- Home

- »

- Next Generation Technologies

- »

-

Retail Core Banking Solution Market Size & Share Report, 2030GVR Report cover

![Retail Core Banking Solution Market Size, Share & Trends Report]()

Retail Core Banking Solution Market (2022 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment, By Enterprise Size, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-014-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

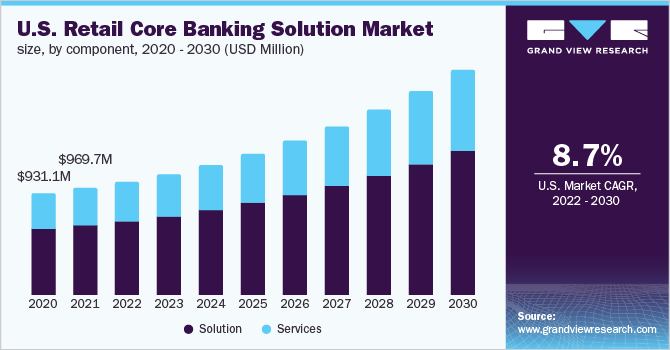

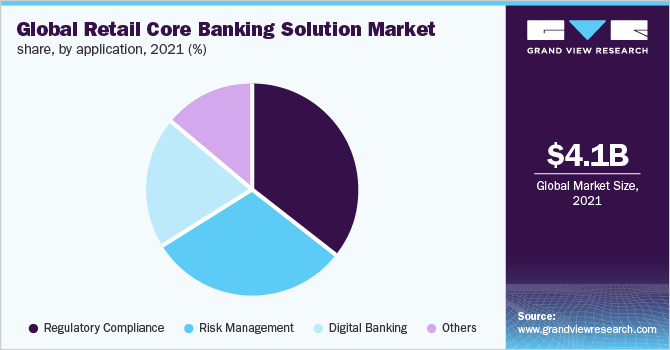

The global retail core banking solution market size was valued at USD 4.07 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 9.8% from 2022 to 2030. The retail core banking solutions aid customers in managing their finances via a secure channel and enable flexibility in accessing their bank accounts, which is one of the primary factors driving the market growth. Moreover, the implementation of retail core banking solutions offers low-cost funding for banks, helps them establish a solid foundation, and maintains an effective Customer Relationship Management (CRM), all of which are anticipated to drive market growth during the forecast period. Additionally, the industry is expanding owing to the rising customer demand for mobile and net banking.

The growing competition from various mobile payment wallets and other Fintech applications is also pressuring banks to adopt better strategies that could provide simple payment options to the clients, which is projected to fuel the market's expansion. In addition, the industry players are concentrating on new product launches to keep a competitive edge. Temenos AG, for instance, debuted Temenos Transact Data Hub in October 2020. It is a core banking Software-as-a-Service (SaaS) platform that operates in real-time. Temenos Transact Data Hub offers a number of vital data capabilities that modern banks need to use to harness the potential of the data stored within the core banking platform.

Several non-traditional businesses are customer-focused, agile, and technology-driven, including retailers, technology providers, and Fintech start-ups. To provide clients with better accessibility, superior service, and affordability, they are utilizing cutting-edge technologies by focusing on the most lucrative components of their value chains, such as mobile payments. Furthermore, they are focusing on eliminating complex processes with the introduction of peer-to-peer (P2P) lending. These companies are establishing themselves as formidable competitors to traditional banks.

Even though there aren't many of these non-traditional businesses at the moment, a few have already taken a sizable chunk of the traditional banking market, driving the market's growth. Moreover, retail core banking solutions support banks with cost-cutting in operational and support activities, which leads to the increased adoption of retail core banking solutions. It also offers real-time transaction processing and managing bank accounts via globally interconnected branches. Additionally, the increased use of core banking technology to modernize banking functionality and the increased emphasis on offering better client services are key drivers of the market expansion for retail core banking solutions.

However, security risks concerning unencrypted data, application vulnerabilities, mobile viruses, and information loss are rising together with the booming demand for retail core banking solutions. Additionally, not all core banking software offers operational flexibility at the scale, which could lead to regulatory difficulties and data breaches. Concerns about information security and privacy can cause financial institutions, credit unions, and corporate banks loss of revenue. Although, rising emphasis on establishing a robust mechanism to overcome the threat of data breaches is anticipated to create new opportunities for the market.

COVID-19 Impact Analysis

The COVID-19 pandemic has affected sectors all around the world. However, due to the rising emphasis on digital banking, the BFSI industry thrives despite the global epidemic. Banks, and financial institutions, among others, have stepped up their digitalization operations significantly in response to the pandemic owing to the changing customer needs. Additionally, COVID-19 has mandated that several end-use verticals take another look at the current core banking technology architecture to remain competitive throughout the pandemic.

Component Insights

The solution segment held the largest revenue share of more than 66.0% in 2021. The segment is expanding as a result of banks' increasing emphasis on better customer interaction, remote data retrievals, record keeping, and smooth workflow. The front-end and back-end of the banking process can be automated by bank personnel with the help of the creation of new centralized services. Moreover, retail core banking solutions enhance customer experience and increase flexibility for the end users, driving the segment's growth.

The services segment is anticipated to witness significant growth over the forecast period. To guarantee continuous service delivery and availability, modern banks require numerous sophisticated systems to operate in tandem. The retail core banking services model ensures excellent usability, full functioning, bug-fixing, prompt upgrades, and managing all the systems at once. This also helps banks to get ahead in the competitive environment by providing an edge over their peers; hence the segment is propelling.

Deployment Insights

The cloud segment dominated the industry in 2021 and accounted for a share of more than 62.0% of the global revenue. The segment's expansion is accelerated by the growing focus on increasing efficiency by effectively monitoring transactions and payments with cloud-based services. The primary driving factor of the segment growth is the increased usage of cloud computing technologies through Software-as-a-Service (SaaS) to assist banks in securing storage and transaction processing. It will also aid end users in enhancing banking processes, such as interest calculation, loan servicing, withdrawal, and deposit processing.

The on-premise segment is expected to register significant growth over the forecast period. The financial institution prefers on-premise solutions as it has several advantages to offer. One such advantage is the overall risk reduction as it is hosted on private servers and provides control over the data. Additionally, compared to cloud-based alternatives, it gives more direct access to the information driving the segment's growth.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share of over 68.0% in 2021. Large retail banks are currently focusing on customer retention due to the fierce competition in the banking industry. The retail core banking solution is the channel between banks and their clients to ensure that the client’s queries are addressed. Core banking technologies let banks conduct efficient consumer analyses while permitting regular customer banking activities. The fundamental banking solutions increase customer satisfaction and significantly lessen client effort, which is responsible for the segment's dominance.

The Small and Medium Enterprises (SMEs) segment is expected to grow at a promising CAGR over the projection period. The changing requirement of SMEs to transform their operations and credit facilities, coupled with the increased need for flexibility, is expected to drive the segment's growth. In addition, the developing SMEs ecosystem is fueling the demand for implementing retail core banking solutions among SMEs, likely accentuating the segment's growth. Moreover, the pandemic has caused a profound change in traditional banking and increased the need for new and innovative solutions, which is expected to create further opportunities for the market.

Application Insights

The regulatory compliance segment dominated the market in 2021 and accounted for a share of over 35.0% of the global revenue. The dominance can be ascribed to the fact that the data security of customers is crucial in banking. A company could suffer irreparable damage from any data breach or internet attack. The option to incorporate additional protection levels is one of the benefits of a custom solution. Hackers are more likely to hunt for weaknesses in generic banking software packages since it increases their potential payout.

The digital banking segment is expected to witness the fastest growth over the forecast period. The growth is attributable to the numerous advantages associated with digital banking, including increased revenue and lower operating costs. Another element driving the market's expansion is the advent of cutting-edge features linked to digital banking, such as online portals and data on applications, among others. Furthermore, another factor boosting the market's expansion is shifting consumer preferences from traditional banking to digital banking.

Regional Insights

North America accounted for the largest revenue share of over 28.0% in 2021. The dominance is anticipated to continue over the projection period owing to significant ongoing technology developments in core banking solutions and adoption by prominent players such as Candian Western Bank and HSBC Holdings plc. In addition, an increase in the number of foreign investors and the presence of major players in the region, such as Oracle and Fiserv, Inc. is also expected to drive market growth in the region. Moreover, it is further anticipated that the rapidly expanding organization sizes and expanding fields of application of these solutions will boost market expansion in the region.

Asia Pacific is expected to grow at the highest CAGR over the forecast period. The growth can be ascribed to growing markets like South Korea, China, India, and Singapore, providing considerable potential for solution providers to grow and develop their product portfolios. Additionally, a rise in mergers and acquisitions (M&A) among banks looking to implement retail core banking solutions to speed up their product development processes is anticipated to offer lucrative opportunities to regional players over the forecast period. Moreover, the region is expected to be driven by the growing acceptance of web-based solutions and mobile applications in the banking sector.

Key Companies & Market Share Insights

Many retail banks are forming associations with suppliers of core banking solutions. For instance, Temenos Headquarters SA, a retail core banking system provider, and BlueShore, a personal loan provider, extended their agreement in September 2020. By the expanded agreement, BlueShore would provide new features to Temenos Headquarters SA Transact and roll them out to its SME, nonprofit, and retail business lines. To quickly roll out new services and capabilities, Temenos Headquarters SA's agile and completely integrated architecture was something BlueShore was eager to take advantage of.

Market players are investing aggressively to expand their global footprint. For instance, in August 2022, as part of its next growth phase, Credgenics, the top provider of SaaS-based technology solutions for loan collections and debt resolution to banks, non-banking finance, and Fintech lenders globally announced its debut in Indonesia. To increase their clientele, they have partnered with system integrators and Core Banking Solution (CBS) providers in Indonesia. This expansion seeks to improve the platform to fulfill the needs of banks and other non-banking lenders for end-to-end retail collections. Some prominent players in the global retail core banking solution market include:

-

Oracle

-

Temenos Headquarters SA

-

Fiserv, Inc.

-

Tata Consultancy Services Limited

-

SAP SE

-

Infosys

-

FIS

-

InfrasoftTech

-

Polaris Software

-

Silverlake Axis Ltd.

Retail Core Banking Solution Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 4.37 billion

Revenue forecast in 2030

USD 9.21 billion

Growth rate

CAGR of 9.8% from 2022 to 2030

Base year of estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

Oracle; Temenos Headquarters SA, Fiserv, Inc.; Tata Consultancy Service Limited; SAP SE; Infosys; FIS; InfrasoftTech, Polaris Software; Silverlake Axis Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retail Core Banking Solution Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global retail core banking solution market report based on component, deployment, enterprise size, application, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Regulatory Compliance

-

Risk Management

-

Digital Banking

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global retail core banking solution market size was estimated at USD 4.07 billion in 2021 and is expected to reach USD 4.37 billion in 2022.

b. The global retail core banking solution market is expected to grow at a compound annual growth rate of 9.8% from 2022 to 2030 to reach USD 9.21 billion by 2030.

b. North America dominated the retail core banking solution market with a share of 28.94% in 2021. The dominance is anticipated to continue over the projection period owing to significant ongoing technology developments in core banking solutions and adoption by prominent players such as Candian Western Bank and HSBC Holdings plc.

b. Some key players operating in the retail core banking solution market include Oracle; Temenos Headquarters SA; Fiserv, Inc.; Tata Consultancy Services Limited; SAP SE; Infosys; FIS; InfrasoftTech; Polaris Software; Silverlake Axis Ltd.

b. Key factors that are driving the market growth include increasing demand for mobile and internet banking, and rising demand for a secure and flexible banking channel.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.