- Home

- »

- Homecare & Decor

- »

-

Retail Cooler Market Size & Share, Industry Report, 2030GVR Report cover

![Retail Cooler Market Size, Share & Trends Report]()

Retail Cooler Market (2025 - 2030) Size, Share & Trends Analysis Report By Capacity (Below 10 Quarts, Above 50 Quarts), By Distribution Channel (Offline, Online), By Region (North America, Europe, Asia Pacific, Central & South America), And Segment Forecasts

- Report ID: GVR-4-68039-582-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Retail Cooler Market Summary

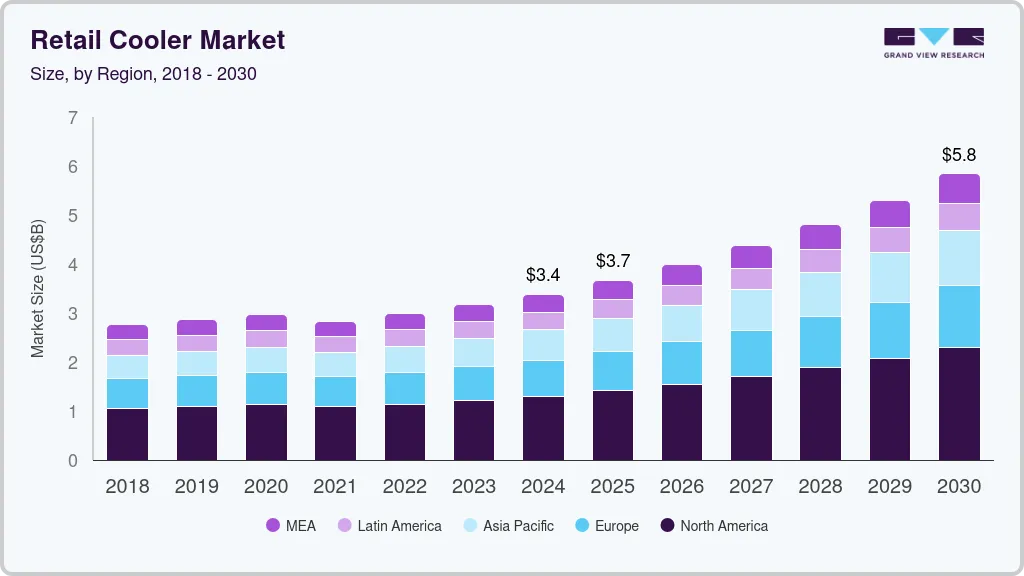

The global retail cooler market size was estimated at USD 3.38 billion in 2024 and is projected to reach USD 5.84 billion by 2030, growing at a CAGR of 9.8% from 2025 to 2030. As consumers increasingly prioritize fresh, perishable, and minimally processed foods, retailers are expanding their offerings of fresh produce, dairy, beverages, and ready-to-eat items that require proper cooling to maintain quality and safety.

Key Market Trends & Insights

- The retail cooler market in North America accounted for a share of 38.52% of the global market revenue in 2024.

- The retail cooler market in the U.S. is expected to grow at a CAGR of 10.2% from 2025 to 2030.

- By capacity, capacity above 50 quartz accounted for a revenue share of 54.44% in 2024.

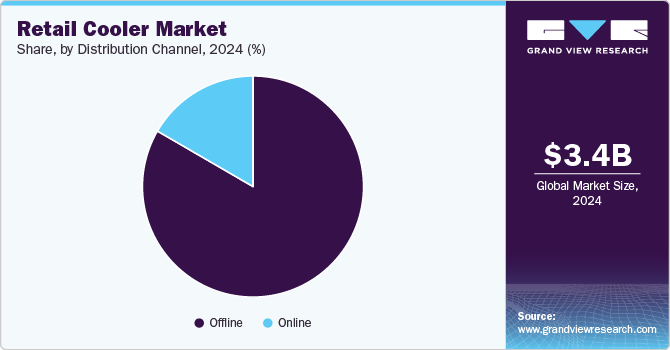

- By distribution channel, retail coolers saw an increased demand through the offline channel, accounting for a market share of 83.37% in 2024.

- By distribution channel, the sales of retail coolers through online channels are expected to grow at a CAGR of 10.8% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 3.38 Billion

- 2030 Projected Market Size: USD 5.84 Billion

- CAGR (2025-2030): 9.8%

- North America: Largest market in 2024

Retail coolers have become essential for presenting these items attractively and conveniently, allowing customers to make healthier, convenience-focused purchasing decisions. The shift towards convenience and grab-and-go options has further heightened the need for efficient cooling solutions, particularly in stores focused on time-conscious urban shoppers.

The expansion of supermarkets, hypermarkets, and convenience stores worldwide has also contributed significantly to the demand for retail coolers. As these retail formats grow, especially in emerging markets where disposable incomes are increasing, the need for reliable refrigeration systems to support a wide variety of chilled and frozen products has become critical. These markets, driven by urbanization and rising living standards, are experiencing an increase in the demand for modern retail infrastructure, including high-quality, energy-efficient coolers that align with evolving consumer expectations.

Sustainability is another key driver, as retailers aim to reduce energy costs and meet environmental goals. The shift towards eco-friendly cooling systems, which use advanced technology to minimize energy consumption and greenhouse gas emissions, is reshaping the market. Many retailers are opting for coolers with energy-saving features, such as LED lighting, improved insulation, and more efficient compressors, to reduce their carbon footprint and operating expenses. This focus on sustainability, combined with the need for quality food preservation and consumer convenience, is fueling the global growth of the retail cooler market.

Capacity Insights

Capacity above 50 quartz accounted for a revenue share of 54.44% in 2024 in the retail coolers market. Coolers above this capacity offer the space needed to store a significant number of perishable items, making them ideal for scenarios like outdoor gatherings, camping trips, and events where extended cooling is required. For retailers, these larger coolers are valuable for managing high stock levels and reducing the need for frequent restocking, providing a more efficient option for stores with high customer foot traffic. Furthermore, advancements in insulation and cooling technology make these larger units energy efficient, despite their size, appealing to both individual and commercial users who value both capacity and sustainability.

The demand for retail coolers with a capacity below 10 quarts is projected to grow at a CAGR of 10.8% from 2025 to 2030, due to their portability, versatility, and appeal to consumers with active lifestyles. These compact coolers are particularly popular among individuals looking for personal cooling solutions for day trips, single-person use, or specific outings like picnics, hikes, and small gatherings. The lightweight design of sub-10-quart coolers makes them easy to carry and fit into various spaces, such as car trunks, backpacks, or even workplace settings, meeting the needs of consumers who prioritize convenience and accessibility.

Distribution Channel Insights

Retail coolers saw an increased demand through the offline channel, accounting for a market share of 83.37% in 2024. Physical stores allow shoppers to assess cooler features like size, capacity, durability, and design, which can be challenging to evaluate online. Moreover, offline channels, such as specialty outdoor and home improvement stores, often offer in-store demonstrations, displays, and product comparisons, enhancing the shopping experience. This hands-on approach is particularly appealing to customers seeking specific features or high-performance coolers for activities like camping, tailgating, or long-distance travel. The availability of immediate purchase and takeaway, without waiting for shipping, further adds to the convenience of offline shopping, making it a valuable channel for consumers looking for quality and reliability in retail coolers.

The sales of retail coolers through online channels are expected to grow at a CAGR of 10.8% from 2025 to 2030, due to growing consumer preference for convenience, broader product selections, and competitive pricing available through e-commerce. Online platforms offer a vast array of cooler options that customers can easily browse and compare, from different sizes and capacities to various brands and features, all without needing to visit physical stores. This convenience aligns with busy lifestyles and the rise in remote shopping preferences. Additionally, online retailers often offer detailed product descriptions, customer reviews, and return options, giving consumers the confidence to purchase products like coolers without seeing them in person.

Regional Insights

The cooler box market in North America accounted for a share of 38.52% of the global market revenue in 2024. North Americans frequently engage in activities such as camping, tailgating, road trips, and outdoor sports, all of which require effective portable cooling solutions. Retail coolers cater to these needs by providing convenient storage for food and beverages, especially in the summer months when outdoor events are most popular. Additionally, the rise of home meal prep and bulk grocery shopping has led to higher demand for coolers that support transportation and temporary storage of fresh items, making them essential for both personal and recreational use.

U.S. Retail Cooler Market Trends

The retail cooler market in the U.S. is expected to grow at a CAGR of 10.2% from 2025 to 2030, due to the country’s strong culture of outdoor and recreational activities, as well as a rising trend toward convenient food and beverage storage solutions. U.S. consumers regularly participate in activities like camping, picnics, tailgating, and beach outings, which require reliable cooling solutions to keep food and drinks fresh throughout the day. Retail coolers serve this need by providing portability, durability, and effective temperature retention, making them essential for outdoor enthusiasts.

Europe Retail Cooler Market Trends

The retail cooler market in Europe accounted for a share of 21.75% of the global market revenue in 2024. Driven by a strong focus on eco-friendly practices, European consumers prefer coolers that offer both high performance and energy efficiency, aligning with the region’s sustainability goals. Additionally, seasonal events, festivals, and road trips are popular across Europe, driving demand for durable, portable cooling solutions that keep food and beverages fresh during outings. Retailers in Europe have responded by offering a range of coolers that meet these needs, further boosting their popularity in the market.

Asia Pacific Retail Cooler Market Trends

The Asia Pacific retail cooler market is expected to grow at a CAGR of 10.8% from 2025 to 2030, due to rising disposable incomes, urbanization, and an increase in outdoor leisure activities. With more people engaging in camping, picnics, and beach outings, especially in countries like Japan, Australia, and China, there is a greater need for portable cooling solutions to keep food and beverages fresh. Additionally, the expanding middle class and a growing interest in convenient food storage drive demand for high-quality, durable coolers. The trend towards health-conscious and fresh-food preferences further enhances demand as consumers seek effective cooling solutions for transporting perishable items safely.

Key Retail Cooler Company Insights

The retail cooler market is concentrated in nature. Major companies, such as Polar Bear Coolers, YETI Holdings, Inc., The Coleman Company, Inc., Grizzly Coolers LLC, and ORCA Coolers LLC, collectively hold a substantial share of the market due to their established brand recognition, extensive product portfolios, and continuous innovation in features and technology. This concentration allows these companies to leverage economies of scale and maintain competitive pricing, while also investing in research and development to meet evolving consumer preferences.

Key Retail Cooler Companies:

The following are the leading companies in the retail cooler market. These companies collectively hold the largest market share and dictate industry trends.

- Polar Bear Coolers

- Lifoam Industries LLC

- ORCA Coolers, LLC

- Plastilite Corporation

- ICEE Containers Pty Ltd.

- Bison Coolers

- Grizzly Coolers LLC

- Huntington Solutions

- The Coleman Company, Inc.

- YETI Holdings, Inc.

Recent Developments

-

In June 2023, Digital retail media company Cooler Screens announced the launch of a health-oriented offering called Cooler Health. This strategic move aims to expand its advertising technology presence to pharmacies, healthcare clinics, and other health-related locations. Cooler Screens develops smart screen software that displays cooler doors in stores, replacing traditional glass doors.

-

In May 2023, Kroger, an American retail company, announced expanding its partnership with Cooler Screens to install digital smart screens in 500 of its stores across the U.S.

Retail Cooler Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.66 billion

Revenue forecast in 2030

USD 5.84 billion

Growth rate

CAGR of 9.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Capacity, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Argentina; South Africa; UAE

Key companies profiled

Polar Bear Coolers; Lifoam Industries LLC; ORCA Coolers, LLC; Plastilite Corporation; ICEE Containers Pty Ltd.; Bison Coolers; Grizzly Coolers LLC; Huntington Solutions; The Coleman Company, Inc.; YETI Holdings, Inc.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retail Cooler Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global retail cooler market report based on capacity, distribution channel, and region.

-

Capacity Outlook (Revenue, USD Million; 2018 - 2030)

-

Below 10 Quarts

-

Between 11-25 Quarts

-

Between 26-50 Quarts

-

Above 50 Quarts

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global retail cooler market size was estimated at USD 3.38 billion in 2024 and is expected to reach USD 3.66 billion in 2025.

b. The global retail cooler market is expected to grow at a compound annual growth rate of 9.8% from 2025 to 2030 to reach USD 5.84 billion by 2030.

b. Above 50 quarts dominated the retail cooler market with a share of 53.8% in 2024. Coolers above this capacity offer the space needed to store a significant number of perishable items, making them ideal for scenarios such as outdoor gatherings, camping trips, and events where extended cooling is required.

b. Some key players operating in the retail cooler market include Polar Bear Coolers; Lifoam Industries LLC; ORCA Coolers, LLC; Plastilite Corporation; ICEE Containers Pty Ltd.; Bison Coolers; Grizzly Coolers LLC; Huntington Solutions; The Coleman Company, Inc.; YETI Holdings, Inc.

b. Key factors that are driving the retail cooler market growth include the growing popularity of outdoor recreational activities such as off-roading and hiking among travelers is a leading factor driving the market. In addition, better technologies used for manufacturing lightweight chillers that can retain ice for a longer duration will contribute to market growth over the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.