- Home

- »

- Electronic Devices

- »

-

Retail Point-of-Sale Terminals Market Size Report, 2030GVR Report cover

![Retail Point-of-Sale Terminals Market Size, Share & Trends Report]()

Retail Point-of-Sale Terminals Market Size, Share & Trends Analysis Report By Product (Fixed POS Terminals, Mobile POS Terminals), By Component, By Deployment, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-021-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

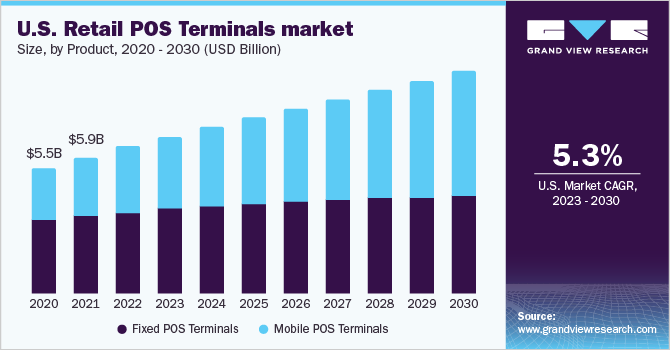

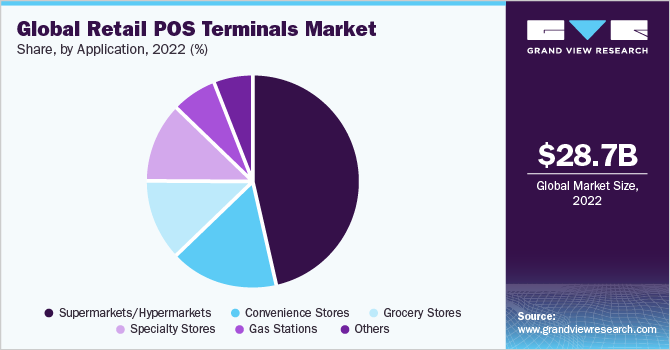

The global retail point-of-sale terminals market size was valued at USD 28.71 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. The growth is mainly driven by the rising adoption of mobile POS terminals across the retail sector & preference for wireless technology and online payment systems. A centralized POS system provides information to retailers’ POS terminals at the client site connected to a central server. Such connected solutions provide business departments with real-time reports on consumer purchasing trends, inventory levels, and online product requests and purchases.

The proliferation of smart devices, such as smartphones, tablets, and laptops, is driving the adoption of Mobile POS (MPOS) terminals, which play a crucial role in processing payments, recording transaction history, and tracking orders. Mobile POS terminals help in enhancing customer interactions to increase sales; while during relatively slower periods, M-POS terminals also help retailers in monitoring the inventory and tracking inventory data, thereby enhancing efficiency and accuracy. As such, M-POS systems are emerging as the future for brick-and-mortar retail stores as they can play a potent role in facilitating employee-consumer interactions. The retail POS technology landscape is evolving rapidly in line with the growing preference for multiple payment methods.

The COVID-19 pandemic has surged the demand for automated billing systems such as point-of-sale terminals among retailers as compared to traditional or cash register billing systems. The expansion of e-commerce sectors across regions is driving the need for point-of-sale terminals for managing sales and tracking inventories. To cater to the growing need of online customers and offer them a customer-centric experience has been the major factor for the growth of point-of-sale terminals across the e-commerce sector. Additionally, growing government support for adopting digital payment systems across regions by introducing new laws and regulations has boosted the adoption of point-of-sale terminals among retailers.

However, growing concerns over data privacy is one of the key restraints for the retail POS terminals market. The point-of-sale terminals help retailers to set up their own e-commerce store with a complete inventory record, thereby allowing them to store products online, on the go, and through in-store channels. With the growing adoption of these systems, combating fraud is becoming crucial for POS vendors, given that compromised POS systems can lead to severe monetary losses and tarnish organizational reputation. Hence, POS vendors are aggressively adopting encryption solutions to encrypt the customer and payment data being handled by POS systems while processing transactions.

Product Insights

The fixed POS terminals segment held the largest revenue share of 61.79% in 2022. The growing demand for fixed POS solutions across the retail sector can be attributed to their vast benefits, including robust business functionality. These solutions enable retailers to manage and track their finances, employee time clock, gift cards, and loyalty programs, among other features.

The mobile POS terminals segment is likely to expand at a significant CAGR of 10.1% over the forecast period. The mobile POS solution is an enhancement to the traditional POS solution. Merchants highly engaged in their daily activities are more inclined toward adopting mPOS solutions with inbuilt scanners that enable reading credit/debit cards through the card reader attached to the tablet or smartphone.

Component Insights

The hardware segment held the largest revenue share of 63.34% in 2022. The growing demand for flexible and portable POS terminals in the retail sector is attributed to the need for faster service, reduced queues, and maintaining transactions through modern payment devices. Peripheral devices such as scanners, barcode readers, pole displays, keyboards, and receipt printers are also inseparable parts of a conventional POS system.

The software segment is likely to expand at a significant CAGR of 9.9% over the forecast period. The growth of the POS software segment can be attributed to the growing demand for new software features such as inventory tracking, customer data management, employee management analytics, sales monitoring, and reporting to improve business operations.

Deployment Insights

The on-premise segment held the largest revenue share of 73.87% in 2022. On-premise POS systems also called legacy POS or traditional POS, store and process information using local servers and save the data on a local drive. The growing demand for on-premise POS systems owing to their distinctive benefits to retailers, such as diverse functionalities and extensive display setup, has propelled the growth of the retail POS terminals industry.

The cloud segment is likely to expand at a significant CAGR of 10.0% over the forecast period. Cloud POS systems have gained immense popularity among small businesses owing to their numerous benefits such as remote access, subscription-based pricing, data security, all-in-one solution, inventory management, and sales management features.

Application Insights

The supermarkets/ hypermarkets segment held the largest revenue share of 46.66% in 2022. Supermarkets/ hypermarkets prefer reliable automated billing software over manually operated billing systems as they allow them to track and manage inventory, revenue, sales, and account information more easily and conveniently. These solutions enable supermarket/ hypermarket retailers to record an overall customer shopping experience to offer better customer service.

The convenience stores segment is likely to expand at a significant CAGR of 7.6% over the forecast period. Convenience stores adopt retail POS terminals to help them identify high-value points of sales features. These terminals also assist convenience store operators in inventory management, order management, and employee management, among other features.

Regional Insights

Asia Pacific held the largest revenue share of 33.45% in 2022 and is expected to register the highest CAGR from 2022 to 2028. The growth can be majorly attributed to the strategic initiatives taken by companies aimed at expanding their retail customer base. China has been witnessing an increase in the number of POS solution offerings in China. The companies are engaged in partnerships/collaboration/acquisitions aimed at providing better POS terminal solutions targeting retailers. Supportive initiatives taken by the government to encourage POS adoption and online payments are among the key factors driving the growth of the market in India.

North America held a significant revenue share in 2021. The growth can be attributed to the presence of some of the most prominent players, including Toast, Inc.; Lightspeed; and TouchBistro. The presence of leading players in the region has enabled the wider adoption of POS terminals among retail businesses owing to easy availability. The increasing adoption of digital technology across every business area and workplace is restructuring the U.S. economy. The post-pandemic effect has impacted the retail industry by digitally transforming businesses faster than previously planned. The adoption of retail POS terminals among stores to record sales, inventory management, and fulfill all the in-store activities has formed a huge base for market growth in the U.S.

Key Companies & Market Share Insights

The key players include Acrelec; AURES Group; Elo Touch Solutions, Inc.; Lightspeed; Clover Network, LLC (Acquired by Fiserv, Inc.); Block, Inc.; HP Development Company, L.P.; NCR Corporation; Oracle; and Revel Systems. To broaden their product offering, industry companies utilize a variety of inorganic growth tactics, such as partnerships, regular mergers, and acquisitions. In March 2021, Lightspeed acquired Vend Limited (New Zealand), a cloud-based point of sale and retail management software company. The acquisition would make Lightspeed the technology partner for over 135,000 customers, significantly expanding the company’s foothold across APAC. Some prominent players in the global retail point-of-sale terminals market include:

-

Acrelec

-

Agilysys Inc.

-

AURES Group

-

Clover Network, Inc.

-

Elo Touch Solutions, Inc.

-

Intuit, Inc.

-

Lightspeed

-

Clover Network, LLC (Acquired by Fiserv, Inc.)

-

Block, Inc.

-

HP Development Company, L.P.

-

NCR Corporation

-

Oracle

-

Revel Systems

-

SAP SE

-

Toshiba Corporation

-

TOAST, Inc.

Retail Point-of-Sale Terminals Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 31.33 billion

Revenue forecast in 2030

USD 51.62 billion

Growth Rate

CAGR of 7.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, component, deployment, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; U.A.E.; Saudi Arabia; South Africa

Key companies profiled

Acrelec; Agilysys Inc.; AURES Group; Elo Touch Solutions, Inc.; Intuit, Inc.; Lightspeed; Clover Network, LLC (Acquired by Fiserv, Inc.); Block, Inc.; HP Development Company, L.P.; NCR Corporation; Oracle; Revel Systems; SAP SE; Toshiba Corporation; TOAST, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retail Point-of-Sale Terminals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global retail point-of-sale terminals market report based on product, component, deployment, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixed POS Terminals

-

Mobile POS Terminals

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Grocery Stores

-

Specialty Stores

-

Gas Stations

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E.

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global retail point-of-sale terminals market size was estimated at USD 28.71 billion in 2022 and is expected to reach USD 31.33 billion in 2023.

b. Key factors that are driving the market growth include changing customer preference, enhance the consumer experience, high volumes of non-cash transactions, and intense demand for additional payment options.

b. Some key players operating in the retail point-of-sale terminals market include Toshiba Tec Corporation, Ingenico Group, NCR Corporation, VeriFone Systems Inc. and PAX Technology.

b. The global retail point-of-sale terminals market is expected to grow at a compound annual growth rate of 7.4% from 2023 to 2030 to reach USD 51.62 billion by 2030.

b. The hardware segment dominated the retail point-of-sale terminals market with a share of 6.3% in 2022. This is attributable to the integration of touchscreen technology in the mobile POS terminals and the introduction of IoT devices which may reduce the product size.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."