- Home

- »

- Homecare & Decor

- »

-

Retail Cooler Market Size And Share, Industry Report, 2033GVR Report cover

![Retail Cooler Market Size, Share & Trends Report]()

Retail Cooler Market (2026 - 2033) Size, Share & Trends Analysis Report By Capacity ( Below 10 Quarts, Between 11-25 Quarts, Between 26-50 Quarts, Above 50 Quarts), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-582-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Retail Cooler Market Summary

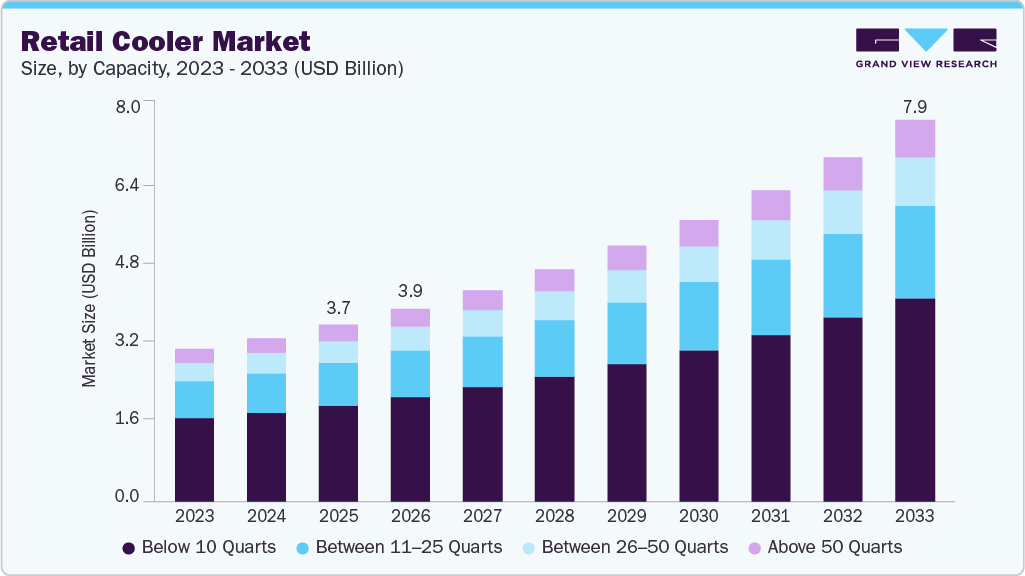

The global retail cooler market size was estimated at USD 3,665.3 million in 2025 and is expected to reach USD 7,904.6 million by 2033, growing at a CAGR of 10.2% from 2026 to 2033. Increasing participation in camping, hiking, beach tourism, fishing, road trips, and weekend micro-vacations has elevated portable coolers from occasional-use products to essential outdoor gear.

Key Market Trends & Insights

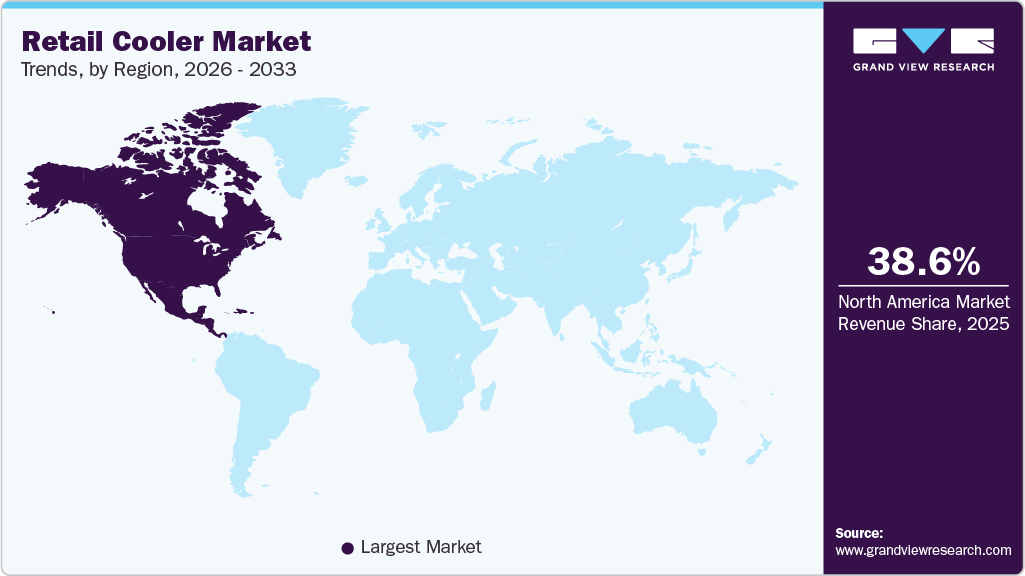

- The North America retail cooler market held the largest global revenue share of 38.6% in 2025.

- The U.S. retail cooler industry led North America with the largest revenue share in 2025.

- By capacity, above 50 quarts led the market with a share of 54.3% in 2025.

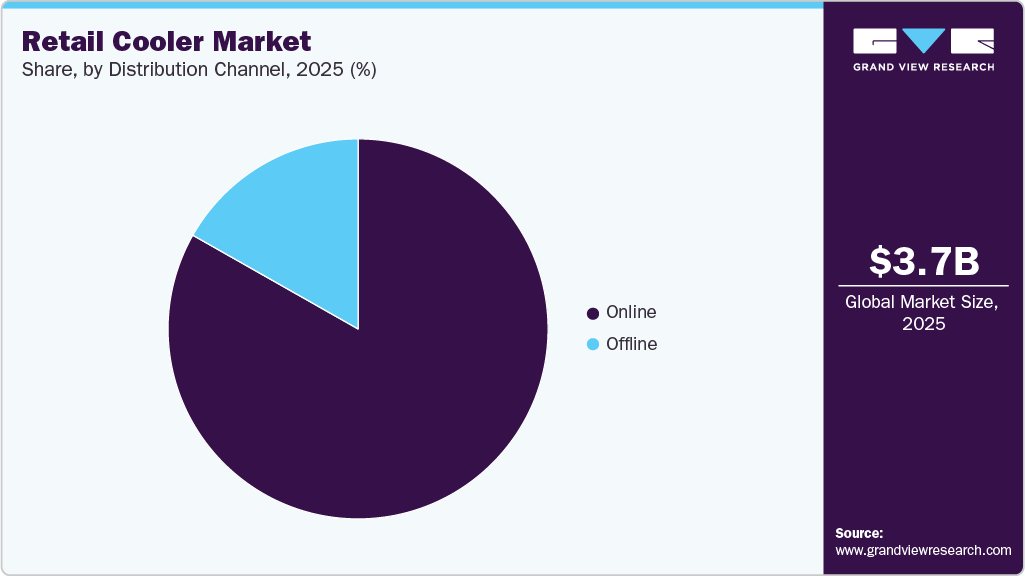

- By distribution channel, offline sales led the market with a share of 83.2% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3,665.3 Million

- 2033 Projected Market Size: USD 7,904.6 Million

- CAGR (2026-2033): 10.2%

- Asia Pacific: Largest market in 2025

According to the 2025 outdoor participation trend report, growth across gateway activities such as hiking, camping, and fishing, each gaining over 2 million new participants, is significantly expanding the addressable consumer base. Additionally, a surge in participation among seniors (+7.4%) and youth (+5.6%) is fostering a more multigenerational outdoor culture, further strengthening demand for versatile and durable equipment. Travel preferences continue to favor nature-based and domestic tourism experiences, boosting demand for high-performance soft and hard coolers that enable reliable off-grid food and beverage storage. As consumers prioritize experiential spending and active lifestyles, portable coolers are increasingly viewed as integral components of outdoor recreation gear rather than simple storage accessories.

Technological innovation is emerging as a key growth driver in the portable coolers market, with brands introducing smart and high-performance features to enhance convenience and efficiency. Advancements such as battery-powered compressor coolers, solar-charging compatibility, integrated temperature monitoring, USB charging ports, and improved lightweight insulation materials are transforming traditional ice boxes into tech-enabled outdoor solutions. These innovations appeal particularly to tech-savvy consumers, overlanders, and long-duration campers who require precise temperature control and extended cooling performance.

In April 2025, EcoFlow introduced the GLACIER Classic 3-in-1 electric cooler, highlighting the growing convergence of outdoor gear and smart technology. The GLACIER Classic combines a cooler, freezer, and battery-powered refrigeration system in one portable unit, offering up to 43 hours of off-grid cooling with a built-in battery and multiple charging options, including solar, car, and AC power. Designed for camping, RV travel, and outdoor adventures, the product features smart controls, dual-zone refrigeration flexibility, and enhanced space efficiency.

The North America retail cooler market thrives on innovative features, with advancements like Dometic's CFX5 leading the way. The introduction of Vacuum-Insulated Panels (VIP) enhances energy efficiency while reducing cooler weight and bulk, a key advantage for campers prioritizing portability. Improved compressor technology, such as Dometic’s VMSO 3.5, ensures consistent temperature control, catering to the growing demand for high-performance coolers. These innovations redefine outdoor cooling, aligning with consumer preferences for sustainable and efficient solutions.

Innovative designs that integrate additional features have become a major driver for the camping cooler market. Products like Igloo’s KoolTunes combine a cooler with Bluetooth speakers, offering a unique two-in-one solution for outdoor gatherings. Such multi-functional designs cater to modern consumers who value convenience and technology integration. From advanced displays to built-in accessories, these upgrades enhance user experience, making coolers an essential part of outdoor adventures. The demand for rugged yet visually appealing coolers propels innovation in design and materials. Dometic’s stainless-steel enhancements and Igloo’s nostalgic silhouettes exemplify how brands combine durability with style. Consumers seek products that not only perform under tough conditions but also resonate with their personal style and outdoor lifestyle. This blend of practicality and aesthetics makes innovative coolers a key driver in the North America camping cooler market.

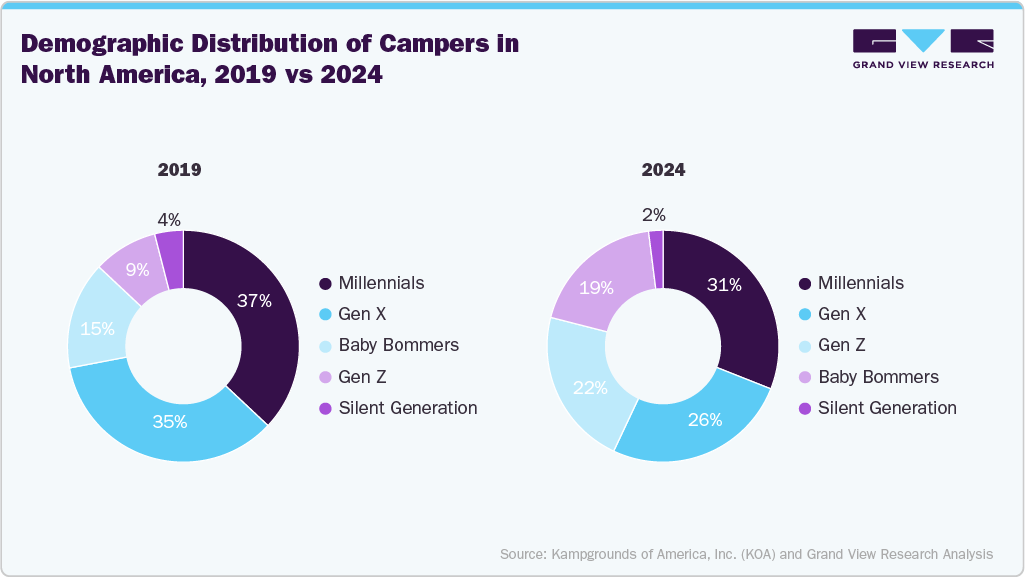

Consumer Insights

According to Kampgrounds of America, Inc. (KOA), the age mix of North American campers has shifted materially over the past few years. Millennials accounted for approximately 37% of campers in 2019, declining to about 31% in 2024, while Gen X reduced from roughly 35% to 26% over the same period. In contrast, Gen Z expanded significantly from about 9% to 22%, indicating accelerated entry of younger consumers into the camping ecosystem. Baby Boomers increased modestly from around 15% to 19%, whereas the Silent Generation contracted from 4% to 2%, reflecting natural demographic attrition. Importantly, the under-30 cohort remains structurally relevant, maintaining a consistent share of participation over time.

This evolving generational composition has direct implications for the camping cooler market. The rise of Gen Z and sustained Millennial participation, together representing over 50% of campers, supports continued premiumization, as younger cohorts typically demonstrate stronger brand affinity, higher engagement with performance-led products, and greater responsiveness to design differentiation. This underpins demand for high-margin roto-molded coolers, soft portable formats, and tech-enabled solutions, while also accelerating digital-first purchasing behavior. Simultaneously, the combined 45%+ share held by Gen X and Baby Boomers sustains volume demand for larger-capacity, value-oriented hard coolers geared toward family and multi-day camping. The result is a structurally bifurcated market characterized by premium growth at the top end and stable mainstream volume at the core, reinforcing long-term expansion dynamics within the category.

Capacity Insights

Capacity above 50 quartz held the largest revenue share of the retail cooler industry in 2025, accounting for a share of 54.3%. The segment’s growth reflects strong consumer preference for high-volume storage solutions suited to extended outdoor stays, group camping, tailgating, boating, and hunting trips. These larger formats typically command higher average selling prices due to thicker insulation walls, rotomolded construction, reinforced latches, and enhanced ice retention performance. Premium models such as the YETI Tundra 65, as well as large-capacity offerings from Coleman and Igloo Products Corp., illustrate how this segment attracts both value-driven family buyers and high-end, performance-oriented consumers. In addition, the expansion of RV travel and multi-day campsite bookings continues to reinforce demand for durable, long-retention coolers capable of servicing larger groups. As a result, revenue concentration remains skewed toward the upper-capacity tier, supported by premiumization and trading up.

The demand for retail coolers with capacity below 10 quarts is estimated to witness a CAGR of 11.2% from 2026 to 2033, indicating accelerating momentum in compact, personal-use formats. Growth in this segment is closely linked to solo travel, day trips, urban outdoor recreation, music festivals, and workplace/lunch portability needs. Lightweight soft coolers and personal hard coolers, such as compact lunchbox-style units and small grab-and-go ice chests, are benefiting from increasing participation among Gen Z and Millennial consumers seeking convenience and mobility. This category also aligns with impulse and gifting purchases, often distributed through e-commerce and specialty sporting retailers. While smaller units contribute less in absolute revenue per unit, their faster growth trajectory reflects the rising frequency of short-duration outdoor activities and the diversification of cooler usage occasions beyond traditional multi-day camping.

Distribution Channel Insights

Sales of retail coolers through offline channels accounted for 83.2% of the total revenue share in 2025, underscoring the continued dominance of brick-and-mortar distribution. Large-format sporting goods retailers, hypermarkets, home improvement chains, and specialty outdoor stores remain critical touchpoints, particularly for high-capacity and premium coolers where consumers prefer in-person evaluation of build quality, insulation thickness, weight, and mobility features. Brands such as YETI, Coleman, and Igloo Products Corp. benefit significantly from in-store merchandising, seasonal displays, and experiential retail strategies that encourage trade-up purchases. Additionally, impulse buying during peak summer and holiday periods further strengthens offline conversion rates, particularly for large-capacity and wheeled variants.

The online sales are projected to expand at a CAGR of 11.2% between 2026 and 2033, reflecting structural shifts in consumer purchasing behavior and the growing role of digital commerce in outdoor gear retail. E-commerce platforms and direct-to-consumer brand websites are increasingly leveraged for product comparison, access to wider SKU assortments, color variants, and limited-edition launches. Compact and mid-sized coolers-due to easier shipping logistics-are particularly well-positioned for online growth. Furthermore, digitally native consumers, especially Gen Z and Millennials, are driving higher online penetration through social media influence, review-based purchasing decisions, and promotional bundling strategies. Although offline remains dominant in absolute revenue terms, the online channel is poised to capture incremental share, gradually reshaping the industry’s distribution landscape over the forecast period.

Regional Insights

The retail cooler market in North America held the largest global revenue share of 38.6% in 2025. This regional growth is underpinned by high per-capita spending on outdoor recreation and a deeply entrenched camping, tailgating, and RV culture. The U.S. alone contributes the majority of regional demand, supported by strong brand penetration from players such as YETI and Igloo Products Corp. Large-capacity coolers above 50 quarts are particularly dominant due to multi-day camping trips and group-based outdoor gatherings. Seasonal sales spikes during Memorial Day and Independence Day further amplify regional revenue concentration.

U.S. Retail Cooler Market Trends

The retail cooler industry in the U.S. is estimated to witness a CAGR of 10.6% from 2026 to 2033. Growth is supported by sustained participation in outdoor recreation, with over 160 million Americans engaging in outdoor activities annually. Premiumization remains pronounced, with high-performance rotomolded coolers often retailing above USD 300, witnessing steady uptake. Direct-to-consumer sales channels and brand-led product drops are accelerating replacement cycles. Additionally, the expansion of electric and battery-powered coolers for overlanding and van-life communities is creating incremental value pools.

The retail cooler market in Canada was valued at USD 86.4 million in 2025. Demand is strongly seasonal, peaking between May and August, driven by lake tourism, fishing, and national park visitation. Larger hard-sided coolers are widely adopted for extended wilderness trips, particularly in provinces such as Ontario and British Columbia. Cold-chain durability and bear-resistant certifications are important product attributes in certain regions. Cross-border brand availability ensures a strong presence of U.S.-based manufacturers in the Canadian retail landscape.

Europe Retail Cooler Market Trends

The retail cooler industry in Europe accounted for a share of 21.7% in 2025. The market is comparatively fragmented, with demand distributed across camping, caravan tourism, beach leisure, and music festivals. Electric and thermoelectric coolers hold relatively higher penetration in continental Europe due to caravan and motorhome usage. Southern European markets show strong uptake of mid-capacity coolers for coastal tourism. Sustainability considerations, including the use of recyclable insulation materials, are increasingly influencing purchasing decisions.

The retail cooler market in the UK is estimated to witness a CAGR of 11.1% from 2026 to 2033. Growth is closely tied to domestic caravan holidays and summer festival culture, including large-scale music events. Compact and wheeled coolers are favored for short-duration outdoor gatherings. E-commerce penetration is expanding rapidly, with consumers actively comparing ice-retention specifications prior to purchase. Weather variability, however, continues to influence year-to-year demand volatility.

The Germany retail cooler market is estimated to witness a CAGR of 10.6% from 2026 to 2033. Germany’s strong caravan and motorhome base supports above-average adoption of powered coolers compatible with 12V systems. Outdoor retail chains and specialty camping stores play a central role in distribution. Product durability and engineering quality are critical purchase drivers, often outweighing aesthetic considerations. Growth is also supported by cross-border tourism within the EU.

Asia Pacific Retail Cooler Market Trends

The retail cooler industry in Asia Pacific is estimated to witness a CAGR of 11.2% from 2026 to 2033. Rising disposable incomes and expanding domestic tourism are accelerating category penetration. Australia represents a mature sub-market with high per-household cooler ownership, particularly for beach and road-trip use. In Southeast Asia, smaller personal coolers are gaining popularity for short leisure outings. Urban e-commerce expansion is significantly improving product accessibility across emerging markets.

The retail cooler market in China is estimated to witness a CAGR of 12.0% from 2026 to 2033. The rapid rise of domestic camping, often referred to as “glamping”, is expanding demand among urban middle-class consumers. Lightweight and design-forward soft coolers are gaining traction for park-based leisure activities. Online marketplaces dominate distribution, with flash sales and influencer-driven promotions shaping purchasing cycles. Local manufacturing capabilities also enable competitive pricing across entry-level segments.

The India retail cooler market is estimated to witness a CAGR of 11.7% from 2026 to 2033. Growth is emerging from increased participation in adventure tourism and a weekend travel culture among urban millennials. Smaller-capacity and value-oriented models dominate due to price sensitivity. Modern trade retail and online platforms are improving category visibility beyond metropolitan cities. Expansion of organized camping operators is gradually increasing awareness of higher-capacity coolers.

Central and South America Retail Cooler Market Trends

The retail cooler industry in Central and South America is estimated to witness a CAGR of 7.7% from 2026 to 2033. Beach tourism and outdoor social gatherings form the core demand base. Brazil and Argentina account for a substantial share of regional consumption. Price competitiveness remains a key determinant of brand selection. Distribution through hypermarkets and local retail chains outweighs premium specialty channels.

Middle East and Asia Retail Cooler Market Trends

The retail cooler industry in the Middle East and Asia is estimated to grow at a CAGR of 9.6% from 2026 to 2033. High ambient temperatures make coolers a functional necessity for desert camping and outdoor excursions. Demand is concentrated in Gulf Cooperation Council countries, where weekend desert trips drive sales of large-capacity coolers. Premium imported brands coexist alongside cost-effective regional manufacturers. Increasing participation in outdoor leisure events is gradually broadening the consumer base across urban centers.

Key Companies & Market Share Insights

The retail cooler market is highly concentrated. Major companies, such as Polar Bear Coolers, YETI Holdings, Inc., The Coleman Company, Inc., Grizzly Coolers LLC, and ORCA Coolers LLC, collectively hold a substantial share of the market due to their established brand recognition, extensive product portfolios, and continuous innovation in features and technology. This concentration allows these companies to leverage economies of scale and maintain competitive pricing, while also investing in research and development to meet evolving consumer preferences.

Key Retail Cooler Companies:

The following key companies have been profiled for this study on the retail cooler market.

- Polar Bear Coolers

- Lifoam Industries LLC

- ORCA Coolers, LLC

- Plastilite Corporation

- ICEE Containers Pty Ltd.

- Bison Coolers

- Grizzly Coolers LLC

- Huntington Solutions

- The Coleman Company, Inc.

- YETI Holdings, Inc.

Recent Developments

-

In January 2026, YETI introduced its bold Venom Collection, a new product lineup featuring a striking neon-green colorway across coolers, drinkware, bags, and outdoor accessories, signaling the brand’s growing focus on style-driven product launches alongside performance and durability. The collection emphasizes high visibility for outdoor use while also appealing to urban lifestyle consumers who want eye-catching gear, blending functionality with fashion-forward design.

-

In April 2025, Coleman launched its Pro Cooler series, designed to offer both rugged performance and ease of transport. These coolers feature thick insulation and sealed lids, keeping ice for up to 5 days. Despite their toughness, they're up to 30% lighter than similar rotomolded models. Built for versatility, they include oversized wheels, one-handed latches, a large drain plug, anti-slip feet, tie-down points, and a lockable lid. The line includes hard coolers in 25, 45, and 55-quart sizes, priced from USD 159 to USD 299, along with soft cooler options for 16 or 24 cans, ranging from USD 59 to USD 79. A 10-year warranty backs each model.

-

In February 2025, YETI unveiled a limited-edition Spring Color Collection featuring pastel shades such as Big Sky Blue, Sandstone Pink, Lowcountry Peach, and Key Lime. This seasonal lineup includes products such as the Tundra 45 Hard Cooler, known for its durability and ice retention. The collection is available for a limited time, and customers are encouraged to act quickly to secure items in their preferred colors.

Retail Cooler Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3,998.9 million

Revenue forecast in 2033

USD 7,904.6 million

Growth rate

CAGR of 10.2% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Capacity, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and the Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Argentina; South Africa; UAE

Key companies profiled

Polar Bear Coolers; Lifoam Industries LLC; ORCA Coolers, LLC; Plastilite Corporation; ICEE Containers Pty Ltd.; Bison Coolers; Grizzly Coolers LLC; Huntington Solutions; The Coleman Company, Inc.; YETI Holdings, Inc.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retail Cooler Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global retail cooler market report based on capacity, distribution channel, and region:

-

Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Below 10 Quarts

-

Between 11-25 Quarts

-

Between 26-50 Quarts

-

Above 50 Quarts

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global retail cooler market size was estimated at USD 3.38 billion in 2024 and is expected to reach USD 3.66 billion in 2025.

b. The global retail cooler market is expected to grow at a compound annual growth rate of 9.8% from 2025 to 2030 to reach USD 5.84 billion by 2030.

b. Above 50 quarts dominated the retail cooler market with a share of 53.8% in 2024. Coolers above this capacity offer the space needed to store a significant number of perishable items, making them ideal for scenarios such as outdoor gatherings, camping trips, and events where extended cooling is required.

b. Some key players operating in the retail cooler market include Polar Bear Coolers; Lifoam Industries LLC; ORCA Coolers, LLC; Plastilite Corporation; ICEE Containers Pty Ltd.; Bison Coolers; Grizzly Coolers LLC; Huntington Solutions; The Coleman Company, Inc.; YETI Holdings, Inc.

b. Key factors that are driving the retail cooler market growth include the growing popularity of outdoor recreational activities such as off-roading and hiking among travelers is a leading factor driving the market. In addition, better technologies used for manufacturing lightweight chillers that can retain ice for a longer duration will contribute to market growth over the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.