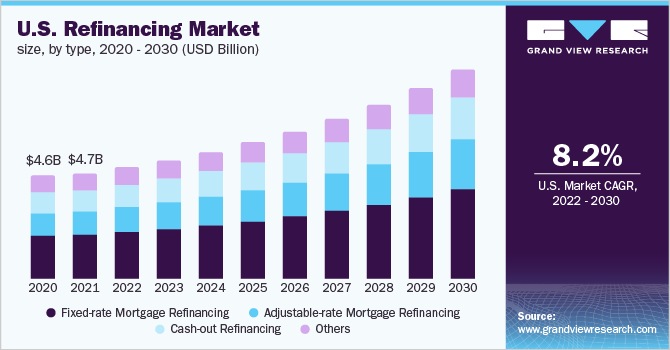

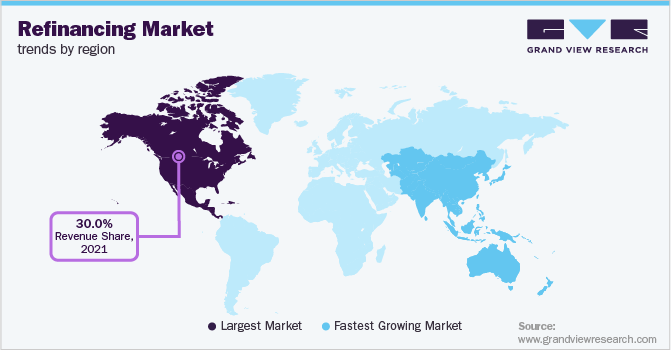

- North America accounted for the largest revenue share of over 30.0% in 2021.

- By type, the fixed-rate mortgage refinancing segment held the largest revenue share of over 40.0% in 2021.

- By deplyment, the on-premises segment dominated with the largest revenue share of over 68.0% in 2021.

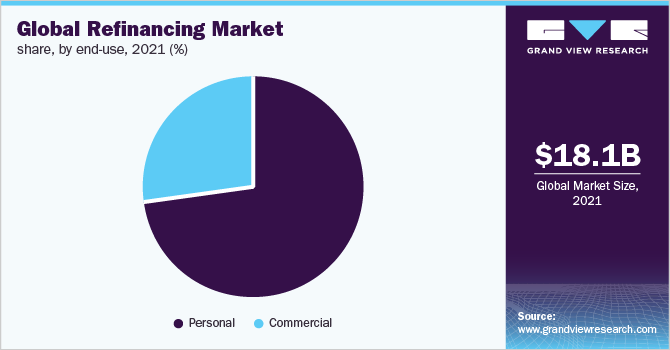

- By end-use, the personal segment dominated the market in 2021 and accounted for over 72.0% of the global revenue.

Market Size & Forecast

- 2021 Market Size: USD 18.09 Billion

- 2030 Projected Market Size: USD 34.04 Billion

- CAGR (2022-2030): 7.5%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

At the same time, banks and financial institutes are offering numerous refinancing options to customers with fixed-rate mortgages and lower interest rates. The aforementioned factors are expected to act as growth impellers for the industry.Numerous players are focusing on developing and launching home financing solutions to help customers qualify for refinancing options. Such product launches are aimed at providing a better customer experience to the customers. For instance, in July 2021, Ally Home, the lending arm of Ally Bank that caters to residential mortgages, launched RefiNow, a home financing option. RefiNow caters to the needs of customers facing difficulties in qualifying or ending up with slower refinancing due to barriers such as lower income levels.

Borrowers refinance their existing loans to benefit from reduced monthly payments so that borrowers can pay faster, modify their loan terms, and cash out the home equity value are also major factors contributing to the industry’s growth. Cash-out refinance is a mortgage refinance that enables borrowers to liquidate home equity built up over the years by paying the original mortgage.

In a cash-out refinance, a new mortgage is obtained, which is higher than the original mortgage, by leveraging the home as collateral. The difference is paid out to the borrower in cash, which acts as a significant factor contributing to the market growth. The obtained cash can then be used to pay off the debt, eliminate the high-interest rates on credit cards, make home improvements, and invest in savings.

Numerous mortgage lenders and banks worldwide, including JPMorgan Chase & Co, ALLY FINANCIAL INC., Rocket Companies, Inc.; Bank of America; and RefiJet, offer diverse mortgage refinancing solutions. These refinancing solutions include vehicle loans, fixed-rate mortgages, adjustable-rate mortgages, jumbo loans, and government loan solutions.

Various providers are also focusing on leveraging technologies such as artificial intelligence and machine learning to automate mortgage processing, thus supporting industry growth. Furthermore, mortgage lenders and refinancers assist buyers with digital tools, such as mortgage calculators, providing an overview of the ongoing interest rates, loan tenure, and discount points as per the refinancing, which in turn, helps buyers choose the refinancing loan wisely.

Rising government initiatives and programs to assist low-income people in obtaining the benefits of lower interest rates in mortgages are also significant factors driving the market growth. Moreover, the government has introduced refinancing instruments to assist people in obtaining the benefits of refinancing loans, which is anticipated to aid market growth.

For instance, some of the government initiatives in the U.S. include Federal Housing Administration (FHA) refinance loans, U.S. Department of Veterans Affairs (VA) refinance loans, and U.S. Department of Agriculture (USDA) refinance loans. However, the high costs associated with mortgage refinancing are expected to hinder the market growth during the forecast period.

COVID-19 Impact Analysis

The COVID-19 outbreak is anticipated to have a positive impact on the refinancing market. As the crisis limited household incomes worldwide, borrowers started opting for financial services with lower interest rates to save money on the high-interest rates. Due to lagging economic activity, refinancing at a lower interest rate enabled the borrowers to reduce mortgage costs. The refinancing activity among high-income borrowers increased significantly compared to low-income homeowners. As a result, refinancing has risen significantly during the COVID-19 pandemic.

Type Insights

The fixed-rate mortgage refinancing segment held the largest revenue share of over 40.0% in 2021. The ability of the fixed-rate mortgage refinance to offer consistent interest rates throughout the entire term of the loan is a major factor driving the segment growth. Borrowers who think interest rates could increase in the coming years opt for fixed-rate mortgage refinancing to keep the current interest rates. Borrowers can refinance from one fixed-rate mortgage to another.

The adjustable-rate mortgage refinancing segment is anticipated to witness significant growth over the forecast period. Adjustable-rate mortgage refinancing offers better benefits to short-term borrowers that are residing in a particular property for a short tenure (ranging from five to seven years). Adjustable-rate mortgage refinancing offers interest rates generally lower than a fixed-rate mortgage, which is a major factor driving growth. Adjustable-rate mortgage refinancing provides lower interest rates for the initial payment period, and the interest rate may change periodically based on the corresponding financial index.

Deployment Insights

The on-premises segment dominated with the largest revenue share of over 68.0% in 2021. The rising number of on-premise loan origination solutions, including refinancing, is a significant factor driving the segment's growth. Prominent on-premise loan and mortgage software have been integrated on-premise to make the loan origination process smoothers. For instance, mortgage software, such as BankPoint, BeSmartee, and The Mortgage Office, have been integrated into the existing on-premise infrastructure, such as data centers for efficient loan pipeline management, loan review, document management, and loan portfolio management.

The cloud segment is anticipated to witness significant growth over the forecast period. The ability of cloud-based refinancing solutions to drive scalability and efficiency in mortgage operations is a major factor driving growth. At the same time, the integration of machine learning and artificial intelligence technologies also acts as a growth driver. Cloud deployment offers benefits such as lower expenditure on loan management systems and automated onboarding and loan operations.

End-use Insights

The personal segment dominated the market in 2021 and accounted for over 72.0% of the global revenue. The rising popularity of the lower interest rates in student loans offered by the refinancing solution providers is a major factor driving the growth. Additionally, borrowers use refinancing loans with a fixed-rate plan which is more accessible than managing several other credit cards with different interest rates. Borrowers may also use refinancing options for medical fees or sponsoring a vacation. Such factors bode well for the growth of the segment over the forecast period.

The commercial segment is anticipated to register a promising CAGR over the forecast period. Refinancing offers numerous benefits in commercial end-uses for real estate business, such as improvement of financials, including return on investment, and Net Operating Income (NOI), which are the major factors propelling the growth. Commercial refinancing also enables funding the property upgrades through cash-outs, which are then used for home building and tax-free improvements. Moreover, commercial companies are also opting for refinancing to expand their business operations across the globe, thereby contributing to the growth.

Regional Insights

North America accounted for the largest revenue share of over 30.0% in 2021. The growth can be attributed to the presence of a large number of prominent players in the region, such as WELLS FARGO & COMPANY, Bank of America, and ALLY FINANCIAL INC, among others. Moreover, this region also includes numerous mortgage investors such as Fannie Mae, Freddie Mac, and Ginnie Mae, which are government-sponsored enterprises that offer better refinancing options. Such presence of mortgage investors in this region offers lucrative growth opportunities for the regional market over the coming years.

Asia Pacific is anticipated to record the highest CAGR over the forecast period. The growing urban population adopting home loans and the rising mortgage loan offerings, including refinancing across the region, are significant factors driving regional growth. Refinancing enables customers to switch to lower interest rates loans which helps them save the extra money that was going to be spent on higher interest rates. Moreover, the increase in the uptake of refinancing solutions across the region has been fueled by students opting for student loans for their higher education. Such factors are expected to create more growth opportunities for the regional market.

Key Companies & Market Share Insights

The market is fragmented in nature. The industry players mainly adopted partnerships and collaborations to launch new products and offer numerous refinancing options to customers. The demand for refinancing options is attributed to the ability to offer lowers interest rates. Additionally, companies collaborated to leverage expertise with innovative technologies such as artificial intelligence and machine learning to provide better customer experiences.

Market players are focusing on new product development to cater to the increasing demands of end-users. At the same time, some players extended flexibility in products that enable customers to cope with financial obligations during the pandemic. Furthermore, regional expansion was among the new strategies adopted by the industry players to expand their mortgage refinancing offerings and market presence. This has helped businesses to develop efficient products and expand their sales of products across different geographies. Some prominent players in the global refinancing market include:

-

WELLS FARGO & COMPANY

-

Bank of America

-

ALLY FINANCIAL INC

-

JPMorgan Chase & Co.

-

Rocket Companies, Inc.

-

Citigroup Inc.

-

RefiJet

-

Better Holdco, Inc.

-

loanDepot, Inc.

-

Caliber Home Loans, Inc.

Refinancing Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 19.03 billion

Revenue forecast in 2030

USD 34.04 billion

Growth rate

CAGR of 7.5% from 2022 to 2030

Base year of estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

WELLS FARGO & COMPANY; Bank of America; ALLY FINANCIAL INC; JPMorgan Chase & Co.; Rocket Companies, Inc.; Citigroup Inc.; RefiJet; Better Holdco, Inc.; loanDepot, Inc.; Caliber Home Loans, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Refinancing Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global refinancing market report based on type, deployment, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Fixed-rate Mortgage Refinancing

-

Adjustable-rate Mortgage Refinancing

-

Cash-out Refinancing

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premise

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Personal

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global refinancing market size was estimated at USD 18.09 billion in 2021 and is expected to reach USD 19.03 billion in 2022.

b. The global refinancing market is expected to grow at a compound annual growth rate of 7.5% from 2022 to 2030 to reach USD 34.04 billion by 2030.

b. North America dominated the refinancing market with a share of 30.15% in 2021. The regional market growth can be attributed to the presence of a large number of prominent players in the region, such as WELLS FARGO & COMPANY, Bank of America, and ALLY FINANCIAL INC, among others

b. Some key players operating in the refinancing market include WELLS FARGO & COMPANY; Bank of America; ALLY FINANCIAL INC; JPMorgan Chase & Co.; Rocket Companies, Inc.; Citigroup Inc.; RefiJet; Better Holdco, Inc.; loanDepot, Inc.; Caliber Home Loans, Inc.

b. Key factors that are driving the market growth include ability to cash out home equity and financial benefits of refinancing a mortgage.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.